Energy prices: A look at the AER and ABS

The Australian Bureau of Statistics (ABS) December 2015 statistics show annual decreases in the Electricity Consumer Price Index (CPI) across three of Australia’s eight capital cities[i]. And data shows a 0.1 per cent annual fall in energy CPI across Australia. Despite these results the ABS is still expected to review its coverage and pricing strategy to include market offers, with over two thirds of customers on electricity and gas market retail contracts in New South Wales, South Australia and Victoria. The Australian Energy Regulator’s (AER) recent retail performance report includes market offers in their findings, which differ to the results released by the ABS especially in the deregulated states.

ABS Energy Prices

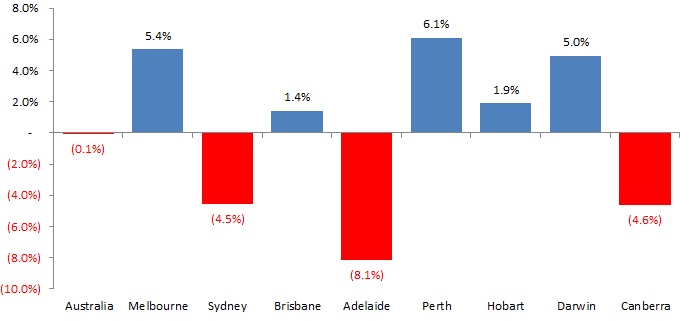

The energy price falls vary across the cities: Adelaide experienced the largest decrease in electricity prices, followed by Canberra and Sydney. One factor behind the decrease in Sydney, Adelaide and Canberra is the change in network prices due to AER determinations. Figure 1 shows annual changes in electricity prices for each capital city as of December 2015. Adelaide saw the largest decrease of 8.1 per cent annually, then Canberra and Sydney, which fell by 4.6 and 4.5 per cent respectively. On the other hand, Perth and Hobart experienced increases of 6.1 and 1.9 per cent respectively.

Figure 1: Annual change in electricity prices across Australia – December 2014 to December 2015[ii]

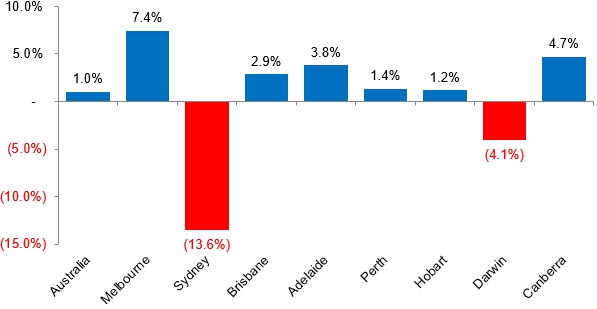

As at December 2015 gas prices had increased across Australia by 1 per cent for the 12 months prior. Figure 2 shows the annual movements in gas prices across Australia. The decline in gas prices in Sydney is primarily due to the Independent Pricing and Regulatory Tribunal (IPART) decision to reduce regulated retail gas prices by an average of 3.9 per cent across NSW from 1 July 2015[iii]. This was largely due to the AER’s recent decision to significantly reduce network prices for those customers in the Jemena gas network, the largest network in NSW[iv].

Figure 2: Annual change in gas prices across Australia – December 2014 to December 2015[v]

Currently ABS data produces seasonally adjusted estimates at the state level for some economic statistics but does not perform seasonal adjustments for the CPI. The original CPI electricity and gas series at state level does not, therefore, include adjustments due to seasonal impacts on estimates. The ABS is currently reviewing its coverage and pricing strategy and its main challenge is the availability of data for market offers.

One source for electricity and gas prices data could be the AER. In their recent annual report on the performance of the retail energy market in Australia the AER used both median market and standing offers in each jurisdiction. The AER uses median, rather than a simple average, in order to ensure the analysis is not skewed by a small number of very cheap or very expensive offers.

According to the analysis by the AER, customers on standing offers made considerable savings by switching to a market offer. In jurisdictions where electricity market offers are available, the median market offer was between 5 and 20 per cent cheaper per year than the standing offer[vi]. The potential savings were slightly smaller for gas market offers at 16 per cent.

As of June 2015, 84 per cent of electricity customers and 83 per cent of gas customers were on market retail contracts in South Australia. Although slightly lower in New South Wales, 69 per cent of electricity customers and 76 per cent of gas customers were on market retail constracts. The two states the ABS recorded the highest offers for was the ACT and Tasmania where the majority of consumers remain on standing offers.

What does the Australian Energy Regulator report show?

The AER reports energy affordability figures, rather than presenting energy prices alone. The report provides an overview of the annual cost of electricity and gas around Australia using a range of prices for electricity and gas offers generally available to residential customers in each distribution zone, and estimates of annual electricity and gas bills as well as annual expenditure on electricity and gas bills as a share of disposable income. For low income households, the AER considers the impact of energy concessions as part of its analysis.

