Green certification key to Government’s climate ambitions

The energy transition is creating surging corporate demand, both domestically and internationally, for renewable electricity. But with growing scrutiny towards greenwashing, it is critical all green electricity claims are verifiable and credible. The Federal Government has designed a policy to perform this function but in recent months the timing of its implementation has come under some doubt.

Here we look at what is known as the Renewable Electricity Guarantee of Origin (‘REGO’) scheme and why its swift implementation is so critical to meeting the Government’s climate ambitions.

The REGO in a nutshell

Last year, the Federal Government started work on the REGO scheme, which is designed to be a voluntary mechanism for the certification of renewable electricity. It would allow energy businesses to claim a certificate for each megawatt hour of renewable generation created which they can then sell to entities (mainly corporations, governments, and councils) wanting to show their green credentials.

During consultation, the Department described renewable certification as an “important building block of the decarbonisation plan” and a “key enabler of decarbonisation across our entire economy” because it would:

- Capitalise on growing voluntary corporate demand for green electricity, which would provide incentives for companies looking to invest in renewable generation.

- Support Australia’s ambition to be a renewable superpower by providing transparency and confidence to global markets that exports like hydrogen are produced using green electricity.

The Department proposed a draft design of the REGO framework in October last year with the intent to commence from 1 January 2025. However, since then, there has been no movement on the REGO’s progress, and some concern is growing that the policy’s rollout may have stalled.

While the Government no doubt has plenty on its plate heading into an election, setting up an enduring green certification scheme should be a high priority – in fact, the Climate Change Authority stressed only late last year that a certification mechanism beyond 2030 is critical to maintain momentum in renewable investment.[i]

Let’s look at why.

Green certification will capitalise on growing voluntary demand for renewables

Much has been said over the past few weeks about Australia’s 43 per cent emissions reduction target by 2030 and whether it is achievable. Ultimately there is no silver bullet for decarbonising Australia’s economy, and only through a robust policy framework will industry have certainty and confidence to invest in low carbon technologies.

So far, the Government has focused on meeting its interim target through accelerated decarbonisation of the electricity sector, framed through an 82 per cent renewable energy target. Alongside state initiatives, the Federal Government has two major policy levers to incentivise renewable investment – the Renewable Energy Target (‘RET’) and expanded Capacity Investment Scheme (‘CIS’).

These policies will push Australia closer to its interim targets but are not expected to be enough on their own. Recent modelling suggests even with full delivery of the 23 gigawatts under the CIS, there will still be a nine-gigawatt gap compared to what is needed to reach 82 per cent, creating an awkward policy dilemma.

While the Government is understandably focused up to 2030, all new renewable projects will run beyond 2030 and therefore market participants (especially those without CIS access) want to see long-term investment signals before they commit. Moreover, there is the known reality that continued investment in renewable generation is needed post-2030 to inch closer to net-zero (as well as replace retiring renewable assets).

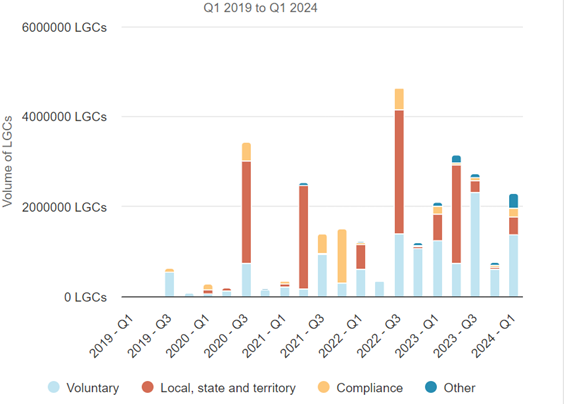

This is where a green certification scheme can help. The last few years have seen exponential growth in voluntary demand for renewable generation, driven by governments and companies making climate commitments (see Figure 1 below). The Clean Energy Regulator says the incoming climate disclosure reforms should further accelerate this demand.[ii]

Figure 1: Voluntary demand for Large-scale Generation Certificates (LGCs) (Q1 2019 to Q1 2024)

Source: Clean Energy Regulator Quarterly Carbon Market Report June 2024

While there is an existing certification scheme through the RET, its design is over 25 years old and is set to wind down in 2030. This is problematic because those investing in renewable generation want to see enduring certification in place so they have policy certainty on their likely return. Meanwhile, those buying certified renewable electricity are starting to have more stringent expectations about renewable energy attributes, which the RET is not designed to meet.

