Getting wind and solar onto the grid: IEA points the way

System integration is part of a whole range of challenges that arise in the deployment of intermittent technologies. A recent report by the International Energy Agency (IEA) “Getting Wind and Sun onto the Grid”[i] highlights the challenges of intermittent energy integration, which are likely to emerge around the world and how to solve them. It points to regional concentration of wind and solar generation potentially leading to issues, such as those seen in South Australia for example.

The IEA report highlights the need for the grid to continually change to suit the evolving needs of the power system, as the share of intermittent generation increases and countries keep pace with changes to energy and climate policies, such as renewable energy and emissions reduction targets.

A failure to keep pace with rising intermittent generation is expected to lead to increased costs in the long run, and may threaten the security of the grid, as currently witnessed in South Australia. With Queensland and Victoria setting high state renewable energy targets these risks are also relevant to those states.

The IEA report lists voltage and frequency ranges of operation, frequency control/active power control, voltage control/reactive power control and synthetic inertia as being required by the grid for different phases of intermittent technology deployment.

IEA report

The IEA report[ii] highlights measures on how to maintain cost-effectiveness and reliability of the power system over four phases of intermittent energy deployment. The four phases are differentiated by an increasing role of growing intermittent capacity in power systems. The four phases are as follows:

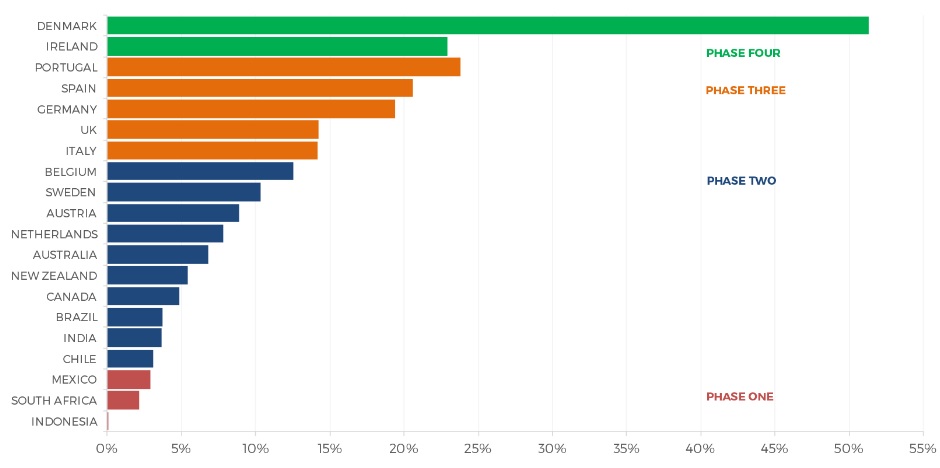

Phase one: Intermittent capacity has no noticeable impact on the system, this phase includes Indonesia, South Africa and Mexico; which have annual intermittent technology shares that reach up to around 3 per cent of annual electricity generation.

Phase two: Intermittent technology’s share of energy ranges from 3 per cent to almost 15 per cent, and countries in this phase are said to be Chile, China, Brazil, India, New Zealand, Australia, the Netherlands, Sweden, Austria and Belgium.

Phase three: With further deployment electricity supply is characterized by significantly higher levels of uncertainty and variability. This requires a more dynamic operation of existing dispatchable power plants, while intermittent energy forecasts become essential for efficient system operation. Where deployment of a large number of smaller variable renewable energy (VRE) plants is concentrated “reverse” flows from the medium and low voltage grid to the transmission level will become increasingly common. Examples of countries considered to be in phase three of intermittent technology deployment include Italy, the United Kingdom, Greece, Spain, Portugal and Germany; the intermittent generation share in these countries ranges from 15 per cent to 25 per cent in annual generation.

