Smart Meters: Is the competitive rollout working?

Back in late 2015, the Australian Energy Market Commission (AEMC) made a final rule to open up competition in metering services. Competition is intended to promote innovation and encourage investment in advanced meters that delivers new services valued by consumers, at a price they are willing to pay.

Improved access to the services enabled by advanced meters gives consumers the scope to better understand and take control of their electricity consumption. They also get greater visibility of the costs associated with their usage patterns. A variety of services such as remote meter reading, remote access to appliances and different pricing options can be enabled by advanced meters.

Investment in advanced meters is now market led. Unless you have a purpose for a smarter meter you don’t have to have one. If you do have a purpose for one, such as you are installing solar or storage, or switching to an innovative tariff, then chances are you have the financial incentive to have an advanced meter installed that will provide the services you need.

In Victoria, in contrast to the current arrangement, the smart meter rollout, which began in 2006, was mandated by the State Government for all households and small businesses under its Advanced Metering Infrastructure (AMI) program. There is now nearly complete penetration of smart meters to Victoria’s more than 2.4 million electricity customers.

AEMC Rule Change

The AEMC made the rule change because the COAG Energy Council identified that despite the benefits advanced meters can offer, the regulatory framework, such as that in Victoria, allowed, and potentially encouraged, the continued installation of meters with functionality of limited benefit to the customer and at uncompetitive cost.

The AEMC points to the introduction of competition in providing advanced meters helping put downward pressure on the price of these services.

This was borne out by the Victorian Auditor General Office’s (VAGO) reviews in 2009 and 2015 report, as well as the Victorian Government’s 2011 review of the program.

The VAGO found that the reality of the mandated Victorian smart meter rollout was that the state approved a program that saw the imposition of costs on consumers that they could not directly control, nor could they access or drive many of the benefits. Consumers were charged upfront for the rollout, in some cases before meters were installed.

In its 2015 report the VAGO found that there was substantial net cost to consumers with cost benefit analysis finding that the expected benefits of the AMI program fell significantly and became a $319 million net cost to consumers, which it also noted could rise.

Victorian consumers, who have been paying for the roll-out of smart meters, have paid more than $2 billion in regulated metering charges.

The COAG Energy Council felt that competitive metering was a better approach. So that’s why we have metering competition and they are pretty sound reasons.

Biggest Single Change Since Full Retail Competition

The introduction of competition in metering is the largest single change in electricity retailing since the introduction of full retail competition (FRC) itself, back in the early 2000s. Like the introduction of FRC, there have been some problems at go live.

Some of these relate to the rules framework, and perhaps unintended consequences of the new rules. Some relate to system changes, and the problems of incorporating and coordinating additional parties to the meter installation transaction. And some relate to a lack of preparedness, where parties have failed to put in place the necessary systems and processes to meet the customer’s needs. These have led to delays in getting meters installed.

That has thrown the metering rollout back into the spotlight, particularly in South Australia where there has been a faster than expected take-up of new meters[i]. In New South Wales, the Independent Pricing and Regulatory Tribunal (IPART) has released a draft report into that state’s rollout and suggested measures to minimise delays.

The AEMC notes that around 500,000 households and small business outside Victoria now have advanced meters installed and in SA more than 10 per cent of the more than 760,000 small electricity customers have the meters[ii].

In response to the SA delays in installing meters, retailers have entered independent and voluntary agreements with the South Australian Government to compensate households when meters are not installed within a prescribed timeframe.

Apart from the rule change, the AEMC, the Essential Services Commission of South Australia (ESCOSA), the Australian Energy Regulator (AER) and the Australian Energy Market Operator have been holding regular workshops with retailers, metering businesses, South Australia Power Networks (SAPN), the Energy and Water Ombudsman of South Australia (EWOSA) and industry groups representing electrical and building contractors. The purpose has been to identify solutions that can be implemented while the AEMC rule change process is in progress that can speed up the process of installation and improve the customer experience.

