What next for integrating wind and solar?

Wind and solar photovoltaic (PV) are currently the fastest-growing sources of electricity globally and, as some countries are occasionally meeting their energy demand entirely from renewable energy resources we are getting a glimpse of a future zero-carbon energy system and its implications. Recent analysis by the International Energy Agency (IEA) on Next Generation Wind and Solar Power[i] shows that the success of these variable renewable resources are bringing serious technical challenges to the fore for system operators responsible for maintaining a balance between stable electricity supply and demand. There are also emerging challenges for policy makers considering the options for bringing on yet more variable renewable supply and understanding the consequences for the power system and power markets.

The IEA analysis is timely. It comes as a key focus of Australia’s energy ministers is on managing the integration of renewables in South Australia. The state is generating around 41 per cent of its total generation from wind energy and solar. South Australia’s changing energy mix has not only led to a series of technical challenges but also increased wholesale price volatility as the state rebalances its supply from dispatchable plant to intermittent generation.

Other Australian states continue to pursue their own renewable energy ambitions, with Victoria the most recent example, announcing that it is seeking to reach 25 per cent renewable generation by 2020 and 40 per cent by 2025. The latter target will require the equivalent of more than 50 new wind farms to be built in the state in around eight years and is likely to lead to significant system challenges in the future.

The IEA report encourages long-term policies that are based on an understanding of the full system value of renewable energy technologies, and a comprehensive and systemic approach that can ensure that even when the wind isn’t blowing or the sun isn’t shining there is power system integrity while climate targets can also be met.

An international look

Scotland experienced one of its windiest days of the year in early August, the high winds were strong enough to power the equivalent of all of Scotland’s electricity needs for the day[ii] while on 9 July Denmark’s wind turbines produced 140 per cent of its electricity[iii]. The problem is weather like this doesn’t happen every day. Simply building more wind farms is not going to deliver a reliable energy system. The IEA has undertaken detailed analysis and considered the implications of what it calls “next generation” wind and solar power.

According to the IEA, a next generation phase of deployment is emerging in which wind and solar PV are technologically mature and economically affordable. It also notes that if the contribution of wind and solar to the electricity generation mix does not exceed a few percentage points, their integration into the grid is simple and poses few challenges. As variable renewable energy (VRE) enters this next generation deployment, the issue of system and market integration becomes a critical priority for renewables policy and energy policy generally – as is the case in South Australia. This challenge is that governments around the world are seeking to simply meet renewable energy targets as part of climate action plans rather than as part of a broader comprehensive and systematic energy policy.

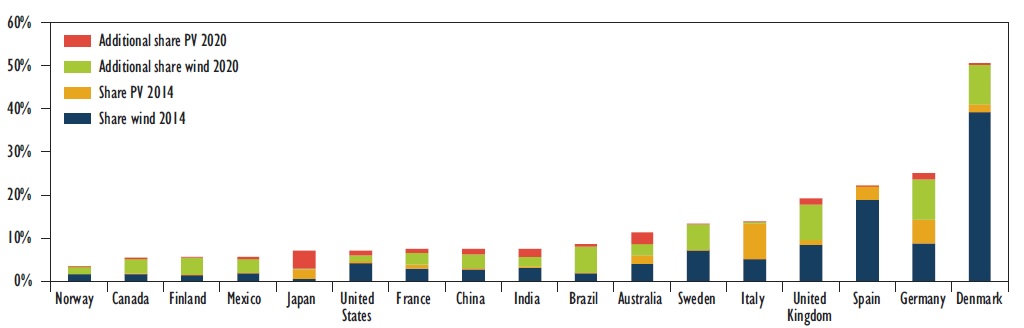

Figure 1 shows the high share of variable renewable energy deployment with challenges becoming apparent and increasingly common in a number of countries. Australia is ranked 7th, more than China and the US, for the share of wind and solar PV by 2020. The ranking doesn’t take account of the availability of interconnection with other systems, nor regional variations within a country. If South Australia was a separate country, it would rank only second to Denmark, which has much greater interconnection with other systems.

Figure 1: Share of VRE generation in 2014 and 2020 for selected countries[iv]

Investment in additional flexible resources – comprising demand-side management, electricity storage (such as pumped hydro), grid infrastructure and flexible generation - is required. According to the IEA, system-friendly variable renewable energy deployment practices will be insufficient to manage high shares of variable renewable energy in the long term. The point at which investment in additional flexible resources becomes necessary depends on the system context, but in all systems an increase in flexible resources will become a cost-effective integration strategy at some point, and require additional investment.

