Renewables still dropping in cost, but rate slows: New assessment

Lazard’s latest Levelized Cost of Energy (LCOE) Analysis shows that while the cost of renewable energy continues to fall, the rate of this decline is slowing. Technologies like onshore wind and utility-scale solar also remain competitive with the marginal cost of existing conventional generation technologies.

So what key trends are revealed in the firm’s annual assessment of different types of generation? We take a look at the report here…

Renewable declines

Lazard’s LCOE analysis[i] shows that certain technologies (largely onshore wind and utility-scale solar, which became cost-competitive with conventional generation several years ago on a new-build basis) remain competitive.

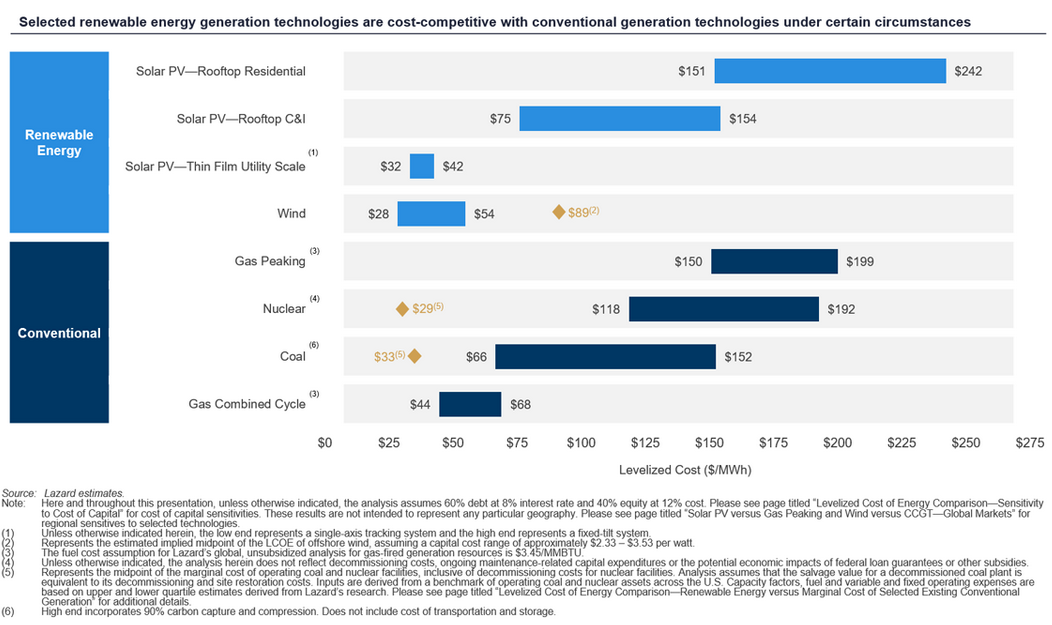

The firm states that under “certain circumstances” resources like wind have remained cost-competitive with conventional generation (figure 1).

Figure 1: LCOE comparison (unsubsidised)

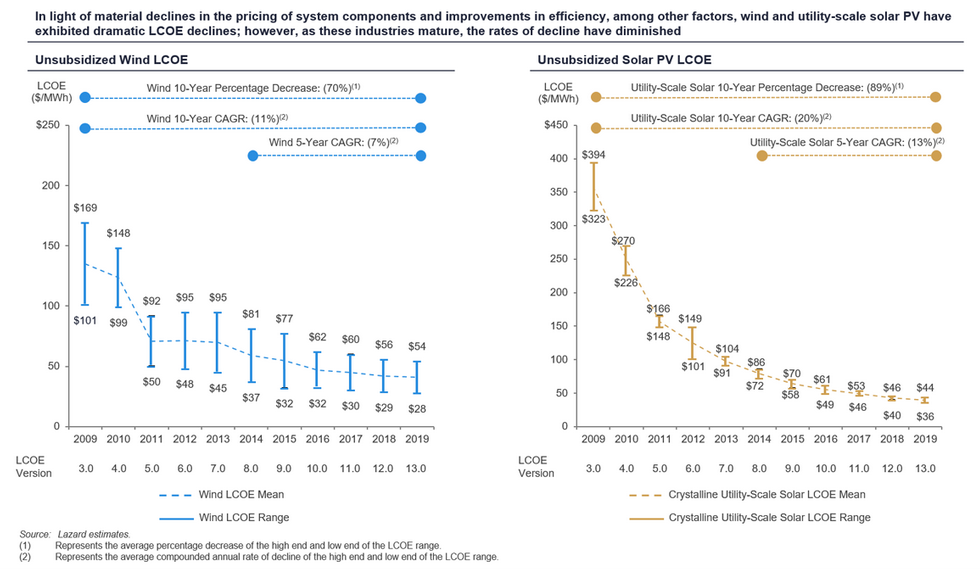

Utility-scale solar costs have been falling by around 13 per cent per year, according to the analysis, compared to onshore wind that has dropped by around 7 per cent annually over the past five years.

