Green hydrogen: Is it still in the pipeline?

Hydrogen has been increasingly under the spotlight recently, with commentators spruiking a range of benefits from long-term energy storage, to its ability to make optimal use of renewable energy sources.

Earlier this year, Chief Scientist Alan Finkel’s hydrogen power strategy group stated that Australia could soon be “exporting sunshine” in the form of renewable energy[i]. The group has gained support from the Commonwealth Government which announced a $50 million investment towards a $500 million world-first hydrogen project in the Latrobe Valley.

Kawasaki’s Latrobe Valley project, delivered by a consortium of Japanese and Australian companies, will see the development of a pilot plant that will integrate carbon capture and storage and ship the hydrogen to Japan to help fulfil that country’s transition to a low emission ‘hydrogen society’.

While the Latrobe Valley will produce hydrogen from brown coal, some see this as a significant step towards achieving “green” hydrogen.

A renewable energy to hydrogen plant has been proposed for Port Lincoln in South Australia (SA), and French company Neoen has also announced its intention to undertake a feasibility study for a hydrogen electrolyser at Port Pirie, also in SA.

In Jandakot, Western Australia, an ATCO trial project will use excess solar power to turn water into hydrogen (more below). The WA Government is also planning to host Australia’s first dedicated renewable hydrogen conference, to showcase hydrogen fuelled products and to provide a platform for the industry to share its future vision as a new and emerging industry.

But while it is currently possible to produce zero-emissions hydrogen, the main problem is cost - it is uneconomical to produce and export at a large scale. So where does hydrogen currently stand?

Morgan Stanley Research

A recent report by Morgan Stanley Research (MSR) has looked at the possibility of hydrogen as a key player in the low carbon transition.

The current size of the global hydrogen market stands at around 70 million tonnes per year, with global sales of approximately US$130 billion. The Hydrogen Council – a global initiative of energy, transport and industry companies – has a vision to generate US$2.5 trillion of global revenue (from both hydrogen and equipment sales) and reach 18 per cent of energy demand by 2050, which would require a ten-fold increase in demand.

Today the bulk of the globe’s hydrogen is produced from fossil fuels, predominantly methane from natural gas. However MSR believe that by replacing it with green hydrogen this can help to lower industrial carbon intensity.

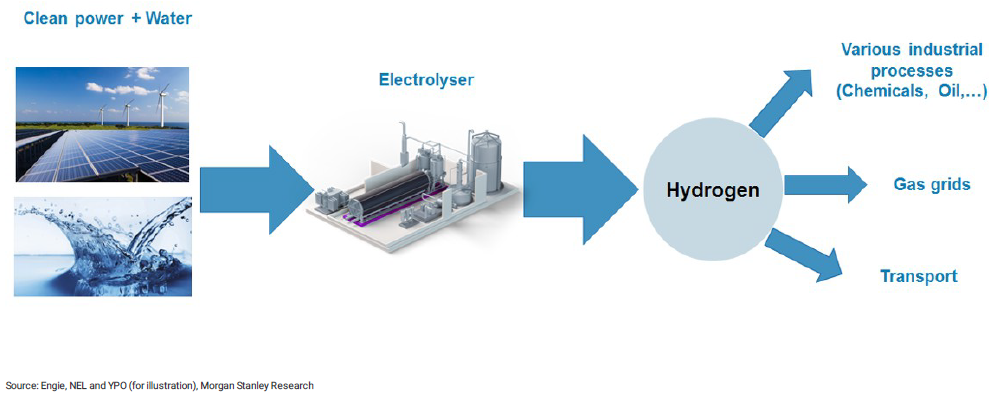

Hydrogen, when produced from clean energy sources, has the potential to reduce carbon emissions from a range of sectors. One method of producing hydrogen is to use electricity to electrolyse water, splitting it into hydrogen and oxygen. And if the electricity is sourced from renewables, this process produces no carbon[ii].

