WA electricity reform and DER: What are the customer implications?

Distributed Energy Resources[i] (DER) have the potential to offer customers lower cost, reliable, efficient energy, and the possibility of energy independence. However, while there has been a growing focus on DER benefits, they also come with some challenges.

An expert panel recently discussed these challenges in the context of Western Australia’s electricity reform, hosted by the Australian Energy Council and Synergies Economic Consulting. Last week’s EnergyInsider looked at some of the technology and wholesale market challenges. Here we consider customers: What are customer implications? And what are customers wanting from the energy supply changes that are currently underway?

The energy transformation

The Wholesale Electricity Market (WEM) operates in the 261,000km2 South West Interconnected System (SWIS) and provides around 18 million MWh of electricity to 1.1 million households and businesses annually. The SWIS has an ‘islanded nature’ – it stands alone from the National Electricity Market (NEM) and therefore needs to be more secure and reliable than a power system with interconnections[ii].

Collectively rooftop DER is the largest energy source in the SWIS, according to the Australian Energy Market Operator’s (AEMO) most recent Integrating Utility-Scale Renewables and DER in the SWIS report. There is now over 1000 MW of rooftop photovoltaic (PV) DER installed behind the meter in the distribution networks. AEMO estimates that installed rooftop DER will more than double by mid-2028 to 2400 MW[iii].

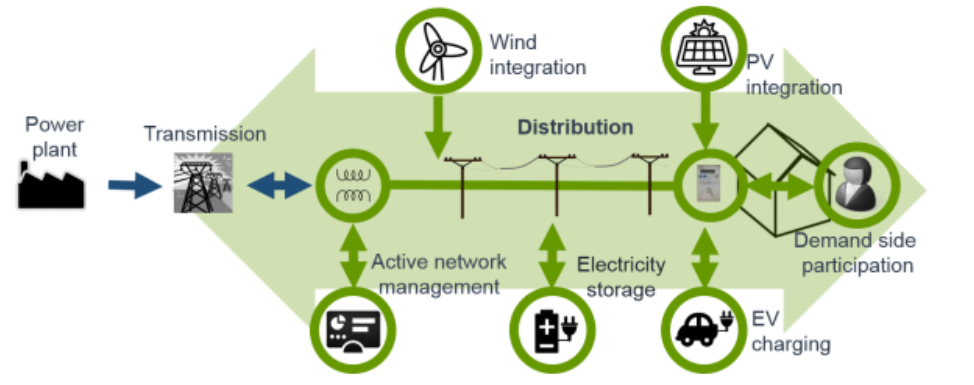

In this evolving electricity system (figure 1), electricity retailer Synergy believe that an affordable, reliable, and sustainable energy supply remain what customers want[iv]. Customers want to keep it simple and they expect increasingly greater choice and technology enablement.

Figure 1: The evolved electricity system

Source: AEMO

Source: AEMO

However, there is uncertainty as to how simple DER will remain for customers - and it is concerning when proposed future DER models have a range of new players involved in the mix, with multiple parties developing and offering customers a new suite of products and services. These scenarios must not only consider added complexity for the customer, but also needs to maintain customer protections (figure 2).

Figure 2: Considerations to ensure the end user benefits

Source: Synergy, WA Electricity Reform: Have we got DER Covered?

Source: Synergy, WA Electricity Reform: Have we got DER Covered?

AEMO state: “There are many different forms of DER with new and varying business models that can provide a range of grid, essential, emergency reserves, and network support services. Unlocking these new value streams in addition to the consumers’ services must be supported by markets and competition to support the investment choices delivering the best value.”[v]

To provide equitable access to the benefits of DER, a strong holistic market design, backed by a strong regulatory framework, is imperative. A substantive framework is already in place with existing retailers that covers various consumer laws, privacy protections, and regulated contracts. And while tweaking this framework will no doubt be required, retailers are seemingly in a strong position to continue to provide customer protections when offering future DER services.

High DER future

The impact of a high DER future is already being felt in Horizon Power’s service area. The utility is “bringing the future forward” by accelerating the uptake of DER in the town of Onslow. The pilot program aims to generate 50 per cent of the town’s electricity from renewable energy sources, by providing residents and businesses with access to low-cost solar and battery storage systems[vi].

Horizon Power has developed a framework where controllable DER is linked to centralised control and dispatch via a DER management system (DERMS).

Figure 3: Onslow microgrid – technology view

Source: Horizon Power, WA Electricity Reform: Have we got DER Covered?

