Competition and sunshine: A WA update

Energy has been front and centre in Western Australia. In particular, the new West Australian Labor Government has signaled its interest in increasing competition in its retail electricity market by making it fully contestable. At present small customers, such as households, have to buy their power from state-owned Synergy. West Australian consumers continue to be active in the solar space, with household solar growth rates in Western Australia the fastest growing across Australia in recent months.

On the generation side, Synergy (www.synergy.net.au) has announced the reduction of 380 MW of its non- generation capacity to address over supply in the market[i]. A 2,500 km pipeline from Western Australia to the Moomba gas hub in South Australia continues to be discussed following the Turnbull Government budget allocating $3.7 million for a feasibility study into a West Australian – South Australian gas pipeline.

Electricity retail competition

Western Australian household electricity prices could rise by 15 per cent within two years as the state seek to remove the current subsidy as a precursor to allowing consumers to choose where they buy their power from according to West Australian Energy Minister, Ben Wyatt.

Since Victoria, South Australia, Queensland and New South Wales opened their retail markets independent assessments have shown that customers are able to save hundreds of dollars on their electricity bills as a result of market offers from retailers. They have also continued to see new businesses come into the electricity market to maintain competitive pressure. Introducing more competition will make the West Australian electricity market will encourage new entrants and give customers greater choice and savings. Closer to home for West Australian residents, gas retail has been competitive since 2013. Wesfarmers owned Kleenheat has challenged incumbent Alinta while east coast providers AGL and Origin Energy have announced plans to enter the West Australian market. This was not lost on Minister Wyatt, who told the West Australian newspaper, “You are seeing it already with gas that competition has quite a dramatic impact on bills. That’s where you see real pressure applied on costs – when there’s a competitive market[ii]”. Larger customers in the electricity market already benefit from competition.

Alinta has flagged an interest in selling electricity to households in Western Australia, but there is the complication of a cross-moratorium that keeps Alinta out of electricity while Synergy is restricted from retailing gas. If this was lifted as part of the competitive process, it’s likely that both businesses would expand to offer dual fuel options. AGL and Origin, as well as other potential east coast entrants and local businesses such as Perth Energy are also candidates for new retail suppliers.

Given that West Australian governments have directly set electricity prices below cost for over a decade, the McGowan Government will need to show potential suppliers that there is a fair process in place for determining any retail price cap once full retail contestability has been introduced. The obvious way to do this would be to delegate the process to the Economic Regulation Authority (ERA) and give the ERA a mandate to “regulate for competition”, for example allowing customer acquisition costs as part of the price cap calculation. Ideally, it would also signal the conditions under which it would remove the price cap.

A time when recent commentary has been critical about Australia’s competitive retail energy markets about electricity prices the West Australian Government has been upfront in highlighting that competition cannot guarantee the lowest possible price for every customer at any point in time, nor can it guarantee that prices will not rise.

As noted above, it has however used gas competition as evidence of the overall benefits of competitive markets.

