Electricity Prices: Are Retail Costs the Real Issue?

Retail costs have been in the news following the release of the Australian Energy Regulator’s draft default market offer decision. This is despite retail costs being dwarfed in the DMO cost stack when compared to network and wholesale costs that make up 33-48 per cent and 31-44 per cent of the DMO 7 draft prices respectively. According to analysis released today increases in the DMO regions have been largely driven by rises in the two largest components of an electricity bill: the network and wholesale costs[i]. These are supply chain costs retailers cannot fully control and pass through to end users.

Retailers play an important role in managing the risk of the entire supply chain to give customers a consistent price during the year.

The DMO is intended as a price safety net for around 8 per cent of customers who do not shop around for better market deals. It is also designed to allow retailers to recover the reasonable costs of doing business and to allow room for competition which benefits the vast majority of customers through cheaper market offers. In terms of the retail profit margin, the AER notes it “should be commensurate with the risk of supplying”, and that it is set at 6 per cent “to allow a prudent retailer to make reasonable profit”.

While retail costs have increased and will continue to be under pressure, retailers have limited scope to manage the risks from the full supply chain. The DMO7 draft determination has already opted to not include a retail competition allowance and maintained the same retail margin as the previous year.

Retail margins are not the problem in managing the cost of energy to households, and there is increasingly limited scope for retailers to manage supply chain costs. The draft determination actually highlights the challenges for retailers in supporting customers during a broader cost-of-living crisis. Increases in retail costs are being driven by higher bad and doubtful debts, provision of hardship programmes and meeting mandated requirements like the accelerated smart meter rollout.

Deck Chairs on the Titanic

Further squeezing retail margins is a bit like shuffling the deck chairs on the Titanic - it's a distraction from what's really happening. Energy costs are increasing as we navigate through the energy transition as we replace up 60 per cent of our generation fleet by investing in a system that can accommodate large volumes of renewable energy. To keep costs down, regulators and politicians need to ensure we can deliver the most efficient outcomes for the energy system, which requires an unwavering focus on the major costs – network and wholesale costs.

Attempts to squeeze retailers to offset increases in other parts of the supply chain will inevitably limit the scope for retailers to offer competitive market deals, which will reduce the savings available to the more than 90 per cent of households on market offers. There is a need to ensure retailers have sufficient room in their margins to invest adequately to support customers in hardship and help them manage energy debts. In addition, any squeeze on the retail component of the cost stack is likely to impact smaller retailers more than larger businesses, which is less than ideal for a competitive environment.

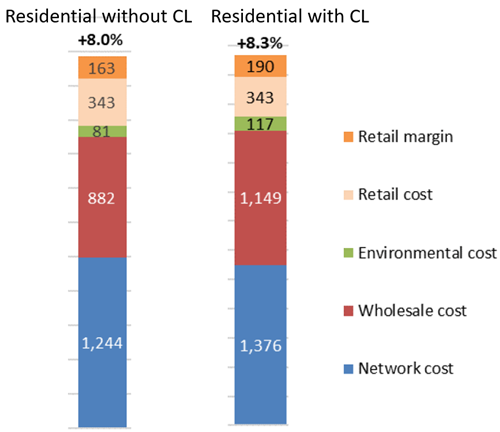

The cost components that go into the residential bill are shown below for customers without controlled load (CL).

Figure 1: Residential without CL, % change from DMO 6 (nominal)

Source: Default market offer prices 2025–26: Draft determination

The potential impact the largest components like network costs have on the cost stack is illustrated by the draft DMO increase recommended for customers in the Essential Energy region in New South Wales, which is the largest distribution network in the DMO regions. This region has a draft DMO increase of 8-8.3 per cent based on residential customer type. Network costs account for nearly 46 per cent (or $1244) of the bill for households without controlled load and around 43 per cent ($1376) for customers with CL. This is out of the expected total bill of $2713 and $3174 respectively. Retail costs only account for $343 for both groups of customers, so 12.6 per cent and 10.8 per cent respectively. Wholesale and network costs, plus the cost of governmental environment schemes combined, account for $2207 (81 per cent) and $2642 (83 per cent) of the residential customers bill, depending on type (see figure 2). Importantly, retailers manage payment risk for all upstream costs. A retailer pays the network and generation costs irrespective of whether the retail bill is paid.

