Electricity retailing: Markets, misconceptions and margins

Electricity retail remains firmly in the spotlight, with the industry awaiting the release of the Thwaites Review’s final report to the Victorian Government, as well as the Australian Competition and Consumer Commission’s (ACCC) preliminary report from its retail inquiry. Much of the commentary in recent months has picked up on a piece by the Grattan Institute that claimed Victorian retail margins were inexplicably high and that observable price dispersion was not consistent with a competitive market[i]. A number of other, mostly more recent papers offer an alternative perspective.

Retail costs and margins – have Grattan got it right?

Oakley Greenwood (OGW) prepared analysis for the Victorian distribution businesses earlier this year that contains one of the most comprehensive longitudinal datasets on the components that go to make up a typical Victorian bill, with data from 1995 and 2001 onwards[ii]. The paper did not attempt to estimate retail margins as a whole and for consistency it focussed on a bill based on a household consuming 4000KWh per annum. For the periods where retail competition was in force (from 2002) an average of the lowest market offer from each retailer in each distribution area was used. The report thus does not address the question of price dispersion, but provides a standard point of comparison over time.

From 2001 to 2017, their estimate of retail services (costs plus margin) declines by 2 per cent, from $373 to $364. This is despite the complexity of retail services increasing, as retailers had to procure energy efficiency (VEET) and renewable energy (RET) certificates, and manage the large increase in metering data resulting from the installation of advanced meters (AMI) as well as comply with increasing regulations set up with a view to customer protection. Victorian regulations in this respect differ from other National Electricity Market (NEM) jurisdictions (in which most retailers operate as well), adding to the costs to serve. In other words, it is almost certain that this represents a narrowing of margins on the most competitive offers, which is what would be expected from the increasing competition as more retailers entered the market. There are now 39 licensed retailers in Victoria.

Figure 1: Changes in the composition of the Victorian residential bill

Source: OGW analysis

Wholesale electricity costs were a big driver of increase over the period, increasing 56 per cent, but crucially if the cut-off had been 2016, they would be the same in real terms as in 2001 (with fluctuations in between). The change from 2016 to 2017 is the impact of Hazelwood closing on the supply/demand balance. Network charges increased by $71 or 20 per cent, although this is a much lower increase than in some other states, and network costs were still well below 1995. Policy costs were the other cause of the increase, with feed-in tariffs, the mandatory AMI rollout, VEET and RET certificates collectively contributing $173 to the annual bill.

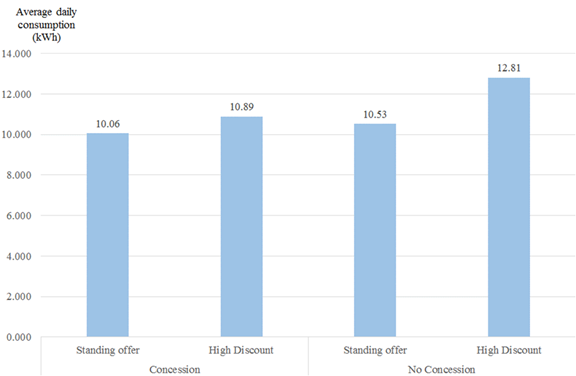

The OGW figures, which point to ongoing competitive pressures in retail as other bill components rose is consistent with other analysis that also looks at those customers who stay on the pricier standing offers. A group of economists from AGL analysed their own customer base to determine whether there was a difference between those customers that took up highly discounted market offers versus those that did not[iii]. What they found was consistent with theoretical expectations – the more households consumed the more likely they were to be on a discounted offer as the savings were greater. The average consumption gap between the two groups of customers narrowed considerably if they were on concessions – i.e. if they were more price sensitive due to income pressures.

Figure 2: Average consumption levels of different household types

Source: AGL

At this point the reader may be wondering, why do any customers stay on the standing offer? The reality is that there are search costs - in terms of time, in any case, entailed in finding a competitive market offer. Accordingly not all customers consider it worth their time to uncover a better offer (note that these offers are not hidden, they can be accessed from government and commercial price comparison sites, and individual retailers advertise their own deals widely).