Lazard suggest that the drop in solar and wind is largely due to the falling price of system components along with improvements in efficiency, and as these industries continue to mature the rates of decline continue to progressively lessen.

Figure 2: Wind and Solar RV LCOE historical comparison (unsubsidised)

Earlier this year Forbes also touched on the reasons for the rapid drop in renewable energy costs, stating that improvements in wind turbine product design has resulted in higher capacity factors than a decade ago:

“Although the new designs are more expensive up front, increased capacity and capacity utilization have outpaced those higher costs to lower the cost of energy produced … A typical base-to-blade tip height for onshore turbines is now often over 500 feet – as tall as the Washington Monument,” Forbes states.

Improvements in manufacturing efficiency is another attributable factor that has lowered the costs of producing solar PV panels, largely in China which meets the majority of global PV module demand. According to Forbes:

“Per unit installation “soft” costs are declining as project developers gain more experience and installations have moved from small scale (rooftop solar) to utility-scale operations (solar farms of hundreds of acres) … Renewables that were once inarguably much more expensive and required large subsidies and mandates to incentivize adoption have slid into grid parity territory, now able to compete directly with conventional sources in many places.”

But to cost-effectively scale up renewables they must be located in places with an abundance of sun, wind and land – and Forbes points out that is typically in remote areas where more transmission infrastructure is required to connect supply and demand, which “may be having an effect on system costs”.

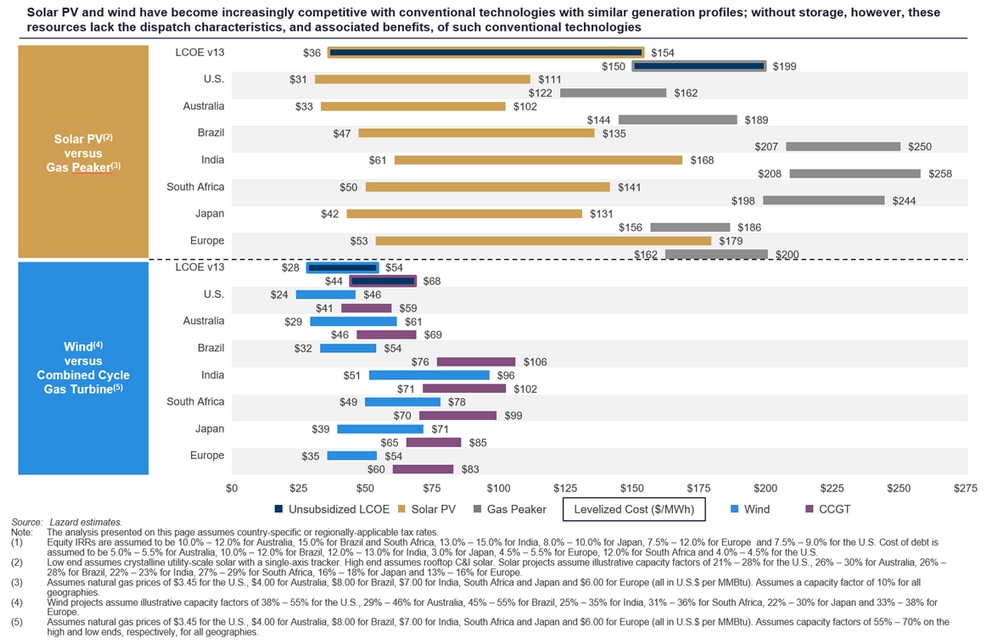

Lazard’s analysis also warns that differences in resource availability across regions, as well as fuel costs, can result in a “meaningful variance” in LCOE (figure 2).