Figure 2 - DMO7 Cost Stack for Residential Customers - Essential Energy Region % Change from DMO6

Source: Source: Default market offer prices 2025–26: Draft determination

Energy Ministers

Energy Ministers at the most recent Energy and Climate Ministerial Council meeting have asked the AER to revisit retailer costs and margins. Retail costs represent 7-16 per cent of the final bill, while retail margins have again been set at 6 per cent for residential customers in line with last year’s DMO, while a competition allowance estimated at just over $20[ii] has been excluded for the second consecutive year in response to cost-of-living pressures on households.

The AER has indicated the main driver of cost increases in DMO7 was costs faced by retailers themselves and not the cost of generation and the poles and wires[iii]. In dollar terms, the change in prices between DMO6 and the current draft show all components of the cost stack (aside from environmental costs) have contributed to price increases. Retail costs in dollar terms, which have been under pressure, have increased the most in some regions and for some residential customer types but not in all distribution zones covered by the DMO.

Overall, the AER draft determination indicates:

- In New South Wales there have been increases in wholesale costs for all customer types driven by higher contract costs, as well as network and retail cost increases.

- In South Australia wholesale and retail costs increased, while network costs decreased.

- In SE Queensland network costs increased for residential without controlled load and decreased for residential customers with controlled load. There was a small increase in wholesale costs and retail costs increased primarily driven by higher operating costs, smart meter costs and increases in bad and doubtful debts[iv].

What Goes into Retail Costs?

In light of the discussion on retailer costs and their impact on the final bill, we thought it worthwhile to look at the cost elements in the retail component of the average default tariff bill[v].

Retail costs include what is known as the cost to serve, which covers billing and IT systems, call centre costs, and hardship programmes to support customers. Hardship programme costs, while still a small component in the DMO, have increased as a direct result of cost-of-living pressure generally. Retail costs also include bad and doubtful debts and the costs of the mandated smart meter rollout, which has recently been accelerated. Bad and doubtful debt allowance has increased 27 per cent overall in DMO7, although in the case of the Energex distribution region, this has increased by more than 50 per cent rising from $26.40 to $40. Smart meter costs have increased by 21 per cent ($13) overall (see figure 3 below).

Changes to the retail and other costs, allowance for bad and doubtful debt, and smart meter costs is shown below.

Figure 3: Change in residential retail cost components DMO 6 to DMO 7 ($/customer), all DMO regions

Source: Default market offer prices 2025–26: Draft determination

In considering the elements of a retailer’s cost to serve, overall labour costs are the major component of the cost to serve, accounting for up to 47 per cent of the total cost for residential customers (see below).

Figure 4: Cost to serve sub-components ($/customer), by DMO region and customer type, including GST

Source: Default market offer prices 2025–26: Draft determination

Lastly the costs to acquire and retain customers, which includes advertising and communications to inform new customers of their options, rights and obligations, make up the retail costs. The major component in this segment is labour costs followed by advertising and marketing and third-party sales. In dollar terms these are $21, $17 and $13.60 respectively in South Australia (out of a total electricity bill of $2344); for customers in the New South Wales DMO distribution regions the figures are $24.09, $18.98 and $14.60 out of the total bill of $1969-$2713 (depending on the distribution area). The cost to bills for South-East Queensland customers are $19.80, $13.80 and $15 out of the total bill of $2185.

Figure 5: Costs to acquire and retain sub-components ($/customer), by DMO region and customer type, including GST

Source: Default market offer prices 2025–26: Draft determination

[i] What are the factors driving changing power bills, and are there any opportunities for reductions? Institute for Energy Economics and Financial Analysis

[ii] See Default market offer prices 2025–26: Draft determination, page 83.

[iii] State and federal governments scold regulator over power price hikes, urging a cost-of-living rethink - ABC News

[iv] See Default market offer prices 2025-26: Draft determination, Appendix D.

[v] To simplify things we use the residential costs without controlled load.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.