Phase four: This is where most challenges emerge, according to the IEA, and here it is possible for the intermittent energy output to cover most or even all power demand in certain situations. New issues emerge which relate to the ability of the power system to maintain stable operating conditions immediately following disturbances to the system. So the resilience in the face of events that might disturb its normal operation on very short timescales (a few seconds and less). Countries that are seeing challenges primarily related to this phase include Ireland and Denmark, with an annual intermittent generation share of around 25 per cent to 50 per cent in annual generation.[iii]

Figure 1 below highlights the difference countries in each phase.

Figure 1: Share of Intermittent generation around the world

Source: International Energy Agency report, “Getting Wind and Sun onto the Grid”, 2017

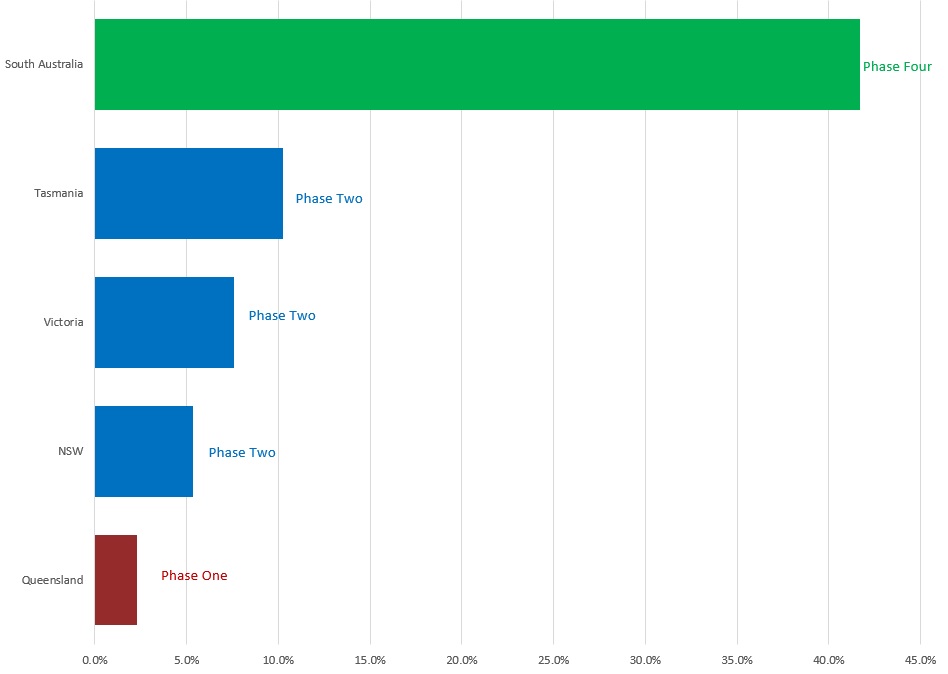

According to the IEA report, unlike other countries around the world, Australia is unique in that certain parts of the country’s large power system are entering a more advanced phase than the rest of the system. Figure 2 highlights where each Australian states sits under the IEA phases.

Figure 2: Share of Intermittent generation across the National Electricity Market (NEM) in 2016

Source: NEM Review program, Global-roam, 2016

How do measures to maintain cost-effectiveness and reliability of the power system differ over four phases of intermittent energy deployment?

In phase one, the challenges are small but the IEA highlights two aspects that are important, these include proper assessment of the impact of those first few intermittent plant on the grid at their point of connection; and secondly having a set of rules in place appropriate to governing their operation. Integration tasks in phase two however are more onerous, although international experiences from the IEA show that they are manageable.

In phase two, although intermittent technologies appear to have a noticeable impact, by upgrading some operational practices they can be managed quite easily according to the IEA. For example, forecasting of intermittent generation output can be done so that flexible power plants can balance their variability, along with that of electricity demand, more efficiently.

Phase three sees the first really significant integration challenges, as the impact of variability is felt both in terms of overall system operation, and by other power plants. Power system flexibility now becomes important. The IEA’s first priority is to make fully available the flexibility[iv] that exists already in the power system, so that it can accommodate the variability of intermittent generation. The way in which conventional power plants operate often represents the easiest flexibility gain.

