Renewables: A tale of ups and downs

The Australian Bureau of Statistics (ABS) released the second annual Employment in Renewable Energy Activities update for 2014-15. Employment in renewable energy activity fell 3 per cent in 2014-2015 in comparison to the year before and continues a decreasing trend from 2011-2012.

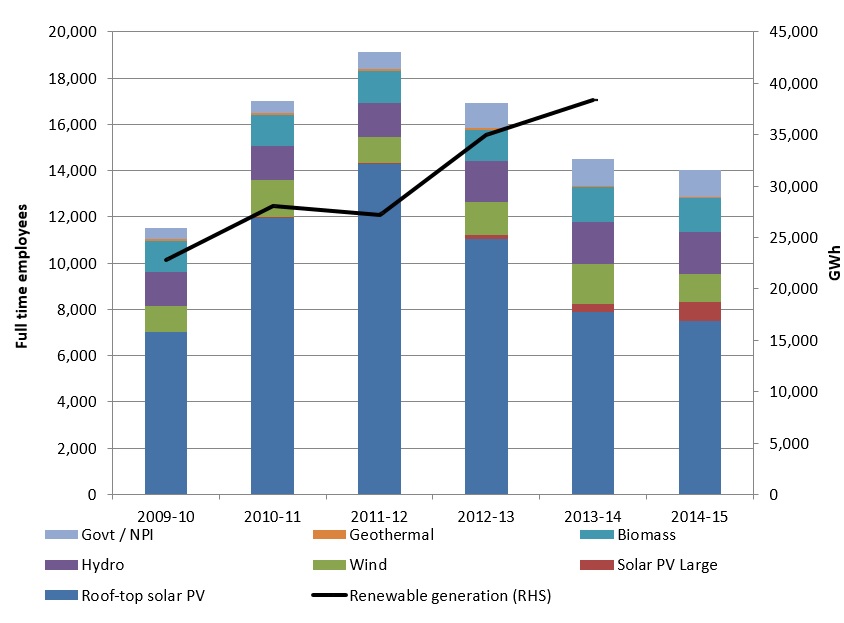

There is also a diverging trend from the amount of renewable energy generated and the number of jobs in renewable energy activities, which is shown in Figure 1. The graph shows the number of full time employees (FTEs) engaged by each subsector of the renewable energy industry and the amount of renewable generation across Australia from 2009-10 to 2013-14 (note that generation statistics for 2014-15 are not yet available).

Figure 1: Direct FTE Employment in Renewable Energy activities by Renewable Energy type

Source: Australian Energy Council analysis of ABS data

The divergence between the electricity generated from renewables and the number of FTEs in the renewable energy sector highlights the fact that these jobs are mainly short-term roles. Many appear to be construction and installation jobs. In the case of utility-scale renewable generation projects, once they are completed they require limited ongoing roles. For example, the 315MW Hornsdale wind farm in South Australia is expected to employ 250 people full-time during construction and have 10 ongoing jobs when the wind farm becomes operational[i].

The decrease in FTEs required as the assets are completed, while the cumulative capacity of renewable generation overall is growing is leading to a larger differential in the electricity production and the number of full-time jobs each year as can be seen in Figure 1.

The correlation between construction and installation jobs in the renewable energy sector is also illustrated by the change in job numbers in solar, which includes rooftop PV, solar hot water and large scale solar. While it remains the most significant source of renewable sector employment (in 2014-2015 solar represented 59 per cent of total employment in renewable energy activities) with 8,310 jobs, it is down from 14,350 solar energy roles in 2011-2012, according to the ABS.

Rooftop solar PV jobs, which include solar hot water systems, peaked at 14,300 in 2011-2012 and stood at 7,480 in 2014-15. Large-scale solar jobs are up from 50 to 830 roles between 2011-2012 and 2014-2015, which reflects work on new large-scale solar farms such as Broken Hill, Moree, Nyngan, Royalla and Kogan Creek solar farms which all started construction in the 2013-14 and 2014-15 financial years

