Wholesale Market Settings Review – Key Issues to Resolve

The Australian Energy Council continues to engage with the Expert Panel conducting the wholesale market settings review. Submissions closed on 14 February, and we understand the Panel received around 100 submissions.

The Review is an important piece of work, as it seeks to define the services the energy system will need as the transition continues and to ensure that market-based incentives and signals deliver the required investment, enabling a shift away from a continued reliance on Government intervention.

What is emerging is good alignment across stakeholders on the key issues to resolve. The Panel’s Chair, Tim Nelson, in a recent podcast[i] articulated some of the common themes coming out of submissions:

- Disconnect between customers and generators on the tenor of contracts vs investment timeframe required to support generation investment decisions. Retailers and C&I customers prefer to commit for 1-2 years, while generators assessing long lived investment decisions require longer timeframes.

- Coordination problem – when there is investment in new generation assets that can also support system security outcomes, it is important to get the optimal mix across energy and security services at least cost to consumers;

- Consumer Energy Resources (CER) opportunity – how do you ensure consumers can benefit from wholesale market signals and ensure CER investment benefits both those investing in CER (such as solar PV and batteries) and the broader energy system.

A key focus for the Panel is to focus on how the market settings can overcome the legacy of Government intervention impacting investment certainty. That is, what is the best approach post the Capacity Investment Scheme (CIS) and Long Term Energy Service Agreements (LTESA) government interventions to allow market signals to deliver the most efficient outcome for consumers.

The Panel Chair outlined the three key services consumers need from their retailer in a high Variable Renewable Energy (VRE) system:

1. Bulk energy – will likely be delivered largely via solar, wind etc;

2. Shaping around bulk energy – inter or intraday, likely delivered by batteries and pumped hydro. This service shifts energy from times of abundance to times of scarcity when VRE is not producing as much; and

3. VRE droughts require a firming technology that can be dispatched during these times.

The Panel has been tasked with coming up with actionable recommendations – things that can be done relatively quickly to get good consumer outcomes and make a difference. The Panel has encouraged stakeholders to collaborate, and its Chair noted he was pleased there were signs of this in the submissions received.

The focus of the Panel aligns well with the work the AEC has done both prior to the review and what we argued in our submission. The AEC has led numerous member discussions on the market settings and has also met extensively with a range of stakeholders to collaborate. Our submission outlined the key issues for the Panel to focus on as:

- The exit of coal generation may result in a shortfall of energy supply during certain periods that cannot be addressed by increasing renewable energy supplies alone, resulting in both short (intra-day) and long duration (multi-day) supply shortages. To avoid the risk of shortfall and to ensure coal generation can exit smoothly, there is a need for a clear and strong ongoing signal to encourage ongoing investment in firm generation.

- With the exit of coal generation and high volumes of renewables in the system, wholesale markets and prices will be more weather-dependent, increasing price volatility, including notable periods of negative prices. As renewables are unable to offer the same level of firm contracts, standard contracts in secondary markets may become harder to obtain. The role of contract markets and their preferred forms have not yet evolved to balance management of risks with exposing customers to an efficient level of price volatility over time.

- The market is not valuing the full range of system security services needed for a net-zero emissions system. As thermal plant exits, system security needs must be met via non-traditional plant, for which there are no market mechanisms or investment incentives in place.

Both the AEC submission and other stakeholders highlighted a revenue sufficiency issue that needs to be addressed. The increased supply of renewables co-exists with existing generation for a period of time, creating over supply in the NEM. Prices fall during this period of over supply before increasing once thermal plant exits the market. Endgame Analytics modelled the price impact of this additional generation and the resultant revenue adequacy issues for both new entrant generation capacity and existing generation capacity, which is outlined in the AEC’s submission to the Expert Panel.[ii]

Figure 1 shows $/kW total cost vs $/kW net revenue (ie for gas peaker and storage pool revenue - fuel costs or costs to charge) for new entrant plant. Total cost represents amortized CAPEX + FOM (Fixed Operation and Maintenance Costs). The area under the graph for each new entrant generator (ie, the difference between revenue and total cost) is a proxy for the total revenue under-recovery that will need to be covered by the CIS or other market mechanisms.

