NEM: Technology and policy shifting the market

The National Electricity Market (NEM) is presently subject to numerous proposals for government interventions. It appears much of the genesis for these interventions is driven by a common view in government and regulators that the market is insufficiently competitive, with vertically and horizontally integrated firms in generation and retailing.

The Australian Energy Council asked respected economist, Rajat Sood, then of Frontier Economics, to contemplate this issue, particularly with a focus on future developments.

What his report found is very significant[i]. The widespread presumptions of imperfect competition derive from a historical paradigm of large generators supplying electricity in one direction to unresponsive consumers. However, profound technological and policy shifts are underway that are radically shifting that paradigm.

In short, the report found that recent and upcoming changes to electricity generation and storage technology, market architecture and supporting infrastructure, like transmission investments, are likely to mitigate medium-term price cycles in the NEM and resolve many of the pressures that provoked market interventions.

The market was designed to balance supply against demand at all times and pricing was largely a signal to change investment in supply rather than to change demand. And because supply sources were lumpy and slow to build, the market would effectively lurch between “feast and famine”. Wholesale prices went through major cycles which was problematic for stakeholder acceptability, even if these outcomes reflected the market operating as designed given the historical industry paradigm. It was inevitable that firms would structure their businesses to better manage these risks, including development of the gentailer model – businesses that have both retail portfolios and generation assets.

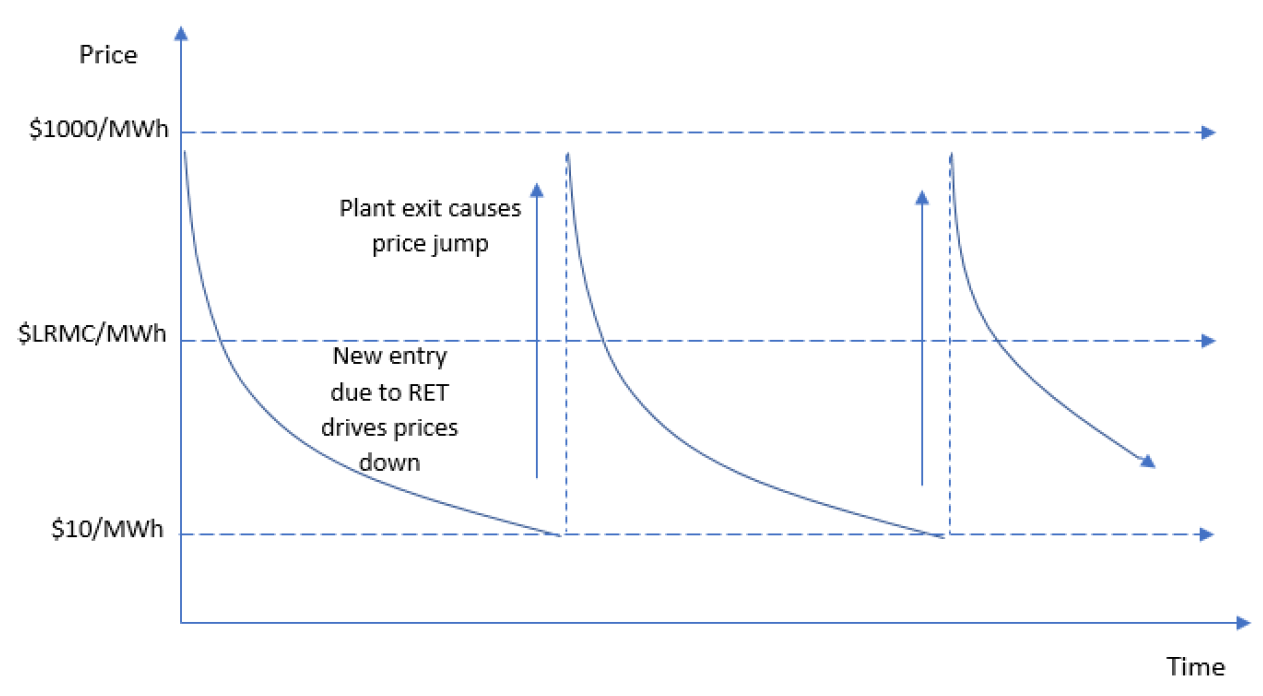

Figure 1: Recent RET-driven price-cycle dynamics

Source: Frontier Economics, 2018

The figure above illustrates this issue in the context of low prices triggering the closures of Northern and Hazelwood power stations. Note the large step changes in wholesale prices when supply changes followed by a long period of high prices and before new supply restarts the cycle. What is overlooked, and what is highlighted by Rajat Sood’s work, is that recent and upcoming changes to electricity generation and storage technology, market architecture and supporting infrastructure are likely to mitigate not only these medium-term price cycles, but also the scope of generators to lead to short-term price spikes. That in turn alleviates much of the push for the kind of interventions that have been put forward and that often lead to unforeseen consequences (which in turn prompt calls for further intervention – a less-than-virtuous circle).

