Queensland's energy approach becomes clearer

Last week the Queensland Government released its detailed response to the Queensland Productivity Commission’s Electricity Pricing recommendations. Its response covered a range of issues including competitive electricity markets, productivity improvements and efficiency and reliability.

The Government has accepted the bulk of the recommendations (43 out of 52) with the most notable, but unsurprising, exception being that it will retain the state’s premium solar feed-in tariff (FiT). Its rejection of the recommendation to consider ending the FiT early reflects the Government’s stated intention to retain the scheme, which was introduced by the previous Labor Government in 2008.

In relation to the recommendations that it did not accept the Energy Minister, Mark Bailey commented that the Government was supported by sound policy rationales based on “strategic goals and the need to remain flexible and responsive to emerging sectoral challenges in the future”[i].

Other recommendations that were not accepted include a requirement for CS Energy and Stanwell to develop and adhere to a voluntary Code of Conduct for their rebidding behaviour, and report annually all late rebids for independent auditing. New market rules came into effect on 1 July that oblige generators not to mislead through action or omission and in light of these there was little be gained by adding a duplicative layer of jurisdictional regulation. In its assessment, the Queensland Government noted that the QPC’s intent had been met by these National Electricity Rules and that the imposition of additional reporting and auditing demands on government-owned businesses would add costs and could put them at a competitive disadvantage.

The State Government also affirmed that it would not merge CS Energy and Stanwell, which would risk creating a super-sized generation business with extensive wholesale price-setting powers and confirmed that it does not intend to increase the net size of the existing government-owned generation capacity. These outcomes are important in supporting competitive outcomes in the Queensland market.

The Government accepted in principle the recommendation that it not favour a particular technology over another but with a rider that “it supports a diversified electricity market underpinned by multiple sources of supply, while recognising the state’s comparative advantages and the need to support low emissions technology and achieve a 50 per cent renewable energy target”. This, and the retention of the Solar Bonus Scheme, reflects the fact that solar and renewable energy policy has been a key focus for the Queensland Government.

Solar Bonus Scheme

A notable rejection of one of the 52 recommendations was the suggestion that the Queensland Government consider the merits of an early close to its premium feed-in tariff scheme, the Solar Bonus Scheme, which runs to 30 June 2028. That scheme mandated a FiT of 44 cents per kilowatt hour, more than triple the market rate at the time it was established.

The Commission had argued that most of those involved would have long recovered their costs by 2020 and that the scheme cost would be around $4.4 billion (with $3 billion of that occurring between the current financial year and 2027-28).

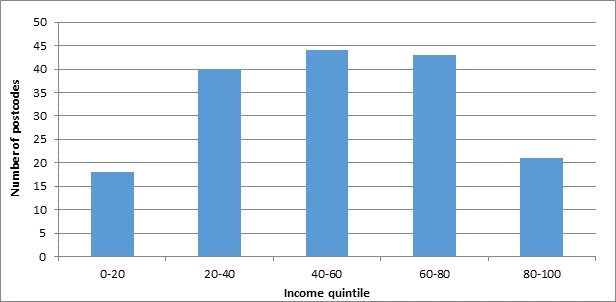

The QPC argued that the Solar Bonus Scheme had met its purpose and that it was adding $89 to a typical household bill in 2015-16 with low income and disadvantaged households disproportionately impacted (see Figure 1).

Figure 1: Queensland postcodes above 30 per cent penetration rate by income quintile (as at December 2015)

Source: esaa Solar report, December 2015

It also rejected the recommendation that it consider amending the eligibility criteria for the Solar Bonus Scheme to exclude existing scheme participants who install a storage device. The Government replied that it will consider how to accommodate the uptake of new technology such as battery storage alongside the scheme.

The QPC has also recommended that the Government not intervene in the solar PV market to achieve its 3,000MW capacity target by 2020, arguing that there did not seem to be a strong enough economic or environmental case for a new premium feed-in tariff. It did so on the basis that the target would be met without any intervention by 2022 and that a price of 45c/kwh (similar to the legacy Solar Bonus Scheme) would be needed to accelerate the target by 24 months.

The Government has previously ruled out re-introducing a premium FiT for residential systems[ii], but has indicated that it will continue to monitor progress towards its solar PV ambitions.

Retail markets and Consumers

The Queensland Government has accepted in principle the recommendation that its role in the retail market should be limited only to matters of significant industry change and support for vulnerable customers in collaboration with community partners.

Significantly, it has expanded the application of the electricity rebate in circumstances where there were calls to limit its application. This is a reflection of the difficulty in politics of removing a rebate, irrespective of the existence of a defensible public policy justification.

In its response the Government said it was:

- providing additional funding of $170.1 million to 2019-20 to extend the electricity rebate to Commonwealth Health Care Card Holders. From 1 January 2017, low-income households and families will become eligible to receive around $330 a year to help pay their energy bills;

- retaining the electricity rebate for holders of a Pensioner Concession Card, Veteran Affairs Gold Card or a Queensland Seniors Card; and

- providing $10 million over two years to deliver improved access to digital metering, greater information about tariff options and co-contributions to help customers invest in operation and equipment changes to manage bill impacts.

Despite accepting this principle, the government largely reserved its position on matters relating to Ergon Energy Retail and the regional Community Service Obligation (CSO). Competition in regional Queensland is unlikely to be effective until these structural issues are addressed.

Ringfencing

An important element of ensuring a fully competitive retail market for new energy services such as distributed generation, storage, metering and data services and demand response is effective ring-fencing of commercial activities from monopoly network activities.

The Commission made a welcome and strong statement on the importance of robust ring-fencing and market-testing of commercial arrangements between the network business and unregulated affiliates, with a long-term goal of full structural separation. Whilst the Government’s response commits to strong ring-fencing in line with the Australian Energy Regulator (AER) guidelines, it hedged its bets on the long-term structural separation.

Given the potential of the leviathan Energy Networks Queensland to unfairly dominate the market for services and technologies that can provide network support back to its regulated entities if ring-fencing is not strictly enforced, new energy services businesses will be watching the government’s actions in this space very carefully.

A full list of the recommendations along with the Government’s response is included here.

[i] http://statements.qld.gov.au/Statement/2016/11/30/power-price-stability-key-focus-of-response-to-qpc-report

[ii] https://www.dews.qld.gov.au/__data/assets/pdf_file/0005/939983/qps-response-outline.pdf

Related Analysis

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

UK looks to revitalise its offshore wind sector

Last year, the UK’s offshore wind ambitions were setback when its renewable auction – Allocation Round 5 or AR5 – failed to attract any new offshore projects, a first for what had been a successful Contracts for Difference scheme. Now the UK Government has boosted the strike price for its current auction and boosted the overall budget for offshore projects. Will it succeed? We take a look.

Energy transition understanding limited: Surveys

Since Graham Richardson first proposed a 20 per cent reduction in Australia’s greenhouse gas emission levels in 1988, climate change and Australia’s energy transition has been at the forefront of government policies and commitments. However, despite more than three decades of climate action and debate in Australia, and energy policy taking centre stage in the political arena over the last decade, a reporting has found confusion and hesitation towards the transition is common among voters. We took a closer look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.