International experiences throughout the report show that a well-balanced portfolio of wind and solar PV power plant can have complementary electricity output profiles, which may enable the better use of existing grid assets. The report expresses concern for South Australia where the concentration of intermittent generation has led to energy reliability issues rather than the state having a dispersed portfolio which would have provided smoother overall output.

The challenges that emerge in phase four become highly technical and the focus moves to the stability of the power system. The challenges that arise in phase four include the design of renewable energy policy frameworks, measures to kick-start a domestic renewable energy market, and questions around the design of wholesale and retail electricity markets. These challenges however are also very likely to occur in earlier phases.

Efficient grid integration of intermittent technologies will see measures that are appropriate and proportionate to the deployment phase. In some systems these measures can be implemented using existing assets, in others it may be required to invest in additional infrastructure. In both cases, the IEA highlights that a failure to keep pace with rising intermittent generation will lead to greater cost in the long run, and may threaten the security of the power system. Conversely, putting in place excessively high requirements on new generation can also increase costs and/or slow deployment.

What is likely to happen across the NEM?

Although there are other countries and regions that have high renewable penetration, none are as singularly reliant on intermittent renewables (wind and to a lesser extent, solar) as South Australia is. Consumers are currently observing increased unreliability events for a variety of reasons. The inability of the South Australian grid though to respond quickly enough to minimise the impact of large losses of load has been a major problem.

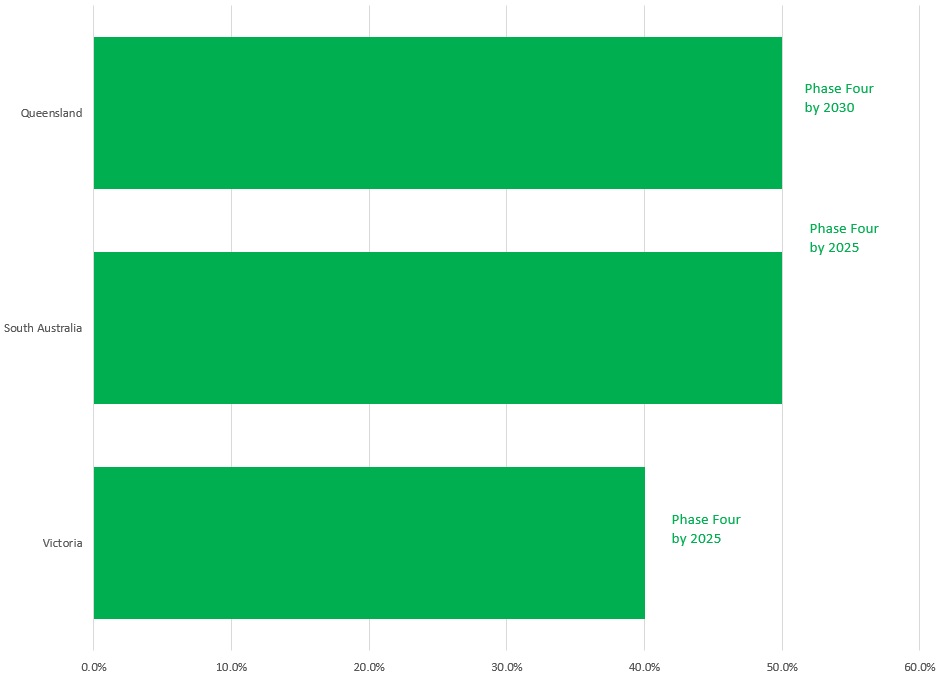

South Australia is likely to be followed by other NEM states in the near future. Queensland and Victoria have set state renewable targets, with wind and solar expected to be the dominant technologies under these schemes[v]. As figure 3 shows this is likely to place most NEM states under phase four, the most critical IEA stage. Tasmania is one state that is unlikely to be impacted as they have a large and flexible portfolio of hydro, so there is less of a driver for achieving high levels of intermittent renewables.

