(Energy in a time of COVID-19) Do we need a reliability hair trigger?

On Friday 20 March the COAG Energy Council met and considered reliability and security in the National Electricity Market (NEM). Were its conclusions well-founded, or did the teleconference result in it being divorced from the realities of the energy market and the consumers who are at its mercy? We take a look.

Discussion

The 22nd Energy Council meeting, held on 22 November 2019, was a straightforward affair, with the Energy Security Board (ESB) being asked to investigate reliability and security, and the Australian Energy Market Commission’s (AEMC), Coordination of Generation and Transmission Investment (COGATI) review. In addition, the ESB was asked to look at short-term actions to progress Renewable Energy Zones (REZs), and actions to progress the Integrated System Plan (ISP).

Four months later and the world has changed significantly, with COVID-19 causing global havoc, and certain to send Australia into a recession. The last time Australia faced such challenging economic conditions was 2009, as a result of the Global Financial Crisis, and economists are unanimous that the impact of this downturn will be more severe[i].

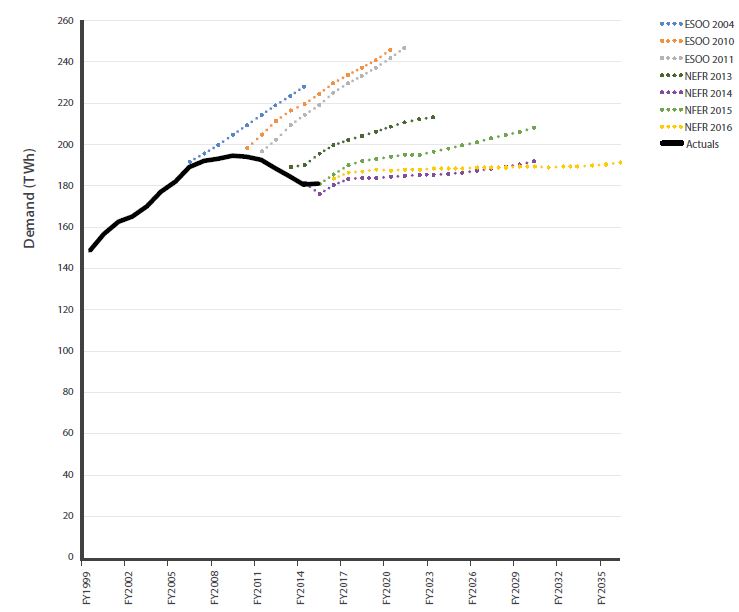

The following graph shows how demand changed at that time as a result of the downturn, and how future projections needed to be repeatedly corrected for a structural shift in electricity demand as a result of changes in economic activity, and altered electricity consumption patterns as a consequence of changes in rooftop solar photovoltaic penetration, energy efficiency improvements and industrial load closures.

Figure 1: Forecast and Actual Electricity Demand

Source: Finkel,[ii] p135

The current forecast economic conditions, which prompted the Reserve Bank of Australia out of session to reduce the cash rate target by 0.25 per cent, and the Commonwealth and State Governments to introduce a number of economic response packages, are likely to cause significant economic challenges, and ultimately reduced demand in the energy industry.

The expected reduced demand is likely to change the supply-demand balance, and a material oversupply is likely to emerge. Judging from previous economic downturns, a fall in demand trajectory is to be expected for years to come.

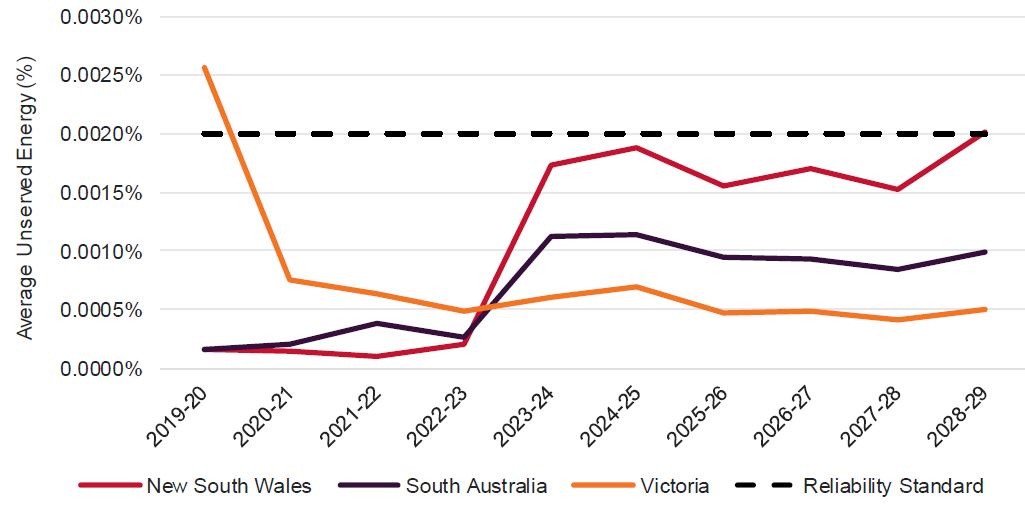

In addition, the current Medium Term Projected Assessment of System Adequacy (MTPASA) shows no unserved energy for the next two years,[iii] and the most recent Electricity Statement of Opportunities reported unserved energy below the existing reliability standard until 2028-29 in New South Wales, as shown in the following graph:

Figure 2: Forecast USE outcomes

Source: AEMO,[iv] ESOO, p79

It is in this context that the COAG Energy Council endorsed:[v]

- an out-of-market capacity reserve;

- amending triggering arrangements for the Retailer Reliability Obligation (RRO); and

- that these measures should be used to keep unserved energy to more than 0.0006 per cent in any region in any year (compared with the current reliability standard of 0.002 per cent in any region in any year).

An “out-of-market capacity reserve” appears to be a re-emergence of the “Enhanced RERT” increased contracting duration that was rejected by the AEMC in 2019. [vi]

What does a 0.0006 per cent reliability standard mean?

At face value a tighter reliability standard will require more generation and/or demand response available to reduce the duration of wholesale outages from 10½ minutes per year to just over 3 minutes per year. This is in a context where customers suffer outages from other causes averaging around 100 minutes per year. The question becomes whether the additional cost of employing the additional generation and/or demand response to achieve the additional 7 minutes of supply is palatable for customers. Recent analysis by the Australian Energy Regulator (AER) to determine the Value of Customer Reliability (and reported in this Energy Insider article) would suggest not.

The detail of the application of the 0.0006 per cent reliability standard is unclear. It has been reported that the new standard won’t directly replace the existing 0.002 per cent reliability standard, instead it will be used as a trigger for additional supplies to be readied,[vii] but the effects of setting the tighter trigger will be that:

- additional supplies will be readied (and at an additional cost);

- these supplies will not be available in the market (and hence will not be able to participate in providing the cheapest available supply);

- retailers will have an additional compliance burden; and

- despite no data yet suggesting that the additional 7 minutes’ reliability is economically worthwhile, customers will pay the extra costs for the additional supply.

The 0.002 per cent reliability standard had historically been promulgated by the Reliability Panel, a technical group comprising a broad collection of industry stakeholders charged with both setting this target and other market settings, such as the price cap. Their broad role ensured they could provide consistency across all the settings, thus encouraging the market to deliver the standard, which as shown by the figure above, it had been. The imposition of a tighter standard will be out of step with market settings, and is presumably the reason the 0.0006 per cent is being applied to some aspects of the reliability arrangements but not the market itself.

Conclusion

Before the COVID-19 crisis there was no indication of a looming generation shortfall, nor were there any signals from consumers that additional reliability was more highly valued than it had been historically when the original reliability standard was introduced. Since the COVID-19 crisis there are stronger indications that demand will be reduced, therefore supply will continue to be in surplus, and decisions to tighten the reliability standard and impose additional costs on consumers seem inopportune, and at odds with good planning practices.

The process that led to these confusing new arrangements stepped outside existing industry governance, occurred without consultation, and appears driven more by a desire to appease over-blown political fears rather than the true interests of consumers.

[i] https://www.abc.net.au/news/2020-03-19/coronavirus-recession-what-does-it-look-like/12064074

[ii] Finkel, et al., Independent Review into the Future Security of the National Electricity Market: Blueprint for the Future, June 2017

[iii] https://www.aemo.com.au/aemo/apps/visualisations/elec-mtpasa.html

[iv] Australian Energy Market Operator, 2019 Electricity Statement of Opportunities – A Report for the National Electricity Market, August 2019, Version 2

[v] COAG Energy Council, 23rd Energy Council Meeting Communiqué, 20th March 2020

[vi] Australian Energy Market Commission, Enhancement to the Reliability and Emergency Reserve Trader Rule Determination, 2 May 2019.

[vii] https://reneweconomy.com.au/coags-new-reliability-threshold-spooks-renewables-industry-regulators-respond-43419/

Related Analysis

Judicial review in environmental law – in the public interest or a public nuisance?

As the Federal Government pursues its productivity agenda, environmental approval processes are under scrutiny. While faster approvals could help, they will remain subject to judicial review. Traditionally, judicial review battles focused on fossil fuel projects, but in recent years it has been used to challenge and delay clean energy developments. This plot twist is complicating efforts to meet 2030 emissions targets and does not look like going away any time soon. Here, we examine the politics of judicial review, its impact on the energy transition, and options for reform.

Climate and energy: What do the next three years hold?

With Labor being returned to Government for a second term, this time with an increased majority, the next three years will represent a litmus test for how Australia is tracking to meet its signature 2030 targets of 43 per cent emissions reduction and 82 per cent renewable generation, and not to mention, the looming 2035 target. With significant obstacles laying ahead, the Government will need to hit the ground running. We take a look at some of the key projections and checkpoints throughout the next term.

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.