Consumers to accelerate the energy transition

New energy technologies are helping to transition the world, with energy utilities following suit. However a new Morgan Stanley report warns that an accelerated consumer-led change could arrive sooner than expected.

According to the report – Consumer Revolution: Shining a light on how the Utilities world is changing – the “accelerated” transition will be led by consumers wanting to take greater control of their energy use and generation. The organisation’s international AlphaWise energy survey, which examines 7,000 people in 7 countries, shows that 1 in 3 consumers are planning to generate their own electricity in the next five years, and 80 per cent of these people keen to trade energy in the future.

While Italian and Spanish consumers are projected to lead the uptake of new energy technology, Australia is expected to spearhead actual installations. But what’s driving this change? We take a look.

Generational shift

Electric vehicles (EV), energy storage, and distributed energy are expected to grow rapidly, according to the report, coexisting with a centralised grid as well as smarter grids.

Figure 1: Global summary of consumer views

Morgan Stanley states that the “key enablers” in the consumer transition to new energy technologies will be declining costs alongside increased consumer education. It notes that currently upfront costs are restraining the uptake of new energy technologies and finds that consumers, generally, are not properly informed on the cost-efficiencies of new energy technologies, “often under or overestimating the benefit”.

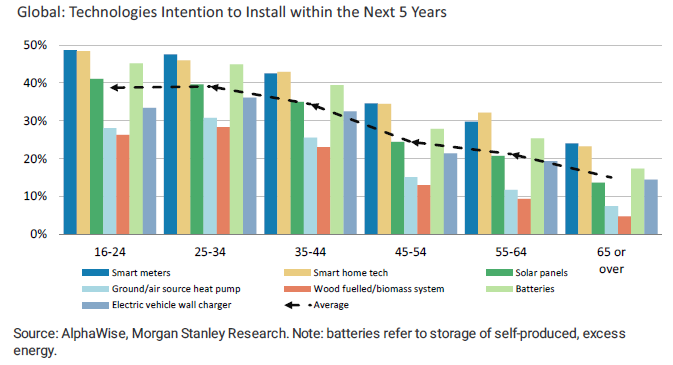

However Morgan Stanley’s research shows that one key driver of accelerated future growth is a greater awareness and an interest of new energy technologies amongst younger generations (Figure 2).

Figure 2: Intention and generational shift

The global survey shows that younger generations are more likely to trade energy (if they’re not already – more below) and they are keen to install more energy technologies. As younger generations age and increase their disposable income, technology costs will inversely decline, leading to an accelerated rate of new energy technology uptake: “as time passes, and costs come down even further, the transition should accelerate further. The consumer is a winner, for utilities it is less clear,” the report says.

Consumer awareness

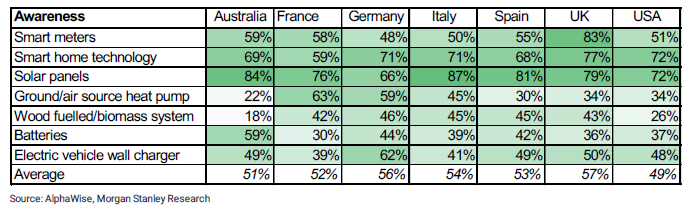

On average, half of all consumers surveyed were aware of the seven new energy technologies presented: Solar panels, smart meters, smart home technology, EV wall charger, batteries for excess energy, ground/air source heat pump, and wood fuelled/biomass system.

The global survey figures show that the overall awareness of these technologies, on average, is similar between countries. UK and German consumers show the greatest awareness (57 per cent and 56 per cent respectively), with the US showing the least (49 per cent). While, on average, around half of the Australians surveyed were aware of the technologies (51 per cent).

Across the globe consumers are most aware of solar panels (78 per cent), smart home technology (70 per cent), and smart meters (58 per cent).

Figure 3: Global awareness of technology, by country

Of the Australians surveyed, 84 per cent had knowledge of solar panels, followed by smart home technology (69 per cent), and smart meters (59 per cent). Australia’s battery awareness (59 per cent) outperformed all other countries, which could be attributed to global companies like Tesla using Australia as a testing ground and therefore, increasing consumer knowledge.

