Barker Inlet: A new technology responding to the market

At the end of 2019 AGL successfully commissioned the 210MW gas-fired Barker Inlet Power Station in South Australia. This major new investment occurred entirely in response to market signals, i.e. without subsidies. The power station employs reciprocating engine technology that has not previously been used in Australia at this scale, and provides remarkable flexibility in supplying on-demand power. Despite being fossil-fuelled, this flexibility will actually help Australia’s transition more rapidly to an almost fully de-carbonised electricity grid.

We take a closer look at the technology and how it supports the transition.

Figure 1: Barker Inlet Power Station

Source: AGL

Source: AGL

Gas-fired generation – a crucial part of the NEM in the past and the future

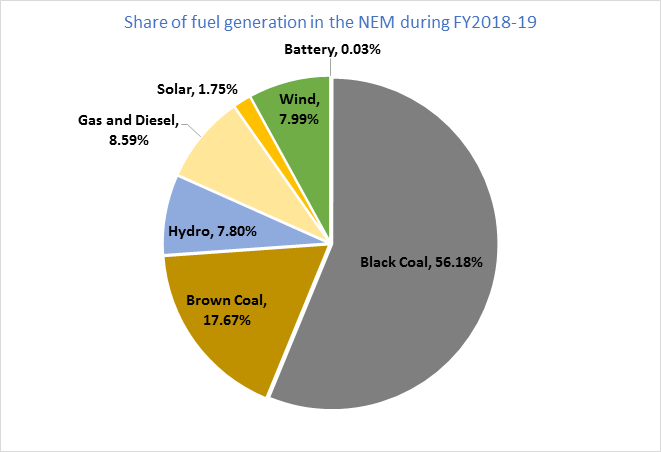

Whilst gas-fired generation has always been a relatively small part of the National Electricity Market’s (NEM) energy mix[i], its capacity and its ability to deliver quick, reliable supply when needed has always been crucial[ii].

Figure 2: NEM energy by fuel shares of large-scale generation

Source: AEC

Source: AEC

At the time of the first Garnaut Climate Change report in 2008 it was assumed that gas-fired generation would be a “bridging fuel” between coal and zero carbon sources due to its lower carbon intensity (around half that of coal) until eventually new zero carbon sources became commercial (which were then predicted to be mostly the non-intermittent sources of solar thermal, geothermal, nuclear and carbon-capture). During that bridging period, which would last several decades, gas was anticipated to move down the merit order, i.e. to take up much of coal’s energy shares in the chart above. Gas would move from a peaking fuel to a base-load.

These predictions proved false. Partly this was due to a lack of the carbon pricing necessary to make natural gas competitive with Australian coal. But, also unexpected, dramatic falls occurred in the price of wind and photovoltaic solar, whilst the non-intermittent zero carbon sources failed to advance.

However their intermittency has in turn consolidated the future of gas-fired generation in something akin to its historical role – as a form of peaking and back-up generation. Over time coal-fired energy shares in the pie chart above will be mostly replaced with wind and solar, but management of their intermittency will require support from each of hydro, storage and gas.

Whilst the role of storage (battery and pumped-hydro) will grow and provide some of the back-up, realistically it will not eliminate the need for gas anytime soon. Storage is very expensive and only gradually declining in cost. Battery storage will provide frequency control, and a few hours energy after sunset, however during still, cloudy weeks, there appear few practical alternatives to gas once the storage capacity is emptied.

As we lose the firm capacity of coal, the installed capacity of gas will need to grow not shrink, but that does not mean gas fired generation emissions need necessarily grow; they may even decline. It will be providing reserve capacity, not bulk energy. Even in a “net zero carbon” economy expected later this century, it may remain economic to retain gas in this role, offsetting its small emissions with negative carbon sources.

Gas-fired Generators aint Gas-fired Generators

There is a surprisingly diverse number of ways to use the heat from hydrocarbon[iii] combustion to make electricity. The NEM has at least four main types:

1. Steam Turbine: Fuel can be burned in a conventional steam boiler in a similar way to coal with the steam driving a turbine. Like a coal plant, these take several hours to start in order to progressively warm the turbine. They also have a minimum stable output, but which is lower than a coal plant at around 20 per cent of full load.

