Tasmania: Interconnectors and price caps, is there a link?

A second interconnector to Tasmania is unlikely to be feasible under expected energy market conditions, according to the final report of Dr John Tamblyn’s study, into the feasibility of a new link with the mainland[i]. The study determined that a business case for a second link should only proceed if one or more of three preconditions were met.

Meanwhile, at a time when Tasmania is assessing this additional interconnection to the National Electricity Market (NEM) the State Government’s concerns about the significant volatility of the NEM has led to legislative moves to introduce a cap on wholesale prices for 12 months.

Second interconnector

In April 2016, the Federal and Tasmanian governments established a feasibility study into a second electricity interconnector between Tasmania and Victoria. The study was initiated in response to energy supply challenges in Tasmania during 2015–16 which were caused by an extended outage of the Basslink interconnector and low hydro water storage levels, a result of low rainfall. The final study was released last month[ii].

Under the expected future energy market conditions the study concluded that it was unclear whether the second interconnector would be an economically feasible investment that would serve the long-term interests of electricity consumers. The modelling found that a second interconnector would deliver positive net benefits under two scenarios.

The first being if there was a significant future reduction in Tasmanian electricity demand. This would allow the surplus generation in the state to be exported rather than wasted because of a constrained link to Victoria.

In the other scenario, the development of an additional interconnector linking South Australia with the eastern states prior to the building of a second interconnector across Bass Strait was found to result in larger net economic benefits. This benefit would be amplified when these two investments were combined with additional interconnector upgrades from New South Wales (NSW) to Victoria and NSW to Queensland, resulting in larger positive net market benefits from a second interconnector under most scenarios modeled for the study.

The study concluded that while the modelling was useful in understanding the market dynamics it did not evaluate potential benefits from a second interconnector that would be allowable under a regulatory investment test for transmission, including competition benefits and some power system reliability and security benefits.

It also notes that a second Tasmanian interconnector would facilitate the development of wind energy. By simply increasing the capacity for the export of the generation to the rest of the NEM, although most of this was forecast to occur in the late 2020s and 2030s because of the earlier build of renewable projects in Victoria and SA.[iii]

Concerns with a second interconnector included:

- Regardless of the how the NEM develops it would have cost implications for electricity consumers. The critical issue was whether the NEM-wide benefits would exceed the NEM-wide costs.

- Policy uncertainty as to whether further strengthening of interconnection across the NEM can be justified when viewed as a system-wide strategy.[iv]

One or more of the preconditions Dr Tamblyn recommended should be met for a detailed business case to progress were:

- The Australian Energy Market Operator, in consultation with Hydro Tasmania and TasNetworks, concludes in a future National Transmission Network Development Plan that a second interconnector would produce significant positive net market benefits under most plausible scenarios.

- Additional interconnection is approved for construction between South Australia and the eastern states.

- A material reduction occurs in Tasmanian electricity demand

Price Caps

The Tasmanian Government introduced the Electricity Supply Industry Amendment (Pricing) Bill to the state’s Legislative Assembly on 2 May. The bill is designed to cap the wholesale power price for 12 months. The legislation will enable the Government to set the wholesale price on the first of July and aims to deliver an outcome which is consistent with Consumer Price Index (CPI) of about 2 per cent[v].

The State Government has pointed to wider market factors outside its control which were placing pressure on wholesale prices, “under the current regulatory settings”[vi]. The closure of Victoria’s Hazelwood power station and reliability issues in South Australia were cited as combining to drive prices to historically high levels.

Tasmania’s Treasurer, Peter Gutwein, told Parliament, “Due to Tasmania’s physical and market based connection to the NEM through Basslink, Tasmanian wholesale spot prices have been forced higher as they mirror the market volatility exhibited within mainland NEM jurisdictions. It has become obvious over recent months that a serious flaw exists in this framework as households and businesses across Tasmania cannot be insulated from this volatility in wholesale electricity prices under the current regulatory framework”.

The claim that this feature of the NEM is a “flaw” does not stand up. The point of the NEM is that market signals drive investment in both generation and (indirectly via the RIT-T process), transmission investment such as Basslink 2. Tasmanians have been happy to take the price-depressing impacts of imports from Victoria many times over the 12 years since Tasmania joined the NEM, but such effects cannot logically be a one-way street.

The Government has been advised that price increases of up to 15 per cent were likely to occur for residential and small business customers on regulated tariffs.

