The energy market: A sensible place to stimulate the economy?

The COVID-19 pandemic has seen major shifts across the globe, with Treasurer Josh Frydenberg warning that the shadow of the economic shock will be profound and long-lasting.[i]

With contractions in GDP, and trade and mobility restricted due to various forms of lock-down, many nations are now looking at their own capability to build more resilient and self-reliant sectors. Expected falling investment rates have some looking to increased investment in the renewable sector to generate high skilled-jobs and industries, all while continuing to support carbon emission targets.

Focus on renewables: A global shift

Dr Fatih Birol, Executive Director of the International Energy Agency, recently suggested that while COVID-19 has had deep economic and health impacts, it could also be an opportune time to inject funds from global economic stimulus packages’ into the development and manufacturing of renewables, saying:

“Large-scale investment to boost the development, deployment and integration of clean energy technologies – such as solar, wind, hydrogen, batteries and carbon capture (CCUS) – should be a central part of governments’ plans because it will bring the twin benefits of stimulating economies and accelerating clean energy transitions. The progress this will achieve in transforming countries’ energy infrastructure won’t be temporary – it can make a lasting difference to our future[ii].”

Dr Birol notes that while global CO2 emissions are expected to fall this year due to the impact of coronavirus on economic activity, this drop would not be the result of governments and companies adopting new policies. He instead suggests that “we need to seize the opportunity to help accelerate” renewables and push more investment into the development of large-scale renewables.

He further notes that the costs of renewables are now lower, coupled with better technology, when compared to previous times when governments’ enacted stimulus packages. Meanwhile technologies such as Carbon Capture and Storage and hydrogen could benefit from lower interest rates and increased investment during this time to propel their development through making the technologies more attractive to investors. He additionally points out that this has been accepted by major East Asian economies, from China to South Korea, for more than a decade.

But what is the right path for Australia?

Domestic stimulus

It was recently reported that Australia's renewables sector will be one of the hardest hit globally due to the impact of COVID-19, alongside Brazil, Mexico and South Africa.[iii] Solar and wind projects are likely to take a hit due to the fall in the Australian dollar, while there’s anticipated delays or cancellations for the majority of large-scale renewable developments in Australia this year[iv], with international travel restrictions to impact project construction timetables in the short term.

The Victorian Government’s home solar rebate program has slowed in uptake since the COVID-19 lockdown, and the restrictions seem to have impacted installations nationally with a slowing in the uptake of rooftop solar systems in March 2020 (covered here in our latest Solar Report).

A recent PwC report looked at the impact COVID-19 on Australia’s renewables sector, and found the virus will impact manufacturing and delay the supply of equipment and materials used in the construction of solar energy facilities, along with short term price increases.

However some believe that Australia could use this time to rebuild and respond with a considered plan to create “jobs-rich economic benefits” - and it’s argued that investment in the renewables sector could provide some substantial inroads[v]. The clean energy sector has argued that a pipeline of wind and solar projects could be brought forward[vi]

The Federal Government’s Economic Response to the Coronavirus, which was announced in March, includes a stimulus package of $17.6 billion of support measures. Its announcement sparked attention on renewable investment with some suggesting[vii] that using part of the package to support the sector’s growth could increase the nation's energy security and help to grow its manufacturing industry – to build solar panels, wind turbines, electrolysers, batteries and smart grids.

There’s also been suggestions that the national stimulus package could help to drive the Federal Government’s own strategy for a clean hydrogen industry. The Federal Government recently committed $300 million to the Clean Energy Finance Corporation to invest in new hydrogen energy projects including those powered by fossil fuels[viii]. According to the National Hydrogen Strategy, developing hydrogen could create around 7,600 skilled and semi-skilled jobs, reduce Australia’s oil import reliance, reduce energy costs, increase opportunities for the creation of new export markets, and add around $11 billion each year to Australia’s gross domestic product through to 2050.

But exactly where should stimulus best spent?

Whilst the positions of Dr Birol and others towards investing in these technologies look initially appealing, they are not entirely consistent with Keynesian stimulatory economics[xii]. This recommends that recessions should be fought with government support for activities that can quickly provide lots of low-skilled employment. This is the best way to immediately increase households’ confidence and spending power. And, once the economy has picked up, the activity should be rapidly shut down in order to avoid stoking future inflation; i.e. the government should always act counter-cyclical to the economy.

