Where do we need a new dispatchable power station?

For the first half of 2017 there has been a campaign for a new coal fired power station to be built in North Queensland[i]. It has been variously suggested that this would both alleviate the high electricity prices in the National Electricity Market (NEM) and incentivise regional investment and employment.

Is North Queensland the right place to build a large dispatchable generator in the NEM? If not, where is the right place and how can we tell?

The NEM has two broad market functions: it operates as a dispatch mechanism, using prices to match supply and demand as efficiently as possible. Because electricity is a commodity that is consumed instantaneously, the spot price can be highly volatile through a 24-hour cycle reflecting morning and evening peaks, and over the year during periods of high demand (typically very hot and very cold weather). Both generators and users of electricity manage this volatility through financial contracts that allow them to fix or cap the future price of electricity over a given period.

The NEM also serves as a longer term investment and dis-investment signal to generators. Sustained high wholesale prices signal demand for new generation capacity, while sustained low wholesale prices signal oversupply and encourage marginal generation to switch off, mothball and eventually close.

The problem of high wholesale prices is not the market failing, but the market working. What is failing is the ability of investors to respond to these market signals because of sustained policy uncertainty.

The current situation in Australia shows this: the NEM is furiously signalling the need for more generation through sustained increases in wholesale prices following the closure of more than 5,000MW of coal fired generation over the past five years. These closures were mostly due to the age of the generators, although market conditions also played a role, for example in the case of the Northern Power Station in South Australia that closed in 2016 due to.

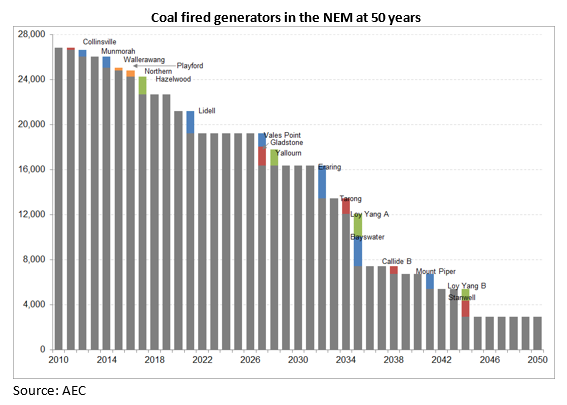

There are more closures to come. We can see what is in store by charting the fleet of coal-fired generators in the NEM and then estimating when each will be withdrawn based on an average life expectancy of 50 years.

Figure 1: Coal fired generators in the NEM and possible 50 year closure schedule

Source: AEC

Clearly the NEM is going to need significant investment in new generation to replace the existing generators as they retire over the coming decades. As a rough guide if demand stays stable we expect to need around 15,000MW of new firm-equivalent capacity over the next 15-20 years. Firm-equivalent could be either new dispatchable generation (coal, gas, hydro) and/or firm equivalent combinations (wind/solar and gas, wind/solar and storage, stand-alone storage, demand response).

The next most immediate closures based on the age of the power stations would be Yallourn power station in Victoria and Liddell in NSW, followed by Vales Point (NSW), Gladstone (Queensland) and Eraring (NSW). On this basis the most immediate scarcity of dispatchable supply from future coal power station closures is more likely to occur in Victoria ahead of NSW and then Queensland. However, some power stations may stay open longer or close earlier depending on commercial factors and market conditions. Of the power stations mentioned above, Liddell’s owner AGL has committed not to extend its operating life beyond 2022.

Where is the NEM signalling it needs new firm-equivalent generation?

As a general rule, higher wholesale prices indicate increased demand for generation capacity. Each state in the NEM has its own nodal price. This is because there are transmission constraints between each jurisdiction. In other words, it is too inefficient (due to losses) for new capacity at one end of the NEM to supply electrons to the other end.

There are a number of different prices quoted for electricity in the NEM. The most frequently used measure of relative historic prices is the volume weighted average (VWA) wholesale price. As the name suggests, this averages prices in each jurisdiction according to how much electricity was supplied at different prices through a given time period.

The Australian Energy Regulator calculates VWA prices for each jurisdiction in the NEM on a financial year basis. These are shown below in table 1.

