Battery Storage: Australia’s current climate

As the world shifts to renewable energy, the importance of battery storage becomes more and more evident with intermittent sources of generation – wind and solar – playing an increasing role during the transition.

The Australian Energy Market Operator (AEMO) has reported growth in renewable capacity has seen increasing instantaneous penetration of renewables in the National Electricity Market (NEM) with a new record of 72.1 per cent reached in October last year. The market operator forecasts increasing periods when the grid will hit 100 per cent instantaneous renewables.

The issue is, renewables are not dispatchable as they are not always available. As more dispatchable plants leave the market, battery storage, along with pumped hydro and gas-fired generation, will become more critical to the grid.

What is battery storage?

Batteries are able to soak up surplus generation and make it available when renewables are offline. They are storage devices that use chemical reactions to absorb and release energy as needed. When paired with renewable energy sources, batteries can store excess energy during periods of low demand and release it during peak times. One benefit of batteries is their flexibility. Unlike wind or solar, batteries can be dispatched when needed, can react quickly, often in fractions of a second, providing energy to the grid. Importantly, batteries can be deployed in various settings and quantities. Large-scale installations, known as grid-scale or large-scale battery storage, can function as significant power sources within the energy network. Smaller batteries can be used in homes for backup power or can be coordinated in a system called a Virtual Power Plant (VPP). VPPs are being actively trialled.

The current climate

Australia’s current storage capacity is 3GW, this is inclusive of batteries, VPPs and pumped hydro. Current forecasts by AEMO show Australia will need at least 22GW by 2030 – a more than 700 per cent increase in capacity in the next six years. The market operator’s Integrated System Plan (ISP) forecasts Australia will need at least 49GW of storage by 2050 in order to reach net zero. As mentioned, this storage capacity will include a mix of pumped hydro, virtual power plants and batteries, including home battery systems. AEMO also sees a significant role for coordinated consumer energy resources (CER) including home batteries. Home battery systems surpassed 250,000 by the end of 2023, accounting for more than 2700 MW hours of capacity. While this number may seem high, around 3.7 million Australian homes have rooftop solar units installed, meaning less than one in 14 households with solar units have home battery systems installed. To achieve the current ISP capacity of coordinated CER, storage will need to rise from today’s 0.2 GW to 3.7 GW in 2029-30 and increase tenfold to 37 GW in 2049-50. If achieved, it is projected it would account for up to 66 per cent of the NEM’s energy storage nameplate capacity.

The market operator sees a significant opportunity here if solar households can be encouraged to install a battery storage system and allow it to be coordinated. However, there are limitations in achieving this, as mentioned below.

Road ahead

Different forms of storage are needed to firm both consumer-owned and utility-scale renewables at different times of the day and year. These vary according to their ‘depth’, that is, the length of time that electricity can be dispatched at maximum output before the stored energy is exhausted.

In total, the NEM is forecast to need 36 GW/522 GWh of storage capacity in 2034-35, rising to 56 GW/660 GWh of storage capacity in 2049/50.

The broad categories of storage needed are:

Consumer owned storage: behind the meter, including EVs that may be able to send electricity back into the grid. Coordinated CER storage is managed as part of a VPP, while passive CER storage is not. While the combined installed capacity of these batteries is large, they can only dispatch electricity for about two hours at full discharge, so their energy storage capacity is relatively small, and deeper, utility scale storage is needed.

Shallow storage: Grid-connected storage that dispatches electricity for less than four hours.

Medium storage: Able to dispatch electricity for four to 12 hours. This may be battery or pumped hydro (or other emerging technologies in future) which can shift large quantities of electricity to meet evening or morning peaks. These solutions are increasingly needed to support renewable energy growth.

Deep storage: Strategic reserves that can dispatch electricity for more than 12 hours, to shift energy over weeks of months (seasonal shifting) or cover long periods of low sunlight and wind (renewable droughts), backed up by gas-powered generation. Borumba Dam’s anticipated 48 GWh capacity in Queensland would be larger than all coordinated CER storage combined, and Snowy 2.0 would provide 350 GWh.

Deep storage systems, capable of dispatching electricity for over 12 hours continuously, can help stabilize fluctuations in daily energy demand and renewable energy supply. The deepest storage options currently available to the NEM are existing large deep-reservoirs that can address renewable energy shortages and balance energy availability throughout different seasons. Transmission projects like HumeLink and Marinus Link are intended to help enhance the NEM's access to these resources.

There is strong interest in developing new deep storage facilities across Australia. However, there are only three projects currently in operation – Temut, Wivenhoe and Shoalhaven – and two more under construction, Snowy 2.0, which will support both New South Wales and Victoria, and Kidston, located in Queensland.