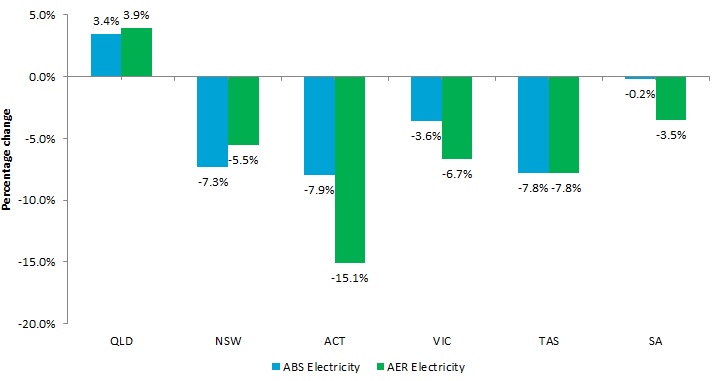

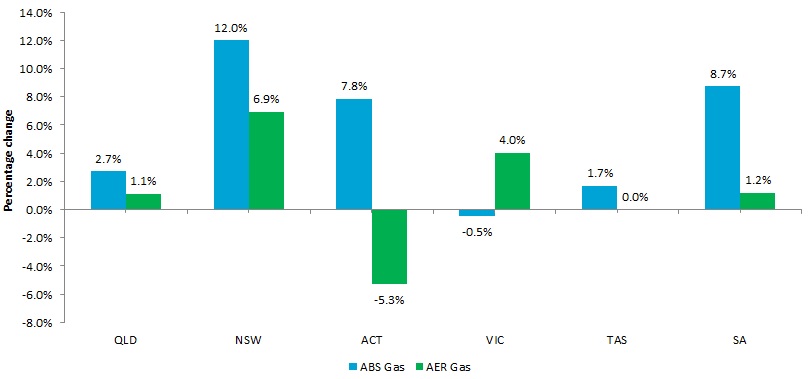

Between June 2014 and June 2015, electricity bills decreased by between 3 and 15 per cent in most jurisdictions, with the exception of Queensland, where bills increased by 4 per cent. Gas bills decreased in Victoria and the ACT, and increased in New South Wales by 7 per cent. Queensland and South Australia also had small increases. Over this period the primary reason for the decrease in energy bills was the removal of the carbon tax.

Australian Energy Council analysis shows that electricity bills fell more in the Victorian and South Australian deregulated markets than the price changes reported in the ABS data. Figures 3 and 4 shows the difference between the data for electricity and gas respectively. The difference for ACT gas prices is partly due to median market offer for gas being cheaper than the median standing offer, whereas in previous years it was the opposite. This is likely to be due to the emergence of competition and use of conditional discounts.

Figure 3: Changes in Electricity Bills from ABS and AER data – June 2014 – June 2015[vii]

Figure 4: Changes in Gas Bills from ABS and AER data – June 2014 – June 2015[viii]

[i] Source: Australian Bureau of Statistics (ABS), 6401.0 - Consumer Price Index, Australia, December 2015

[ii] Source: ABS

[iii] Independent Pricing and Regulatory Tribunal (IPART), 2015, “Regulated gas prices to fall for most customers” http://www.ipart.nsw.gov.au/Home/Industries/Gas/Reviews/Retail_Pricing/Review_of_regulated_retail_gas_tariffs_and_charges_for_2015-16/16_Jun_2015_-_Media_Release/Regulated_gas_prices_to_fall_for_most_customers_-_16_June_2015

[iv] ibid

[v] Source: ABS

[vi] Australian Energy Regulator, 2015, “Annual report on the performance of the retail energy market 2014-15”

[vii] Source: AER,ABS Note: Comparing AER and ABS data we have assumed bills and prices movements have minimal difference and City and State data is predominantly dependent on the distributors so we have used States across both for simplicity.

[viii] Source: AER, ABS Note: Comparing AER and ABS data we have assumed bills and prices movements have minimal difference and City and State data is predominantly dependent on the distributors so we have used States across both for simplicity.

Related Analysis

Energy Retail: Meeting the Future Needs of Energy Consumers

The electrification of everything, responsive demand and energy storage, the rise of prosumers and digitalisation and the evolving regulatory framework are all changing the landscape for energy consumers, making it clear that the traditional energy only retail model is not likely to meet all of consumers’ needs in a high consumer energy resources (CER) world. Currently, the AEC and its members are in the midst of a series of projects which will help consumers find the connections they need. What are are they and how will they help? We take a closer look.

Energy regulation: A tale of increasing overload?

The energy sector is seeing an increase in regulation, with the retail laws and rules seemingly being changed year on year. This has led to old, overlapping or obsolete regulation not being removed, making it difficult for retailers to comply with, and regulators to enforce these rules and laws. We take a look at how overregulation is affecting customers and the cost of electricity.

Transmission Access Reform: Has the time passed?

Last week submissions to the AEMC’s Transmission Access Reform consultation paper closed. It is the latest in a long running consideration of how best to ensure both efficient dispatch and investment in new generation to ensure new kit is sited in the best locations. But this continued pursuit of reform brings to the fore the question of whether other policy initiatives have already superseded the need for the proposed changes. We take a look at where the reform proposals have come from, as well as concerns about the suggested approach that have emerged.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.