Figure 1: Average amortised cost ($/kW) and net revenue ($/kW) of new entrant by type

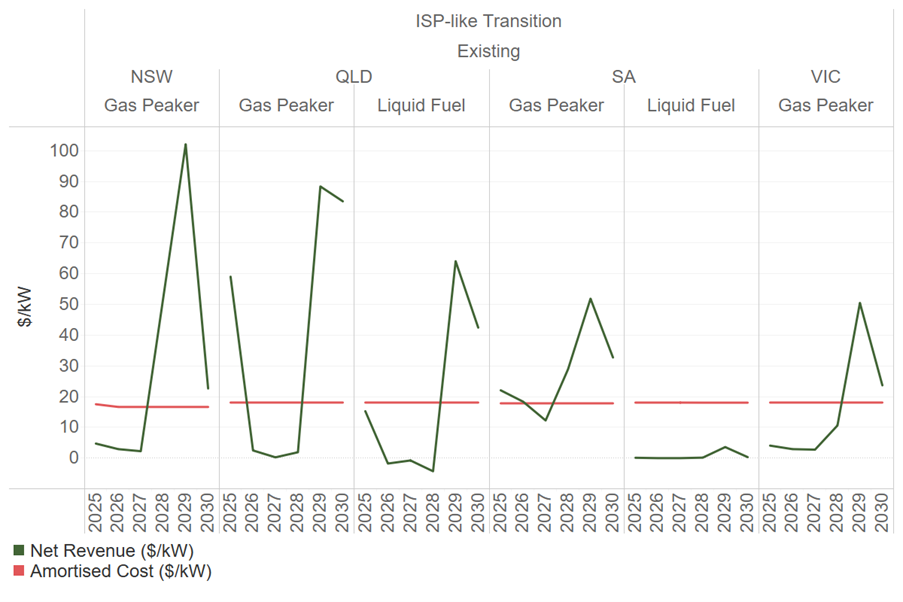

Figure 2 shows annual net revenue for thermal peaking capacity versus fixed operations and maintenance cost. Over supply into the market and price suppression means limited dispatch of thermal plant. Existing thermal plants will not recover costs in most years out to 2030 in all states. Where the revenue line drops below cost, the plant will be at risk of exiting. However, there is a clear insurance value of maintaining the plant for reliability purposes. In this world, thermal plants may need to be made whole or risk disorderly exit.

Figure 2: Average amortised cost ($/kW) and net revenue ($/kW) of existing thermal fleet (excluding coal)

The Australian Energy Market Commission (AEMC) highlighted fundamental challenges impacting long-term investment decisions for bulk renewables, firming and gas-powered generation:

“A key requirement in the transition is to ensure new assets are in place before old assets retire. To achieve this, we need to introduce mechanisms to support both asset entry and the reliable exit of aging thermal generation. This leads to a period where financial support is being provided to have renewables, firming and coal in the market. The overlap period should be minimised between new assets entering and coal retirement to reduce the cost of supporting all these projects.”[iii]

So what comes next? The Expert Panel will be engaging bilaterally with stakeholders on the issues it thinks are solvable in a timely way and are key to the market going forward. The AEC is keen to play its part to help bring together industry to align on both those key issues and market-based solutions. The Expert Panel will release its Draft Report to Energy and Climate Change Ministerial Council (ECMC) mid-2025, with a Final Report due by the end of 2025.

[i] Market changes could come quickly - Energy Insiders - a RenewEconomy Podcast - Apple Podcasts

[ii] https://www.energycouncil.com.au/media/syxld2km/20250214-nem-whs-mkt-set-review-initial-consult-aec-sub-final.pdf

[iii] https://www.aemc.gov.au/sites/default/files/2025-02/AEMC%20Submission%20NEM%20review%20-%20Feb%202025%201.pdf

Related Analysis

Wholesale Market Settings Review – A Shared Vision Is Required

The Federal Government’s review into the National Electricity Market (NEM) wholesale market settings is a crucial step in ensuring reliable energy supply as coal-fired generation phases out and renewables become the dominant energy source. With energy markets worldwide facing the challenge of balancing low-emissions, low-cost generation with the need for firmed energy supply, this review must identify reforms that incentivise investment in flexible, dispatchable generation sources. So, what will be needed in order for this review to succeed? We take a closer look.

Is increased volatility the new norm?

This year has showcased an increased level of volatility in the National Electricity Market (NEM). To date we have seen significant fluctuations in spot prices with prices hitting both maximum price caps on several occasions and ongoing growth in periods of negative prices with generation being curtailed at times. We took a closer look at why this is happening and the impact this could have on the grid in the future.

A tale of two approaches: How does Victoria’s energy plan differ from the 2024 ISP?

The release of the Victorian Government’s energy plan – Cheaper, Cleaner, Renewable: Our Plan for Victoria’s Electricity Future, outlines the Government’s roadmap and what will be needed to reach an ambitious emission reduction target of net zero by 2045. Like AEMO’s 2024 Integrated System Plan (ISP), Victoria sees wind and solar as key pillars to their transition, along with battery storage. So, what does it believe it will need to achieve net zero, and how does this differ from the ISP? We take a closer look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.