Figure 3: Future share of intermittent generation across QLD, SA and VIC following the state targets

Source: AEC analysis, various sources, 2017

As we have observed over the past year in South Australia, managing a high intermittent generation electricity grid is materially different to the conventional baseload model of the 20th century. The market has been increasingly distorted by a number of policy interventions and poor policy co-ordination.

To try and solve its energy security issues, the South Australian Government has decided to build a 100 MW of battery storage system and a government-owned 250 MW gas-fired power plant.

So what steps do the IEA propose should be taken?

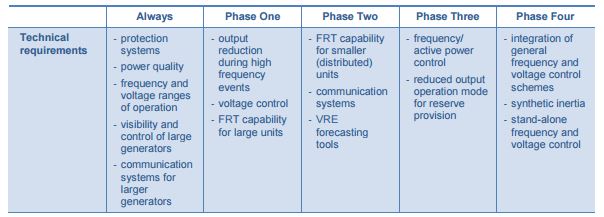

The IEA report lists requirements the intermittent generators depend on for different phases of intermittent energy deployment reached. These requirements are influenced by the instantaneous share of intermittent generation which is categorised according to different phases of intermittent deployment in Table 1.

Table 1: Technical requirements for different phases of intermittent deployment

Source: International Energy Agency “Getting Wind and Sun onto the Grid” report, 2017

The main technical requirements related to intermittent deployment are:

- Protection systems: these are to isolate faults and mitigate the impact of faults on the electrical network.

- Communication systems: these are to allow the system operator to monitor the output of intermittent energy in real time.

- Power quality: the main aspects of power quality include harmonics and flicker, which occur in terms of waveform distortions and short-term fluctuations.

- Voltage and frequency ranges of operation: these are the operating ranges of the power system under different conditions.

- Frequency control/active power control: this is the ability to provide active power regulation, particularly downwards in response to over-frequency (active power, or real power, measured in watts).

- Spinning reserves: these are extra reserves of power that can be made immediately available by power plants that are already connected and operating to correct imbalances that cannot be corrected otherwise.

- VRE resource forecasting: this relates to tools for forecasting the output of intermittent energy over different timeframes to help system operators/planners with scheduling dispatchable power plants and spinning reserves cost-effectively.

- Voltage control/reactive power control: this relates to the ability of intermittent energy to respond to voltage fluctuations at their point of connection.

- Fault ride through (FRT): Intermittent energy may or may not have the capability to remain connected to the network for a certain length of time during voltage disturbances.

- Simulation models: these are models that replicate the physical behaviour of the electric grid, which are used to simulate possible scenarios to facilitate decision-making in power system planning and operation.

- Synthetic inertia: at higher shares of intermittent generation the rate of change of frequency (RoCoF) will increase unless intermittent generators can provide inertia to the system.

In South Australia, the State Government has pointed out that it would be preferable if they could solve energy policy at the national level. This will require a suite of policy measures: a constraint/signal on greenhouse gases, agreement on improved gas access, a revised renewable energy policy as well as upgrades to the way the grid is operated to help avert and prevent future blackouts, whilst still seeking to keep costs down. All points that have been raised by the IEA.

[i] International Energy Agency, 2017, “Getting Wind and Sun onto the Grid: A Manual for Policy Makers”

[ii] ibid

[iii] ibid

[iv] The term flexibility in this context describes the ability of the power system to respond to uncertainty and variability in the supply-demand balance, in the timescale of minutes to hours, for example providing power from other sources when the wind drops.

[v] Department of Environment, Land, Water and Planning, 2016, “Victorian Renewable Energy Auction Scheme - Summary report of stakeholder submissions”

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

International Energy Summit: The State of the Global Energy Transition

Australian Energy Council CEO Louisa Kinnear and the Energy Networks Australia CEO and Chair, Dom van den Berg and John Cleland recently attended the International Electricity Summit. Held every 18 months, the Summit brings together leaders from across the globe to share updates on energy markets around the world and the opportunities and challenges being faced as the world collectively transitions to net zero. We take a look at what was discussed.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.