Life on the edge: Solving South Australia’s latest electricity experiment

South Australia is a world leading pioneer in the integration of intermittent renewables in a constrained grid. It has now has more than 40 per cent of its generation from wind and solar. It has also experienced two blackouts inside the past year. Last Wednesday’s storms resulted in a state wide outage. As the first independent report emerges from the incident, there is intense focus on what happened and what could have been done, if anything, to reduce the scale of the outage. Energy ministers will be considering the outage on Friday. What should they consider?

What happened in South Australia?

At 4.18pm Australian Eastern Standard Time (AEST) on 28 September a severe storm damaged transmission and distribution electricity assets in South Australia which triggered a sequence of events leading to a state-wide power outage[i] (system black):

- At 4:16pm a fault occurred on Northfield–Harrow 66 kV feeder in the Adelaide metropolitan area network.

- At 4:17pm a two-phase-to-ground fault occurred on the Brinkworth – Templers West 275 kV line which meant that one 275 kV transmission was out of service. This was followed by a fault on the Davenport – Belalie 275 kV line. (No significant change in generation or load was observed at this time).

- At 4:18pm faults on the Davenport – Mt Lock 275 KV transmission line and the Davenport – Belalie 275 kV line resulted in both being out of service. There was a resulting 123 MW reduction in output from North Brown Hill Wind Farm, Bluff Wind Farm, Hallett Wind Farm, and Hallett Hill Wind Farm. Hornsdale wind farm reduced output by 86MW and Snowtown 2 wind farm reduced output by 106 MW.

- The multiple loss of load led to an increase in the flow across the Heywood Interconnector with Victoria which overloaded the link. The automatic-protection mechanism activated, tripping the interconnector, which led to the remaining customer load and all SA electricity generation being lost.

The restoration of electricity supply started in Adelaide at 7:00pm. By midnight on Wednesday 28 September 2016, 80–90 per cent of electricity was restored.

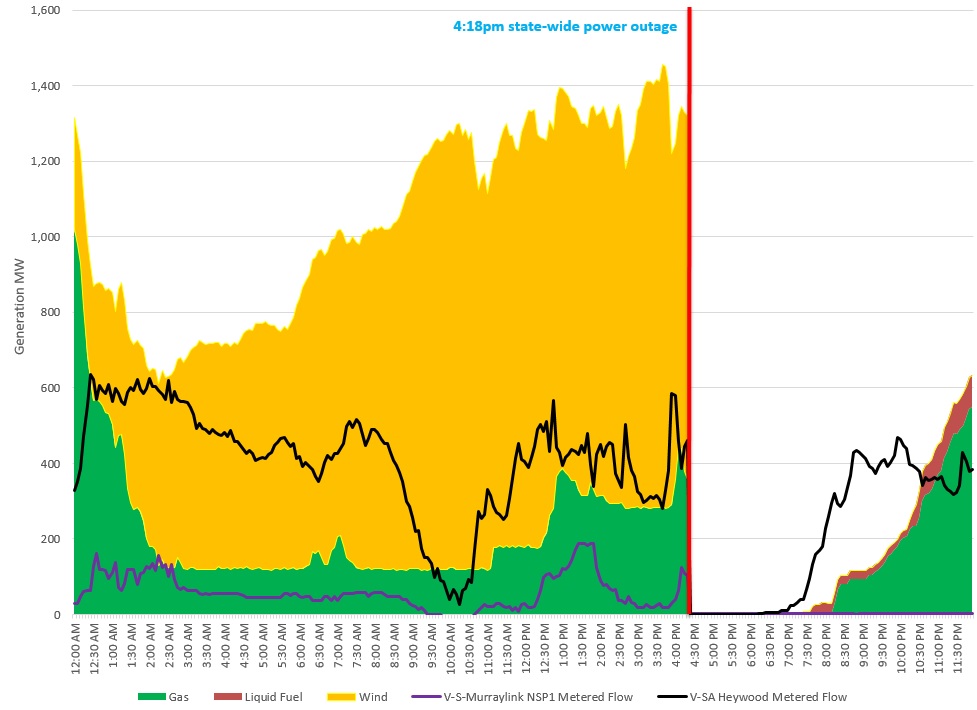

At the time of the power failure, there was approximately 1,900 megawatts (MW) of electricity being consumed. This was being met by 880MW of South Australian wind generation, 330MW of local gas generation and more than 600MW of supply from Victoria via the Heywood interconnector and the Murraylink DC cable. Figure 1 shows the South Australian energy generation and interconnector moments before the blackout.