The theoretical underpinnings of the price discrimination (businesses using varying approaches to offer different prices across their customer base) and price dispersion (the range of prices that customers actually pay) that occur in a competitive market where search costs exist are explained in a paper by the Competition Economists’ Group (CEG) submitted to the ACCC inquiry[iv]. The paper uses worked examples of simplified competition to illustrate the (counterintuitive) point that “Giving firms the flexibility to discriminate against their existing ‘sticky’ customer base actually results in lower prices to the ‘sticky’ customers. However, this is a more intuitive result when it is recognised that that the flipside is that price discrimination gives firms the flexibility, and incentive, to discriminate in favour of competitors’ customers by offering them prices close to marginal cost. With all firms doing this to their competitors’ customers then all firms are limited in the mark-up on marginal cost they can successfully charge to their existing customers.[v]”

In other words, at any point there is an equilibrium where less sticky customers get highly competitive prices (noting that this also maintains pressure on retailers to cut costs at any part of the supply chain that they can) and stickier customers pay more, but the amount is constrained by the fact that there is some price differential at which they will be motivated to move. This analysis differs from the Grattan report, which starts from the premise of perfect competition with no switching costs that should lead to price equalisation.

To what extent should price dispersion be a concern?

Figures of how many customers are on each type of offer are not readily available. The AGL paper however, gives an indication of its split between standing offer customers and discount customers.

Figure 3: Customer dispersion

Source: AGL

As Figure 3 shows, over half their customer base are on high level discounts, about a tenth are on the standing offer, which leaves around a third somewhere in between. As AGL represents the incumbent retailer in several parts of the NEM, they are likely to have a higher proportion of standing offer customers than second tier retailers, all of whose customers had to have switched at least once. In Victoria, at least, it is the norm that when retailers become aware that customers are having payment difficulties, part of the hardship management process is to check if the customer is on the standing offer and to move them to a discounted offer.

Figure 3 also includes estimates of marginal and average costs (AGL’s figures are a bit lower than OGW’s probably due to ignoring GST). Many of the costs of an electricity retailer are essentially fixed – they don’t vary with the amount their customers consume – so marginal cost is lower than the average cost. With the most heavily discounted customers tending to pay an amount close to the marginal cost, a retailer is only viable if it can recover its fixed costs and a reasonable margin from the remainder of its customer base.

Is price dispersion fair?

The challenge with the above analysis is that most people aren’t economists. Accordingly, governments and the ACCC may face pressure to “do something” about price dispersion if there is a popular view that it is unfair that different customers pay different prices – despite that being a normal feature of most product and service markets in Australia, including for basic goods and services like housing and food. Of course it is a far greater concern when a low-income household is paying significantly more than they need to than an affluent household for whom the electricity bill is a trivial expense. If public opinion ends up dictating that the former should be protected from the possibility of price discrimination, a targeted approach that focusses on assisting those who need it would be preferable to a blanket approach. CEG warns that the theory suggests that attempts to rule out price dispersion, i.e. by constraining retailers’ ability to price-discriminate, will ultimately result in the best offers disappearing, and in fact with less competitive pressures, the average price paid by customers is likely to rise.

Does this theory stack up in practice? As it happens the thesis has been tested in the British electricity market, where a series of interventions by Ofgem, the regulator, had precisely that effect. The sequence of events is well documented in an article by Professor Stephen Littlechild that can be found in the latest issue of Network, a regulators’ journal[vi]. Ofgem became concerned about price discrimination following its “electricity probe” in 2008. Specifically it was concerned that large retailers charged on average higher prices (10 per cent or so) to customers in their “home” area (i.e. the region in which they had started with the whole customer base before competition was instituted) than those in other retailers’ home areas. Customers in all areas still had five large retailers and numerous small retailers that they could get deals from instead of their “home” retailer, but Ofgem considered that this price discrimination was borne more heavily by vulnerable customers on the basis that they were the least likely to have switched away from their original home retailer. So Ofgem implemented a non-discrimination rule – at the time at acknowledged that it did not expect this to reduce overall margins/revenues but considered it worthwhile anyway. Several prominent British economists criticised the decision and predicted that it would reduce the competitive dynamic and so probably lead to increasing margins overall. This is what happened over the next few years – in fact margins increased 38 per cent (based on Ofgem’s own regulatory accounts – see below for a brief cautionary tale on the challenges of accurately determining margins).

Ofgem responded by doubling down on regulation, reasoning that part of the problem was the proliferation of offers. They restricted each retailer to “a maximum of four tariffs per fuel natural gas and electric power) per payment method (direct debit, standard credit and prepayment). All tariffs were to have a simple two-part structure that is a standing charge and a single unit rate … Discounts were allowed only if expressed in pounds, not as percentages, and were later prohibited other than for dual fuel and online accounts”[vii].

