Energy Retail: Meeting the Future Needs of Energy Consumers

The electrification of everything, responsive demand and energy storage, the rise of prosumers and digitalisation and the evolving regulatory framework are all changing the landscape for energy consumers, making it clear that the traditional energy only retail model is not likely to meet all of consumers’ needs in a high consumer energy resources (CER) world.

As governments are actively considering the role of market participants in a high CER world and other market participants roles are re-positioning, it’s vital to create a supportive environment for customer choice and flexibility as the energy market evolves and as more consumer energy resources are brought into people’s homes, businesses and communities. The Australian Energy Council (AEC) and its members are working to ensure customers have the support they need to make the best decisions for their circumstances and find the right products and services. And we look forward to collaborating with other parties to deliver an energy market that is in the long-term interests of consumers.

With these goals in mind, the AEC is in the midst of a series of projects which will help consumers find the connections they need. The first of these projects considers the role of the retailer in a high CER future. The project commenced in mid-July this year and we have been considering critical trends, consumer needs and preferences and the role of retailers in supporting customer outcomes, from the perspective of a hypothetical model retailer.

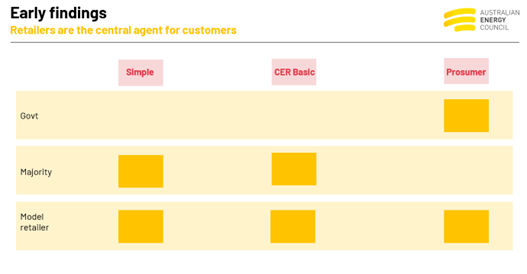

It’s still early days for this project but several themes are emerging. For example, we are seeing that in the future, retailers will still be the central agents for customers in the evolving competitive retail market. In red on the below diagram, we identify three cohorts of customers. It’s apparent that government and regulators are focussing current reforms on the prosumer while most customers are still in the simple or CER basic cohorts. Our view is that the retailer of the future will want to have a suite of offers that cater to each of the three cohorts.

We plan to release a public facing document later this year. When complete, the “role of retailer's” project will provide the framework for why specific policy and regulatory settings are needed to ensure customers are adequately served and protected during the system wide energy market transition.

The second project we have been working on is a CER Orchestration collaboration with Energy Networks Australia. This collaboration arose out of several forces, but in particular an acknowledgement from both AEC and Energy Networks Australia (ENA) members that no single part of the supply chain can alone deliver the breadth of solutions needed to enable consumers to thrive in a future energy system. The project aims to build relationships between networks and retailers so we can find alignment on CER integration priorities. We want the focus to be on building relationships between the two parties so that mutual understanding can develop, and we can explore what future projects might be possible.

In our CER Strategy, we acknowledge that CER integration is not a task that can be achieved by one party alone. Success will require collaboration across multiple parties. The achievement of this project will require a concerted effort to foster genuine collaboration, some of which we are already seeing emerge between networks and retailers, for example, in the community battery space.

The third Future Retail project seeks to illustrate a ‘Retailer Vision for Tariffs’. There is an important distinction which needs to be made between network tariffs and retail tariffs. At present, the drive for cost reflectivity is at the network end, with networks developing network tariffs which are then approved by the Australian Energy Regulator (AER).

Under current arrangements, and considering retail price regulation, it is challenging to understand the rationale for small customer cost reflective network tariffs if the customers do not see the price signals. The benefits the AER talks about in terms of reducing the need for additional investment only accrue when customers shift their behaviour at the right scale, at the correct location, at the right time, and at lower cost than other network options. Postage stamped network price signals deliver no benefits given network utilisation differs significantly by location.

In recent months, there has been significant media attention on the challenges which customers face when dealing with cost reflective network tariffs which are passed through to customers by their retailer. There has been a reaction from decision makers to try to strengthen the consumer protections surrounding this arrangement.

The AEC position on tariffs is iterative, highlighting that customer needs will change as products, technology, and the energy system continues to evolve. For today’s market;

- Customers should be able to opt in to changes in network tariffs in conjunction with their retailer i.e. they should not be mandated by a network that bears no obligation for education, assistance or relief.

- Customers want tariffs that are simple (easy to understand) and actionable (provide a clear price signal that they can easily act on). A key component here is that the customer should both understand their retail tariff and have the capacity to act on it.

- The AEC does not support demand tariffs or power factor tariffs for small customer classes. The AEMC is undertaking its review on electricity pricing for a consumer-driven future, and we urge that mandatory assignment to these types of network tariffs be paused until after this more comprehensive review.

- The introduction of flat tariff structures with the DMO/VDO was linked to a significant reduction in innovative/complex tariffs offered by retailers. The impact of price regulation on the ability of pricing to support a transitioning energy system needs to be further investigated.

- The AEC supports simple time of use tariffs which nudge the customer towards future behaviour shifts e.g. the draft Victorian networks simple three part Time of Use tariffs developed jointly to apply across Victoria for the current round of networks TSS’s.

- As the energy market evolves, retailers need industry, government, and regulator support to develop more dynamic network pricing signals to unlock the long-term benefits of the changing energy landscape for customers. As a positive example of this, EnergyAustralia is actively collaborating with the Energy Charter to try and make this vision a reality for customers. The AEC welcomes this collaboration.

The AEC is excited about our work in Future Retail which stands to benefit customers, retailers and the system as a whole. By starting with the customer as our focus and investigating consumer needs and preferences in a future setting, we can help create an energy system ecosystem that best supports those needs and preferences. Retailers have unique relationships with their customers which deliver deep and nuanced insights, and our current projects attempt to draw on these insights to help shape an energy market of the future that is in the long-term interests of consumers. We know it is vital to deliver a transition at the lowest possible cost to customers and to maximise customer capacity to make choices that suit their circumstances. The customers of the future are becoming more diverse, not less, and it is our goal to ensure the market arrangements and system can cater to these individual needs. We welcome our part in creating a supportive environment for customers as their needs continue to evolve and as the competitive retail energy market continues its transition.

Related Analysis

Beyond the Rebate: Battery Policy, VPPs, and Household Returns

A re-elected Labor Government’s promise to cut home battery costs by 30 per cent through the Small-scale Renewable Energy Scheme (SRES) has sparked interest—and raised questions. While the move may accelerate battery uptake among solar households, critics warn it could deepen inequities by leaving renters and vulnerable customers behind. More importantly greater value will be realised if the storage capacity is also coordinated through mechanisms like Virtual Power Plants (VPPs). We take a look at the benefits of VPPs.

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

Australia's Solar Waste: A Growing Problem

Australia has long been a global leader in the adoption of solar energy, with one of the highest per capita rates of rooftop solar installations worldwide. Solar power has become a cornerstone in the nation's commitment to sustainability, contributing significantly to reducing its carbon footprint and reliance on fossil fuels. However, as solar panels reach the end of their lifespan, the issue of solar panel waste is rapidly emerging as a significant environmental challenge that could escalate in the coming decades. We take a closer look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.