Banking on a falling market

According to the Clean Energy Regulator’s (CER) most recent update, 86.1 per cent of large-scale renewable certificates (LGCs) were surrendered on time for the 2018 assessment year. 3.4 million LGCs were carried forward paid shortfall for the 2018 period - the equivalent of around $220 million. While the surrender rate for small-scale technology certificates (STCs) was 99.9 per cent.

The Large-scale Renewable Energy Target (LRET) supports the development and growth of large-scale renewable energy generation - like wind and solar farms, or hydroelectric power stations. For older hydro-electric power stations built before the Renewable Energy Target (RET) was conceived, the financial incentive only applies to generation above its historical average, so is designed to encourage a boost in production.

There are now 11,805 MW of renewable energy projects that are generating, under construction or committed to be built; which is nearly double the 6400 MW needed to meet the 2020 RET[i].

In October last year the regulator said that, given that the RET will be exceeded, it has no objections to the use of shortfall in the expectation that clients would “true up” these positions with large-scale generation certificates in a subsequent year[ii].

Under law, energy companies are able to make up this liability over the next three years when LGCs are surrendered to clear the shortfall. It has been recently reported that some companies have chosen to pay a penalty for some of their 2018 liability - and with more renewables coming into the system, this means lower costs for customers who effectively pay for the scheme through their energy bill.

The LRET: Looking forward

The charge is set at $65 per certificate not surrendered. As it is not a tax-deductible expense, this means entities can purchase large-scale certificates (LGCs) and small-scale certificates (STCs) - which are tax-deductible - at a price of around $93 and be no worse off than paying the shortfall charge.

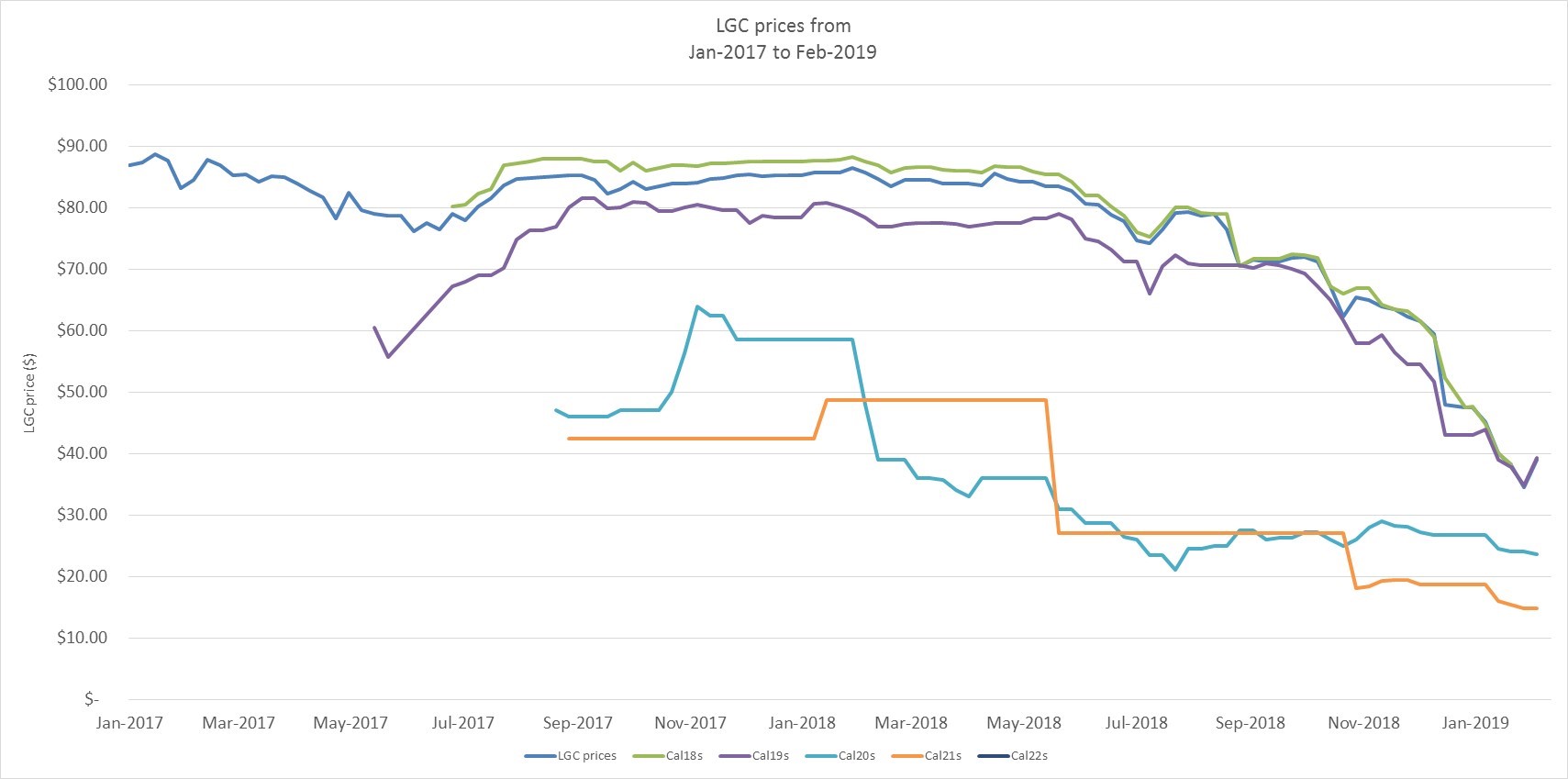

CER analysis, illustrated in figure 1 below, shows that LGC spot prices remained relatively consistent (above $80) from mid-2016 to mid-2018. The CER states that as the pipeline of renewable energy projects continue to grow and exceed the 2020 RET, LGC spot prices halved from June 2018 to December 2018 and dropped further to $34.50 in early 2019 before increasing slightly to $39 at 14 February 2019.