Queensland is currently evaluating two deep storage initiatives, Borumba Dam and Pioneer-Burdekin, although their fate may be influenced by the upcoming state election. Additionally, Hydro Tasmania is exploring a new pumped hydro project at Cethana as part of the Battery of the Nation initiative. New South Wales has also set a legislative target to achieve 2 GW of storage with at least 8 hours of duration by 2030

As shown in Figure 1, shallow storage will play a major role over the next two decades, while coordinated CER will account for more than 50 per cent of installed capacity by 2050. Deep storage, including Snowy 2.0 and Borumba will be around 10 per cent of Australia’s total capacity by 2050, however it is worth noting that this model only includes committed projects, meaning this capacity could be higher if more projects are proposed and brought online.

Figure 1: Storage installed capacity and energy storage capacity, NEM

Source: 2024 Integrated System Plan, AEMO

As shown in Figure 1, Coordinated CER will play a major role in helping Australia’s transition to net zero, with it providing an overwhelming majority of Australia’s storage by the 2040’s. This exponential increase in storage will be achieved through the integration of home batteries into virtual power plants, where excess stored energy is shared to help balance out supply and demand on the power grid. This technology will increase Australia’s storage capacity and will reduce the need for expensive large-scale batteries to be built around communities where there is a high intake of solar and home batteries.

In June, Energy Minister Chris Bowen announced the Australian Renewable Energy Agency (ARENA) would support up to 370 community batteries as part of Round 1 of its Community Batteries Fund, bringing the total amount of community batteries supported by the federal government to more than 420 across Australia[i]. This program allows local neighborhoods to reap the benefits batteries can provide. These batteries will deliver renewable energy to local residents, help lower household energy rates and will improve power reliability and quality to customers.

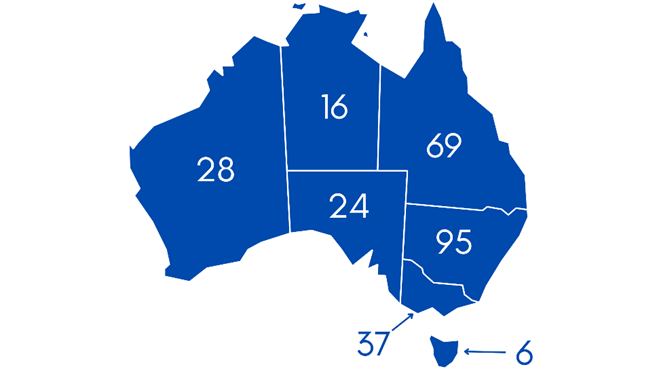

Figure 2: Number of community batteries announced by ARENA across Australia

Source: Australian Renewable Energy Agency

*Note: This map does not include the 95 batteries supported by ARENA that are across multiple locations.

Like governments, energy companies are also investing in battery infrastructure, to help strengthen Australia’s energy grid.

- Earlier this year, Synergy began construction on Australia’s second-largest battery project to date, the 500MW Collie Battery Energy Storage System (CBESS) in Western Australia[ii]. Due to be completed in 2025, this project is being constructed next to the Collie Power Station, other generators are emulating this to utilise existing infrastructure, thus reducing development costs.

- Last month, Origin announced it had approved the second stage of development for its large-scale battery at Eraring Power Station in NSW[iii]. The second stage will add a 240MW four-hour duration grid-forming battery to the 460MW two-hour duration battery already under development which is expected to come online at the end of 2025. Origin has committed to more than 1.5GW of large-scale batteries across its three owned projects at Eraring and Mortlake.

- AGL announced late last year it would begin construction in 2024 on its 500MW, two-hour duration, grid scale battery to be located at the Hunter Energy Hub in NSW[iv]. In August 2023, AGL’s 250MW Torrens Island battery commenced operation.

- EnergyAustralia is planning to develop a 50MW four-hour duration battery alongside the Hallett gas-fired power station in Adelaide[v]. If successful, EA plans to triple the battery’s capacity to 150MW in a future second stage. They are also investigating the development of a 500MW, four-hour duration, battery energy storage system (BESS) adjacent to their Mt Piper power station in NSW. This project is currently in the assessment phase.

- French renewables developer Neoen is set to build Australia’s largest battery in Collie, a 560 MW, four-hour duration storage system[vi]. Neoen currently has 1.7GW of storage assets in operation or under construction. Akaysha Energy is also developing a 415MW, four-hour battery in NSW, along with an 850MW, two-hour super battery in Waratah, NSW.

Challenges faced

Like solar panels, the operational lifespan of batteries is relatively short, needing to be replaced around every 20 years. This presents a challenge for Australia’s net zero ambitions, as batteries that have been installed through the 2020s are likely to be need to be replaced in the 2040s – when the ambition to transition to net zero by 2050 will be at full steam.

