EV development: Will it stall or accelerate?

Energy Minister Josh Frydenberg recently stated that electric vehicles (EV) would revolutionise Australia, which promptly incited debate about whether the government should support the development of EVs or incentivise their purchase[i].

EVs have the potential to deliver a range of benefits to the economy, environment and consumer. And advances in technology have created a new breed of vehicle that could surpass petrol-driven cars on safety, running costs, performance and design – but where do EV developments currently stand?

Meeting mass market demands

The EV market is small, making it hard for manufacturers to achieve economies of scale. And building cars quickly has proven challenging. A market leader Telsa, for example, has fallen behind on its mass market production of the highly anticipated Tesla Model 3[ii]. Launched in July last year, by August the entry-level car had reached 455,000 pre-orders.

The Model 3 is Telsa’s first mass-market vehicle, and while some questioned if Tesla could get the cheaper model off the ground to meet demand, the company’s downfall actually came from its strongest product offering to date – building the batteries. The demand for batteries, and the raw materials that go into them, is also exercising the planning of major car manufacturers like BMW[iii] and the Volkswagen Group[iv] which have sought to lock in supplies. We have previously written about the challenges emerging from relatively limited global supplies of cobalt for batteries.

In the Model 3’s case, Tesla required an unprecedented number of battery packs to build 500,000 Model 3s, so it sped-up battery assembly and automated a large amount of the production process. This lead to bottlenecks and delays in the battery production line – which was described as “production hell” by Elon Musk himself[v].

In the fourth quarter of 2017, only 1550 Model 3’s had made it off the production line[vi]. Musk had previously predicted that by December 2017, Model 3 production would reach 5,000 cars a week, but at the start of 2018, this goal was pushed back to mid-2018[vii]. According to the Tesla website, deliveries for Model 3 reservations placed today will commence in late 2018[viii].

So where do we currently stand?

Australia’s combined sales of electric and hybrid cars fell during 2017, with EV sales representing just 0.1 per cent of all new vehicle sales. States are developing more charging infrastructure with WA and Queensland creating “electric highways” (map here).

In a report released last year, Accelerating EV Adoption without Breaking the Bank, analysts at Energeia looked at the EV market in both Australia and California. It identified three key issues that are currently holding back the uptake of EVs:

1. Offer models that customers want

Energeia’s analysis shows that customers are ultimately drawn to car models that are already popular within the market.

In a recent op-ed, Dr Alan Finkel stated that Australia’s bestselling light vehicle is the Toyota Corolla. He points out that the 2017 petrol sedan has emissions of 178 grams per kilometre while the much larger Tesla Model S75 RP has lower emissions, at 168 grams per kilometre, charged on the 2017 national electricity grid (910 kg/MWh emissions).

Yet Energeia’s report highlights that the EV models currently offered in the Australia market are not high-selling vehicle lines, which could be a contributing factor to slow uptake.

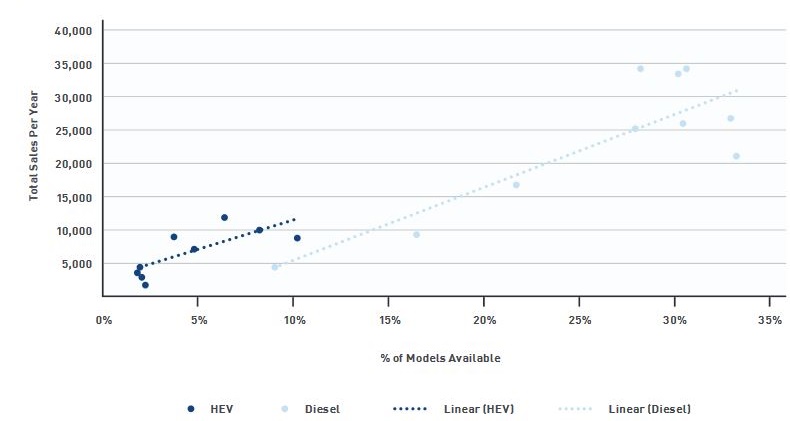

Energeia looks at the uptake of diesel in the 1990s (and later hybrid electric vehicles), which showed that customers were inclined to make “more economically rational investment decisions where diesel was offered in the model that they liked to drive in the first place.”[ix] Shown in figure 1, the report estimates that vehicle availability is a key driver in customer uptake.

