Fork in the policy road: How do we map the way?

In the run up to the release of the much anticipated Finkel Review there has been new reports released that point to what they see as the key ailments with the energy sector, as well as potential remedies or directions that could be taken.

The most recent report themes tell a tale, ‘Wrestling with the electricity market transformation’ and ‘Powering through: how to restore confidence in the National Electricity Market’.

These reports – from legal firm Gilbert + Tobin (G+T) and the Grattan Institute respectively – do have a common thread: increased politicisation of energy with government interventions and uncoordinated responses leading to less than ideal outcomes. So how do they view the state of the current market and what do they see as potential responses?

Too Late To Stop?

G+T warns that it may be too late to hope for “coherent national energy policy”, while the Grattan Institute warns that politicians have responded to perceived failings by announcing a series of uncoordinated and potentially expensive government interventions in the electricity sector. It comments that “the political blame game over blackouts and security of supply is an unhelpful distraction at best. At worst, the risk is that government make ‘knee-jerk’ policy decisions at great cost to the community”.[i]

Grattan points to the fact that the recent government announcements – SA’s energy plan, the Federal Government’s so-called Snowy Hydro 2.0, the political deal with Nick Xenaphon which included funding for a potential solar thermal power station in SA and the feasibility study into expansion of the Tasmanian hydro scheme – appear to involve significant government investment in generation. “These announcements are worrying because they may commit governments to investments prior to cost-benefit analysis. And if investments go ahead, they have the potential to undermine private investment in generation and could weaken the NEM and lead towards regulation and central government planning and control”.

G+T believes that energy politics are here to stay and likely to drive policy. A consequence of this politicisation is the dismantling of “any coherent and integrated approach towards a national energy policy” – a trend that is described as “deeply regrettable”.

“Competitive Federalism”

With the loss of an integrated national approach, some form of hybrid model looks likely to emerge with the result being a single market supplemented by state initiatives.

They anticipate that a form of “competitive federalism” could emerge with parallels to the US. “We see Australia following the US approach away from a coherent national policy and towards ‘competitive federalism’ – frustrating the purpose of the Finkel Review”.

There is a serious note of caution about heading this way, because while they point out it might have some benefits, overall without a coordinated and integrated approach, “we will quickly fall behind our global peers”.

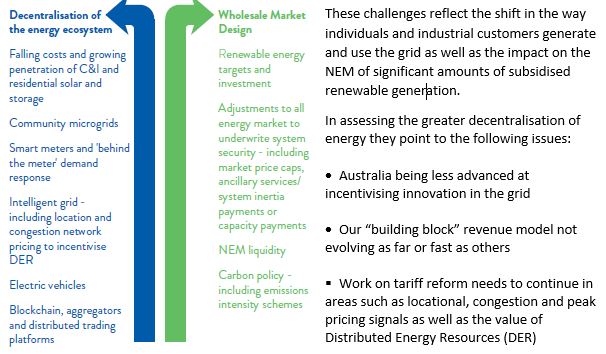

G&T point to two distinct, but related policy challenges, which are shown in Figure 1

Figure 1: Two distinct policy challenges

Source: Gilbert + Tobin, 2017

- Without urgent work Australia will be held back by slow smart meter rollouts, incomplete retail contestability and the absence of incentives or any kind of policy for electric vehicles

- Less developed C&I storage solutions

- The Australian Energy Regulator has taken a more rigid approach to participation and investment by network owners in DER.

For wholesale markets G+T’s analysis points to:

- renewed debate on capacity payments of some kind being inevitable. “If politics will not allow an all-energy market to work”, contestable capacity payments are a better option than direct government investment in generation which simply pushes private capital out of the market.

- Better management of the transition from Australia’s current generation portfolio would be facilitated by an emission intensity scheme (EIS), which is efficient and could maintain energy security.

The Grattan Institute argues that there are a few tweaks that could be made to avoid the NEM falling further into chaos and that short-term reforms would give the market a chance to respond and buy time for policy makers to develop and implement the best long-term solutions.

Grattan says that policy makers need to address immediate concerns – urgent action is needed to stabilise a physical system with increasing levels of intermittent wind and solar.

Its report points to the need for the Australian Energy Market Commission (AEMC) and AEMO to ensure that all supply and demand options are in place to manage system security and potential shortages next summer.

More broadly, governments need to address long-term capacity risks by rebuilding investor confidence in the NEM. It indicates that that investor confidence will depend on a credible emissions reduction policy that works with the electricity market. “The cheapest (and least-distorting) policy is an explicit carbon price – either set by government through a tax or, better still, set by the market through an emissions trading scheme (cap-and-trade or an emissions intensity scheme).”

Ideally, this would be driven by the Federal and state governments agreeing to a national approach, but “if the federal government does not lead this effort, a second-best solution would be for the states to agree on a coordinated approach”.

Overall it paints these possible scenarios for the NEM:

- The market could work with clear policy direction and some adaptive steps to support the transition;

- The market could fail to deliver new investment and divestment without a fundamental restructure to alternative market structures; or

- Governments could just give up on the market and choose to take matters into their own hands.

Grattan closes its assessment of the energy sector by stating that Australia has arrived at a fork in the road, “The decisions we make in 2017 may effectively be choices between the ongoing primacy of markets, or central planning and regulation”.

[i] Grattan Institute, Powering through – How to restore confidence in the National Electricity Market

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.