Figure 1: The hydrogen value chain

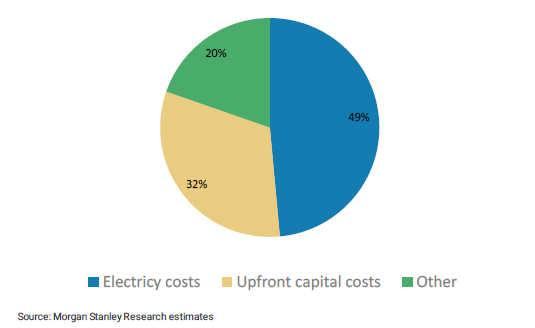

However this process is currently expensive because electricity is a significant cost input (Figure 2). Based on current polymer electrolyte membrane electrolysers, around 1.5MWh of electricity is required to produce 25kg of hydrogen, according to the report.

Figure 2: Breakdown of the levelised cost of hydrogen (for grid injection) by expenditures

Why hydrogen?

Hydrogen hosts a range of potential benefits: It can serve as an alternative fuel for internal combustion engines, it can be used in fuel cells for transportation and for distributed energy supply[iii].

“Hydrogen can be used as a mix with natural gas in gas grids, as a heating and cooling fuel in dedicated grids to substitute fossil fuels for cars, buses, trucks, trains and ferries,” the report says.

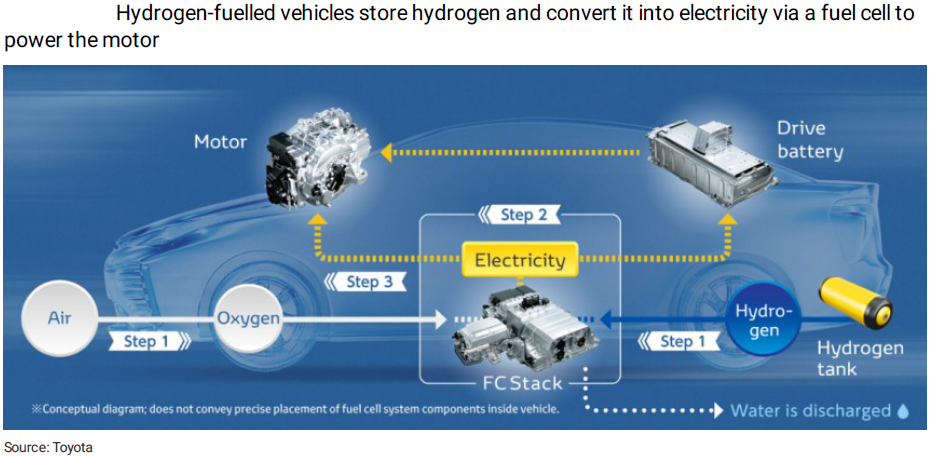

However MSR believe that fuel cells will be the main driver of future hydrogen demand. Instead of storing electricity in batteries, fuel cell vehicles can instead store hydrogen in their tanks and convert it into electricity - essentially making them electric. Fuel cell vehicles are also efficient – they can be filled up in three minutes like a normal car, have a range of up to 800 kilometres, can lead to a significant cut in airborne pollutants, and run much more quietly.

Figure 3: Hydrogen-fuelled vehicle

MSR estimate that fuel cell electric passenger cars could represent three per cent of new vehicles sales by 2030 (35 per cent by 2050) consuming 12,000 tons of hydrogen every day (4 million tons a year).

But hydrogen is not just limited to transport. MSR believe industrial gas companies and utilities are in the best position to benefit from a transition to green hydrogen, where it can be used to reduce emissions within the sector’s existing processes. It can also be used in major industrial processes such as ammonia and fertiliser production, and in the oil refining, metals and food processing sectors.

The virtuous circle

Electrolysers, which are used to produce hydrogen, are flexible and may be able offer ancillary services to power grids to offset the intermittency of renewables by converting electricity into hydrogen which, unlike electricity, can be stored.

Electrolysers are as flexible as gas turbines with their quick response capabilities. According to the report, NEL Hydrogen’s M series electrolysers have a start-up time of less than five minutes while it can take 10-25 minutes for some gas turbines to start.

