Tracking the Renewable Energy Target

In February, Energy Insider highlighted the increase in renewable energy projects, along with the increasing price of Renewable Energy Certificates (RECs). The Renewable Energy Target (RET) has been in the news again this week, with the Clean Energy Regulator (CER) highlighting the “unprecedented” number of new projects in 2016[i].

In its annual review on progress toward meeting the RET, Tracking Towards 2020: Encouraging renewable energy in Australia, the CER also notes that the momentum from 2016 had continued into 2017.

The regulator believes that the 2020 RET remains achievable, if “the current pace of investment continues throughout 2017”. The review also indicates that major institutions have backed new vehicles for funding renewables, while retailers have signed up to new power purchase agreements and costs continue to fall, particularly for utility scale solar[ii].

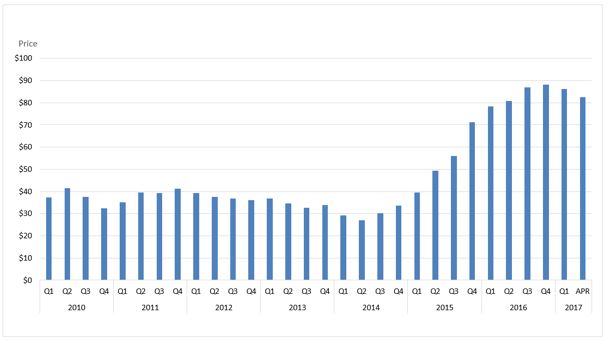

There has also been a slight shift in the price trend line for Renewable Energy Certificates (RECs). RECs reached an all-time high at the end of 2016 when the average price for the last quarter was $88.07/MWh (signalling a scarcity of supply). Prices in October were above $89/MWh, with the highest recorded price to date of $89.50/MWh set on 27 October 2016.

Prices have drifted down from those levels with the first quarter of 2017 recording an average price of $86.28/MWh and this continued in April 2017 when the price was $82.40/MWh.

The CER expects the slow start in 2016 to lead to a tightening of certificate supply in the short term, with RECs from new projects coming on stream more slowly than the rise in demand from electricity retailers to meet their RET obligations. In February 2017, a surplus of around 13.4 million large-scale certificates remained in the REC Registry[iii]

Looking forward the regulator notes that the large-scale certificate spot price may remain relatively high until sufficient committed projects are announced, “to give the market confidence in an adequate supply of certificates through to 2020”. It also believes that demand and supply is likely to remain tightly balanced in the 2018 compliance year, although “the recent series of new project announcements leads us to consider that the market is most likely to remain in surplus overall”[iv].

Renewable Energy Certificate prices

For much of the period following the enhancement of the RET in 2010, to 45,000 GWh pa by 2020 the spot price was somewhere between $30/$40 per MWh. The price path since then is shown in Figure 1 below:

Figure 1 Quarterly Average prices for RECs 2010-2017

Source: Australian Energy Council analysis, 2017

It’s important to note that the spot price is only the marginal price. Most RECs are procured via long-term contracts. In some cases, the price may cover energy as well, so there is no explicit REC “price”. The marginal price can be a useful indicator of how tight the supply/demand balance is overall.

The CER believes the price could remain high until sufficient committed projects are announced to give the market confidence in an adequate supply of certificates through to 2020. “Once the market has formed a view that the necessary build to meet the target is likely to be committed, and that adequate supply will return, the spot price should start to moderate,” the administrative report says.

In a separate report to the CER, Ernst & Young argues that the bundled price of electricity and large-scale generation certificates (LGCs), estimated as the average spot LGC price plus the average wholesale electricity prices, across Australia appear to be high enough to make the new renewables build required financially viable[v]. It also notes that the increase in prices (which reached $85.50 per REC at the time of its report) and the recent increase in activity at this price level over a sustained period “suggests that the market has confidence in the regulatory framework governing the sector”.

How does the shortfall work?

The RET legislation wisely contains a safety valve. Liable entities (retailers and some large users) can choose to pay a shortfall charge rather than surrender certificates. The charge is set at $65 per certificate not surrendered, but because it is not a tax-deductible expense (whereas the cost of acquiring certificates is), it is considered to have an effective value of around $93 (designed to act as a deterrent to deliberate failure to acquire certificates). Businesses may value the deterrent lower depending on their tax position, which could explain why they may elect to pay a shortfall even when certificates are available at a lower price.

The Clean Energy Regulator views “the intentional failure to surrender certificates as a failure to comply with the spirit of the law as it undermines the objectives of the scheme”. The combined compliance rate for electricity retailers in 2016 for large-scale and small-scale certificates was 93.8 per cent. In 2016, retailers were required to surrender 21.43 million large-scale certificates and 16.95 small-scale technology certificates.

