NEG a moderating influence: KPMG

KPMG has released a report - the National Energy Guarantee: pricing and the Australian economy - into the potential impact of the National Energy Guarantee (NEG), ahead of COAG receiving the modelling from the Energy Security Board.

Consistent with the ESB, KPMG Economics anticipates that the NEG and other recent energy reforms (gas, retailer) are likely (KPMG’s emphasis) to assist in moderating wholesale electricity price increases in future.

It believes that the requirement for existing plants to provide three years’ advance notice of closure and the obligation for retailers to contract with dispatchable generation means that volatility in the NEM should be curtailed compared to recent events.

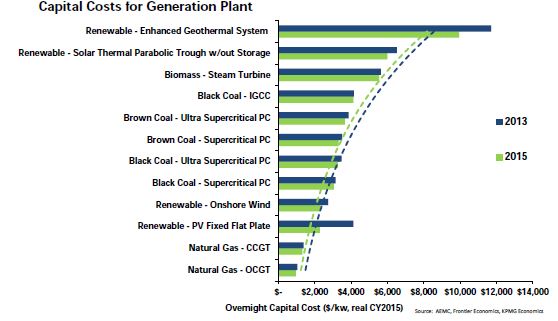

The report points to the NEG placing the onus on the retailer to establish a portfolio of electricity generation, either owned or contracted, that balances cost, emissions and “dispatchability”. It notes that the capital costs per KW of electricity has been declining in real terms and expects the cost curve (shown in Figure 1) will continue to shift inwards for renewable technologies, while recognising that gas will play an important role in firming up renewables.

Figure 1: Cost curve

While it has not undertaken formal modelling, KPMG says that the NEG in conjunction with the other policy measures underway such as the Federal Government’s gas market changes, demand side management and reserve capacity, is expected to put downward pressure on energy costs, compared to business-as-usual.

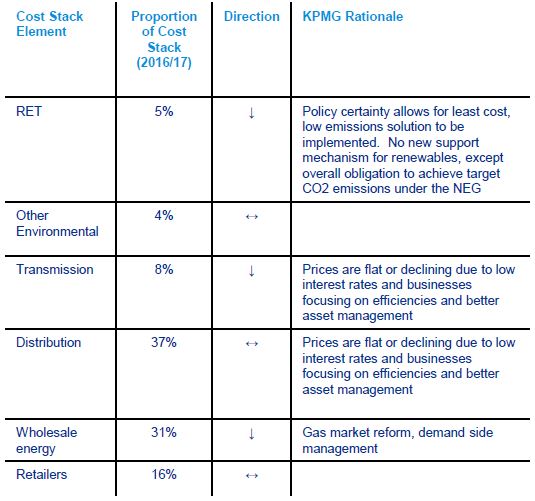

KPMG’s expectations are shown in Table 1 below.

Table 1: KPMG assessment of impact of NEG and other reforms approved by COAG on cost stack

Source: KPMG Economics

It believes the impact of the NEG on wholesale energy prices will depend on the relative strength of two off-setting factors:

- The costs associated with meeting the emission target, given the cost of low emission generation technology is generally higher than higher carbon emitting generation

- An expected decrease in the return on capital associated with investment in generation assets because of policy certainty.

With electricity price changes having the capacity to impact the size and structure of the Australian economy, KPMG has also undertaken simulations of potential repercussions for sectors of the economy if there is a 10 per cent increase in the cost of electricity generation. This is both considered in the short and long term.

KPMG uses its Computable General Equilibrium model (KPMG-CGE) to undertake two simulations - short run and long run – to assess the behaviour of businesses making decisions about investment in fixed capital. The short run is defined as a period in which businesses can’t adjust their stock of fixed capital in response to a shock. In the long-run scenario businesses fully adjust their stock of fixed capital.

In its short-run simulation KPMG reports that all headline macroeconomic aggregates are below levels without a price “shock”. GDP is projected to be around 0.24 per cent below the baseline level, which is equivalent to $4.2 billion per annum in 2017 dollars.

“The increase in domestic costs is particularly negative for the cost-sensitive export sector, which is projected to contract by about 0.31 per cent relative to the baseline. Household consumption is negatively impacted by the direct and indirect impacts of the rise in electricity generation costs,” the report states.

The indirect impact is on the goods and services bought by households as well as a reduction in income because of a fall in aggregate employment which they estimate to be around 26,000 jobs.

Aggregate imports contract by about 0.16 per cent, as slower domestic activity reduces demand for imports, which it considers would outweigh any reduced Australian competitiveness.