Source: Horizon Power, WA Electricity Reform: Have we got DER Covered?

However the Onslow trial is looking beyond getting the technology architecture right. It is aiming to understand how customer engagement, incentive design (including the transaction framework for the services that customers are providing), as well as how contractual and regulatory frameworks support a new supply model.

From a technology perspective, all the pieces are there but it is complex to get end-to-end commands from the control room to a customer device. There's as many as nine different vendors involved in Horizon Power getting a command from end-to-end. So it will be important to consider open standards and protocols to ensure the necessary interoperability exist for reliable communications.

Potential challenges are becoming apparent to Horizon Power in relation to applying DERMS in markets such as the NEM or WEM. For example, a command dispatched to a DER might be intended to achieve a certain outcome for the distribution operator, but that may run contrary to the objectives of the retailer. Being a vertically integrated utility, this is easier for Horizon Power to manage. However it raises the question of how the customers individual investment is factored into an analysis of optimal customer outcomes. It is likely to take a lot of time and effort to get all of the fundamentals of DER orchestration in place for it to bring system wide and society wide benefits.

Understanding customer needs

While decisions about where and when to install DER and how to operate it are increasingly consequential, many electricity customers lack the information, time and control to efficiently direct investment in, and operation of DER.

As part of its annual retail competition review, the Australian Energy Market Commission (AEMC) polled 2,000 respondents about a range of energy technologies such as solar, batteries, smart devices, and energy services. Initially the participants had trouble understanding energy services and their benefits. The participants were shown an advertisement of a typical day of an average family, and how the family interacted with energy services. Afterwards, they showed increased interest in energy services, particularly in relation to what energy technology to purchase next, and services become the most valued offer.

EnergyOS is also focussed on the theme of energy services. To really engage with the full suite of DER opportunities, the tech start-up believes that consumers must first become familiar with the new generation of services available. They say that this requires a different way of thinking: services are fundamentally different from products, and therefore, require a different mindset.

Western Power is looking to further understand customers' future energy needs through utilising energy scenarios – like the uptake of different technology, macro-economic and demographic factors - and how these determine future energy requirements of customers. They are modelling 50 scenarios and 50 future grids to determine what would be the most efficient grid to serve the most likely future energy need. From that, they pose the question of how to transition to that new grid. A lot of the modelling uses automated tools and systems, and it is currently a proof of concept that Western Power is looking to develop further.

Conclusion

It is clear that the benefits of DER need to flow across the value chain for retailers to sustainably offer a compelling value proposition to customers. To support this, reform is needed in relation to network tariffs and other pricing signals that allow retailers to share in the end user benefits. Such reform may even encourage further product development, with the possibility of energy products coming to mirror Telco products. So while the customer challenges of a high DER future are evident, there is also confidence that solutions can be developed.

[i] Definition of DER: By ‘distributed’ we mean connected to consumers on the distribution network, and we imply small scale and a diversity of locations and technologies. ‘Energy’ refers to both the release and absorption of energy. ‘Resources’ means being put to a useful purpose. Some examples therefore could include inverter-based generation, batteries, controlled small loads and electric vehicles.

[ii] AEMO, Integrating Utility-Scale Renewables and DER in the SWIS, March 2019

[iii] AEMO, Integrating Utility-Scale Renewables and DER in the SWIS, March 2019

[iv] Synergy presentation, WA Electricity Reform: Have we got DER Covered? panel, 7 March 2019

[v] AEMO, Integrating Utility-Scale Renewables and DER in the SWIS, March 2019

[vi] https://horizonpower.com.au/our-community/projects/onslow-distributed-energy-resource-der-project/

Related Analysis

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

UK looks to revitalise its offshore wind sector

Last year, the UK’s offshore wind ambitions were setback when its renewable auction – Allocation Round 5 or AR5 – failed to attract any new offshore projects, a first for what had been a successful Contracts for Difference scheme. Now the UK Government has boosted the strike price for its current auction and boosted the overall budget for offshore projects. Will it succeed? We take a look.

Energy transition understanding limited: Surveys

Since Graham Richardson first proposed a 20 per cent reduction in Australia’s greenhouse gas emission levels in 1988, climate change and Australia’s energy transition has been at the forefront of government policies and commitments. However, despite more than three decades of climate action and debate in Australia, and energy policy taking centre stage in the political arena over the last decade, a reporting has found confusion and hesitation towards the transition is common among voters. We took a closer look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.