As noted in our piece, Reckoning with the RET in February, whilst it is a disappointing outcome for the penalty shortfall to be triggered, it is a useful element of the legislation. While the goal of the RET is to increase renewable energy in Australia, there is no sense that this goal is to be achieved at any cost. Accordingly, the penalty mechanism reflects the cap policymakers put on the cost of renewable energy that consumers are obliged to bear.

Secondly, the purpose of setting the liability on retailers, who operate in competitive markets, was to use the power of competition to minimise the cost of procuring the new renewables. This market dynamic is best served by having a cap. Otherwise, suppliers of renewable energy certificates know that the buyers have to buy a certain quantity at any price, which gives them additional negotiating power. Given that on top of the mandatory requirement, there are some parties that procure RECs for voluntary surrender, a cap does not mean that the supply of RECs be constrained – it just depends whether voluntary buyers are willing to pay more than $93 for a certificate. If they are not, then why would it be good value for mandatory buyers to bear that cost?

In this context the CER’s comments about paying the shortfall are disappointing. It appears entirely consistent and appropriate for a liable entity to minimise their costs in this way when faced with a high price for certificates. As in any market the price is dependent on both buyers and sellers, so it would make as much sense to criticise renewables developers for failing to offer certificates at a reasonable enough price that a liable entity could minimise its cost. But in practice they are clearly not able to do so, perhaps reflecting the ongoing policy uncertainty. In particular, new assets can only earn RECs until 2030, which is well before their end of their expected lifespan.

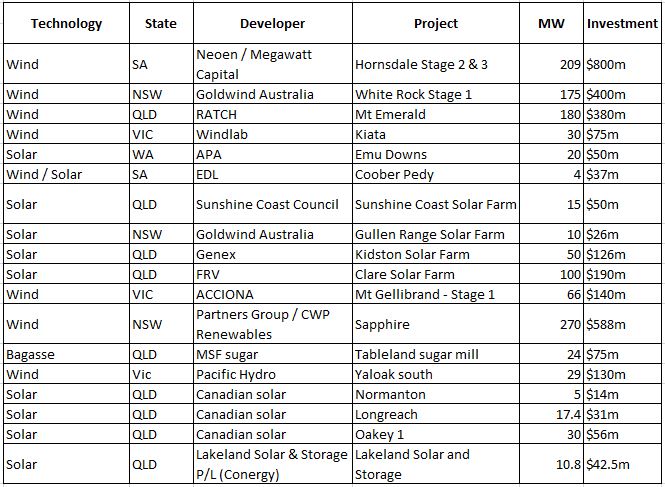

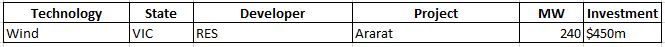

While the spot price, as the marginal REC price, reflects the risk premium many developers/owners require, assets that are still getting built. The CER report estimates that 1350 MW of new large-scale renewable projects were committed in 2016 with another 719 MW sufficiently advanced to count as probable – around one-third of the new capacity required to deliver the 2020 RET[vi]. In addition, to this the regulator has assessed that 3000 MW will need to be committed in 2017[vii]. The Clean Energy Council (CEC) updated a list of projects either currently under construction, completed or planned to start during this year (i.e. in total these projects represent more than a single year’s worth of investment). These are outlined below:

Table 1 Projects under construction

Table 2 Projects with financial commitment – to start construction in 2017

Table 3 Projects completed in 2017

Sources: Clean Energy Council, Australian Energy Council analysis, 2017

In conclusion, renewables projects are getting built with the majority of projects being wind and solar developments – intermittent generation – although a few are seeking to include storage in some form.

Next year should see most of the other ARENA large-scale solar projects under construction, plus Victoria and Queensland have both indicated they will start underwriting new renewables in their respective states to meet their 50 per cent RETs.

The uplift in renewable projects highlights that Australia’s energy businesses are also serious about delivering on the RET. The outstanding issue remains a durable national energy and climate policy that will encourage broader energy investment and allow the market to coordinate energy technologies to achieve reliability of supply and reduce emissions at the lowest possible cost.

[i] Renewable Energy Target delivering with momentum building towards 2020 target, Clean Energy Regulator media release, May 2017

[ii] Tracking towards 2020: Encouraging renewable energy in Australia, Clean Energy Regulator, 2016

[iii] Ibid, page 10

[iv] Ibid, page 9

[v] Ernst & young, Meeting the Renewable Energy Target, Innnovative approaches to financing renewables, page 4

[vi] Tracking towards 2020: Encouraging renewable energy in Australia, Clean Energy Regulator, 2016, page 9

[vii] Ibid, page 11

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.