New York’s REV: Again, up in bright lights!

The New York Reforming the Energy Vision (REV) is again in the spot light with the recent second REV Future 2016 conference that was held in late September 2016. The REV Future 2016 conference brought together key stakeholders, technology providers, utilities and state policy makers to discuss actionable business strategies to operationalise the ongoing REV initiative for a clean, resilient and affordable energy system in the State of New York.[1] This article examines the reasons why the REV was introduced, its goals and initiatives, and how it is progressing two and half years down the track.

New York State - Reforming the Energy Vision

In April 2014, New York’s Governor, Andrew Cuomo announced the REV strategy, to transform the New York State retail electricity market and overhaul the State’s energy efficiency and renewable energy programs.

Audrey Zibelman, Chair of the New York’s Public Service Commission (PSC) has stated, “By fundamentally restructuring the way utilities and energy companies sell electricity, New York can maximize the utilization of resources, and reduce the need for new infrastructure through expanded demand management, energy efficiency, renewable energy, distributed generation, and energy storage programs.”[2]

The PSC, through the REV, aims to encourage clean energy innovation, in which they claim should attract new investment into the State and improve consumer choice and affordability. [3] However, attracting new investment doesn’t reconcile with their notion of reducing the need for new infrastructure.

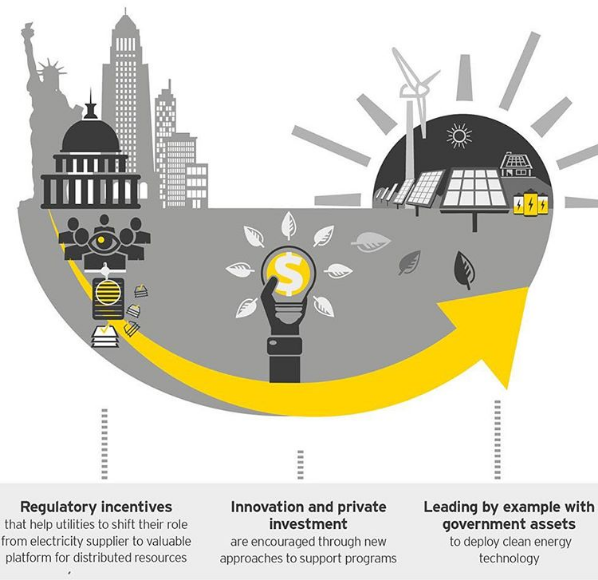

Through a regulatory overhaul, the REV strategy aims to promote greater energy efficiency, increased penetration of renewable energy resources, including wind and solar; and support the broader deployment of distributed energy resources. These could include micro grids, roof-top solar, other on-site power supplies, and storage.[4] Figure 1 outlines the three-pronged approach which will allow the State to achieve its clean energy targets while saving customers money and stimulating the economy.[5]

Figure 1: Approach to achieving clean energy targets

Source: Ernst and Young, http://rev.ny.gov/, 2016

The REV will also support the market for energy management products, empowering customers by allowing them more choice in how they manage and consume electric energy.[6]

Why change was needed

New York’s PSC identified that the electricity industry has mostly remained unchanged for the last century. However, the PSC has recognised that the transformation of electricity demand and supply is apparent, with emerging technologies and the increasing competitiveness of renewable energy. This coupled with aging network infrastructure, extreme weather events, system security and resiliency needs, are all factors that the PSC find as influencing this transformation.[7]

The PSC has argued that the power system is oversized to meet the few hours of peak demand every year. Therefore the maintenance of idle capacity to meet these rare peak demand periods results in high levels of inefficiency and rising electricity bills.[8] They also point out that the New York system suffers from annual losses of nearly 9 per cent from the transmission and distribution system; inefficient commodity markets; and inadequate storage for electricity.[9] However, it is important to note that there are losses in any distribution system, and loss reduction is only worthwhile to the point where the resources expended on loss reduction do not exceed the value of the losses avoided.

REV Clean Energy Goals

1. Generation

Through the mandatory REV Clean Energy Standard, the State of New York has committed to 50 per cent of all electricity used by 2030 to be generated from renewable energy sources.[10]

2. Reduced Emissions

The REV goal for electricity is one of the nation's most ambitious clean energy targets, with a target of a 40 per cent reduction in greenhouse gas emissions from 1990 levels by 2030. This target puts the State on a path to achieve its longer-term goal of decreasing carbon emissions 80 per cent by 2050. Furthermore, the State will continue to safely operate their nuclear power plants to aid the fight against climate change.[11]

3. Decrease energy consumption

The REV also has committed to 600 trillion Btu in energy efficiency gains, which equates to a 23 per cent reduction from 2012 in energy consumption in buildings. Through leading by example, State-owned buildings and facilitates (including the New York Power Authority) have committed to reducing energy consumption by at least 20 per cent by 2020, which will also save taxpayers millions of dollars on State electricity bills.[12]