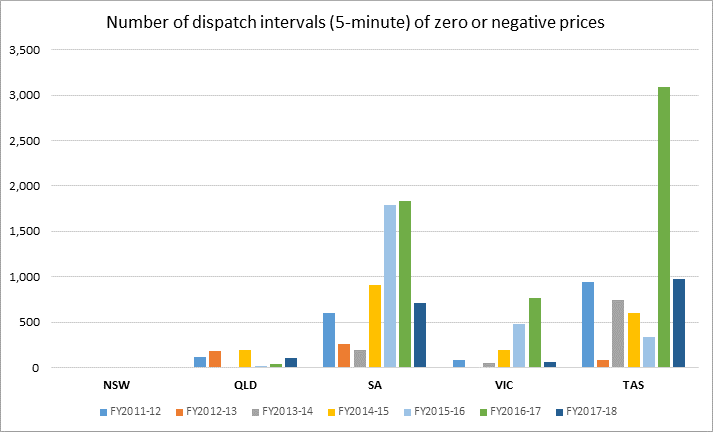

MSR believe that hydrogen could help to address the lack of flexibility of renewable power systems and create a “virtuous circle” for the power sector: A higher rate of renewable power could lead to lower electricity prices, which in turn, influences hydrogen costs. And as more renewable capacity is deployed, hydrogen can play a part as an integrator harnessing surplus power generation and balancing intermittent supply and demand. The graph below shows how frequently wholesale energy is free (or better than free!) in the National Energy Market. While it still only occurs for a few percent of the time, it is becoming gradually more common with more intermittent energy coming into the system. It declined somewhat in 2017-18 due to the closure of inflexible coal plants and increased transmission export capacity from South Australia, but is likely to grow again.

Figure 4:

Source: Australian Energy Council’s Analysis of NEM Review

Source: Australian Energy Council’s Analysis of NEM Review

However electrolysers are currently small (maximum of 10MW) and their total installed capacity remains low. By building installed electrolyser capacity, MSR believe that national power systems could achieve a higher share of renewable power without creating “too much” instability, allowing wind and solar farm operators to avoid curtailment.

As an offshoot, MSR expect an increasing green hydrogen demand to also boost electrolyser manufacturing in the long term once the technology is proven and develops economies of scale. While in utilities, it is estimated that hydrogen could influence grid investment and drive renewables investment to up to €140bn per year in 2019-2050.