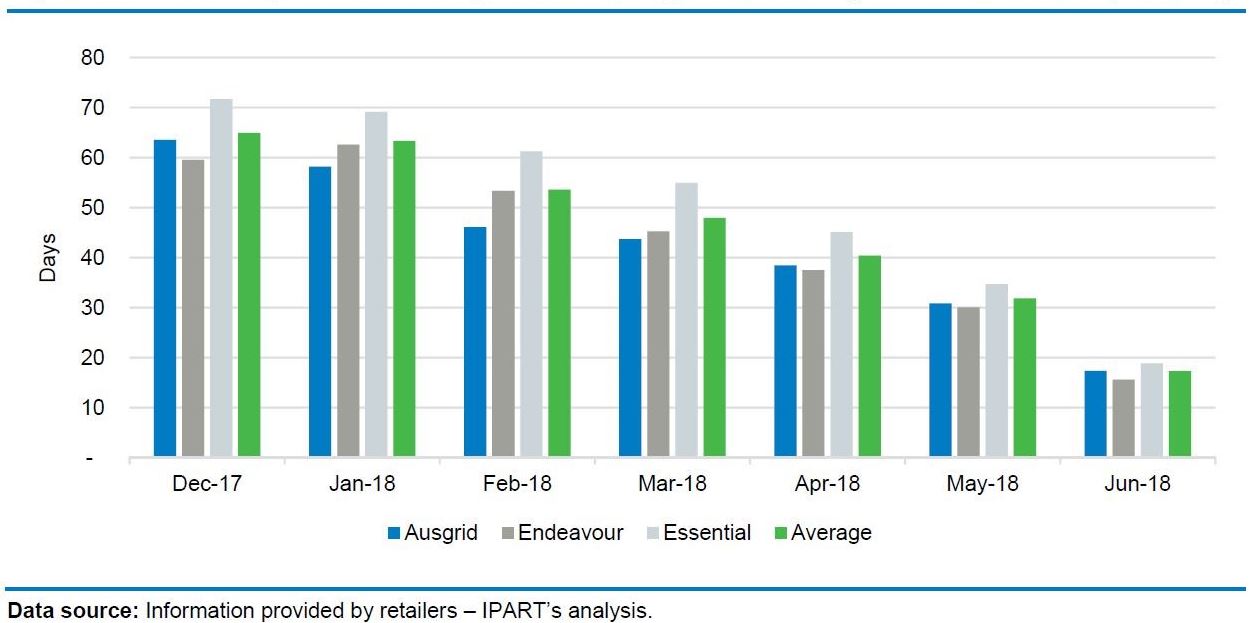

This collaboration has led to improvements in meter installation timeframes and reduced the instances of customers being left without electricity supply as a result of metering related works[iii]. NSW is also noting improvements in installation timeframes as the new arrangements are better bedded down [iv] (see figure 1).

Figure 1: Average Business Days To Install Smart Meters in NSW by Distribution Source: Retailers’ metering practices in NSW, Oct 2018

Source: Retailers’ metering practices in NSW, Oct 2018

The South Australian timeframe agreement stays in place until the new AEMC national rule comes into effect on 1 January next year, which also requires electricity retailers to meet connection or a simple meter exchange on a date agreed with the customer. In the current draft form of the AEMC determination, if no date can be agreed, then the retailer will be subject to a maximum of six business days for a new connection or 15 business days for a simple meter exchange. Replacements of faulty meters would also have to be done within 15 business days.

The draft rule also proposes new obligations on distribution network service providers (DNSPs). DNSPs will be required to notify retailers as soon have they have completed connection work and also oblige them to use AEMO’s B2B e-hub, an industry-wide online booking system, to coordinate with retailers on the installation process.

The rule change was based on a request from the Australian Government. Retailers, in conjunction with metering businesses, have also submitted rule changes to the AEMC to address some of the anomalies in the rules framework, though these have not been adopted in the draft determination. Interestingly, IPART shared the retailers views on the need for greater flexibility around planned interruption notifications to customers for meter exchanges[v].The AEMC metering installation time frames rule change draft determination represents a necessary post implementation clean-up that is welcomed by the industry. Submissions on the rule change are due by 25 October.

There have been problems in the implementation of the Power of Choice reforms, but this is not proof that metering competition doesn’t work. Most stakeholders were in agreement that the delays are not solely the result of implementation issues on the part of retailers and metering parties, and that there are problems with the current rules and they need to change. Consequently, energy ombudsmen, consumer groups, government departments and other industry bodies were supportive of introducing a regulated timeframe for meter installations.[vi]

Such a large-scale rollout of new technology, which will be piecemeal in some less populated places and not in more densely populated ones, is bound to be difficult and there is no perfect model. The market for smart meters is in its youth and needs careful monitoring and evaluation as it develops. Policymakers nevertheless need to get on the front foot and guarantee simple access to smart meter data and services for all consumers. And marketers need to actively encourage participation and to demonstrate to consumers how services linked to smart meters can lower their electricity costs and to ensure that no one is left behind in this emerging market.

[i] AEMC draft rule determination, 13 September 2018

[ii] ibid

[iii] ibid

[iv] Retailers’ Meter Installation Practices in NSW, IPART Draft Report, 2 October 2018

[v] ibid

[vi] https://www.aemc.gov.au/sites/default/files/2018-09/Draft%20Determination.pdf

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.