RERT Locker II: The Sequel

On 20 August the Australian Energy Market Operator’s (AEMO) latest invitation to tender for long notice Reliability and Emergency Reserve Trader (RERT) for the coming summer in Victoria and South Australia will close.

The RERT is a safety net mechanism through which AEMO can obtain additional supply capacity to meet a forecast shortfall against the reliability standard (<0.002 per cent of demand not met in a financial year). This supply is then held out of the market and used as a last resort to avoid involuntary customer interruptions. The cost is then recovered across all customers in the affected regions.

It follows the use of the RERT last summer (which we have previously written about in The RERT Locker and Planning for Summer: What have we learnt). That was only the fourth time that it had been invoked. The cost of that intervention has been previously discussed, but last week AEMO updated its cost information on the program and it is clear that the most recent invocation dwarfed the previous spending.

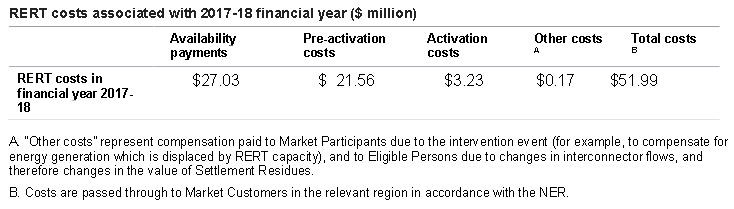

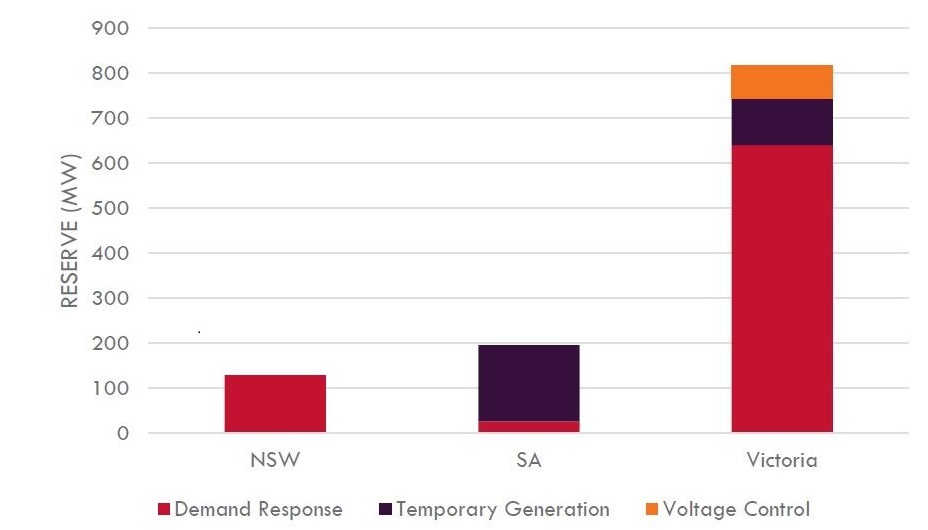

In its updated figures AEMO reports that the RERT cost was $51.99 million[i], with more than $50 million of the costs coming from Victoria (and being passed on to Victorian electricity customers). More than 600MW of demand response with a further 104MW of emergency generation was acquired in Victoria (out of a total of 1141MW[ii] ). The remaining $1.2 million was attributed to South Australia.

A break-down of the costs is shown below:

The make-up of last summer’s RERT is shown in Figure 1.

Figure 1: RERT available by generation/demand

Source: AEMO

Whilst the RERT was contracted for the entire summer, it was actually activated (called into operation) in Victoria on 30 November 2017, and in Victoria and South Australia on 19 January 2018 when reserve levels were forecast to reduce to a point that would trigger a lack of reserve (LOR) 2 declaration. In addition, RERT was contracted for in New South Wales on 7 and 8 June but not used.

In its Summer 2017-18 Operations Review, AEMO reports that 32MW was activated pre-contingency on 30 November 2017, and 136.5 MW was activated pre-contingency on 19 January 2018. An additional 440 MW was contracted for post-contingency activation on 19 January 2018.

Rule Changes

Since last summer AEMO has successfully proposed a rule change to increase the amount of time that it has to procure emergency reserves by reinstating the long-notice RERT. This means AEMO can call on a wider range of providers, but it also means it may pre-empt these providers from operating within the general market, which may have resolved the shortfall naturally.

AEMO is now seeking an enhancement to the RERT. The Australian Energy Market Commission (AEMC), which is to consider the rule changes, has issued a consultation paper[iii] seeking views on the proposed changes including:

- The pros and cons of further increasing the procurement lead time to one year and potentially permitting multi-year contracting where AEMO sees value in doing so.

- The procurement trigger for the RERT, including potentially delinking it from the existing reliability standard and using instead another metric to be determined by AEMO.

- The transparency of how much AEMO should procure and potential methodologies.

- Introducing a high-level framework for standardised RERT products.

Submissions closed on 26 July. A draft determination is expected in October and a final decision by the end of December[iv].

Getting the Balance Right

The rule change proposal has highlighted the challenge of getting the balance between reliability and affordability right.

While AEMO reported that the RERT had cost less than $6 per household[v], this referred only to the share of the $51m that was recovered from domestic customers, and the additional costs to medium and larger energy users were more significant[vi]. The Energy Users Association of Australia (EUAA) has said in some cases invoices sent to its members were for hundreds of thousands of dollars[vii].

Its submission to the AEMC, the EUAA was blunt:

“This submission begins with our member experiences from the 2017/18 RERT (it is not good).

“Our over riding concern is that the direction AEMO is taking seems to be driven by a desire to focus on system security and reliability, irrespective of the cost. This will lead to a gold plated network being complemented by gold plated reliability.”

