Implications of doubling global renewables by 2030: IRENA tries to work it out

The International Renewable Energy Agency (IRENA) released a report on January 17, Renewable Energy Benefits: Measuring the Economics. The report captures and measures the effects of renewable energy deployment on the basis of a holistic macroeconomic framework and the impacts of reaching the 2030 target of doubling the share of renewable energy globally compared to 2010. The focus is on four macroeconomic variables; GDP, employment, welfare and trade. The report is transparent in acknowledging its limitations, yet even with these limitations, some extreme assumptions manage to lead the report to favourable conclusion in regards to doubling of renewable energy by 2030. Three main cases are analysed throughout the report, these are described below:

Reference case: Business-as-usual case that reflects the most up to date official country plans under existing legislations. Where information from Remap is not available, the new policies scenario from the World Energy Outlook (2014) is used.

Remap: The global share of renewables doubles by 2030 compared to 2010, reaching 36 per cent in total final energy consumption. The global doubling does not imply a doubling in each country. Where information from Remap is not available, the IEA 450 scenario is used.

RemapE: The global share of renewables also doubles by 2030, but greater emphasis is placed on electrification of heating and transport, requiring a greater deployment of renewables for power generation. For instance, electric mobility is more widely adopted instead of biofuels for cars. More power generation based on renewables is needed to meet the additional electricity demand, while doubling the renewable energy share.

GDP

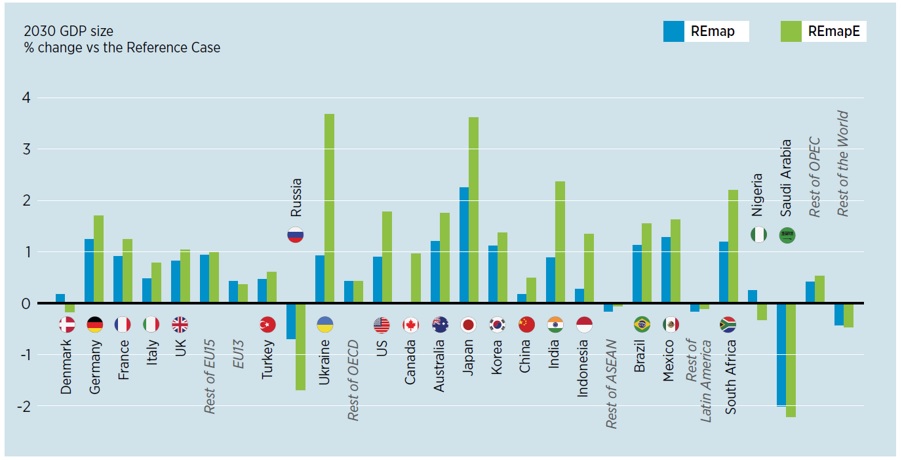

The report show that doubling the share of renewable energy globally by 2030 increases global GDP in 2030 between 0.6 and 1.1 per cent compared to business as usual case, equal to USD 707 billion and USD 1.3 trillion. Figure 1 shows the change in GDP in selected countries.

Figure 1: GDP impacts (2030 GDP size, % change vs the Reference Case)

IRENA claims the key driver to increased GDP growth is increased investment and ripple effects throughout the economy. A key issue missed in this analysis is the effects of disinvestment in the energy industry and closure of power plants due to the increased surplus of generation capacity. An early Spanish study[i] claimed 2.2 jobs were lost for every job created by Spain’s renewables schemes, but the methodology of this study has been broadly criticised as overly simplistic. What it did highlight, however, was that public subsidies will have some crowding out effect of private spending, which will reduce jobs elsewhere in the economy. Even though this example may be one sided, it does show the reverse ripple effect which must be considered. The effects of increased renewables on global fossil fuel trade is discussed in the global fossil fuel trade section below.