Challenges and opportunities

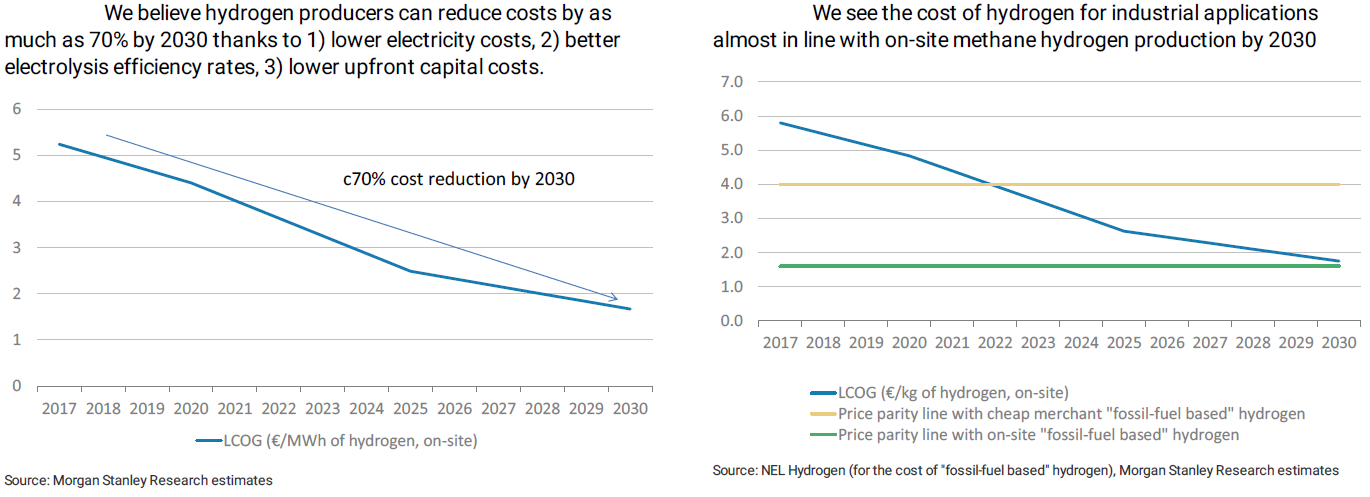

While the Hydrogen Council’s 2050 vision requires major investment, MSR believe that the economics have started to improve with the levelised cost of hydrogen estimated to drop up to 70 per cent (to €1.7/kg) by 2030. And while green hydrogen is currently 2-3 times more expensive than hydrogen from methane, the report anticipates that the prospect for green hydrogen is set to improve due to the declining costs of renewables, coupled with increased government policies to support decarbonisation. It is estimated that price parity could be achieved by 2030 (Figure 4).

Figure 5: Projected hydrogen cost reductions

Utilities see hydrogen as an opportunity, and so far, there has been some small-scale support in the UK, Japan and Germany. Although MSR believe that more infrastructure is required – storage, charging, pipelines – there are still several “unanswered technological and policy questions”.

The report notes that the “headwinds” for green hydrogen development include:

- Lack of storage, transport and mobility infrastructure: Currently there is limited developed infrastructure to store and transport hydrogen. Charging stations for transport are also unlikely to be developed without government subsidies.

- Safety: Hydrogen is flammable, colourless and odourless, which makes safety checks more difficult.

- Energy intensity: Green hydrogen production is not energy efficient, with around 30 per cent of the energy in the electricity wasted.

- Water intensity: Access to water could be a deterrent as water electrolysis requires potable water as an input. ITM power says their product requires 27 litres of water for 1Kg of hydrogen. According to the report, this is around twice as much water than needed for the steam methane reformer, which is the most common type of production today, though technology developments could improve water usage.

MSR also believe that broad government support is required for further development, “electricity grid fee waivers, support for infrastructure development and tougher environmental standards are all potential drivers,” the report says, “we are seeing increasing signs of support in Europe (we mapped €5bn in projects this year), with more projects in Japan, China, US, Australia.”

Where are we?

Over the past few months new projects have been announced across the globe in industries such as refining, power, ferries, and rail. Locally, we have seen interest in the development of hydrogen technology, while opportunities to export to emerging markets looks increasingly possible.

Hydrogen cities

Japan plans to use the 2020 Tokyo Olympics to showcase the city’s ‘hydrogen society’ with hydrogen fuel cell vehicles, a network of filling stations, and a hydrogen-powered athletes’ village.

It forms part of the country’s national strategy towards achieving an emissions-free society and increasing its ‘hydrogen economy’. While the technology is still costly, fuel cell vehicle sales are not expected to increase without more refuelling stations. To combat this chicken and egg problem, 11 companies backed by the Japanese government - including Toyota, Honda and Nissan - announced a venture in March to pool resources to build 80 hydrogen stations in the next four years.

Australia’s hydrogen city

In January Australia’s own ‘hydrogen city’ was proposed by Dr Alan Finkel and Innovation and Science Australia. While still only a concept, it proposes an entire city be converted to clean hydrogen by 2030, using zero-emission energy sources such as solar, wind or hydro.

The ACT Government has purchased 20 of Hyundai’s Nexo vehicles as part of a $23 million renewable fuels test, with the cars expected to arrive by early 2019[iv]. While there are tens of thousands across Japan, South Korea and Singapore, there are only five hydrogen-fuelled cars currently in Australia. Some believe Federal Government support will be vital for the cars to become a common sight on Australian roads.

Woodside Petroleum recently called for the Federal Government to mandate a percentage of government cars be electric or zero-emission vehicles, arguing that the rollout of electric car chargers could be powered by hydrogen fuel cells. Woodside stated that Australia should be investing in hydrogen infrastructure to aid the uptake of hydrogen fuel cell electric vehicles[v].