Table 1: VWA wholesale prices financial year basis by state, NEM 2007-17

Source: AER

It is clear that prices in each year vary for a number of reasons: they can be higher as a result of sustained extreme weather conditions (like we saw in Queensland and NSW last summer), as a result of scarcity of supply (Tasmania’s low dam levels and interconnector problems in 2015-16), rapid increases in demand (the LNG trains in Queensland, which use electric compressors, started up in 2016-17) or because of the fuel type setting the marginal price (SA has had historically higher electricity prices because its long run marginal cost of generation is set by more expensive gas generators). Conversely the data shows the effect of chronic oversupply in suppressing prices as demand fell but capacity increased in the five years after 2009.

Another way of using price to measure where new capacity is needed is by looking at the forward contract market for electricity. Because of the natural volatility in the electricity market, around 80 per cent of wholesale electricity is traded in forward contract markets between retailers, major industrial customers and generators. These derivative markets are a good way of minimising risk for both parties. It’s a particularly good measure of demand for baseload generation because generally firm or firm equivalent generation are the only parties offering swap contracts into the future. A wind or solar farm would need a storage system or other firm equivalent services to be able to offer and deliver guaranteed supply into the future (as they don’t know if they will be generating).

Looking at the future contract market for 2018 the highest contract prices are being struck in South Australia, followed by Victoria. Queensland has the lowest forward contract prices, suggesting it has the weakest demand for new baseload generation. The Tasmanian price is set by the Tasmanian Government, which owns Hydro Tasmania.

Figure 2: Future baseload wholesale prices, calendar year 2018

Source: ASX

A non-market measure of demand for new dispatchable capacity is the Reliability and Emergency Reserve Trader (RERT) mechanism re-instated by AEMO for the summer of 2017-18. The RERT is a mechanism by which AEMO can contract demand response from large customers or aggregators of demand to help manage periods of critically high demand, typically heat waves. In June AEMO announced it was looking to contract up to 600MW of RERT in Victoria and 75MW in South Australia. AEMO is not seeking to contract RERT in Queensland, NSW or Tasmania.

The reason AEMO is contracting RERT in Victoria and SA is that it has identified low reserve conditions in those states for this summer and beyond. In other words, there is potentially not enough dispatchable generation. This is a useful guide as to where new dispatchable generation is most valuable in the NEM.

Based on these different indicators, the market is signalling the biggest need for new dispatchable generation in Victoria and South Australia.

So why are we talking about a new coal power station in north Queensland?

Since January 2017 the Federal Resources Minister, Senator Matt Canavan, the Chief Executive of the Queensland Resources Council, Ian Macfarlane and Queensland LNP leader Tim Nicholls have all promoted the idea of building a new high-efficiency, low-emissions (HELE) coal-fired generator in North Queensland[ii]. The rationale for this has been varied: principally to supply baseload generation to bring down power prices, create or restore jobs and attract new investment, to repair apparent supply problems in North Queensland.

North Queensland sits on the furthest northern reaches of the NEM. From an electricity perspective, it is made up of three regions: North (around Mackay), Ross (Townsville) and Far North (Cairns). The following scheduled[iii] power stations are currently operating there.

Table 2: North Queensland generation

Source: AEMO, Powerlink

There is currently more than 800MW of scheduled generation located in North Queensland, plus a further 800MW in semi-scheduled and non-scheduled generation (mainly renewables and coal seam gas). The 190MW Collinsville black coal power station south of Townsville was closed in 2012. Total demand in North Queensland obviously varies but evening demand peaks are typically around 880MW across the three regions and in 2016-17 demand peaked at 1458MW (in February)[iv].

More significantly, the utilisation rates of the two large gas-fired generators located around Townsville is generally low. Most power to the region is supplied by the large coal fired generators in the state’s central west. Local generation effectively operates more as a back-up in the event of transmission faults.

Building baseload generation in North Queensland to supply the rest of the NEM is not only further marginalised by significant load losses because of the distances involved, but it is constrained by the size of the 1200MW rated QNI and 180MW Directlink interconnectors which run south into NSW.