The EUAA also argued that AEMO’s justification that community expectations had shifted is not sufficient to impose large costs on medium and large energy users. “EUAA members do not agree with this interpretation of community expectations. We wonder if those expressing these expectations are actually facing the full costs of their preferences?”

Other submissions to the AEMC have also raised questions about the value of proposed rule changes with many questioning the rationale, the potential to distort market signals and raising the need for greater transparency[viii].

In its submission EnergyAustralia recognised that AEMO is facing increasing challenges in operating the power system and “that there can be increased risk of USE[ix] at times, but there is no evidence that customers are willing to pay for a tightening of the reliability standard”. It also noted that numerous customers have raised concerns over the cost and the transparency of the RERT process last summer.

St Vincent de Paul and SACOSS in a submission said: “We believe that consumers are extremely concerned about high prices and affordability and would not want the RERT to add additional unnecessary costs. This is particularly pertinent when reliability at the point of consumption may not be delivered. In consultation with our members, St Vincent de Paul and SACOSS are uncertain about the value delivered by the RERT.”

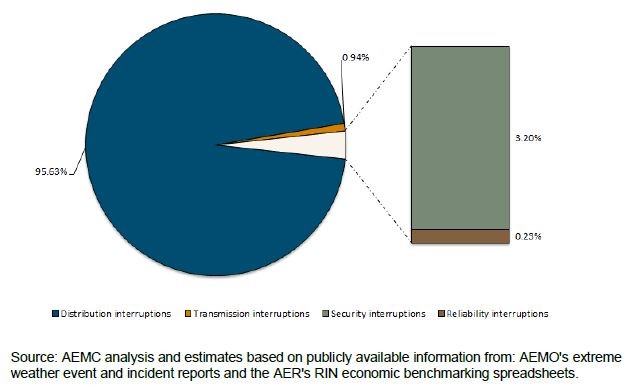

Another point to consider is whether a focus on the RERT is diverting attention from the more pressing issues facing the industry. In the following figure 2, the AEMC has broken up the actual energy lost by cause of customer interruption. The RERT can only address reliability matters, i.e. shortages of bulk supply. Yet this represents a very tiny amount of interrupted energy: 0.23 per cent.

Figure 2: Sources of supply interruptions in the NEM: 2007-08 to 2016-17[x]

It is worth noting that “security” events (disturbances in the transmission network) cause more than ten times the customer inconvenience as reliability events. This cannot be addressed by having more generation or demand-side reserves, instead requiring action to provide a more robust (but not “gold-plated”) grid, through ancillary services markets and the like.

Conclusion

The Australia Energy Council’s greatest concerns around the RERT changes relate to longer-term contracting and proposals to engage RERT reserves on a different basis than the market’s Reliability Standard. These aspects potentially:

- increase the distortionary aspects of the RERT on the energy market;

- lead to the RERT becoming a permanent alternative market to the energy market;

- create inefficient consumer costs; and

- confuse the governance and implementation of the NEM’s reliability standard.

There is no doubt that the RERT is an important safety net that supports reliable electricity supply in the NEM, but as noted by the AEMC[xi] it does carry direct and indirect costs. The direct costs last summer were substantial. Indirect costs are due to the potential distortionary effects the RERT can have on market outcomes.

In invoking the RERT there needs to be a careful balancing of the price paid to have power available, against the cost of not having that availability.

[i] https://www.aemo.com.au/-/media/Files/Electricity/NEM/Security_and_Reliability/RERT-Update---cost-of-RERT-2017-18.pdf

[ii] https://www.aemo.com.au/-/media/Files/Media_Centre/2018/Summer-2017-18-operations-review.pdf

[iii] https://www.aemc.gov.au/sites/default/files/2018-06/Consultation%20paper_0.pdf

[iv] https://www.aemc.gov.au/rule-changes/enhancement-reliability-and-emergency-reserve-trader

[v] https://www.afr.com/news/politics/aemo-looks-to-new-tools-machine-learning-to-manage-extreme-weather-20180522-h10e2v

[vi] https://www.aemc.gov.au/sites/default/files/2018-07/EnergyAustralia_1.PDF

[vii] https://www.aemc.gov.au/sites/default/files/2018-07/EUAA.PDF

[viii] https://www.aemc.gov.au/rule-changes/enhancement-reliability-and-emergency-reserve-trader

[ix] USE – Unserved energy

[x] https://www.aemc.gov.au/sites/default/files/2018-07/Final%20report_0.pdf page 12

[xi] https://www.aemc.gov.au/news-centre/media-releases/have-your-say-reliability-and-emergency-reserve-trader-framework

Related Analysis

Retail protection reviews – A view from the frontline

The Australian Energy Regulator (AER) and the Essential Services Commission (ESC) have released separate papers to review and consult on changes to their respective regulation around payment difficulty. Many elements of the proposed changes focus on the interactions between an energy retailer’s call-centre and their hardship customers, we visited one of these call centres to understand how these frameworks are implemented in practice. Drawing on this experience, we take a look at the reviews that are underway.

Data Centres and Energy Demand – What’s Needed?

The growth in data centres brings with it increased energy demands and as a result the use of power has become the number one issue for their operators globally. Australia is seen as a country that will continue to see growth in data centres and Morgan Stanley Research has taken a detailed look at both the anticipated growth in data centres in Australia and what it might mean for our grid. We take a closer look.

Green certification key to Government’s climate ambitions

The energy transition is creating surging corporate demand, both domestically and internationally, for renewable electricity. But with growing scrutiny towards greenwashing, it is critical all green electricity claims are verifiable and credible. The Federal Government has designed a policy to perform this function but in recent months the timing of its implementation has come under some doubt. We take a closer look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.