At the time the transmission lines went out in the mid-north of South Australia, the remaining generation in South Australia was either slow responding thermal base load or wind. Wind generation at scale cannot increase output to meet sudden losses in load. The interconnector to Victoria was already operating near its capacity. The combined lack of responsive capacity of remaining wind, gas and the interconnector meant the sudden load losses could not be covered and the interconnector tripped because of the demands placed on it.

Figure 1: South Australia Generation mix and Interconnector flow[ii]

Source: NEM review, market participant data

What has happened in the past?

System black events are very rare in modern electricity grids. SA’s state-wide loss of power followed a partial blackout in November last year which impacted around 100,000 South Australian homes.

In the past 52 years there have been two state-wide blackouts, including South Australia – the other was NSW in 1964[iii], which was prior to the establishment of the National Electricity Market. This was triggered by an electrical storm. Of course there have been other weather events and natural disasters that have led to widespread or region-wide blackouts, such in northern Queensland in 2011 following Cyclone Yasi.

So what now?

It is critical that we understand and learn from what occurred in South Australia so we can manage the transition to a lower carbon electricity market. There are a range of policy solutions including the way we schedule and dispatch generation in South Australia, to the augmenting of the grid with technologies like extra generation, storage and interconnection. All will provide different benefits and impose additional costs on consumers. Given we are only beginning to diagnose the sequence of events in South Australia, it is unclear which, if any, of these is the most efficient solution.

The leading technology solution being proposed by some stakeholders is the construction of a new interconnector between NSW and South Australia. TransGrid has proposed a single circuit 275Kv link from NSW to SA and has estimated the cost to be $500 million. The NSW Government has flagged the possibility of additional electricity interconnection to ease the stress on energy networks[iv].

South Australia is currently connected to Victoria by two transmission lines which allow it to source a maximum of around 23 per cent of peak load from that state.[v] At the end of FY2015, South Australia imported 16.7 per cent of its electricity from Victoria. Following the closure of the coal-fired Northern Power Station on 9 May 2016 the interconnector is playing an increased role in meeting the state’s power needs.

Interconnectors move energy from one region to another. In the case of a SA-NSW interconnector, it would be a long life asset whose primary role would be to move electrons from firm, high emissions (coal) power stations in NSW to SA. The intent of an additional interconnector would be to provide additional and alternative firm supply in South Australia and provide ancillary services. These benefits should be considered against the potential risks: Specifically a second interconnector could:

- Increase net greenhouse emissions: displace lower emissions gas fired generation in SA with higher emissions coal fired generation;

- Increase energy costs in NSW: NSW consumers will share the cost of the interconnector and could assume an increase in wholesale prices reflecting increased demand via the new interconnector;

- Accelerate early closure of remaining firm “baseload” generation in South Australia: in the absence of a material carbon price, coal fired generation from NSW would compete with and undercut remaining higher cost gas fired generation in South Australia. These gas generators have been made increasingly marginal with the increased deploy of wind generation. Further new competition from cheaper coal fired generators could accelerate their closure, leaving South Australia with even less firm generation which may be needed to manage the grid in an increasing range of scenarios.

- Be exposed to carbon risks arising from the commercial or carbon-based closure of source high emissions generation in NSW: high emissions coal fired generators could come under either commercial or carbon policy pressure to close within the next decade, posing the risk that there may be insufficient surplus electrons in NSW to supply the new interconnector. AEMO is already forecasting declining flows on the existing Heywood interconnector after 2018 in the expectation that some coal fired generation in Victoria will exit the market.