This resulted in retailers withdrawing a number of niche tariffs that particular groups benefitted from – most notably “a ‘StayWarm’ tariff that gave customers over 60 years of age a fixed monthly bill regardless of how much energy the customer used (though the bill could be adjusted on a forward-looking basis depending on actual usage)”[viii]. Furthermore, it stifled tariff innovation and made it harder for retailers to use aggressively priced new offers to poach new customers from their rivals.

The political backdrop is that overall prices were rising – as in Australia; this was primarily driven by underlying cost drives such as rising fuel costs and the costs of decarbonising the system. But of course, this was hard to explain well and it was easy to assume that retailer profits were the problem. This culminated at the recent general election with major parties commenting on how hard they were going to regulate the industry, including via the reintroduction of price caps.

Are retailers making “too much” money from their sticky customers?

This is a surprisingly hard question to answer. Firstly, we need to know how much profit a retail business makes. This requires knowing both revenue and costs, neither of which are publicly available (the same is true of most industries, except to the extent that they can be inferred from public corporate accounts – the problem here is that there are few listed companies and they mostly have other business units than just electricity retailing). Profit estimates will vary widely depending on the cost and revenue assumptions. CEG critiqued Grattan’s headline estimate of a 13 per cent profit margin in Victoria, pointing out that the AEMC’s assessment of a representative market offer for 2014/15 was $150 lower than Grattan’s. Additionally, Grattan do not appear to have accounted for their own estimate of hedging costs ($15/MWh) fully, given they include a figure of $30 in total while the representative consumption figure for Victoria is around 4-5MW per annum. These two adjustments alone would result in a revised profit margin of 0-3 per cent. While this may seem implausibly low, the point is that any given estimate of profit margins must be taken with a pinch of salt. Whether the wide-ranging information gathering powers the ACCC can bring to bear on their review results in a more definitive margin estimate remains to be seen.

Are all retail offers selling the same thing?

The premise of both the CEG and the Grattan analysis is that electricity supply is essentially a homogeneous good. This assumption aids theoretical analysis and may seem obvious at first glance - after all you get your electrons whatever retailer you’re with or which of their contracts you are on. The reality is more subtle - a major role of retailers is risk management and this is reflected in the diversity of offers. So just as financial services such as insurance or a mortgage are differentiated by risk factors such as fixed/floating interest rates and excess levels, retail electricity offers are differentiated by a range of risk management tools including: conditionality or otherwise of discounts; varying fixed/variable components of the tariff; fixed v floating reference tariffs; time-of-use or maximum demand tariff options; different feed-in-tariffs payment methods and frequency. more recently, more exotic options such as monthly fee plus cost pass-through (Mojo), (active purchasing of electricity volume “packs” (Powershop) free periods (AGL, Dodo), fixed bills (Origin) On top of this there are service level differentiations, including apps to monitor usage, energy efficiency advice, green energy products or carbon offsets, inducements such as free movie tickets or discounted footy memberships and so on.

Once all these differences are taken into account the likelihood of prices in the market converging on a single level becomes even more remote.

Conclusion

The ACCC have a challenging task ahead of them. Misconceptions abound in the energy retail sector. The danger is that an ill-formed concept of how a competitive retail market “should” look like will create an impossible goal, and as the British experience shows, well-meaning regulatory intervention can have detrimental effects on consumers.

[i] Price shock: is the retail electricity market failing consumers?, Grattan Institute, March 2017

[ii] Causes of residential electricity bill changes in Victoria, 1995 to 2017, OGW, February 2017

[iii] Price dispersion in Australian retail electricity markets, Nelson, McCracken-Hewson, Whish-Wilson, Bashir, June 2017

[iv] Competition in electricity retail markets, CEG, June 2017

[v] CEG, p26

[vi] Competition and Price Controls in the UK Retail Energy Market, Professor Stephen Littlechild, June 2017, in Issue 63 of Network

[vii] ibid

[viii] ibid

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

Navigating Energy Consumer Reforms: What is the impact?

Both the Essential Services Commission (ESC) and Australian Energy Market Commission have recently unveiled consultation papers outlining reforms intended to alleviate the financial burden on energy consumers and further strengthen customer protections. These proposals range from bill crediting mechanisms, additional protections for customers on legacy contracts to the removal of additional fees and charges. We take a closer look at the reforms currently under consultation, examining how they might work in practice and the potential impact on consumers.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.