The crowding out of coal

BP recently released the 66th Statistical Review of World Energy 2017[i] (the report). It showed that global energy consumption grew by 1 per cent, a similar rate to 2014 and 2015, and almost half the average growth rate of the past decade.

In the report’s introduction, Bob Dudley, BP Group Chief Executive, writes that “global energy markets are in transition … the relentless drive to improve energy efficiency is causing global energy consumption overall to decelerate.”

According to the report, energy growth is getting slower and demand is shifting to fast-developing economies (China and India). Global energy markets are adapting to short-term price challenges, while a longer-term transition continues.

This transition was particularly noticeable in the contrasting decelerated growth of coal and oil, and the accelerated growth of gas and renewable power. The report highlighted changes in the fuel mix, the rise of renewables, and coal’s increasing challenge as the energy market shifts, in both global and domestic markets. In Australia, we mirrored this global trend, as seen in Table 1.

Table 1: Australia’s 2016 primary energy consumption by fuel, million tonnes oil equivalent

Source: BP Statistical Review of World Energy 2017

The decline of coal

“The turnaround in the fortunes of coal over the past few years is stark: it is only four years ago that coal was the largest source of energy demand growth,” writes Spencer Dale, BP Group Chief Economist.

In 2016 coal consumption fell globally for the second consecutive year by 1.7 per cent. Coal’s share within primary energy consumption fell to 28.1 per cent - the lowest since 2004.

On the supply side, global coal production fell by 6.12 per cent, which to date, is the largest decline on record (Figure 1). The report suggests that coal and oil have peaked and are moving towards an ongoing decline.

Figure 1: World coal production, annual percentage growth 1982-2016

Source: BP Statistical Review of World Energy 2017

Australia followed this trend, with coal consumption falling by 0.68 per cent and production dropping by 2.4 per cent in 2016 (Table 2).

Table 2: Australia’s 2016 primary energy production by fuel

Source: BP Statistical Review of World Energy 2017

The rise of renewables

In 2016 renewable energy again grew rapidly. As Bob Dudley writes in the report: “Of course, the energy mix is shifting towards cleaner, lower carbon fuels, driven by environmental needs to grow and prosper, while also reducing carbon emissions.”

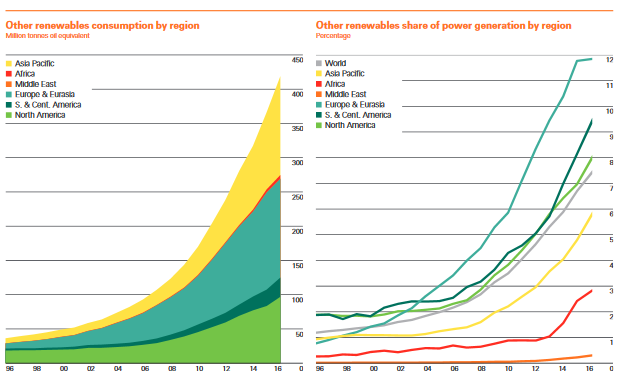

Globally, renewable power (wind, wave, solar and geothermal energy and combustible renewables and renewable waste) consumption grew by 14.1 per cent and hydroelectric power generation rose by 2.5 per cent.

In Australia renewable consumption (except hydro) increased by 12.5 per cent, with the majority of renewable power from solar. Hydroelectric power consumption grew by 27.7 per cent.

Figure 2: Renewable (except hydro) consumption and production by region, 2016

Source: BP Statistical Review of World Energy 2017

Yet despite high growth rates, renewable power represents only 8 per cent of global power generation.

The report also showed renewable power’s impact on the reduction of carbon emissions; a combination of weak global energy demand and a market shift to more renewable power, saw 2014-2016 as the lowest average emissions growth over a three year period since 1981-83, with carbon emissions estimated to have grown by only 0.1 per cent.

The future of gas

Global natural gas consumption increased by 1.5 per cent, lower than the previous decade’s average of 2.3 per cent growth.

While global production had its weakest growth in 34 years, it is estimated that 2016 was the first year of a “growth spurt” with world liquefied natural gas (LNG) supplies expected to increase by around 30 per cent by 2020 – which, accordingly to the report, is the equivalent to a new train coming on stream every two to three months for the next four years.

While Australia’s natural gas consumption declined by over 4 per cent, the nation’s production of LNG was the global “standout performer” with a supply increase of 25.2 per cent due to new facilities coming on stream in 2016 (Figure 3). Global LNG imports/exports grew by 6.2 per cent, which was likely driven by Australia’s increased output.

Figure 3: LNG supply and demand, 2016

Source: BP Statistical Review of World Energy 2017

With the changes in the energy mix, LNG may emerge as a growing flexible transition fuel. Spencer Dale writes in the report: “As the importance of LNG trade grows, global gas markets are likely to evolve quite materially. Alongside increasing market integration, we are likely to see a shift towards a more flexible style of trading, supported by a deeper, more competitive market structure.”

Has coal’s prime passed?

The report predicts that coal consumption has probably peaked and it is currently in steady decline (alongside oil). It shows evidence that the fight for coal may be a losing battle, with much of the future growth likely to come from natural gas and renewables. Another important driver is the extent to which electric vehicles take off – this would see oil lose share and gas and renewables (as electricity fuel sources) increase further. It also remains to be seen whether the much touted “hydrogen economy” takes off.

For the world’s power grids, a key challenge will be maintaining security and reliability of supply given the different characteristics of coal-fired power and the renewables that are predicted to be its main replacement. As Bob Dudley writes: “As we know from history, one set of challenges is likely to be replaced by another, as we learn to operate in ever-changing markets to harness the opportunities afforded by the transition to a lower carbon environment.”

[i] BP Statistical Review of World Energy 2016, June 2017

Related Analysis

Integrated System Plan – What Should We Expect?

The release of an expert study of last year’s autumn wind drought in Australia by consultancy Global Power Energy[i] this week raised some questions about the approach used by the Australian Energy Market Operator’s in its 2024 Integrated System Plan (ISP). The ISP has been subject to debate before. For example, there has previously been criticism that some of the ISP’s modelling assumes what amounts to “perfect foresight” of wind and solar output and demand[ii], rather than a series of inputs and assumptions. The ISP is produced every two years and with the draft of the next ISP (2026) due for release soon, it is useful to consider what it is and what it is not, along with what the ISP seeks to do.

The ‘f’ word that’s critical to ensuring a successful global energy transition

You might not be aware but there’s a new ‘f’ word being floated in the energy industry. Ok, maybe it’s not that new, but it is becoming increasingly important as the world transitions to a low emissions energy system. That word is flexibility. The concept of flexibility came up time and time again at the recent International Electricity Summit held in in Sendai, Japan, which considered how the energy transition is being navigated globally. Read more

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.