Figure 1: Relationship between EV uptake and model availability

Source: Energeia, Accelerating EV Adoption without Breaking the Bank

Source: Energeia, Accelerating EV Adoption without Breaking the Bank

Energeia states that if Australia’s highest selling vehicles were offered as battery electric or plug-in hybrid electric vehicles, there would be a three-fold annual increase in EV sales compared to current incentive levels.

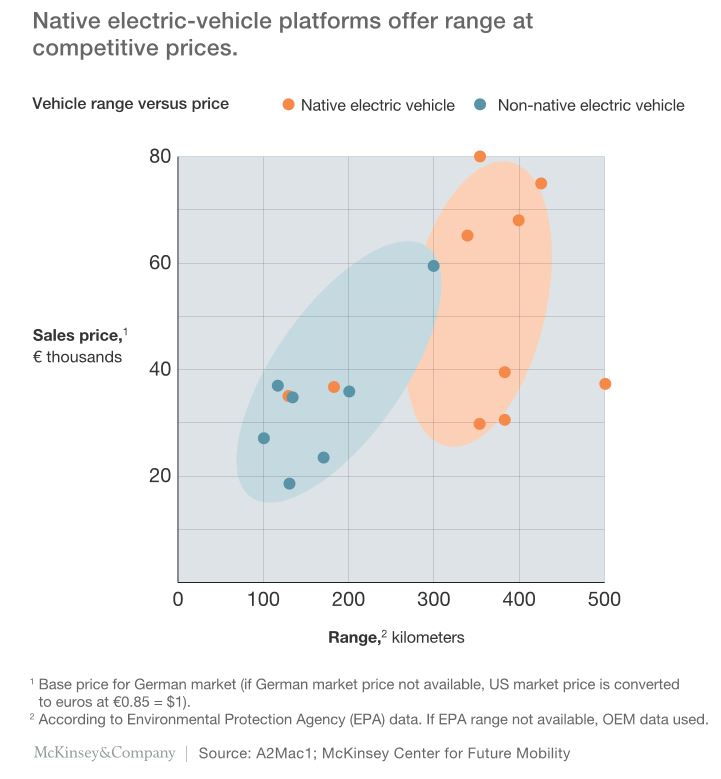

While Energeia argues that better take up will occur if known models are built as EVs, McKinsey & Company in a paper on trends in EV design postulates that cars developed from scratch are better (in terms of range and interior room, for example) rather than modified versions of existing internal combustion engine (ICE) models made on existing production lines[x].

McKinsey’s benchmarking showed “a clear gap in driving range and interior space between models with native EV platforms and those based on ICE. Native EVs optimize battery packaging; non-native EVs force the battery into the awkward footprint of the ICE platform, which limits the realised energy capacity”[xi]. The native EV can increase range without pushing up price (Figure 2).

Figure 2: Native EV platforms Vs Existing platforms

2. Orchestrated managed charging

Energeia’s report anticipates that as each new model increases its driving range, EVs will grow to become the single largest load in a residential premise[xii]. It suggests that extending each model’s driving range will not see EVs driven for longer distances, but instead drivers will charge less frequently and there will be an increasing demand for higher charging rates.

Energeia estimates that mid-size battery electric vehicles will reach a driving range of 400 miles (644 kms) and charge rates comparable to 7.2 kW within three to five years.

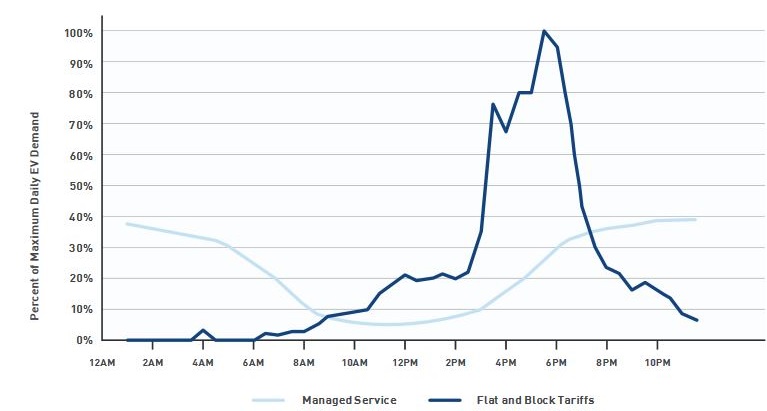

Energeia’s modelling of charging patterns (figure 3) shows that electricity tariffs could lead to an increase in peak demand.