How the REV works – Three pillars of activity

1. Regulatory reform

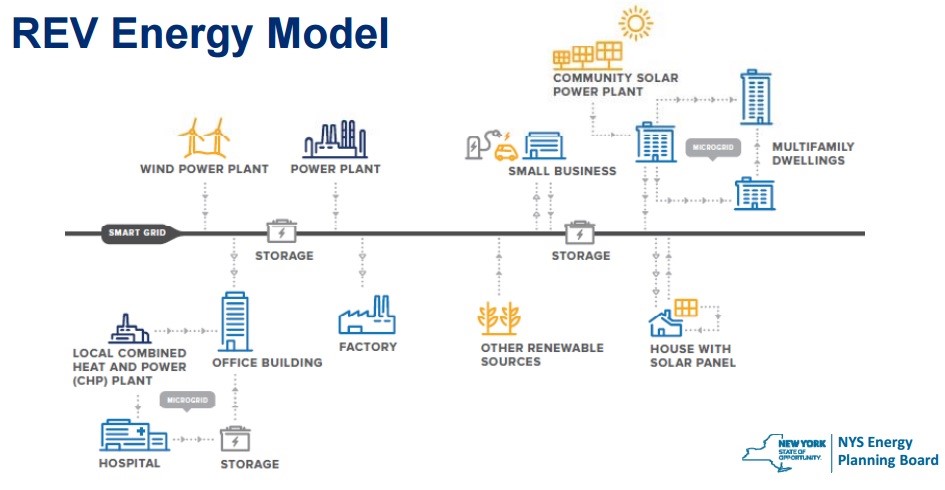

The regulatory reform, led by the PSC, plans to provide a new status on the grid to local energy and likely heighten micro grid development. The roll out involves two tracks: Track One focuses on developing the structure of the new utility market, and Track Two focuses on changes to tariff, market and incentive structures to better align utility interests. In early 2015, as part of Track One, the PSC issued a framework that establishes “a distributed system platform (DSP) operator to facilitate the creation of new markets for distributed energy resources (DER)” [13], such as solar, geothermal, wind, fuel cells, combined heat and power, battery storage, energy efficiency and other energy services. Essentially, utilities will act as the ‘distributed system platform (DSP) providers’ for the market play of microgrids, solar and other distributed energy resources under the REV.[14] The platform will act as an exchange for distributed energy services rather than wholesale power. DSP providers will essentially become the purchaser and aggregator for distributed resources[15].

Figure 2: REV Energy Model

Source: New York State Department of Public Service, Feb 2016

In May 2016, as part of Track Two of the REV roll out, the PSC introduced an Order that implements a framework for ratemaking and utility revenue model. The Order requires utilities to develop retail markets for DER, which will allow customers to manage their energy usage through a two way approach between customers and service providers.[16] Enerknol Research claims that in a developed DER market, utilities serving as DSPs will be able to generate additional revenue from third-party market participants which will provide utilities with financial incentives to adoptive an efficient mix of third party and utility investment.[17] In the meantime utilities will need to file an overall system efficiency proposal by the 1st December 2016, as required by the Order.

Further progress of the REV saw the PSC, in September this year, issue an Order that sets up standards for codes of conduct for utilities' dual roles in order to minimise any negative competitive impacts.[18] The Order changed the codes of conduct to reflect utilities' new roles as DSPs and DER providers. Utilities will now have to file new language for their codes of conduct that clearly prohibits preferential treatment to affiliates on interconnections and dispatch of DER. Another aspect of the new codes of conduct is information sharing, so that utilities do not favour their affiliates with information that is not widely available.[19] The PSC aims to have market information distributed to all participants, not just affiliates.

Given that the DSP role is relatively new, it is possible the same employees performing traditional distribution planning would help manage DSP markets. Direct ownership of DER by utilities has only been allowed in quite limited circumstances, and therefore the PSC does not find it necessary to enforce functional separation between employees running the distribution system and those involved with DER.[20]

The PSC stated the "REV is predicated on the integration of multiple parties into the state's electric infrastructure to increase efficiencies. Requiring the electric utilities to separate their traditional planning and operating functions from the DSP market functions could prevent efficiencies from developing” which could potentially increase ratepayer costs and impede market development.[21]

In addition, utilities have agreed to the REV goals to increase DER penetration, while maintaining traditional revenue streams until alternatives have been fully established. By expanding the sources for utility revenues, New York State has ensured that the utilities share the incentive of increased distributed generation and technology driven grid efficiency and productivity, which could be replicated in other US states.[22]

This has parallels to the current debate in Australia regarding whether DNSPs should be allowed to deliver behind the meter (BTM) services i.e. embedded generation, storage and demand management tools, as well as own the assets that these services will be delivered through. The concern is that when DNSPs supply and/or own the assets, competitive neutrality in the provision of these services to customers is compromised. This could allow NSPs to dominate the market for BTM services in their own service area, which would deny customers the dynamic benefits of effective competition.