As shown in Figure 1, Coordinated CER will play a major role in Australia’s storage capacity, with VPPs critical to this. This will require an increased uptake of home batteries across Australia, which as mentioned earlier, is lagging significantly behind when compared to the uptake of rooftop solar. Currently, the typical cost of a household battery ranges from around $1000 per KW for large systems, to around $2000 per KW for smaller batteries – around 5KW[vii]. While it will be important for more households with solar to install batteries to meet the ISP, households need to be willing to share/export their excess electricity back into the grid. For households to be willing to spend thousands of dollars to install a battery system and to agree to share the excess energy back to the grid, governments will need to provide incentives. Some states have begun offering incentives for home batteries systems like providing rebates for the up-front installation costs and for connecting a household or business to a VPP[viii], but for installations to significantly grow, these incentives will also need to increase.

Another obstacle is the lack of long-duration batteries currently available. Currently, shallow and medium-duration batteries can provide reliability to Australia’s grid during the summer. However, lulls in wind and solar during the winter, like we saw earlier this year, will require longer-duration batteries. This highlights a challenge that will need to be overcome to achieve net-zero. Currently, Australia has pumped-hydro as a long-storage option, however, more of this will be required as dispatchable generation is phased out. Additionally, alternative long duration energy storage (ALDES) will be required. This could include compressed air, redox flow and thermal storage.[ix] However, these ALDES are still emerging.

Additionally, as mentioned in a previous Energy Insider, two pumped hydro projects are earmarked for Queensland – the 2GW Borumba Dam Pumped Hydro facility and the 5GW Pioneer-Burdekin facility. Both projects are part of the Queensland Government’s Energy and Jobs Plan. With the state’s election to be held in October, the fate of these projects is still in the air. The Queensland Opposition has stated that if they win government, they will scrap the Pioneer-Burdekin project[x], and potentially scrap Borumba Dam, which is currently progressing through environmental assessments. If the LNP win in October, Queensland will be needing to find an additional 5GW of storage projects to make up the shortfall from scrapping Pioneer-Burdekin, and potentially may need to find an additional 7GW if Borumba is scrapped also[xi]. There are currently no other alternatives being offered to make up this shortfall.

[i] https://minister.dcceew.gov.au/bowen/media-releases/more-420-community-batteries-lower-energy-costs-and-boost-reliability

[ii] https://www.synergy.net.au/Our-energy/SynergyRED/Large-Scale-Battery-Energy-Storage-Systems/Collie-Battery-Energy-Storage-System

[iii] https://www.originenergy.com.au/about/investors-media/origin-approves-second-stage-of-eraring-battery/

[iv] https://www.agl.com.au/about-agl/media-centre/asx-and-media-releases/2023/december/final-investment-decision-reached-on-the-500-mw-liddell-battery-

[v] https://www.energyaustralia.com.au/about-us/what-we-do/new-energy-projects/hallett-battery-energy-storage-system#:~:text=EnergyAustralia%20is%20planning%20to%20develop,capacity%20of%20up%20to%20200MWh

[vi] https://neoen.com/en/news/2024/neoen-to-build-stage-2-of-collie-battery-after-winning-its-second-4-hour-storage-contract-in-australia/

[vii] https://www.solarquotes.com.au/battery-storage/cost

[viii] https://www.energy.nsw.gov.au/households/rebates-grants-and-schemes/household-energy-saving-upgrades/residential-battery-incentives

[ix] https://assets.cleanenergycouncil.org.au/documents/The-future-of-long-duration-energy-storage.pdf

[x] https://www.abc.net.au/news/2024-06-10/pumped-hydro-future-uncertain-in-queensland/103951806

[xi] New pumped hydro sites explored, $2.8m campaign spruiks its merits | The Courier Mail

Related Analysis

What does the Queensland Energy Roadmap mean for the 2026 ISP?

The Queensland Government recently unveiled its new Energy Roadmap for the state. The new Roadmap reshapes the pace and scale of the state’s energy transition by opting to retain the state’s existing coal assets in Queensland’s generation mix for longer. Somewhat coincidentally, the AEMC has started consultation on the “treatment of jurisdictional policies” like the Queensland Energy Roadmap in AEMO’s Integrated System Plan (“ISP’) as part of its broader Statutory Review of the ISP. So what does Queensland’s new Roadmap mean for AEMO’s signature whole-of-system electricity plan? We take a closer look.

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Unlocking Consumer Energy Resources: Addressing data sharing barriers with retailer participation

Australia’s energy transition increasingly relies on Consumer Energy Resources (CER) such as rooftop solar, batteries, electric vehicles and smart appliances, which are now essential to system reliability, affordability and resilience. Without effective data-sharing frameworks, however, the full potential of CER cannot be realised, limiting performance, innovation and market reform. A recent consultation paper under the National CER Roadmap identifies six key barriers, with retailers well placed to address many of them through clear policy direction and regulatory alignment. We take a closer look at the barriers outlined in the paper and the future role of retailers in addressing them.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.