Large-scale energy projects, however, do not have these characteristics. They tend to be slow to plan and permit before activity commences, and their costs are dominated by imported capital rather than local labour, and as the few jobs are highly skilled, they can’t provide the sort of employment needed in a crisis. This would in fact be a very poor allocation of stimulus money: little will end up in local households, and that will be long after it’s needed.

Some have proposed transmission projects as part of the stimulus. Whilst certainly part of the long-term energy transition, they are perhaps the worst stimulus candidates due to the time taken to build and their very high capital to labour ratios. Further, the resulting network costs will actually act as a drain on households’ and business’ spending power.

There are numerous far better stimulus opportunities across the economy outside energy. For example in those service sectors hit hardest by the lockdown, like tourism. As former treasury secretary Ken Henry famously said during the Global Financial Crisis (GFC): “Go hard, go early, go households.”[xiii]

In energy-related matters, we should look only for immediate, low-skilled labour-intensive activities. Energy efficiency at the consumer level is an obvious candidate. Whilst the Home Insulation initiative during the GFC sadly resulted in a tragic scandal[xiv], it was in fact grounded in some good economics. Hopefully we could do manage such projects better this time around.

What about demand?

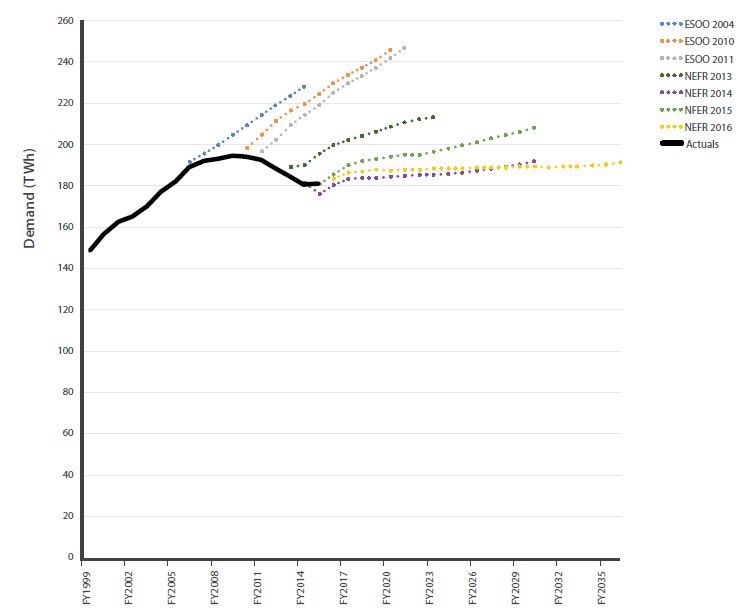

The GFC was followed by a large fall in expected demand growth. There is every chance the same will happen after COVID-19. A recent energy insider discussed this.

Figure 1: Forecast and Actual Electricity Demand

Source: Finkel[xv], p135

Source: Finkel[xv], p135

It is very early in the crisis to gain a view on the economic impacts, but AEMO’s economic advisor, BIS Oxford, has shared with participants their initial thoughts. These show the forecasts provided prior to COVID-19 (dotted line), the updated central forecast assuming the crisis is rapidly resolved (blue line), and a downside scenario (black line) should it extend say with a second infection spike. AEMO is yet to convert these economic predictions into energy predictions.

Figure 2: Year on year forecast of Australian Gross Domestic Product

Source: Haver Analytics/BIS Oxford Economics on behalf of AEMO

Figure 3: Year on year Australian population change

Source: Haver Analytics/BIS Oxford Economics on behalf of AEMO

Even in the best scenario, a recession is expected, which did not occur in the GFC. The downside scenario is unprecedented in recent decades, and in combination with a big fall in population growth rate, seems certain to seriously impact energy demand.

There is not much point though stimulating more supply if there is less demand. The expected reduced demand is likely to lead to a natural oversupply, and there is a risk that adding more large-scale supply in the manner advocated by Dr Birol and others could exacerbate the oversupply with “white elephant” projects. In turn excess supply causes a loss of confidence for market investors and disorderly closures. In the long-term this would exacerbate the cycle, with the market lurching again from over to under-supply.