The REV regulatory reform model is quite different from the arrangements here in Australia, whereby distribution network service providers (DNSP) only own the distribution network assets and maintain the services through those assets, and it is the retailers who interact with the end user i.e. the customer.

2. Market Activation – Clean Energy Fund

To ensure clean energy is fully integrated into the energy system, the Clean Energy Fund (CEF) 10 year program will address the identified barriers (including limited access to financing, burdensome permitting and local approval processes, and lack of consumer awareness). In turn the CEF will support the growth and deployment of clean energy technologies. In January 2016, the New York PSC approved funding of $5 billion into the CEF to reduce multiple barriers to the uptake and adoption of clean energy technologies, stimulate private investment, and influence policy (codes and regulations), while also providing support to low income and rural communities.

The market activation pillar of activity is being led by the New York Energy and Research Development Authority.

3. Leading by example

New York State plans to lead by example by leveraging their significant public energy assets, including the New York Power Authority. The New York Power Authority will ‘pilot innovative technologies, demonstrating what’s possible to consumers and businesses, providing their expertise and showcasing opportunities to invest in grid innovation and upgrades that will drive cost savings for consumers’.[23] This initiative also includes arranging innovative energy solutions across state-owned buildings, university campuses, and state fleet vehicles.[24]

Leading by example pillar of activity is being led by the New York Power Authority.

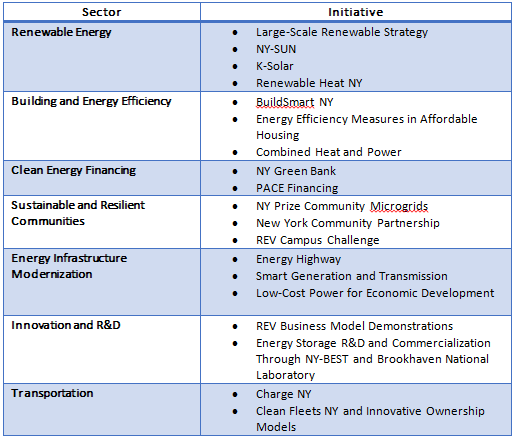

REV specific action initiatives

The 2015 New York State Energy Plan is the REV roadmap which outlines more than 40 initiatives to develop a clean, resilient and affordable energy system. These initiatives have moved from conceptual policy to practical implementation. Figure 3 provides examples of New York initiatives by category.

Figure 3: Examples of New York REV specific action initiatives

Source: New York State Department of Public Service, Feb 2016

While some of these programs (initiatives) stem directly from REV and others were initiated in the lead-up to REV, all of them aim to achieve the REV goals in various sectors across New York’s energy industry. The most successful programs, such as NY Green Bank[25], could be replicated in other states that are also following New York’s footsteps toward energy industry transformation, e.g. California.[26]

Where to from here?

Approximately two and half years after the REV announcement some clean energy companies are experiencing frustration as they wait for this market overhaul. There seems to be less urgency amongst vendors and utilities, where many stakeholders are still involved in various working groups that are part of the process. [27] Stakeholders have expressed some scepticism of the process and are hoping the next steps will provide some positive assurance.

The Chair of the Department of Public Service’s, Audrey Zibelman, continues to focus on the success of the REV with the increased uptake of solar in the State, the nearly $300 million committed by New York’s Green Bank, and numerous efforts with programs, working groups and expanded community –choice aggregation.[28] “We have created a space in New York where innovative companies can work with utilities to build this energy system of the future,” Richard Kauffman, Chair of New York State - Energy & Finance, said at the REV Future 2016.

However, there have been delays in some of REV’s deliverables including: the unlocking of the interconnection queue[29] which is now expected to be unlocked within the first quarter of 2017; and REV Connect[30] which has been created but it is unclear when it will help launch future projects or how quickly those will eventuate.[31]

Zibelman remains confident of the REV’s progress and has said “There are no losers ... All boats are being lifted through this process.”[32] Time will tell if this regulatory reform will actually deliver a cleaner, more resilient and affordable energy system to New Yorkers.

[1] https://www.greentechmedia.com/events/live/new-york-rev-future-2016

[2] New York State Department of Public Service, Reforming the Energy Vision - About the Initiative, 28 January 2016, http://www3.dps.ny.gov/W/PSCWeb.nsf/All/CC4F2EFA3A23551585257DEA007DCFE2?OpenDocument

[3] New York State Department of Public Service, Reforming the Energy Vision - About the Initiative, 28 January 2016.

