Intermittent renewables: A balancing act

With increasing amount of intermittent generation entering the Australian National Electricity Market (NEM), there are reviews underway into their potential impact on energy security. The COAG Energy Council recently agreed to appoint an expert panel to consider energy security, while AEMO is looking at the effects of increased intermittent generation on the Frequency Control Ancillary Services (FCAS) market.

In Europe some countries have placed full balancing requirements on intermittent generators.

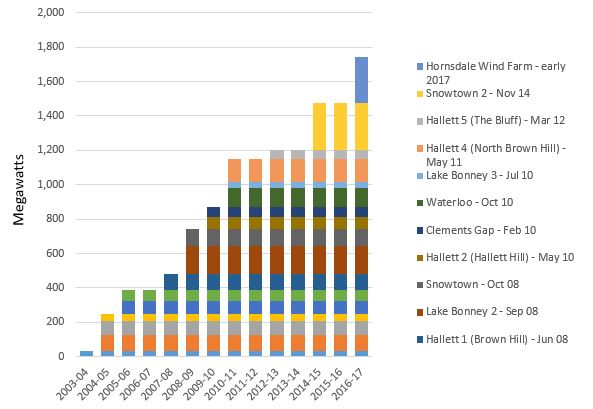

South Australia has built the most wind farms in Australia since the introduction of renewable schemes making it the leading renewable state. Figure 1 shows the installed wind capacity in South Australia since 2003-04.

Figure 1: Installed wind capacity in South Australia (project name – commissioned date)

Source: Electricity Gas Australia 2015, Australian Energy Council research

The majority of wind generators are being paid a fixed price, independent of the wholesale market outcomes and are having a material effect on the wholesale market. These payments occur through a contract called a Power Purchase Agreement. Generators are paid a fixed price for all the electricity they generate (and the Large-Scale Generation Certificates they create at the same time), irrespective of the prevailing pool price at the time of generation. These contracts are commonly negotiated by retailers who aim to procure their required Large-scale Generation Certificates. More recently, as seen in the ACT, reverse auctions are initiated by the State government where the winning bidder is awarded the contract. Generators subsidized at a fixed price are indifferent to spot price outcomes and can into bid energy into the market at almost zero or even negative prices. In the short term, when the wind is blowing or sun shining renewable generators can bid down the wholesale price to below the cost of production.

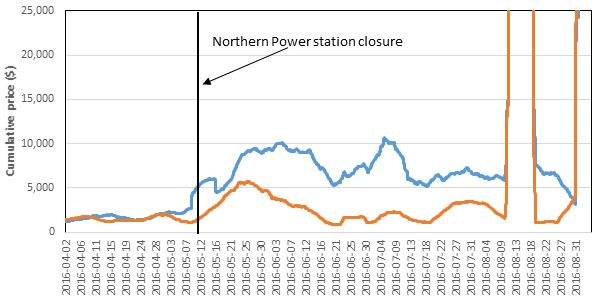

The closure of Northern power station led to increased price volatility in the ancillary services market. Lower and Raise regulated services correct minor deviation in frequency, within normal operating band of 49.85 Hz and 50.15 Hz. Capacity is bid into the market. The capacity if used, is paid the nominated price allocated by AEMO. Figure 2 shows the increased volatility in the aforementioned markets.

Figure 2: FCAS raise and FCAS lower prices in South Australia

Source: NEM-Review, Cumulative 7 day price is shown, 2016

The ancillary services market has been historically a low cost secondary market. Table 1 shows the total payments to the ancillary services market over the previous 5 years.

Table 1: Payments to Ancillary Services Providers in South Australia

|

Calendar Year |

Ancillary Services Payments |

|

2012 |

$9.0m |

|

2013 |

$7.3m |

|

2014 |

$4.4m |

|

2015 |

$38.1m |

|

2016 (Jan-Oct) |

$26.0m |

Source: AEMO, 2016

South Australia’s total consumption in 2014-15 was 11,957 GWh. Dividing the 2016 ancillary services payment by the annual usage suggests that ancillary services costs for 2016 financial year are equivalent to $2.17/MWh of energy consumed. Based on the 2014-15 wholesale price, this equates to an extra 5.5 per cent[i].

Currently, AEMO is working with stakeholders to produce a Future Power System Security Program. The program aims to identify long-term technical challenges in maintaining power system security along with the short-term solutions to problems being faced at the moment. One of the challenges forecast is the insufficient amount of available FCAS. AEMO notes that, although any technology can participate in the FCAS market if it is technically capable, these services have historically only been provided by synchronous generation, such as hydro, coal or gas plant. Synchronous generation is being displaced in some regions by asynchronous (and intermittently available) generation such as solar and wind plant, so, if the FCAS market does not encourage new participants to provide the service, there will come a time when insufficient FCAS is available to arrest frequency deviations[ii].

International approaches

Different markets have different outcomes and responsibilities when it comes to balancing electricity. These can happen in the form of a secondary market, where participants bid a certain amount of capacity to be controlled by the operators ahead of schedule, as seen in the NEM.

Other options include the aggregation of small generation and demand resources. The aggregator can be a retailer or a third party who acts as an intermediary between providers and buyers of flexibility.