Figure 3: Aggregated EV Charging Profiles at Distribution Network Level

Source: Energeia, Accelerating EV Adoption without Breaking the Bank

Source: Energeia, Accelerating EV Adoption without Breaking the Bank

Customers on a flat tariff recharge based on convenience, usually when they arrive at work (9am) or when they return home (6pm), resulting in a spike around these times. While time-of-use customers recharge their vehicle during off-peak periods, creating an overnight peak because all drivers recharge their vehicle at the same time.

The modelling predicts that EV driven peak demand is expected to begin by 2020. A solution, according to the report, is “orchestrated managed charging.” In the US there have been a small number of pilot programs experimenting with different technologies to determine the best approach to managed charging. With varying levels of success, some include[xiii]:

- San Diego Gas & Electric phone app pilot, where EV drivers can save money by setting vehicle charging times to low-priced hours of the day.

- Southern California Edison used a workplace charging pilot to learn about driver responsiveness to pricing. It included a high price option allowing users to have no charging disruption; a medium price allowing for a slower Level 1 charging rate; and a low price where drivers were entirely curtailed during a demand event.

- A Pepco pilot program reduced chargers from a Level 2 to a Level 1 for an hour during a demand response event and provided opt-out capabilities for customers.

3. Places to charge

The report found that the current thinking around charging infrastructure (i.e. Enable EVs to be used for any type of trip distance; encourage charging during excess solar supply; and, enable people without a garage to own an EV) could lead to under-utilisation, inefficient investment, and avoidable increases in electricity distribution costs.

It suggests that[xiv]:

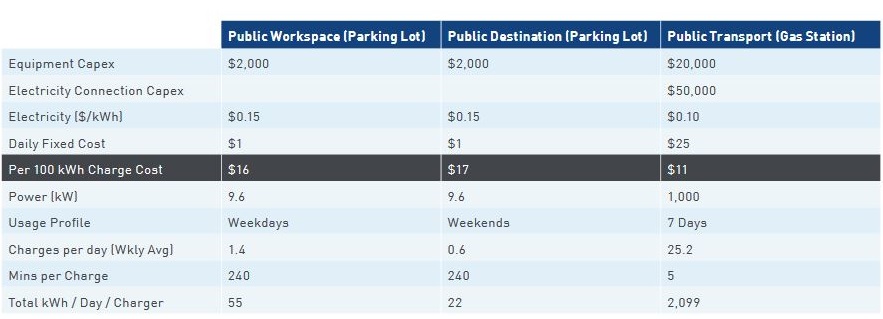

- Charging needs changing rapidly, increasingly focused on recharging speed: Energeia suggest range extension of EVs should only be applied to a small number of drivers who make long haul trips. The report references this figure to be only 1.5 per cent of daily trips in the US. Instead the report expects 1MW public charges at 5-minute gas refuelling times (figure 4).

- Low utilisation and peak demand impacts could be a challenge for workplace charging: Energeia’s modelling estimates that “un-orchestrated workplace charging” may increase high-voltage network costs, unless an offsetting amount of solar PV is connected on the same feeder. It also points out that workplace recharging is limited to work hours, which could result in low levels of use and, as a result, higher per charge costs.

- High costs to guarantee charging for those without a private charger: Drivers without a private charger need to feel confident that they can use a charging spot, however establishing an adequate number of charging stations, in the right locations, will involve a large amount of investment and the charges are likely to be under-utilised.

To identify a possible solution, the report looks to California to illustrate that gas stations may have already solved refuelling obstacles. The future of EV charging stations could be based on the current “gas station refuelling model”. The model solves the problem of recharging convenience – via an already familiar and easy to accept method for the driver – while also resolving some of the development and cost issues associated with “destination charging” (Figure 4).