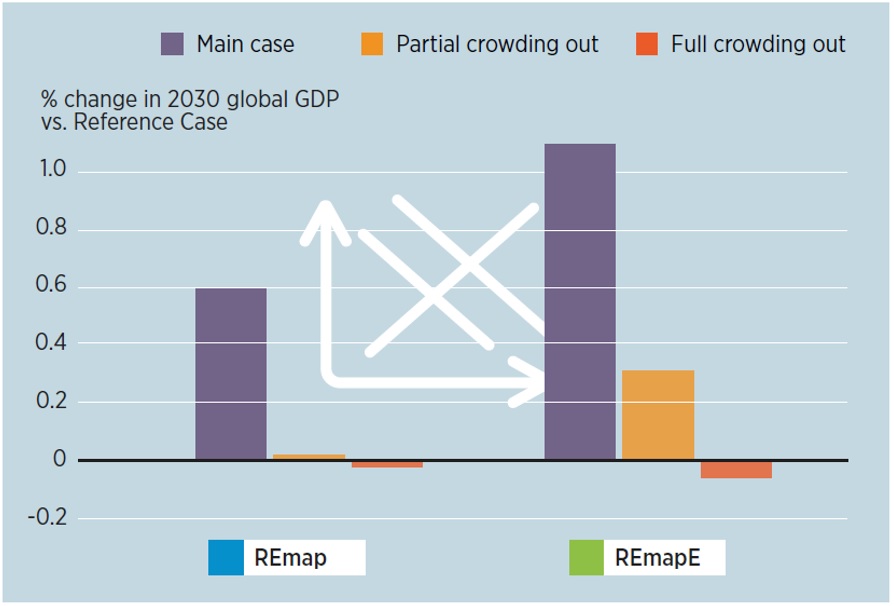

The analysis also assumes no crowding out effect. Electricity generation is a capital intensive industry, where renewables cost a large amount to set up. These costs stem from the cost of land, materials and labour. IRENA recognises that the assumption of no crowding out is problematic and has conducted a sensitivity analysis, where crowding out is set at 50 per cent and 100 per cent. Figure 2 shows the sensitivity analysis.

Figure 2: Impacts of crowding out of capital (2030 GDP size, % change vs the Reference Case)

Under the 100 per cent crowding out scenario, savings in the economy are equal to investment. Lending is taken away from other areas of the economy to fund new renewable projects. This scenario sees GDP decrease as highlighted above.

Jobs

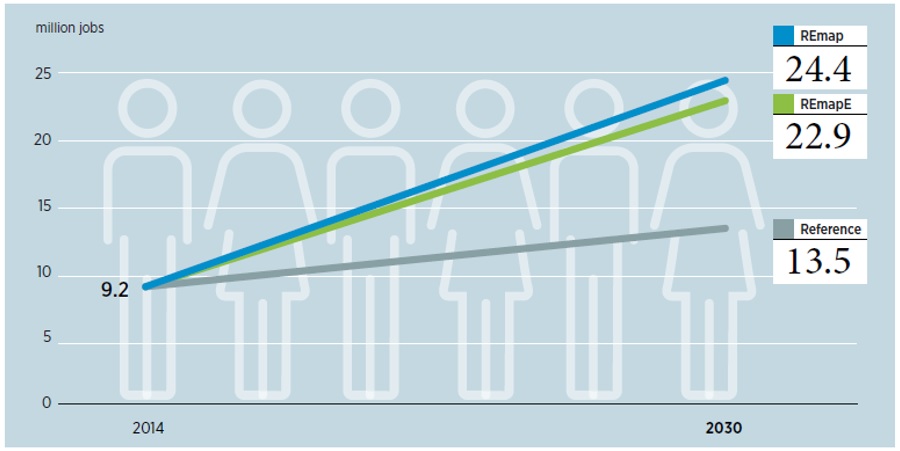

IRENA estimates that doubling renewable energy globally by 2030 will result in an annual growth rate of 6 per cent compared to 2 per cent under the reference case. Figure 3 shows the projections for employment over the outlook period.

Figure 3: Estimated employment in the renewable energy sector (million jobs)

Most of the jobs associated with renewable energy are in the construction and engineering sectors, which are only short term jobs. The long term effects of renewable energy policy on the creation of jobs through policy implementation should focus on how overall employment is impacted and whether any effects persist over the longer term. The net effects of job creation due to renewable energy policies has been analysed previously.

Welfare

The analysis of welfare is split into three categories; economic, social and environmental. The three criteria are then split into sub categories. These sub categories include, but are not limited to; household consumption, economy-wide investment, individual status, self-esteem and health expenditure due to air pollution and the depletion of natural capital through the consumption of raw materials.

Shortcomings in the analysis include the effects of double counting, weighing of sub indicators and the conversion of these indicators to a common unit for aggregation. IRENA concludes that doubling the share of renewables will increase welfare 2.7 to 3.7 per cent.

The complex and difficult nature of aggregating values, which are not correlated and the assignment of weight to these sub indicators should be taken into account when interpreting these results.