Technology mix

The output of wind and solar power is somewhat complementary in many regions of the world, while variable renewable energy is also complementary to other, dispatchable renewable resources, such as hydropower. The report highlights that deploying a mix of technologies can thus assist in minimizing the amount of dispatchable capacity needed to balance out VRE. Despite the apparent complementarity of solar and wind, Germany is becoming more reliant on its interconnectors with other states as it continues its Energiewende policy that seeks to replace fossil fuel and nuclear generation with renewables[v].

A similar situation is occurring in Australia, South Australia is currently experiencing a series of technical challenges and price volatility as a result of its rebalancing of the supply mix from dispatchable plant to intermittent. South Australia now has around 38 per cent of its total large scale generation sourced from wind energy, with another 3 per cent estimated to be supplied by distributed rooftop solar PV[vi]. South Australia has limited baseload capacity (and what it does have is now powered by gas) and a strong reliance on the interconnection with the National Electricity Market via Victoria. With the removal of coal-fired generation earlier this year from the mix of technologies South Australia is now dependent on wind, solar and gas for local supply.

Levelised cost of electricity (LCOE) for wind and solar

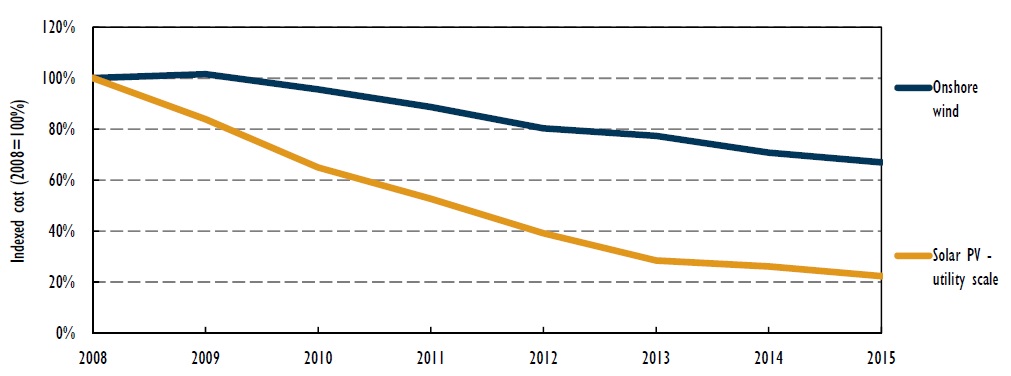

Between 2008 and 2015, the average cost of land-based wind decreased by 35 per cent while for solar PV costs fell by almost 80 per cent, as shown in Figure 2. The IEA tends to use the LCOE as the most commonly defined measure of cost for a particular generating technology at the level of a power plant. This is calculated by summing all plant-level costs (investment, fuel, emissions, operation and maintenance, etc.) and dividing them by the amount of electricity the plant will produce. For capital-intensive plant such as wind and solar, the LCOE is highly sensitive to assumptions about the cost of capital.

Figure 2: Indexed cost of onshore wind and utility-scale PV[vii]

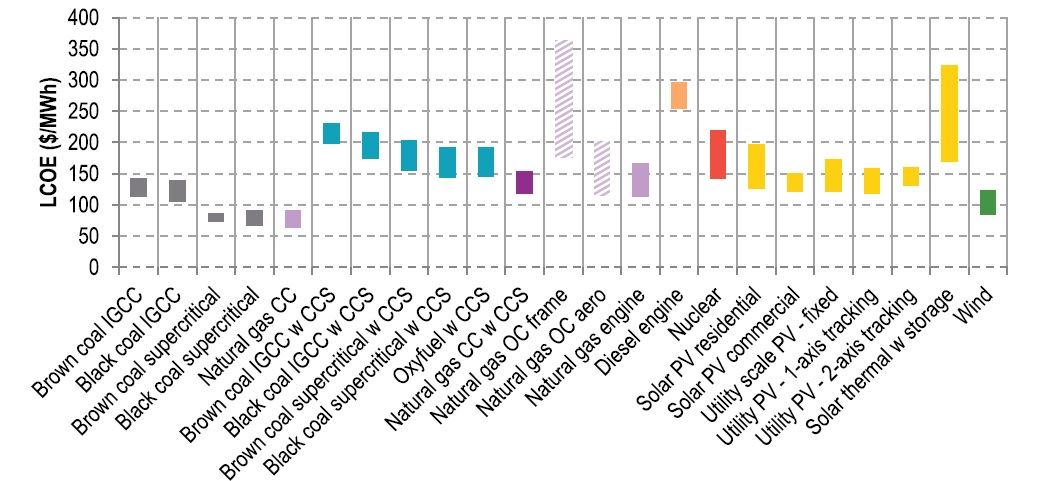

The LCOE of wind power and solar PV has seen them come close to, or even below, the LCOE of fossil fuel and nuclear options. For example, the IEA found that that the lowest currently reported costs for land-based wind are US $30-35 per megawatt hour (MWh) (Morocco) and for solar PV are US $49/MWh (Peru). The most recent estimates of LCOEs for a range of generation technologies in Australia was published late last year by CO2CRC[viii]. Wind generation was estimated to be the lowest cost renewable or zero emissions technology and cheaper than several fossil fuel options.