Examples include Newport and Torrens Island “A” and “B” Power Stations. This is now a legacy technology as by the 1990’s their costs, efficiencies and flexibilities could all be bettered by technologies two and three.

2. Open-cycle gas turbine: This is effectively a stationary jet-engine. Air is first compressed, then heated and expanded by combusting fuel in it, then released through a gas turbine. The “gas” in the name actually refers to the turbine’s working fluid, (i.e. gaseous air) not the fuel. They can operate on gaseous and liquid fuels, but not solid fuels like coal.

These are cheaper and quicker to build than steam boilers. They are also more flexible, with start-up times typically between 10-20 minutes[iv].

Historically they had low energy efficiency, however technological improvements, many from the aviation industry, have improved them to the point they now can now exceed our older steam plants. Whilst they can operate at variable output, their efficiency degrades substantially so after starting, owners prefer to run them at maximum output.

There are numerous examples of this technology across the NEM, and in most power systems.

3. Combined-Cycle gas turbine: This is where the hot exhaust of an open-cycle gas turbine is directed into the boiler of a small steam turbine, thereby capturing additional power from the heat of the fuel combusted in the gas turbine. This way they achieve remarkable thermal efficiency, but cost more to build than an open-cycle gas turbine, and face some of the slowness and inflexibilities of steam turbines. Being cheaper to run and less flexible, they are intended to run lower in the merit order than open-cycle gas turbines. This was the form of technology expected to support the “bridging fuel” scenario as discussed earlier.

Examples in the NEM are Pelican Point, Tamar Valley, Tallawarra, Swanbank E and Darling Downs.

4. Reciprocating engine: This is effectively a large internal-combustion engine with cylinders and pistons conceptually similar to those used in transport. Thanks to a century of detailed design, these have efficiencies similar to the best open-cycle gas turbines, with similar build times and slightly higher capital costs. Where they really stand out however is in their flexibility, discussed further below.

The NEM already had some smaller examples such as Port Stanvac and Angaston in South Australia (diesel-fuelled) and Appin and Tower in New South Wales (coal-mine methane fuelled) all approximately 50MW each. At 210MW, Barker Inlet is Australia’s first very large-scale reciprocating engine, and unlikely to be the last.

Table 1: Comparison of Gas-fired generation technologies

|

Technology |

Approx thermal efficiency |

Approx new capital cost (machine only) |

Start-up time to full load |

Ability to follow dispatch targets |

|

Steam turbine |

35-40 per cent |

Superceded technology |

3-8 hours |

Variable above min load ~20 per cent with moderate ramp rates |

|

Open Cycle turbine |

35-41 per cent |

$0.9m/MW |

10-20 minutes |

Variable, fast ramp rates but efficiency declines |

|

Combined Cycle turbine |

50-55 per cent |

$1.3m/MW |

20-40 minutes |

Variable above min load ~50 per cent with moderate ramp rates, efficiency declines |

|

Reciprocating engine |

45-48 per cent |

$1.2m/MW[v] |

5 minutes |

Fully variable, fast ramp-rates, no efficiency loss. |

Source: AEMO Integrated System Plan 2019 Input and Assumptions workbook, AGL, Power Engineering Magazine 1.1.18.

Reciprocating engine features

US manufacturers Cummins and Caterpillar are well-known builders of small and medium-scale reciprocating engines and typically supply them for remote power supplies, e.g. mine sites. Finnish company Wartsila historically specialised in marine engines but has moved that knowledge into large, grid-connected power stations. They supplied the Barker Inlet equipment.

Barker Inlet comprises 12 x 17.6MW engines. If, for example, 100MW was dispatched by the Australian Energy Market Operator (AEMO), then only 6 of the engines would start and operate near full load. Being able to quickly start up and shut down individual engines means that at any desired output each operating engine can run close to its maximum efficiency level. And with many small discrete engines, forced outages only affects a small amount of the total capacity at any one time.

But where the reciprocating engine particularly stands out is its rapid start capability. The plant can synchronise to the grid within 90 seconds of receiving a start signal, and reach full load less than four minutes later. And the additional maintenance cost penalty of every start and shut down is very minor. These characteristics mean its operational flexibility approaches that of hydro plant.