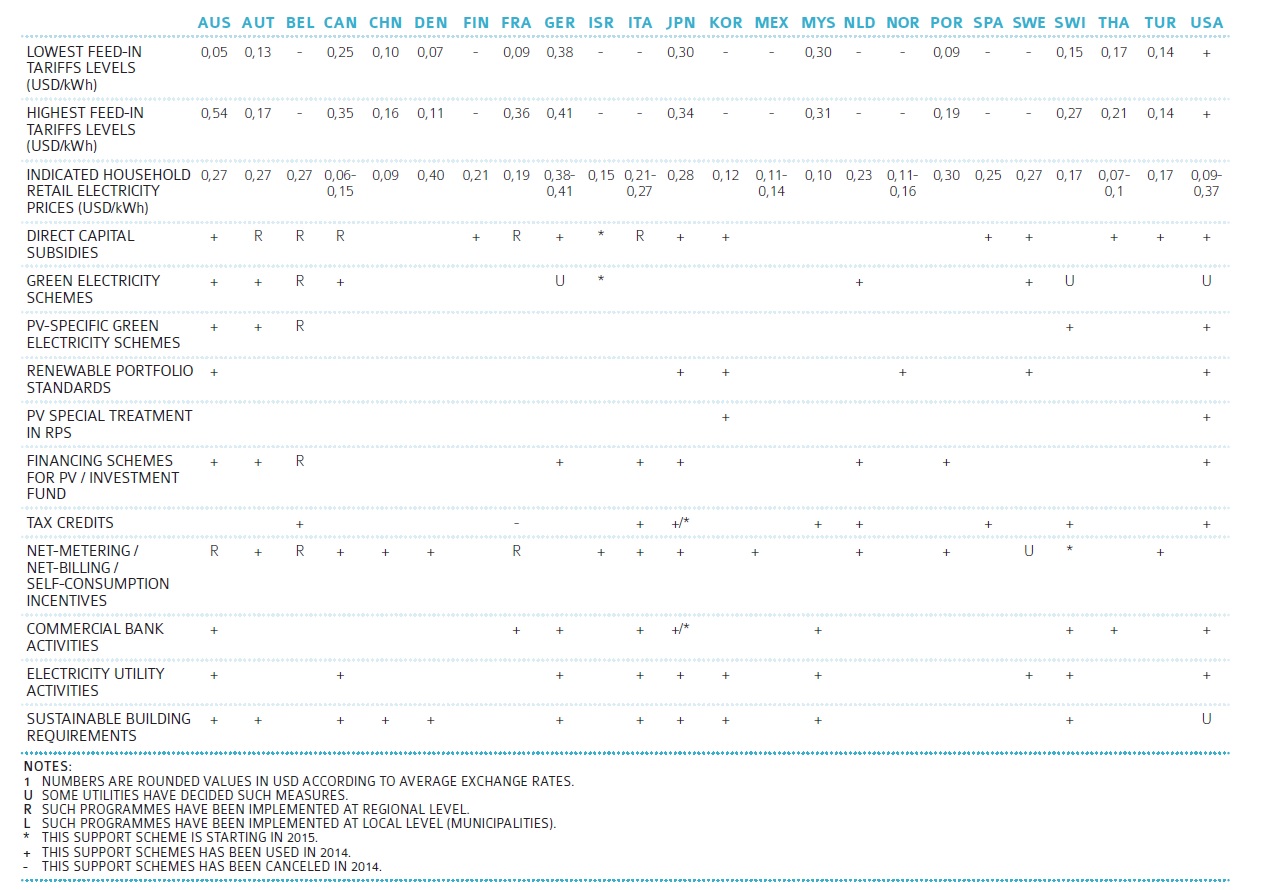

The rise and fall of FTEs in the roof-top solar PV sector is driven by a range of support mechanisms. The most recent International Energy Agency (IEA) trends in photovoltaic application report compares the support mechanisms for solar PV in selected countries, including Australia.

Australia uses all support mechanisms with the exception of two, those being PV special treatment in Renewable Performance Standards and tax credits. It is worth noting, however, that tax credit support mechanisms were introduced in Australia’s 2015-16 budget and small businesses became eligible to write off purchases under $20,000. The only country which utilises as many support mechanisms as Australia is the USA.

The generous schemes and subsidies have led to a penetration rate of above 40 per cent in some Australian suburbs and figure 2 shows the penetration rate for Brisbane and its surrounding suburbs.

Figure 2: Brisbane solar penetration rate

Source: Australian PV Institute (APVI) Solar Map

As noted above rooftop solar jobs peaked at 14,300 in 2011-2012 and stood at 7,480 in 2014-15. In June 2012, Australia experienced the highest capacity of solar installations with 179 MW of rooftop solar PV installed. The maximum monthly installation in 2014-15 was 77 MW in October 2014[ii].

Employment in wind has remained steady from 2009-10 to present, averaging 1,377 FTEs over the period and peaking at 1,720 in 2013-14. As at February 2014 a total of 15 wind farms were under construction across Australia[iii]. Investment in wind energy is driven by Federal schemes such as the Renewable Energy Target (RET), and State-based schemes such as the ACT’s 50 per cent RET. These targets provide investment signals through periodic reverse auctions in the case of the ACT and through a market for Large-Scale Generation Certificates in the case of the Federal RET.

Hydro power stations employ the second highest number of people in renewable energy related activities and have been consistent employers. The Tarraleah power station was commissioned in 1938 and still runs today, while the most recent hydro power station to be commissioned was the Jounama power station, which was commissioned in 2010. The number of employees in the hydro sector has increased to 1,820 in 2014-15.

[i] Government of South Australia, “State’s latest wind farm project continues clean jobs growth”,http://www.statedevelopment.sa.gov.au/news-releases/all-news-updates/states-latest-wind-farm-project-continues-clean-jobs-growth

[ii] Australian Energy Council analysis of CER data

[iii] Appendix 2a, Electricity Gas Australia 2014

Related Analysis

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

A farewell to UK coal

While Australia is still grappling with the timetable for closure of its coal-fired power stations and how best to manage the energy transition, the UK firmly set its sights on October this year as the right time for all coal to exit its grid a few years ago. Now its last operating coal-fired plant – Ratcliffe-on-Soar – has already taken delivery of its last coal and will cease generating at the end of this month. We take a look at the closure and the UK’s move away from coal.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.