The Treasurer has argued that, “While Tasmanian wholesale spot prices have increased considerably, the actual cost of generating electricity in Tasmania has not increased to the same extent…. the Government does not consider it appropriate that Tasmanian electricity customers should be impacted by higher prices resulting from our direct linkage to the Victorian wholesale price which is increasing as a result of factors that are outside of the State’s control.”[vii]

The Bill is yet to go to the Upper House.

At a time when Tasmania is discussing becoming more interconnected this decision is distancing Tasmania from the market operations of the NEM. An energy-only market requires pricing volatility, which is designed to incentivise new investment.

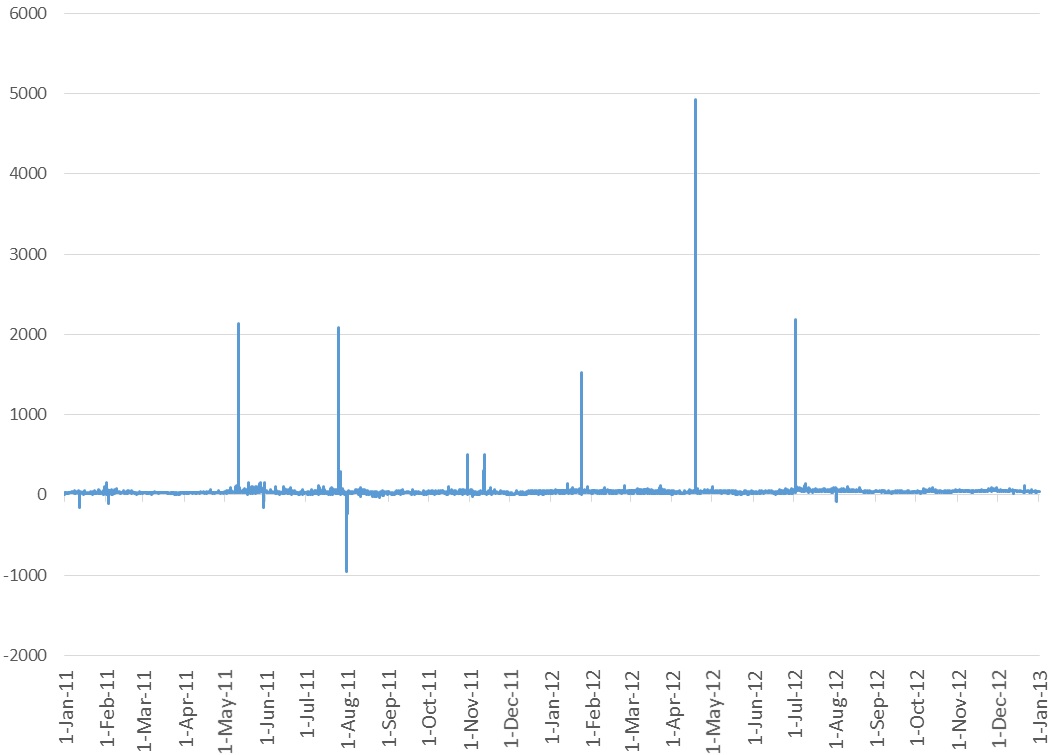

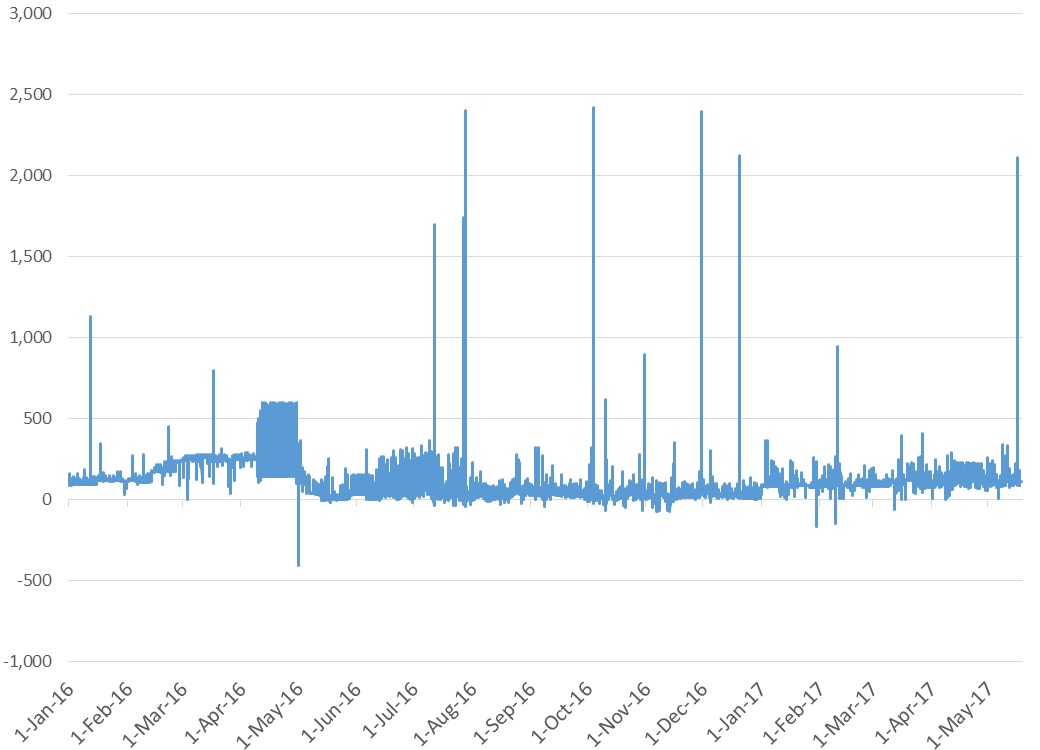

The price volatility in Tasmania is not simply a consequence of Hazelwood’s closure. Prices in recent years have been impacted by other factors such as low rainfall and outages with Basslink. Figure 1 and 2 shows the increase wholesale price volatility between 2011-12 and 2016-17.

Figure 1: Tasmanian Half-Hourly Spot price data from 2011 to 2012

Source: NEM Review, global roam, 2017

Figure 2: Tasmanian Half-Hourly Spot price data from 2016 to 2017 (March)

Source: NEM Review, global roam, 2017

Tasmania has more ability than other states to do this because the energy generation, distribution and retail companies remain publicly owned. Hydro Tasmania expects the wholesale electricity cap to save consumers $20 per megawatt hour, while it is expected to reduce the energy provider’s revenue between $10 million and $15 million next year[viii]. But of course, such intervention is a warning to other electricity businesses of the additional political risks of investing in Tasmania.

[i] Dr John Tamblyn, 2017, “Feasibility of a second Tasmanian interconnector Final Study” April 2017

[ii] ibid

[iii] ibid

[iv] ibid