According to the report, “the sooner high powered public EV charges are collocated at gas stations across California, the sooner we will see drivers without a dedicated parking space transitioning to electrified transportation options, and a viable charging business model.”

Figure 4: Comparing High Power Petrol Station to Low Power Based Public Charging

Source: Energeia, Accelerating EV Adoption without Breaking the Bank

Source: Energeia, Accelerating EV Adoption without Breaking the Bank

An esaa report looked at the key demographic and geographic trends common among early Californian adopters of EVs. These included distance from the CBD, availability of off street parking and households with two or more cars. Applying these metrics to Australian capital cities, a typical sample of the most highly suited EV suburbs in each capital city is shown in figure 5.

Figure 5: Most highly suited EV suburbs

Source: esaa, Sparking an Electric Vehicle debate in Australia, 2013

Future predictions

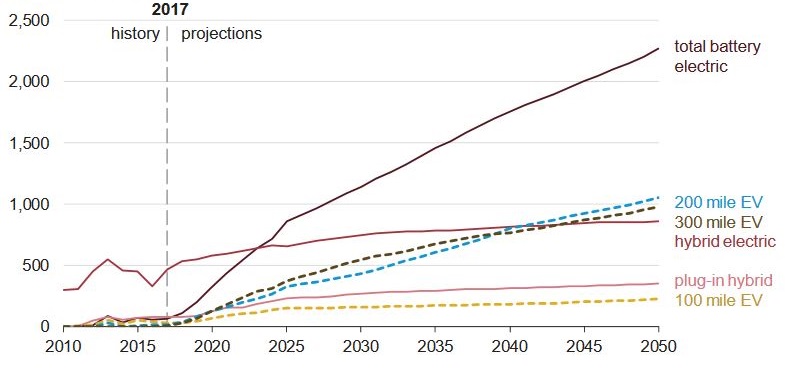

Tesla produced just over 100,000 vehicles in 2017[xv] and despite production bottlenecks and delays, the company is still aiming to produce 1 million cars per year by 2020 (for context, Toyota has produced more than 10 million vehicles per year since 2012). According to the US Energy Information Administration (EIA), there is growing demand to support this ambitious goal (Figure 6).

Figure 6: New vehicle sales of battery powered vehicles, thousands of vehicles

Source: EIA, Annual Energy Outlook 2018

Source: EIA, Annual Energy Outlook 2018

The EIA estimates that battery-electric vehicle sales will increase from less than 1 per cent of total US vehicle sales in 2017 to 12 per cent in 2050. While plug-in hybrid electric vehicle sales will have a slight increase from less than 1 per cent in 2017 to 2 per cent in 2050[xvi].

These increases are helped by California’s Zero-Emission Vehicle regulation that requires a minimum percentage of car and truck sales to be electric and plug-in hybrid electric vehicles in California and nine other states. The regulation will come into full effect in 2025 - the same time the sales of these vehicles is expected to reach 1.1 million[xvii].

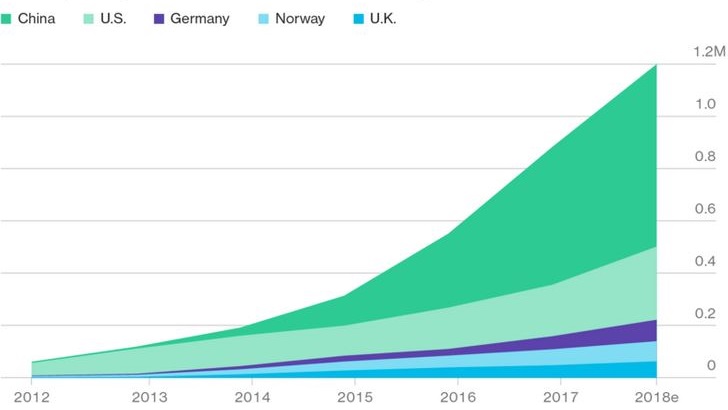

Outside the US, governments around the world have introduced measures to accelerate the demand of EVs. The EV sales-surge has also been driven by China, where the government is focussed on increasing sales through incentives (figure 7). It is estimated that 700,000 EVs were sold in China last year, with the China-built BAIC EC180 being the world’s top selling EV.