Trade

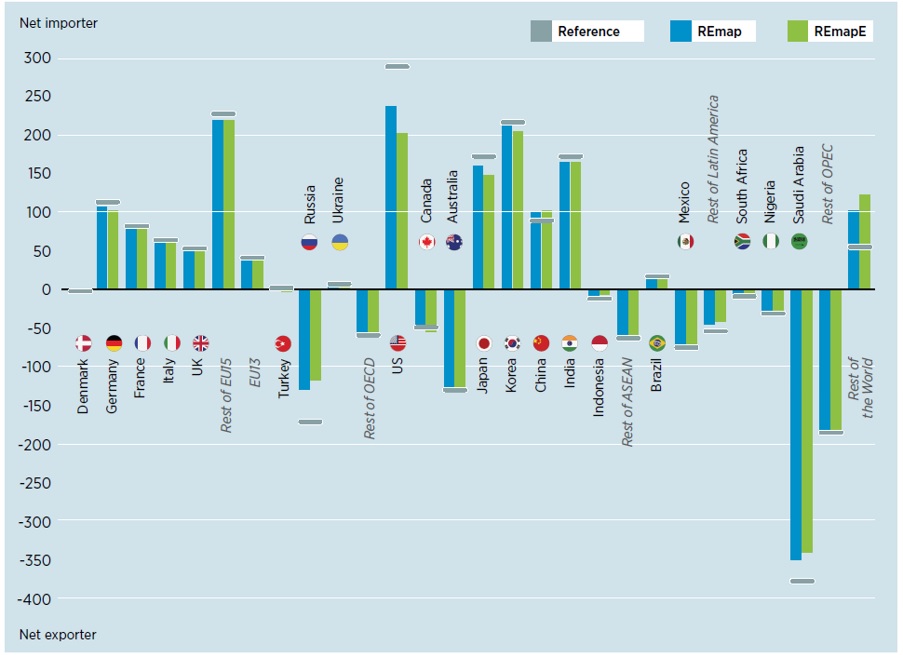

Increased renewable penetration leads to less reliance on fossil fuels. Countries such as Japan, China, India and the EU, spend up to 7% of their GDP on energy imports. IRENA notes that the reduction in net imports for these countries will increase GDP through increased domestic demand for goods and services. On the other side of the equation, countries such as Australia will see the opposite effects where the decreased demand for fossil fuels will decrease GDP due to Australia being a net exporting countries. Figure 4 shows the forecast change in net imports of fossil fuels over the outlook period.

Figure 4: Net imports of fossil fuels in the Reference, REmap and REmapE Cases (USD billion, 2015)

Conclusion

The findings of the report are misleading. The relationship between the variables analysed and the implication of assumptions embedded in the analysis, such as the effects that no crowding out will have on investment, welfare, jobs and international trade will have on the outcome mean that the statistics presented must be used with caution. This is a good starting point, however analysis of this size still has a long way to progress.

[i] Gabriel Calzada Alvarez, PhD, et al, Study of the Effects on Employment of Public Aid to Renewable Energy Sources, King Juan Carlos University, Madrid, March 2009.

Related Analysis

International Energy Summit: The State of the Global Energy Transition

Australian Energy Council CEO Louisa Kinnear and the Energy Networks Australia CEO and Chair, Dom van den Berg and John Cleland recently attended the International Electricity Summit. Held every 18 months, the Summit brings together leaders from across the globe to share updates on energy markets around the world and the opportunities and challenges being faced as the world collectively transitions to net zero. We take a look at what was discussed.

Great British Energy – The UK’s new state-owned energy company

Last week’s UK election saw the Labour Party return to government after 14 years in opposition. Their emphatic win – the largest majority in a quarter of a century - delivered a mandate to implement their party manifesto, including a promise to set up Great British Energy (GB Energy), a publicly-owned and independently-run energy company which aims to deliver cheaper energy bills and cleaner power. So what is GB Energy and how will it work? We take a closer look.

Delivering on the ISP – risks and opportunities for future iterations

AEMO’s Integrated System Plan (ISP) maps an optimal development path (ODP) for generation, storage and network investments to hit the country’s net zero by 2050 target. It is predicated on a range of Federal and state government policy settings and reforms and on a range of scenarios succeeding. As with all modelling exercises, the ISP is based on a range of inputs and assumptions, all of which can, and do, change. AEMO itself has highlighted several risks. We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.