Solar installations continue to increase in Western Australia

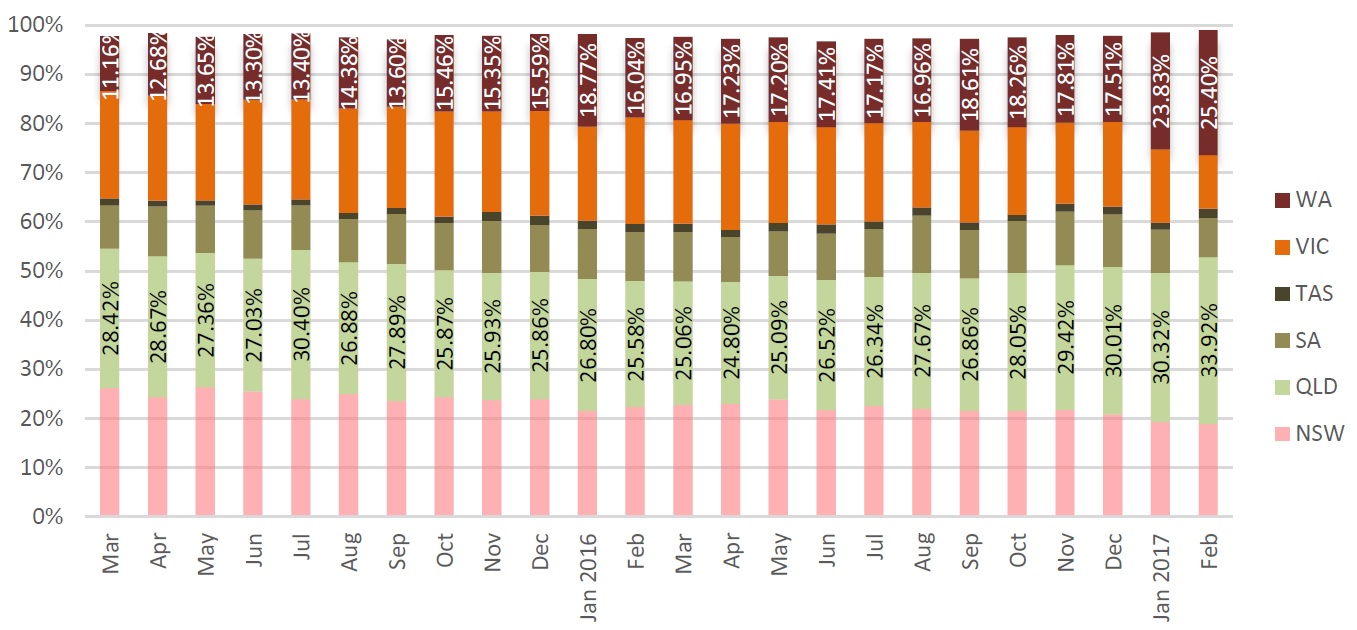

In Western Australia, households, businesses, and commercial developments are installing solar panels at a record rate, with installations up 33 per cent from last year. Although in a number of east coast states the number of solar growth rates are slowing, figure 1 shows the increase in solar in West Australia with the proportion of each month’s number of solar photovoltaic (PV) installations increasing in recent months.

South Australia and Victoria also show an increasing trend in solar PV installations in recent months and they accounted for nearly 60 per cent of total installations. Queensland though continues to lead the states for the greatest proportion of households with solar PV installed.

Figure 1: Proportion of monthly installed solar PV capacity by state Source: Australian Energy Council Solar report, 2017

Source: Australian Energy Council Solar report, 2017

Synergy to reduce electricity generation cap by 2018

Synergy will reduce its non-renewable generation capacity to address over supply in the market. The plans to reduce generation capacity were announced by the previous West Australian government in April 2016 and recently Synergy made the decision to reduce generation capacity based on a number of critical factors[iii].

The assets designated for retirement are:

- Muja AB units 1 to 4 (240 MW)

- Mungarra gas turbine units 1, 2 and 3 (113 MW)

- West Kalgoorlie gas turbine units 2 and 3 (62 MW)

- Kwinana gas turbine unit 1 (21 MW)

Synergy will progressively retire the four assets by September 2018, whereby its generation cap, exclusive of renewable generation, will reduce to 2,275 MW. Discussions have been undertaken between Synergy, the Australian Energy Market Operator (AEMO) and Western Power to finalise the decision to ensure the SWIS does not experience supply issues.

Other Synergy units, including Muja CD will remain in operation in accordance with requirements.

The reduction in generation capacity comes at a time when the Wholesale Electricity Market (WEM) Electricity Statement of Opportunities (ESOO)[iv] highlighted that an all-time peak demand occurred on 8 February 2016 when demand was 4,013 MW. AEMO has forecast peak demand to increase at an average annual rate of 1.4 per cent over the next 10 years[v].