Figure 3: Solar vs gas peaking and wind vs CCGT - global markets

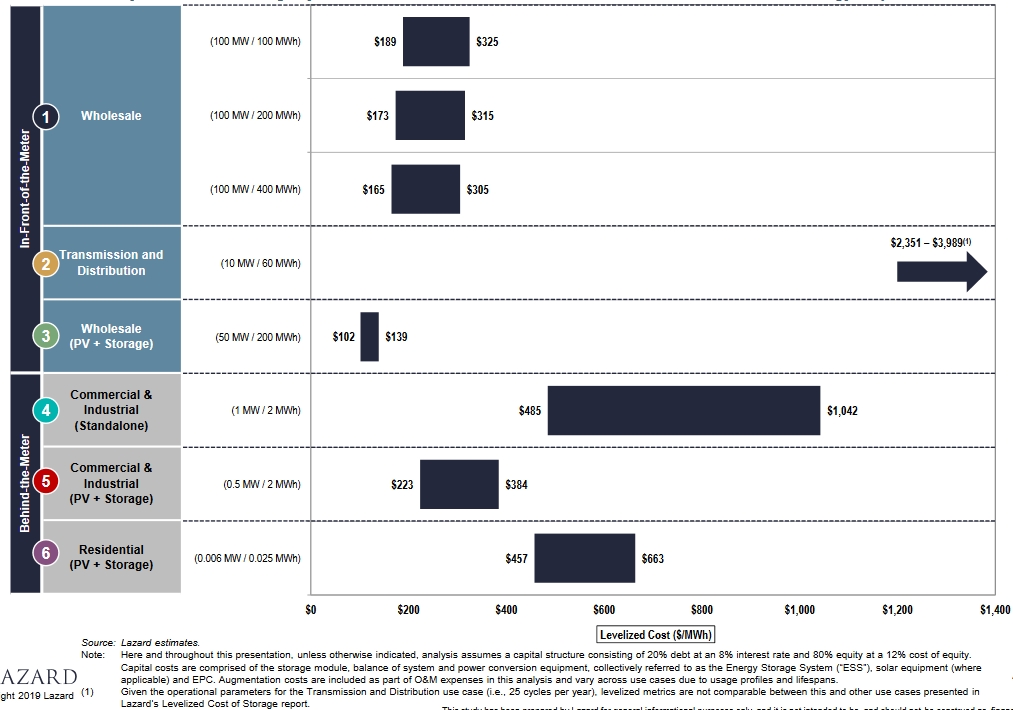

Lazard states that without storage, renewables lack the benefits of conventional technologies. The firm’s accompanying Levelized Cost of Storage Analysis shows that storage costs, mainly for lithium-ion technology, have continued to decline at a pace faster than that for other storage technologies.

Figure 4: Levelised cost of storage comparison: Energy ($/MWh-year) (unsubsidised)

For shorter duration applications, lithium-ion remains the least expensive energy storage technology and continues to decrease in cost, again, Lazard states this is due to a maturing supply chain and increases in efficiencies:

“Solar PV + storage systems are economically attractive for short-duration wholesale and commercial use cases, though they remain challenged for residential and longer-duration wholesale use cases.”

[i] While based on US costs, Lazard’s assessment

Related Analysis

International Energy Summit: The State of the Global Energy Transition

Australian Energy Council CEO Louisa Kinnear and the Energy Networks Australia CEO and Chair, Dom van den Berg and John Cleland recently attended the International Electricity Summit. Held every 18 months, the Summit brings together leaders from across the globe to share updates on energy markets around the world and the opportunities and challenges being faced as the world collectively transitions to net zero. We take a look at what was discussed.

Great British Energy – The UK’s new state-owned energy company

Last week’s UK election saw the Labour Party return to government after 14 years in opposition. Their emphatic win – the largest majority in a quarter of a century - delivered a mandate to implement their party manifesto, including a promise to set up Great British Energy (GB Energy), a publicly-owned and independently-run energy company which aims to deliver cheaper energy bills and cleaner power. So what is GB Energy and how will it work? We take a closer look.

Delivering on the ISP – risks and opportunities for future iterations

AEMO’s Integrated System Plan (ISP) maps an optimal development path (ODP) for generation, storage and network investments to hit the country’s net zero by 2050 target. It is predicated on a range of Federal and state government policy settings and reforms and on a range of scenarios succeeding. As with all modelling exercises, the ISP is based on a range of inputs and assumptions, all of which can, and do, change. AEMO itself has highlighted several risks. We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.