Intent to install

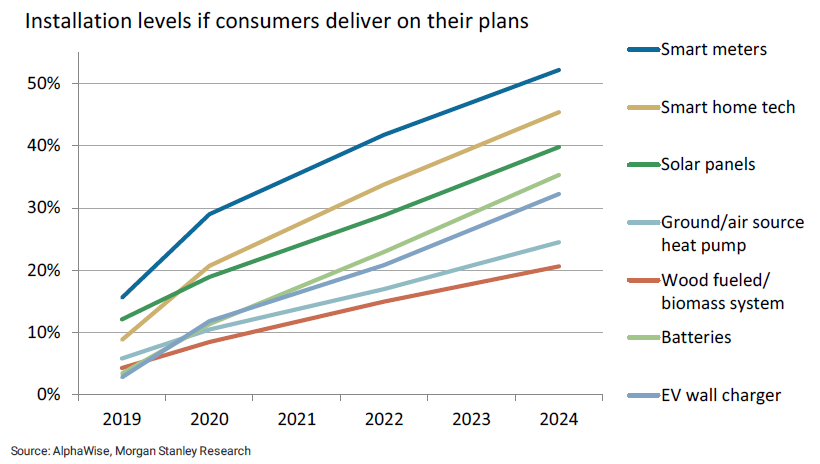

Globally, over 50 per cent of consumers intend to have a smart meter by 2024 with government initiatives helping to drive consumer engagement. And with solar panel and battery installations anticipated to rise, there is also an expected reduction in demand.

Based on current consumer intent, all of the new energy technologies assessed are expected to steadily grow, with 1 in 3 consumers surveyed wanting to install energy technology in the next 5 years.

Figure 4: Installation levels to 2024, based on consumer intent

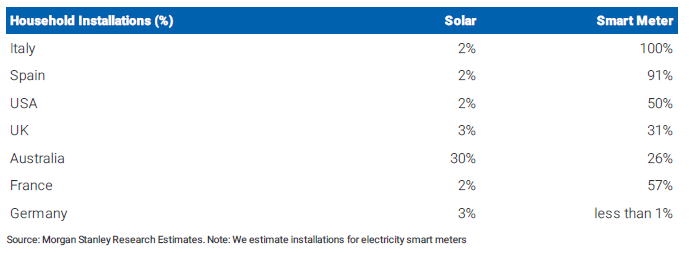

Italian and Spanish consumers have the highest intention to install new energy technologies (and are therefore also more interested in trading energy) this coincides with Italy’s 100 per cent smart meter installation rate, which is closely followed by Spain at 91 per cent. This high rate of intention is also helped by the perceived high economic attractiveness of installing new energy technologies in both countries.

Figure 5: Global intention to install in the next five years, by country

Of Australian’s surveyed, 60 per cent intend to install new energy technology by 2024. Batteries again top the list for intended Australian installations (40 per cent), followed by smart meters (37 per cent) and smart meter technology (36 per cent).

However, Morgan Stanley warns that intent does not equal actual uptake. In previous global surveys, consumer intention has ranked higher than actual installations, due to external impacts like subsidy changes. The report states:

“Our Australian supply survey showed a similar disparity between intention to install and actual uptake of batteries (which were not subsidised at the time). But the reverse in solar panels alone (installs proved higher than anticipated, which have better economics and subsidies).”

Actual installations

Morgan Stanley points out that the experience of investing in one new energy technology has a “snow-ball effect”: Actual uptake of one technology influences a consumer to purchase additional energy technologies, and this “self-reinforcing cycle” is expected to further drive technology uptake forward.

Education also has a direct influence on the actual installations of new energy technologies, according to the report, and it highlights that government policies have helped to increase this awareness. New smart home technologies have also attracted more consumer engagement, especially in managing household energy use.