France and the UK will ban sales of new petrol and diesel cars by 2040. The Netherlands, where almost half of all new car sales are already electric or hybrid, is aiming for all new cars sold by 2030 to be emissions-free.

Germany has had disappointing sales since 2016, when the government first offered EV subsidies and plug-in hybrid rebates. EV sales are expected to increase in 2018, due to the increased number of charging stations on highways[xviii]. There is also a 300 million-euro budget for built-out charging infrastructure.

Carmakers are also coming on board. Volkswagen, BMW, Ford and Daimler have come together to invest in construction of a fast-charging network along Europe’s highways - 100 stations by the end of this year are planned, before quadrupling the total by the end of the decade[xix].

Figure 7: Electric car sales

Source: Bloomberg

Car manufacturing is scale-intensive, and while the small EV market makes it harder for manufacturers to be cost-competitive, it is still developing. In 2017, many carmakers announced plans to bring electric versions of their vehicles to market in the next few years. Dominant sellers within the Australian market, Toyota and Mazda, pledged to build a US $1.6 billion electric and hybrid vehicle plant by 2021. The companies also announced that they are aligning with manufacturer Senso to develop basic EV technology with plans to expand beyond the Toyota Prius. While Ford vowed to contribute $4.5 billion over five years on new all-electric and hybrid vehicles, with 13 new models expected for release by 2023.[xx]

[i] The Saturday Age, The electric car is the future: Finkel, 10 Feb 2018

[ii] Economist, The impact investor, 10 Feb 2018

[iii] Electrek, BMW is trying to secure a 10-year supply, 12 Feb 2018

[iv] The Guardian, Carmakers’ electric dreams depend on supplies of rare minerals, 30 Jul 2018

[v] Business Insider, Why Tesla's Model 3 production problems are troubling, 3 Nov 2017

[vi] https://www.cnbc.com/2018/01/03/tesla-q4-2017-production-and-delivery-numbers.html

[vii] Business Insider, Elon Musk Tesla Model 3 Production Problems, 8 Feb 2018

[viii] Tesla, Model 3, https://www.tesla.com/model3

[ix] Energeia, Accelerating EV Adoption Without Breaking the Bank

[x] McKinsey&Company, Trends in electric vehicle design, Oct 2017

[xi] Ibid

[xii] Energeia, Accelerating EV Adoption Without Breaking the Bank

[xiii] Utilities and Electric Vehicles, The Case for Managed Charging, April 2017

[xiv] Energeia, Accelerating EV Adoption Without Breaking the Bank

[xv] Business Insider, Elon Musk Tesla Model 3 Production Problems, 8 Feb 2018

[xvi] US Energy Information Administration, Annual Energy Outlook 2018

[xvii] US Energy Information Administration, Annual Energy Outlook 2018

[xviii] Blomberg, Telsas are finally replacing porches on the autobahn, 13 Feb 2018

[xix] Blomberg, Telsas are finally replacing porches on the autobahn, 13 Feb 2018

[xx] Mashable, Here's how every major automaker plans to go electric, 4 Oct 2017

Related Analysis

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Community Power Network Trial: Potential risks and market impact

Australia leads the world in rooftop solar, yet renters, apartment dwellers and low-income households remain excluded from many of the benefits. Ausgrid’s proposed Community Power Network trial seeks to address this gap by installing and operating shared solar and batteries, with returns redistributed to local customers. While the model could broaden access, it also challenges the long-standing separation between monopoly networks and contestable markets, raising questions about precedent, competitive neutrality, cross-subsidies, and the potential for market distortion. We take a look at the trial’s design, its domestic and international precedents, associated risks and considerations, and the broader implications for the energy market.

Competition a key to VPP development: ACCC report

The Australian Competition and Consumer Commission’s most recent report on the electricity market provides good insights into the extent of emerging energy services such as virtual power plants (VPPs), electric vehicle tariffs and behavioural demand response programs. As highlighted by the focus in the ACCC’s report, retailers are actively engaging in innovation and new energy services, such as VPPs. Here we look at what the report found in relation to the emergence of VPPs, which are expected to play an important and growing role in the grid as more homes install solar with battery storage, the benefits that can accrue to customers, as well as potential areas for considerations to support this emerging new market.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.