The Barker Inlet plant is dual fuel, natural gas and diesel, which provides electricity security in the case of gas supply disruption or economic unavailability. An interesting feature of internal combustion engines is that diesel ignites on compression whereas natural gas requires a spark. Barker Inlet solves this problem by injecting a very small amount of diesel with the natural gas, which the compression will ignite in turn igniting the natural gas.

Figure 3: Dual fuel reciprocating engines

Source: AGL

Source: AGL

Why it suits the market

Wind and large-scale solar plant are not only intermittent, but are also challenging to forecast, notwithstanding the impressive achievements in AEMO’s Australian Wind/Solar Energy Forecasting System (AWEFS/ASEFS). Events can still occur where a widespread and relatively large change in output can surprise. For example, on the very hot 20 December 2019, Victorian wind output produced 1000MW less than what had been forecast only three hours earlier[vi].

South Australia, with its very high penetration of these technologies has historically been the most volatile NEM region in terms of supply/demand and ultimately price. The introduction of five-minute settlement in 2021 will further sharpen this price signal.

In this market the ideal back-up plant is one which can be easily shutdown at times of surplus and be very quickly re-started in shortfall, and, having started, cleanly follow a variable dispatch level producing only the amount of energy required.

The volatile spot price expresses this need, which AGL have responded to with their choice of technology in this investment. As the penetration of solar and wind grows ever greater, this volatile spot price signal is likely to encourage similar investments in other regions.

Conventional power system dispatch places the slowest and cheapest plant at the bottom of the merit order, whilst more expensive, flexible plant is used last. AGL has a peculiar challenge in operating Barker Inlet in tandem with their legacy steam turbine plant, Torrens Island, which is both less flexible and more expensive to operate.

[i] Note: Gas-fired generation has always had a much larger share of the energy mix in the Western Australian and Northern Territory grids.

[ii] See: Australian Energy Council, EnergyInsider Transitioning with gas: What role will it play?

[iii] Hydrocarbon fuels include natural gas and liquid fuels, such as diesel, but exclude solid fuels such as coal and biomass.

[iv] Within open-cycle gas turbines, there are two broad types: slower and cheaper “industrial” gas turbines and more responsive “aero-derivative” gas turbines, which accounts for this range.

[v] Note: Reciprocating engine capital cost not provided by AEMO. Value estimated from AEMO open-cycle and multiplied by relative costs at https://www.power-eng.com/2018/01/01/mid-sized-new-generation-reciprocating-internal-combustion-engines-or-combustion-turbine/#gref

[vi] http://www.wattclarity.com.au/wordpress/wp-content/uploads/2019/12/2019-12-20-at-16-30-ez2view-ForecastConvergence-WindandSolar-VIC.png

Related Analysis

Winter Bills: Is it cheaper to heat your house with gas or electricity?

As gas and electricity prices continue to fluctuate across Australia’s east coast, households and businesses are facing rising winter energy costs and growing uncertainty. Seasonal demand, household gas consumption, and the efficiency of electric heating systems, particularly when paired with rooftop solar, are playing an increasingly important role in shaping energy bills. Drawing on data from the Australian Energy Council’s Solar Report Q2 2025, this article explores how these factors affect costs and highlights potential savings for households of different sizes.

The energy transition and power bills: Why aren’t they cheaper?

With energy prices increasing for households and businesses there is the question: why aren’t we seeing lower bills given the promise of cheaper energy with increasing amounts of renewables in the grid. A recent working paper published by Griffith University’s Centre for Applied Energy Economics & Policy Research has tested the proposition of whether a renewables grid is cheaper than a counterfactual grid that has only coal and gas as new entrants. It provides good insights into the dynamics that have been at play.

The gas transition: What do gorillas have to do with it?

The gas transition poses an unavoidable challenge: what to do with the potential for billions of dollars of stranded assets. Current approaches, such as accelerated depreciation, are fixes that Professorial Fellow at Monash University and energy expert Ron Ben-David argues will risk triggering both political and financial crises. He has put forward a novel, market-based solution that he claims can transform the regulated asset base (RAB) into a manageable financial obligation. We take a look and examine the issue.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.