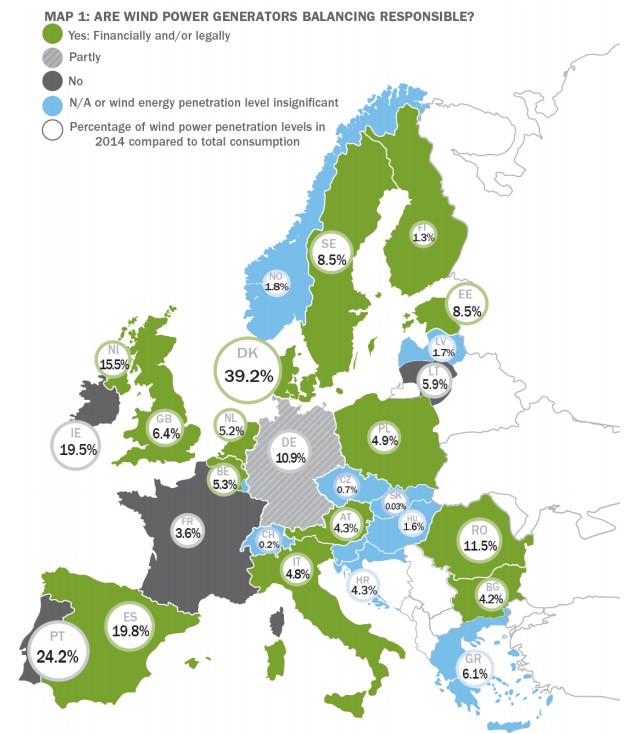

In Denmark, Finland, Estonia, Netherlands, Spain and Sweden, renewable sources have full balancing responsibilities. Where intermittent renewables are being treated as conventional generation in the sense they have the same obligations for their imbalance position. This encourages improved forecasting, but also competitive aggregators in the role to minimise balancing risks and offer ancillary services for renewable resources. This incentivises intermittent generators to act like firm generators, by entering into separate contracts with flexible operators and/or aggregators[iii] who may, for example, have flexible resources such as residential demand response and storage facilities.

European Wind Energy Association (EWAA) released its report Balancing Responsibility and Costs of Wind Power Plants in September 2015. The report analyses member countries of the EWAA and the policies surrounding existing and new intermittent generation. Figure 3 shows which countries place a balancing cost on wind generators and the proportion of their annual energy which is provided by wind.

Figure 3: Are wind power generators responsible for balancing their power?

Source: European Wind Energy Association, 2015

In 14 out of the 18 Member States where data was received, wind generators are financially or legally responsible for balancing energy. In these countries, wind power generators generally have the same balancing rules as conventional generators.

Would this approach work with the National Electricity Market?

At present, balancing services for the whole system are procured by AEMO using a combination of real time markets and other mechanisms (eg for regulation FCAS). The total costs are recharged to market participants using “causer pays”. So individual generators are generally not directly responsible for procuring balancing services to meet the requirements they may impose on the system. It would be a significant change to the NEM rules to implement this approach and it may be easier and allow for more efficient balancing services overall to refine the “causer pays” approach, to provide a sharper incentive to all types of generation to manage the impact they have on the system.

Either way, the need for a strong signal of accountability for balancing requirements will only increase if state governments such as Victoria and Queensland follow through on their plans to underwrite large quantities of renewable generation over a short period.

[i] EGA 2016

[ii] AEMO, “FUTURE POWER SYSTEM SECURITY PROGRAM”, https://www.aemo.com.au/Electricity/National-Electricity-Market-NEM/Security-and-reliability/-/media/823E457AEA5E43BE83DDD56767126BF2.ashx

[iii] Oxford Institute for Energy Studies, “Flexibility-Enabling Contracts in Electricity Markets”, https://www.oxfordenergy.org/wpcms/wp-content/uploads/2014/07/Flexibility-Enabling-Contracts-in-Electricity-Markets-EL-21.pdf

Related Analysis

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Community Power Network Trial: Potential risks and market impact

Australia leads the world in rooftop solar, yet renters, apartment dwellers and low-income households remain excluded from many of the benefits. Ausgrid’s proposed Community Power Network trial seeks to address this gap by installing and operating shared solar and batteries, with returns redistributed to local customers. While the model could broaden access, it also challenges the long-standing separation between monopoly networks and contestable markets, raising questions about precedent, competitive neutrality, cross-subsidies, and the potential for market distortion. We take a look at the trial’s design, its domestic and international precedents, associated risks and considerations, and the broader implications for the energy market.

Competition a key to VPP development: ACCC report

The Australian Competition and Consumer Commission’s most recent report on the electricity market provides good insights into the extent of emerging energy services such as virtual power plants (VPPs), electric vehicle tariffs and behavioural demand response programs. As highlighted by the focus in the ACCC’s report, retailers are actively engaging in innovation and new energy services, such as VPPs. Here we look at what the report found in relation to the emergence of VPPs, which are expected to play an important and growing role in the grid as more homes install solar with battery storage, the benefits that can accrue to customers, as well as potential areas for considerations to support this emerging new market.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.