Figure 3: 2015 Levelised cost of electricity ($/MWh)[ix]

The IEA report, however, highlights that there are limitations to LCOE because it can be blind to the when, where and how of power generation. The when refers to the temporal, or time, profile of power generation (i.e. sunny days for solar), the where refers to the location of power plant (i.e. remoteness from the grid), and the how refers to the system implications that the type of generation technology may have. Whenever technologies differ in the when, where and how of their generation, a comparison based on LCOE is no longer sufficient and can be misleading, according to the IEA. A comparison based only on LCOE implicitly assumes that the electricity generated from different sources has the same value.

The value of electricity depends on when and where it is generated, particularly in a power system with a high share of variable renewable energy. During certain times, an abundance of generation can coincide with relatively low demand – in such cases the value of the electricity will be low. Conversely, when little generation is available and demand is high, the value of electricity will be high which, again, has recently been demonstrated in Australia by the spike in wholesale prices in South Australia. Considering the value of electricity for the overall system opens a new perspective on the challenge of variable renewable energy integration and power system transformation.

Where do we go from here?

The conclusions and recommendations proposed by the IEA to support the continued growth of wind and solar include:

- Develop or update long-term energy strategies to accurately reflect the potential contribution of next-generation wind and solar power to meeting energy policy objectives;

- Upgrade system and market operations to unlock the contribution of all flexible resources to dealing with more frequent and pronounced swings in the supply-demand balance of electricity;

- Make the overall system more accommodating to variable generation by investing in an appropriate mix of flexible resources;

- Deploy wind and solar power in a system-friendly fashion by fostering the use of best technologies, and by optimising the timing, location and technology mix of deployment;

- Review and revise planning standards, as well as the institutional and regulatory structure of low- and medium-voltage grids, reflecting their new role in a smarter, more decentralised electricity system, and ensure a fair allocation of network costs; and,

- Reform electricity markets and operating protocols to allow for the provision of system services by wind and solar power plants.

These recommendations are generic, rather than aimed at specific countries. In market systems like the NEM and the WEM, price signals should be the main instrument for achieving goals, such as eliciting sufficient flexible resources, the appropriate mix of technologies and incentivising optimal deployment. The positive effects of renewables include reduced fuel costs, reduced greenhouse gas emissions, and increased energy security, but, equally, when the wind isn’t blowing or the sun isn’t shining there needs to be more flexible grid infrastructure that is able to handle the variability of supply.

[i] International Energy Agency, 2016, “Next Generation Wind and Solar Power From cost to value”

[ii] The Guardian, 2016, “Scotland's wind turbines cover all its electricity needs for a day”, August 11th 2016

[iii] The Guardian, 2016, “Wind power generates 140% of Denmark's electricity demand”, 10th of July 2015

[iv] Source: International Energy Agency, 2016, “Next Generation Wind and Solar Power From cost to value”

[v] Energiewende Germany website, 2016, << http://energytransition.de/ >>

[vi] NEM Review

[vii] Source: International Energy Agency, 2016, “Next Generation Wind and Solar Power From cost to value”

[viii] CO2CRC, 2016, “Australian Power Generation Technology report”

[ix] Source: CO2CRC, 2016, “Australian Power Generation Technology report”

Related Analysis

The ‘f’ word that’s critical to ensuring a successful global energy transition

You might not be aware but there’s a new ‘f’ word being floated in the energy industry. Ok, maybe it’s not that new, but it is becoming increasingly important as the world transitions to a low emissions energy system. That word is flexibility. The concept of flexibility came up time and time again at the recent International Electricity Summit held in in Sendai, Japan, which considered how the energy transition is being navigated globally. Read more

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Community Power Network Trial: Potential risks and market impact

Australia leads the world in rooftop solar, yet renters, apartment dwellers and low-income households remain excluded from many of the benefits. Ausgrid’s proposed Community Power Network trial seeks to address this gap by installing and operating shared solar and batteries, with returns redistributed to local customers. While the model could broaden access, it also challenges the long-standing separation between monopoly networks and contestable markets, raising questions about precedent, competitive neutrality, cross-subsidies, and the potential for market distortion. We take a look at the trial’s design, its domestic and international precedents, associated risks and considerations, and the broader implications for the energy market.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.