On this evidence, there does not appear to be a pressing commercial case for a new coal-fired generator in North Queensland. The proposed Adani coal mine may provide a new supply of lower cost coal to any future coal power station in the region (as well as a new source of demand), although the biggest challenges with coal-fired generation remain (1) their long term carbon risk (2) the long (50 years) investment risk of these assets in an increasingly evolving market and (3) the relative lack of operational flexibility in a market that is paying a premium for more dynamic response.

North Queensland remains an important political battleground for both major parties at the State and Federal level. It hosts four marginal Federal seats[v] and is an important economic region for the state and the nation. As with other regions, it’s important for governments to consider the most efficient and effective ways to deliver sustainable growth. Energy security and affordability is part of that consideration. But North Queensland does not present a compelling case for new coal fired generation.

Governments sometimes adopt the Field of Dreams approach to new infrastructure – “if you build it, he will come”[vi]. In this case, the argument has been frequently made that a new coal-fired generator would attract new energy-intensive business to the region. The problems with this line of argument are many: artificially suppressing electricity prices by artificially creating oversupply in a region from a high emissions generator (with high potential carbon risk) does not guarantee investment and the comparative advantage is at high risk of being quickly unwound; if the private sector believes that the government will enter the market, this will have a chilling effect on new private investment. Ill-judged subsidies for new generation can lead to the displacement of existing, higher marginal cost generation, which then causes the supply-demand balance to revert, resulting in higher prices again (see South Australia in 2016). So if the government is going to build one coal-fired power station, it better be prepared to build 10.

Conclusion

It’s clear from the likely closure of more coal fired generators along the eastern sea board over the next two decades that we need to think carefully how we will replace this dispatchable capacity at the lowest cost, while meeting reliability and emission requirements. All technologies – wind, solar, storage, hydro, gas, coal, biomass and demand response - may be required to rebuild a lower emissions 21st century grid. There may be a role for new coal if it can bring down its emissions, operate more flexibly and/or as a possible baseload anchor to intermittent generation. The 21st century grid may operate quite differently than the one we are used to.

In the short run, the next big driver of wholesale electricity prices is likely to be the wave of 3,300MW of new renewable projects, which may help soften prices by around 2019 but perhaps at the price of increased volatility.[vii]

What is clear is we urgently need to begin strategic investment in new capacity to ensure energy security, bring down wholesale energy costs, reduce emissions and to reduce price volatility. We should allow the market to determine the best technology fit and its best location based on a workable national emission and energy policy platform.

[i] Evan Schwarten, AAP, February 8 2017, Renee Viellaris, Courier Mail, June 19 2017, David Crowe, The Australian, March 27, 2017

[ii] “New Power Plant Hailed as Solution”, Domanii Cameron, Townsville Bulletin, July 10 2017.

[iii] Above 30MW, directable by AEMO

[iv] Powerlink Q-data

[v] Including Capricornia (LNP less than 1 per cent), Herbert (ALP less than 1 per cent), Flynn (LNP 1%), Dawson (LNP 3.5%)

[vi] Field of Dreams, 1989, Universal Pictures

[vii] Clean Energy Council media release, May 2 2017

Related Analysis

Is increased volatility the new norm?

This year has showcased an increased level of volatility in the National Electricity Market (NEM). To date we have seen significant fluctuations in spot prices with prices hitting both maximum price caps on several occasions and ongoing growth in periods of negative prices with generation being curtailed at times. We took a closer look at why this is happening and the impact this could have on the grid in the future.

Is there a better way to manage AEMO’s costs?

The market operator performs a vital role in managing the electricity and gas systems and markets across Australia. In WA, AEMO recovers the costs of performing its functions via fees paid by market participants, based on expenditure approved by the State’s Economic Regulation Authority. In the last few years, AEMO’s costs have sky-rocketed in WA driven in part by the amount of market reform and the challenges of budgeting projects that are not adequately defined. Here we take a look at how AEMO’s costs have escalated, proposed changes to the allowable revenue framework, and what can be done to keep a lid on costs.

A farewell to UK coal

While Australia is still grappling with the timetable for closure of its coal-fired power stations and how best to manage the energy transition, the UK firmly set its sights on October this year as the right time for all coal to exit its grid a few years ago. Now its last operating coal-fired plant – Ratcliffe-on-Soar – has already taken delivery of its last coal and will cease generating at the end of this month. We take a look at the closure and the UK’s move away from coal.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.