Figure 6: Solar and smart meter installations, by country

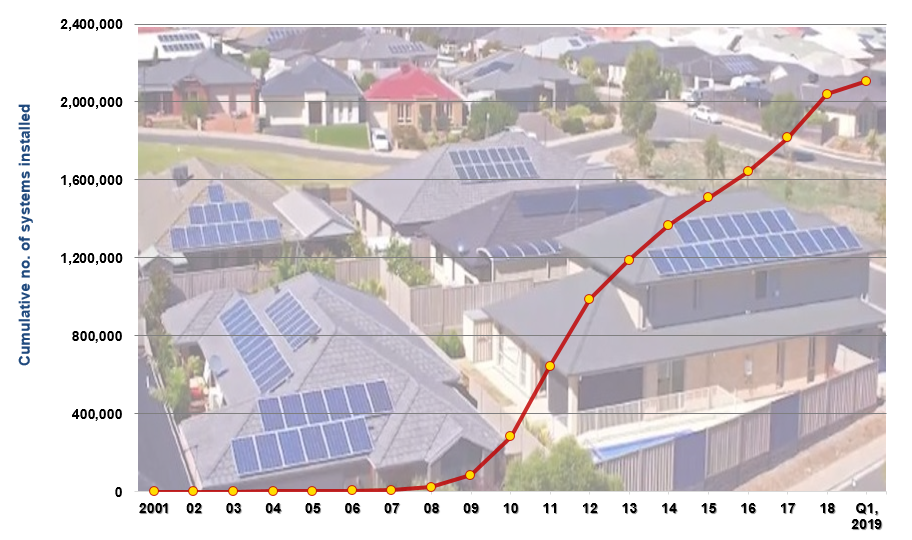

Australia outperforms the world on actual solar installations sitting just below 30 per cent (compared to 2-3 per cent solar installations in Europe and the US) with a 26 per cent national smart meter rollout. This is also supported by Clean Energy Regulator data that shows the rapid uptake of residential solar installations across Australia (Figure 7).

Figure 7: Australian rooftop solar growth, 2001 – Q1 2019

Source: Clean Energy Regulator data, Photo is credited to UrbanizeHub (South Australia shot)

Source: Clean Energy Regulator data, Photo is credited to UrbanizeHub (South Australia shot)

Yet the report warns that Australia’s policy uncertainty also “hampers” asset planning growth. It says:

“Australia leads the current consumer transition, with behind the meter installations at around 30 per cent of connections. Rooftop solar will reach 14 per cent of total installed capacity in May 2019 (MSe), catalysed by an early adopting public, generous initial subsidies, high traditional tariffs, and global suppliers using Australia as a testing ground (particularly in batteries, where Australians show highest product awareness globally). The key debates in Australian Utilities are around firming of variable renewable energy resources, and orchestrating ubiquitous distributed energy resources.”

Keen to trade

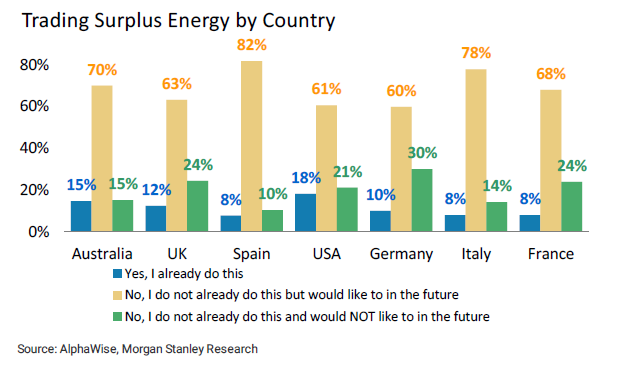

Globally there is a strong consumer demand to trade energy. Currently 11 per cent trade globally, with 69 per cent of the people surveyed expressing that they would like to trade in future.

While consumer interest in trading is high across all age groups, the younger generations lead: 92 per cent of 16-24 year olds want to trade their excess energy (includes 15 per cent who already do so); while 92 per cent of 25-34 year are currently trading or want to trade in the future. Consumer interest progressively declines as age increases.

Spain and Italy are again expected to lead a rise in trading, with 82 per cent and 78 per cent of respondents respectively keen to trade/sell in the future. Yet Morgan Stanley states that with Australia consumers “significantly ahead” in installations, they appear “more likely” to want to engage in energy trading, supported by 70 per cent of Australian respondents showing interest in energy trading.

Figure 8: Desire to trade, by country

Of the early adopters already trading, 56 per cent do it themselves, while people who are planning to trade would prefer to do it through a company (43 per cent).

Related Analysis

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

UK looks to revitalise its offshore wind sector

Last year, the UK’s offshore wind ambitions were setback when its renewable auction – Allocation Round 5 or AR5 – failed to attract any new offshore projects, a first for what had been a successful Contracts for Difference scheme. Now the UK Government has boosted the strike price for its current auction and boosted the overall budget for offshore projects. Will it succeed? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.