For example, an energy attribute that is seeing increased demand is timestamping (i.e. the time at which the renewable electricity is generated). This is important to companies with claims about being 100 per cent renewable and is a proposed design feature for REGO certificates.

Looking forward, timestamped certificates should provide an incentive for companies to produce green electricity (likely in combination with storage) at times where fossil fuel generation is dominant. This is because green electricity produced at times of otherwise low renewable supply will fetch a premium from the voluntary market. Incentives of this type will become more important over time as the cost of additional renewable penetration increases the closer we get to zero electricity missions.

Lastly and importantly for government, the REGO will not be a cost impost on customers. Unlike the RET, REGO certificates would be voluntary meaning there is no requirement for electricity retailers to purchase them.

Green certification will fast track Australia’s ambition to be a renewable superpower

During the May budget, the Federal Government committed $8 billion in incentives over ten years to support the production of renewable hydrogen – a key part of its Future Made in Australia ambition. The details and design of these incentives will be consulted on later in the year.

In a recent speech, Treasurer Jim Chalmers set expectations for around 20 large renewable hydrogen projects to come online through this incentive. But this will not happen right away. In fact, the Clean Energy Finance Corporation does not see green hydrogen being cost competitive until at least 2030, and even possibly well after that.[iii] These economics mean by the time renewable hydrogen is ready for commercial sale, the certification scheme for verifying its green authenticity will have wound down.

While this might sound like a policy problem for 2030, it is not that simple. Hydrogen production has long lead times and investors looking at its commercial prospects need long-term policy certainty now. Enduring green certification is particularly important because:

- ARENA, who are administering grants through the Hydrogen Headstart program, have specified that access to funding requires proving that 100 per cent of all electricity used to produce hydrogen is from renewables.

- International markets are already mobilising around stringent certification standards for green hydrogen. This was illustrated at COP28 last year when Australia, alongside many other major economies, signed the Declaration of Intent on Mutual Recognition of Certification Schemes for Renewable and Low-Carbon Hydrogen.

- Prospective industrial and commercial customers want to sign long-term contracts well beyond 2030 and expect an enduring certification mechanism to be in place ahead of time. For example, a recently signed 15-year green hydrogen supply contract in Europe will run from 2030 to 2045.

So green certification is not just some fuzzy ESG expectation; it has strong commercial appeal to those likely to invest in any hydrogen future.

Conclusion

An enduring green certification scheme is a missing piece in the Government’s current policy ambition and is integral to realising a net-zero Australia. Its timely implementation will help provide long-term investment signals to private capital to continue pushing ahead with Australia’s energy transformation.

Not only will this complement the hard work being done under the CIS, but it will also position Australia to capitalise on its renewable superpower ambitions.

[i] Climate Change Authority, ‘2023 Annual Progress Report’, October 2023, p86.

[ii] Clean Energy Regulator, ‘RET Administration Report 2022’, March 2024, p29.

[iii] Clean Energy Finance Corporation, ‘Australian hydrogen markets study’, May 2021, p87.

Related Analysis

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Community Power Network Trial: Potential risks and market impact

Australia leads the world in rooftop solar, yet renters, apartment dwellers and low-income households remain excluded from many of the benefits. Ausgrid’s proposed Community Power Network trial seeks to address this gap by installing and operating shared solar and batteries, with returns redistributed to local customers. While the model could broaden access, it also challenges the long-standing separation between monopoly networks and contestable markets, raising questions about precedent, competitive neutrality, cross-subsidies, and the potential for market distortion. We take a look at the trial’s design, its domestic and international precedents, associated risks and considerations, and the broader implications for the energy market.

Judicial review in environmental law – in the public interest or a public nuisance?

As the Federal Government pursues its productivity agenda, environmental approval processes are under scrutiny. While faster approvals could help, they will remain subject to judicial review. Traditionally, judicial review battles focused on fossil fuel projects, but in recent years it has been used to challenge and delay clean energy developments. This plot twist is complicating efforts to meet 2030 emissions targets and does not look like going away any time soon. Here, we examine the politics of judicial review, its impact on the energy transition, and options for reform.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.