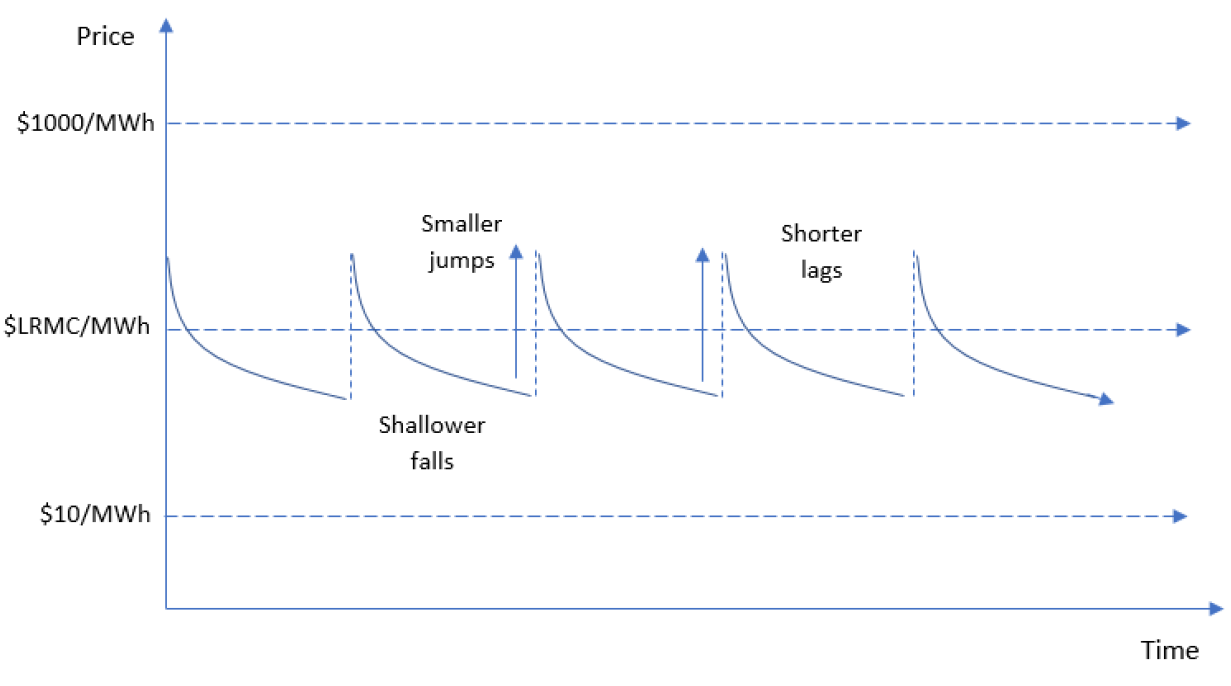

Figure 2: Future RET-driven price cycles in the NEM  Source: Frontier Economics, 2018

Source: Frontier Economics, 2018

Figure 2 illustrates the smaller steps that would be expected in the market of the future and the quicker recovery to a level of equilibrium and reasonable prices. This is cause for some optimism about future stakeholder acceptability.

The report notes that the types of changes that are forthcoming or likely to occur over the next few years include:

- The availability of renewable plant in much smaller increments, reflecting much smaller scale efficiencies than traditional generators, and the much shorter lead times for commissioning such plant. These developments will make it easier for small non-vertically-integrated retailers and business customers to sponsor the entry of new plant.

- Substantial reductions in the costs of utility-scale solar thermal plant and battery storage, in particular.

- More transmission investment across the NEM to reduce network constraints and facilitate the movement of power from ‘renewable energy zones’ to demand centres.

- Detailed changes to the operation of the NEM to change bidding incentives and promote dispatchable demand response from smaller customers.

- A new obligation on generators to notify the market of their intention to exit three years in advance of closure.

- Smarter metering and energy management systems combined with further increases in rooftop PV and distributed batteries to increase the real-time ability of demand to respond to high wholesale prices.

- The possibility of a liquefied natural gas (LNG) import terminal in the southern part of the NEM (there are currently three proposals for import terminals) helping to diversify fuel supplies and increase competition.

This combination of technological, economic and policy-driven changes is likely to have a very significant effect on participant short and longer-term decision-making and on medium-term price cycles.

These kinds of developments, according to the report, are likely to offer these major benefits from the perspective of policy-makers and regulators:

- They should help smooth wholesale price volatility in both the short term and in the medium to longer term;

- They should reduce the advantages of the vertically-integrated ‘gentailer’ business model; and

- They should encourage more competition in the NEM wholesale market.

When contemplating interventions, policy makers should be considering their application to the industry of the future, rather than that of the past.

[i] NEM structure in light of technology and policy changes, Report for the Australian Energy Council prepared by Rajat Sood, Frontier Economics, 13 December 2018

Related Analysis

A New Year: New regulated offer; new records but some old challenges

A new year has brought major developments across Australia’s energy markets, with new regulatory interventions alongside record-breaking renewable generation. The Federal Government’s Solar Sharer Offer marks a significant shift in retail market design, while the wholesale market delivered historic renewable output and much lower prices, driven largely by strong wind and growing battery capacity. We take a look at what these changes mean for customers, retailers and the reliability of the power system, and where old challenges continue to resurface.

2025 Another Year Full of Energy (Developments)

2025 has been another year in which energy-related issues have been front and centre. It ended with a flurry of announcements and releases, including a new Solar Sharer tariff proposed by the Federal Government and the release of the 2026 Integrated System Plan (ISP) draft. Below we highlight some of the more notable developments over the past 12 months.

Getting it right: How to make the “Solar Sharer” work for everyone

On paper, the government’s proposed "Solar Sharer Offer" (SSO) sounds like the kind of policy win that everyone should cheer for. The pitch is delightful: Australia has too much solar power in the middle of the day; the grid is literally overflowing with sunshine: let’s give households free energy during 11am and 2pm. But as the economist Milton Friedman famously warned, "There is no such thing as a free lunch." Here is a no-nonsense guide to making the SSO work.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.