The next export boom?

Currently, North America leads the hydrogen fuel cell vehicle market. However, Japan is expected to register the highest growth in Asia-Pacific by 2023[vi] - and Australia looks like a potential front-runner to becoming a key exporter to emerging Asian markets.

Prime Ministers Malcolm Turnbull and Shinzo Abe of Japan signed an accord in January to jointly pursue opportunities in the hydrogen supply chain between the two countries. While late last year the CSIRO launched new Future Science Platforms to make Australia a renewable energy exporter. The $13.5 million investment aims to make Australia a “hydrogen fuel leader” (Figure 5).

“As of this year Australia is the world's biggest natural gas exporter. Hydrogen could be in the same position in the next couple of decades,” CSIRO principal research scientist Michael Dolan said.

Figure 6: Will hydrogen be Australia’s next export?

In April this year the Commonwealth Government and AGL Energy announced that they had reached an agreement to work on the Latrobe Valley trial project with Japanese company, Kawasaki Heavy Industries for lignite-to-liquid hydrogen conversion. The first hydrogen shipment to Japan is scheduled for 2020-21.

The CSIRO has also announced that it has a new way to make clean hydrogen fuel from ammonia, which would allow it to be stored and transported safely to international markets. Two cars powered by hydrogen derived from ammonia were recently tested in Brisbane. The conversion pilot project, to be launched later this year, is anticipated to open a new supply chain to emerging markets in Japan, South Korea and Europe.

Investment and innovation

South Australia has several hydrogen projects expected to progress this year. The Australian Renewable Energy Agency (ARENA) funded a South Australian pilot project for AquaHydrex, in partnership with Australian Gas Networks, to set up an electrolyser that will use the excess renewable energy to generate hydrogen to be injected into the South Australian gas grid.

“Hydrogen is set to play a larger role in the renewable energy space not only in Australia, but around the world,” ARENA Chief Executive Ivor Frischknecht was reported to say.

“The potential for hydrogen to be a carrier of renewable energy is limitless which is why ARENA will be funding projects from the production of hydrogen all the way to transporting and end use. The capability to supply renewable hydrogen at a competitive price is likely to lead to investment throughout the rest of the supply chain, including dedicated renewables for export.”[vii]

ARENA has also announced $1.5 million to fund Australia’s first green hydrogen innovation hub at Jandakot, Western Australia. ATCO will trial the production, storage and use of renewable hydrogen to energise a commercial-scale microgrid, and testing the use of hydrogen in different settings and applications including in household appliances. The $3.3 million development project will evaluate the potential for renewable hydrogen to be generated, stored and used at a larger scale[viii].

Also to the west, Australia’s Hazer Group is piloting the Hazer process - a low-cost, low-emission hydrogen production process - which uses iron ore instead of much more costly catalysts such as powdered nickel[ix].

[i] https://www.theaustralian.com.au/national-affairs/climate/chief-scientist-alan-finkel-talks-up-green-hydrogen-exports/news-story/084d7c40674373ab969312a2674fd534

[ii] https://www.createdigital.org.au/hydrogen-could-be-a-major-clean-energy-export-but-first-there-is-work-to-do/

[iii] http://www.hydrogenaustralia.org/information/hydrogen.html

[iv] https://www.news.com.au/technology/innovation/motoring/hitech/hyundai-nexo-hydrogen-car-coming-to-australia-this-year/news-story/70718407b2b6a78020d054febd9a5f57

[v] https://www.energycouncil.com.au/media/13324/woodside-and-hydrogen.pdf

[vi] https://ittechherald.com/2018/08/11/global-hydrogen-fuel-cell-vehicle-market-insights-forecast-to-2025-top-manufacturers-region-type-and-application/

[vii] https://arena.gov.au/blog/hydrogen-funding-round/

[viii] https://pacetoday.com.au/green-hydrogen-innovation-hub-built-wa/

[ix] https://www.afr.com/technology/hazer-group-draws-overseas-interest-with-hydrogen-breakthrough-20171001-gys4q7

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.