[4] New York State Department of Public Service, Reforming the Energy Vision - About the Initiative, 28 January 2016.

[5] Ernst and Young, October 2016. https://www.instagram.com/p/BK9Y58IjX-u/

[6] Ibid.

[7] New York State Department of Public Service, Reforming the Energy Vision - About the Initiative, 28 January 2016, http://www3.dps.ny.gov/W/PSCWeb.nsf/All/CC4F2EFA3A23551585257DEA007DCFE2?OpenDocument

[8] Ibid, p 2.

[9] Tweed, K, ‘New York Launches Major Regulatory Reform for Utilities’, Greentech Media, April 28, 2014, http://www.greentechmedia.com/articles/read/new-york-launches-major-regulatory-reform-for-utilities

[10] New York State Department of Public Service, Reforming the Energy Vision, March 2016, p.1.

[11] New York State Department of Public Service, Reforming the Energy Vision - What you need to Know https://www.ny.gov/sites/ny.gov/files/atoms/files/REV42616WHATYOUNEEDTOKNOW.pdf

[12] Ibid, p.5.

[13] New York State Department of Public Service, Staff’s Proposed Guiding Principles for Revised Utility Codes of Conduct, 5 April 2016, p1. phttp://www3.dps.ny.gov/W/PSCWeb.nsf/All/C12C0A18F55877E785257E6F005D533E?OpenDocument

[14] Wood, E, ‘Moody’s on New York REV: Winners, Losers and What’s Next’, Microgrid Knowledge, 21 October 2015, https://microgridknowledge.com/moodys-on-new-york-rev-winners-losers-and-whats-next/

[15] Ibid.

[16] Enerknol Research, ‘New York adopts new revenue model or electric utilities under REV’, 6 June 2016 http://breakingenergy.com/2016/06/06/new-york-adopts-new-revenue-model-for-electric-utilities-under-rev/

[17] Ibid.

[18] New York State Department of Public Service, Staff’s Proposed Guiding Principles for Revised Utility Codes of Conduct, 5 April 2016, p1.

[19] Smart Grid Today, ‘New York to let utilities play in REV DER markets’, 21 September 2016, http://www.smartgridtoday.com/public/New-York-to-let-utilities-play-in-REV-DER-markets.cfm

[20] Ibid.

[21] Ibid.

[22] Enerknol Research, ‘New York adopts new revenue model or electric utilities under REV’, 6 June 2016 http://breakingenergy.com/2016/06/06/new-york-adopts-new-revenue-model-for-electric-utilities-under-rev/

[23] New York State Department of Public Service, Reforming the Energy Vision, March 2016, p.5.

[24] New York State Department of Public Service, Reforming the Energy Vision, March 2016.

[25] NY Green Bank (NYGB) is the largest green bank in the US with $1 billion in capital and a goal of attracting greater private sector financing or clean energy projects. The NYGB will continue to reinvest funds a leverage private capital to build a New York State scalable clean energy future.

[26] Enerkol Research, ‘New York Adopts New Revenue Model For Electric Utilities Under REV’, 6 June 2016.

[27] Tweed, K, ‘The Shine Wears Off New York’s REV as the Hard Work Sets In’, Greentech Media, September 30, 2016, http://www.greentechmedia.com/articles/read/new-york-launches-major-regulatory-reform-for-utilities

[28] Ibid.

[29] Reforms that explicitly call for the streamlining of New York’s current interconnection approval processes to assist with the integration of DERs into system planning and operation.

[30] The platform to connect customers, third-party energy providers and utilities for demonstration projects.

[31] Tweed, K, ‘The Shine Wears off New York’s REV as the Hard Work Sets In’, Greentech Media, September 30 2016.

[32] Ibid.

Related Analysis

The ‘f’ word that’s critical to ensuring a successful global energy transition

You might not be aware but there’s a new ‘f’ word being floated in the energy industry. Ok, maybe it’s not that new, but it is becoming increasingly important as the world transitions to a low emissions energy system. That word is flexibility. The concept of flexibility came up time and time again at the recent International Electricity Summit held in in Sendai, Japan, which considered how the energy transition is being navigated globally. Read more

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Community Power Network Trial: Potential risks and market impact

Australia leads the world in rooftop solar, yet renters, apartment dwellers and low-income households remain excluded from many of the benefits. Ausgrid’s proposed Community Power Network trial seeks to address this gap by installing and operating shared solar and batteries, with returns redistributed to local customers. While the model could broaden access, it also challenges the long-standing separation between monopoly networks and contestable markets, raising questions about precedent, competitive neutrality, cross-subsidies, and the potential for market distortion. We take a look at the trial’s design, its domestic and international precedents, associated risks and considerations, and the broader implications for the energy market.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.