[v] ABC News, 2017, “Government to legislate this week to cap Tasmanian power price for 12 months”, http://www.abc.net.au/news/2017-04-30/tasmanian-government-to-legislate-power-price-cap/8483948

[vi] Second Reading Speech, Hon. Peter Gutwein MP, Electricity Supply Industry Amendment (Pricing) Bill 2017

[vii] ibid

[viii] http://www.themercury.com.au/news/tasmania/energy-minister-matthew-groom-and-hydro-ceo-steve-davy-announce-details-around-wholesale-contract-pricing-to-support-local-businesses/news-story/37a8607dafaee8ebd1c4fe9a2b8b9082

Related Analysis

Is increased volatility the new norm?

This year has showcased an increased level of volatility in the National Electricity Market (NEM). To date we have seen significant fluctuations in spot prices with prices hitting both maximum price caps on several occasions and ongoing growth in periods of negative prices with generation being curtailed at times. We took a closer look at why this is happening and the impact this could have on the grid in the future.

Is there a better way to manage AEMO’s costs?

The market operator performs a vital role in managing the electricity and gas systems and markets across Australia. In WA, AEMO recovers the costs of performing its functions via fees paid by market participants, based on expenditure approved by the State’s Economic Regulation Authority. In the last few years, AEMO’s costs have sky-rocketed in WA driven in part by the amount of market reform and the challenges of budgeting projects that are not adequately defined. Here we take a look at how AEMO’s costs have escalated, proposed changes to the allowable revenue framework, and what can be done to keep a lid on costs.

Offshore wind feasibility licenses have been granted – what are the proposals and who’s behind them?

The Federal Government has announced the first proposed offshore wind projects to receive a feasibility licence for development of generation in the Gippsland Offshore Wind Zone. We take a look at the proponents and projects.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.