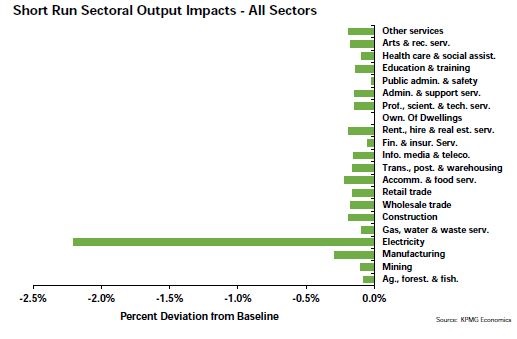

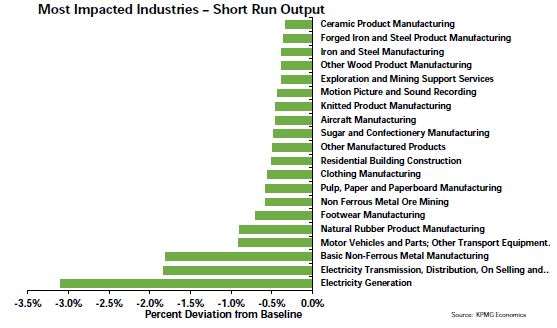

The expected short-run impacts are shown in Figures 2 and 3 below.

Figure 2

Figure 3

Perhaps unsurprisingly, electricity is expected to see the biggest contraction as households and businesses reduce their demand. Figure 3 goes into more detail on the impacts for various sectors and activities.

In the long run…

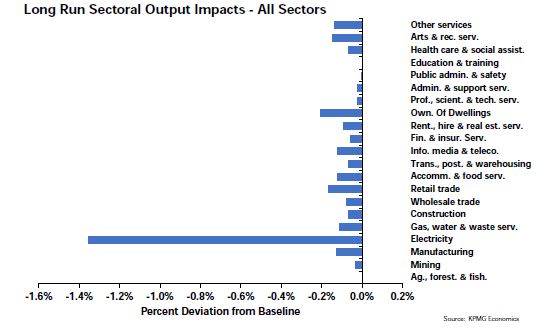

A 10 per cent increase in the cost of generating electricity would also mean negative impacts on the economy in the long run. KPMG projects that most sectors tend to reduce their stocks of fixed capital to restore rates of return to their long run equilibrium values. The overall reduction in GDP in the longer term is smaller compared to the short term impact.

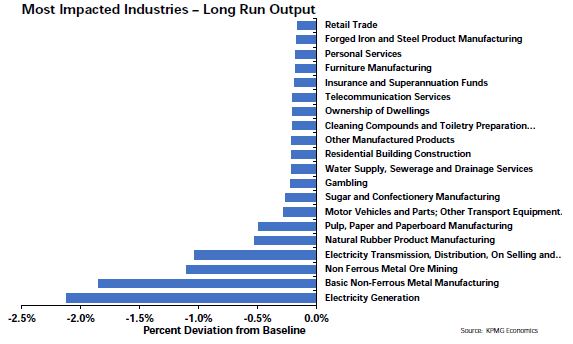

Notable changes in the impacts between the long run and short run projections are:

- Electricity-intensive and import competing footwear manufacturing, clothing manufacturing and knitted product manufacturing sectors are no longer in the 20 most impact sub-sectors

- The basic non ferrous metal manufacturing and the non ferrous metal ore mining sub sectors continue to be significantly adversely impacted. This is largely because they are capital intensive and don’t see as much offsetting benefit from a drop in real wages.

Again electricity generation is shown as the most impacted area as demand reduces. Figure 4 shows the output impacts, while Figure 5 highlights the most impacted sectors.

Figure 4

Figure 5

KPMG concludes its report that given the importance of electricity to economic activity and the structure of the economy: “Careful modelling of any policy response to the current circumstances facing Australia’s energy market is therefore vitally important to manage potential concerns of households and businesses regarding how any change to electricity prices will impact them”.

Related Analysis

Judicial review in environmental law – in the public interest or a public nuisance?

As the Federal Government pursues its productivity agenda, environmental approval processes are under scrutiny. While faster approvals could help, they will remain subject to judicial review. Traditionally, judicial review battles focused on fossil fuel projects, but in recent years it has been used to challenge and delay clean energy developments. This plot twist is complicating efforts to meet 2030 emissions targets and does not look like going away any time soon. Here, we examine the politics of judicial review, its impact on the energy transition, and options for reform.

Climate and energy: What do the next three years hold?

With Labor being returned to Government for a second term, this time with an increased majority, the next three years will represent a litmus test for how Australia is tracking to meet its signature 2030 targets of 43 per cent emissions reduction and 82 per cent renewable generation, and not to mention, the looming 2035 target. With significant obstacles laying ahead, the Government will need to hit the ground running. We take a look at some of the key projections and checkpoints throughout the next term.

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.