- Face stranding risks well in advance of the asset’s operating lifetime: In the absence of a national climate policy or energy strategy, it is difficult to predict what conditions a new interconnector will be operating under in 10 years’ time, let alone by the end of its working life in the second half of this century.

- Remain exposed to being weather events like last week: a SA-NSW interconnector would likely have been knocked out by the same weather events that occurred on 28 September.

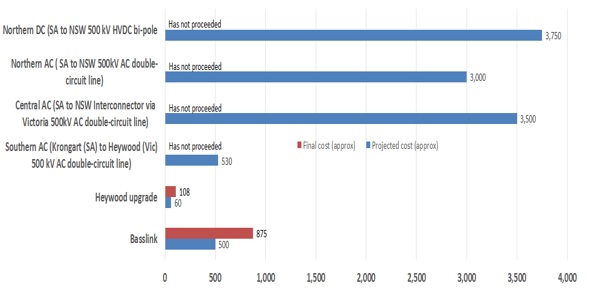

An extra interconnector could cost from $500-3,750 million on recent estimates. Figure 2 illustrates the cost estimates of previously proposed interconnector projects. The cost of interconnectors is relatively high in Australia as the distances are great and the size of the participating markets are small. As a result progress on building interconnectors has been slow over the past decade.

Figure 2: Projected and Final costs for the construction of interconnectors

Source: AEMO 2011, “South Australia – Victoria (Heywood) Interconnector Upgrade RIT-T: Project Specification Consultation Report October”, October 2011 and AEMO, 2011, “ElectraNet-AEMO Joint Feasibility Study South Australian Interconnector Feasibility Study” and AEMO, 2014, ‘The Heywood Interconnector: Overview of the upgrade and current status”, July 2014 and Murraylink Transmission Company Pty Ltd Contingent Project Proposal, May 2012.

Conclusion

The 28 September blackout in South Australia was a significant event which requires careful review and a considered response. Australian governments have form in reacting quickly to blackouts with expensive and inefficient solutions: blackouts in NSW and Queensland in 2004 resulting in big increases in reliability standards or “gold plating” of the networks; blackouts in Western Australia in 2005 resulted in an expensive and inefficient capacity payments system.

South Australia is a world leader in the integration of intermittent generation, and the lessons it learns should influence how we decarbonise the world’s electricity systems. The storms knocked out key transmissions lines in the state’s mid-north which resulted in a sudden loss of generation which could not be covered by remaining generation sources.

More detailed analysis is still to be completed on the blackout. It is likely to inform improved grid management and operational responses and identify what types of infrastructure would augment a high intermittent generation grid.

The preliminary AEMO report provides clarity around the sequence of events that occurred, but also reveals the need for more detailed information to fill in some of the blanks that will help improve system security into the future.

It reinforces that we may need to think differently about the potential effect of extreme weather events, as we operate a more weather-dependent electricity system.

[i] Australian Energy Market Operator (AEMO), 2016, “Preliminary Report – Black System Event in South Australia on 28 September 2016”, << https://www.aemo.com.au/Media-Centre/Media-Statement-South-Australia-Interim-Report >>

[ii] The restart of wind is unlikely to have occurred, according to market participants, because of the difficulty in returning the transmission lines online and has been removed from the chart.

[iii][iii] http://www.abc.net.au/news/2016-09-29/rushing-to-renewables-risks-sector's-reputation:-uhlmann/7888290

[iv] The Australian, 2016, “Minister backs move to connect energy networks”

[v] Energy markets and the implications of renewables – South Australian case study, Deloitte Access Economics, page 3.

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

UK looks to revitalise its offshore wind sector

Last year, the UK’s offshore wind ambitions were setback when its renewable auction – Allocation Round 5 or AR5 – failed to attract any new offshore projects, a first for what had been a successful Contracts for Difference scheme. Now the UK Government has boosted the strike price for its current auction and boosted the overall budget for offshore projects. Will it succeed? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.