Due to more renewables are coming into the system, future certificate prices are expected to decline and companies can make up the shortfall by buying LGCs at a lower price. Figure 1 also shows that forward prices for 2020 (CAL20) and 2021 (CAL21) drop further to $23.60 and $14.75 respectively[iii].

However the LGC price is not only expected to decrease due to the increase of renewable energy projects. The RET is expected to reach a plateau by 2020 while the accreditation of generation and the creation of LGCs continues under the LRET until 2030, the end of the scheme. Although there is additional supply, which reduces the price, the lack of increasing demand also has an effect on prices.

Figure 1: Large-scale generation certificate price fall

Source: Clean Energy Regulator, Large-scale generation certificate market update - February 2019

According to the CER:

“As LGC prices fall, the impact of the Large-scale Renewable Energy Target (LRET) on household electricity prices will also decrease. The AEMC estimates the pass through cost of the LRET in 2019 to be $44 based on LGC spot prices from August 2018. Using current spot prices, the pass through costs decrease to $33. This reduction is expected to offset the increased cost to consumers from the Small-scale Renewable Energy Scheme.”

Background

The RET has been operating in various forms since the Mandatory RET commenced in 2001, which had an aim to source 2 per cent of the country’s energy from renewable sources. An expanded RET scheme began in January 2010 and was designed to ensure that at least 20 per cent of Australia’s electricity comes from large-scale renewable energy sources by 2020.

Under the RET liable entities (large purchasers of electricity, such as energy retailers and large energy users) must purchase a percentage of their electricity from renewable sources each year.

In 2014 the Federal Government appointed an independent panel to consider the 2020 target. Due to a fall in electricity demand, the scheme’s targets were heading towards around 27 per cent of Australia’s projected 2020 energy use, and an adjustment was necessary. Following the review, new legislation passed in June 2015 that reduced the large-scale new renewable energy target from 41,000 gigawatt hours to 33,000 gigawatt hours. Given a fall in electricity demand, the reduced target in combination with small-scale renewable energy and legacy hydro generation, is expected to equate to 23 per cent of the country’s electricity supply sourced from large-scale renewable energy by 2020.

Since January 2011 the RET has been split into two parts – the Small-scale Renewable Energy Scheme (SRES) and the Large-scale Renewable Energy Target (LRET).

How does the RET work?

The RET creates a floating-price market where certificates are currency. When renewable sources generate electricity, they can create Renewable Energy Certificates (RECs); one certificate can be created for each megawatt-hour of power generated. Entities that have an obligation under the RET are legally required to purchase a determined number of RECs and surrender them to the CER. Some trade-exposed energy-intensive industries are exempt, but the target is maintained by proportionally increasing the obligation on other electricity consumers.

SRES: Liable entities will receive a shortfall charge under the SRES if they fail to surrender all their STCs for any quarter of an assessment year or can choose to pay a shortfall charge rather than surrender certificates. The CER adjusts retailers’ SRES liability each year with the objective of achieving a fairly stable price of about $40 per certificate.

LRET: For LGCs, shortfalls can be carried forward (up to 10 per cent) or paid (over 10 per cent). Liable entities will receive a shortfall charge if they surrender 90 per cent or less of their total LGCs for an assessment year. However if more than 90 per cent are surrendered, the shortfall can be carried forward to the next assessment year. The legislated demand for 2019 is set at 31.2 million LGCs, an increase of 2.5 million LGCs from 2018. The CER states that as long as short-term prices remain higher than longer-term prices, deferral of liability through shortfall may continue.

The purpose of setting the liability on retailers is to use the power of competition to minimise the cost of procuring the new renewables by encouraging supply. While there has been commentary about the penalty shortfall being triggered, it is a useful element of the RET. The goal for the RET is to increase renewable energy in Australia, and there is no sense that this is should be achieved at any cost.

[i] Clean Energy Regulator, Large-scale generation certificate market update - February 2019

[ii] Clean Energy Regulator, Industry update on surrender of large-scale generation certificates

[iii] Clean Energy Regulator, Large-scale generation certificate market update - February 2019

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

2025 Election: A tale of two campaigns

The election has been called and the campaigning has started in earnest. With both major parties proposing a markedly different path to deliver the energy transition and to reach net zero, we take a look at what sits beneath the big headlines and analyse how the current Labor Government is tracking towards its targets, and how a potential future Coalition Government might deliver on their commitments.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.