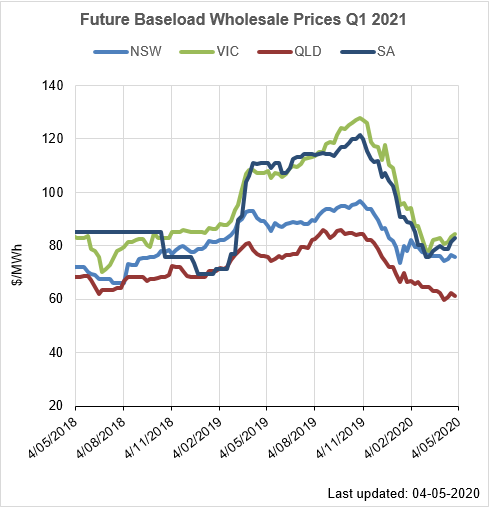

The recent rapid shift in expectations from an under to over-supplied NEM is already apparent in the forward price of electricity below. With respect to large, upstream investments, a cautious approach seems appropriate at this time.

Figure 4:

Source: AEC analysis

Rather than distorting the market through poorly directed stimulus, the government’s attention should remain focused on creating the best policy environment that encourages private investment of the type and timing signalled by the market itself.

What next?

Working through the first stage of COVID-19 has raised economic, as well as significant health challenges, for Australia and finding the best ways to encourage activity post the crisis peak is being debated.

As a result we are seeing a range of proposals to stimulate economic activity, with many proposals coming forward in the energy sector. Regardless of the circumstances it remains important the proposals are fully assessed to avoid unintended consequences and the best way to encourage investment will remain having the right policy and market settings in place.

Transmission construction: Not an easy place to redeploy retrenched café staff.

Source: flyingmag.com

[i] https://www.canberratimes.com.au/story/6745300/coronavirus-restrictions-cost-economy-4b-a-week-frydenberg/

[ii] https://www.iea.org/commentaries/put-clean-energy-at-the-heart-of-stimulus-plans-to-counter-the-coronavirus-crisis

[iii] https://www.afr.com/companies/energy/new-renewables-to-grind-to-halt-under-covid-19-20200325-p54drv

[iv] https://www.theaustralian.com.au/business/mining-energy/weaker-dollar-takes-wind-out-of-renewable-energy-projects/news-story/f0e71c5c7690749ef35c5083d3878dd1

[v] https://www.cleanenergycouncil.org.au/advocacy-initiatives/a-clean-recovery

[vi] A Clean Recovery: Using Australia’s enormous renewable energy potential to create jobs and jumpstart the economy, 5 May 2020

[vii] https://theconversation.com/want-an-economic-tonic-mr-morrison-use-that-stimulus-money-to-turbocharge-renewables-137074

[viii] https://www.smh.com.au/politics/federal/300m-clean-energy-fund-to-back-fossil-fuel-hydrogen-projects-20200503-p54pdr.html

[ix] https://www.nsw.gov.au/news/planning-changes-to-support-growth-renewable-energy-projects

[xi] https://www.planning.vic.gov.au/latest-news/building-victorias-recovery-taskforce

[xii] Description of Keynesian economics: https://www.investopedia.com/terms/k/keynesianeconomics.asp

[xiii] https://www.smh.com.au/national/before-ken-henry-is-crucified-remember-the-good-he-did-20190208-p50whn.html

[xiv] https://www.abc.net.au/news/2014-05-21/parker-lessons-to-be-learnt-from-the-pink-batts-disaster/5466762

[xv] Finkel, et al., Independent Review into the Future Security of the National Electricity Market: Blueprint for the Future, June 2017

Related Analysis

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Community Power Network Trial: Potential risks and market impact

Australia leads the world in rooftop solar, yet renters, apartment dwellers and low-income households remain excluded from many of the benefits. Ausgrid’s proposed Community Power Network trial seeks to address this gap by installing and operating shared solar and batteries, with returns redistributed to local customers. While the model could broaden access, it also challenges the long-standing separation between monopoly networks and contestable markets, raising questions about precedent, competitive neutrality, cross-subsidies, and the potential for market distortion. We take a look at the trial’s design, its domestic and international precedents, associated risks and considerations, and the broader implications for the energy market.

Judicial review in environmental law – in the public interest or a public nuisance?

As the Federal Government pursues its productivity agenda, environmental approval processes are under scrutiny. While faster approvals could help, they will remain subject to judicial review. Traditionally, judicial review battles focused on fossil fuel projects, but in recent years it has been used to challenge and delay clean energy developments. This plot twist is complicating efforts to meet 2030 emissions targets and does not look like going away any time soon. Here, we examine the politics of judicial review, its impact on the energy transition, and options for reform.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.