Figure 2: Peak demand forecasts for different weather scenarios, expected demand growth

Source: AEMO, 2016

East/West pipeline

The idea of a 2,500 km pipeline from North West Western Australia to the Moomba gas hub in South Australia has been discussed as a way to ease the east coast gas crisis over the coming years. The Turnbull Government in the recent budget allocated $5.2 million for feasibility studies into new gas pipelines which include $3.7 million for the West Australian – South Australian gas pipeline and $1.5 million for the Northern Territory – South Australia pipeline.[vi]

The pipeline would link West Australia’s prolific offshore gas fields to the South Australian energy hub of Moomba, effectively opening a pathway for that gas in the major markets of eastern Australia.

The economics of the pipeline plan however have been queried, with Ord Minnett calculating the project would deliver gas to Sydney at a cost of more than $13 a gigajoule, while Credit Suisse analyst Mark Samter highlighted that the plan would be more expensive than importing LNG into the east coast. The West Australian Government poured cold water on the idea pretty quickly, too.

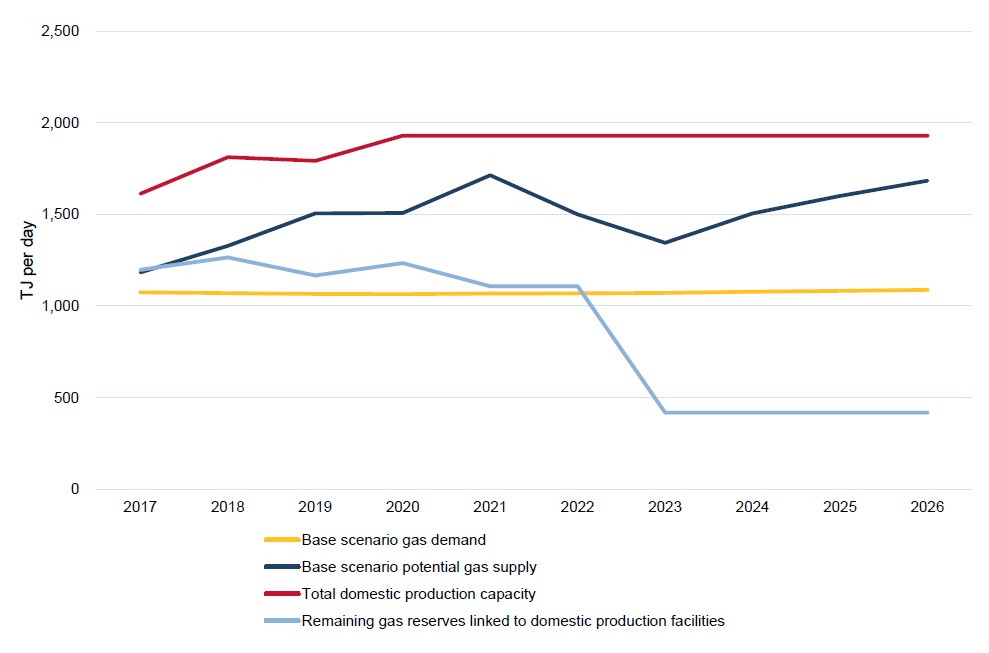

AEMO expects gas supply in West Australia to exceed demand over the next 10 years, assuming the continued development of gas reserves[vii]. Growth in domestic gas demand is forecast to be around 0.1 per cent over the outlook period, as only a handful of large gas consumers are expected to enter the market over the period[viii]. The assumptions however do not include the West Australian – South Australian pipeline

Figure 3: Gas Demand Supply Balance, 2017 to 2026

Source: AEMO, 2016

[i] https://www.synergy.net.au/About-us/News-and-announcements/Media-releases/Synergy-to-Reduce-Generation-Capacity-by-380-MW

[ii] “Going Up”, West Australian, 22 May 2017

[iii] West Australian Government Media Release, 2017, “Synergy to reduce electricity generation cap by 2018”

[iv] AEMO, 2016, “Deferred 2015 Electricity Statement of Opportunities”

[v] ibid

[vi] http://www.afr.com/news/policy/budget/budget-2017-new-gas-pipelines-to-fix-energy-crisis-20170509-1nxuzn#ixzz4hxShrBXS

[vii] AEMO, 2016, “2016 Western Australian Gas Statement of Opportunities (GSOO)”

[viii] ibid

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.