Are higher wholesale prices the new norm?

Is a $100/MWh volume weighted average (VWA) wholesale price across all National Electricity Market (NEM) states likely to become a more common occurrence? The question arises because since July 2016 we have seen VWA prices in all NEM states reach more than $100/MWh on five occasions. Prior to 2016 this had not occurred. It appears to be driven by firm generation retiring as an increasing amount of intermittent generation comes into the market, the need for expensive short-term generation to fill supply gaps and the absence of national energy policy certainty.

Most recently, wholesale prices have jumped as a result of the announced (and now completed) closure of the Hazelwood Power Station in Victoria. It was the latest in a series of baseload power station closures that over time have impacted all states across the NEM. There is now less firm capacity available, not just within jurisdictions but also for export to other states.

This closure of firm generation has reduced oversupply as demand has begun to increase, partly due to increased demand in Queensland Liquefied Natural Gas (LNG) plants, as well as population growth and improvements in Australia’s economy. Future wholesale price contracts are up by 50 per cent since January in three of the four mainland states that make up the NEM and since 2011 wholesale electricity prices have more than doubled across the NEM.

A look at several high price incidents across 2016-17

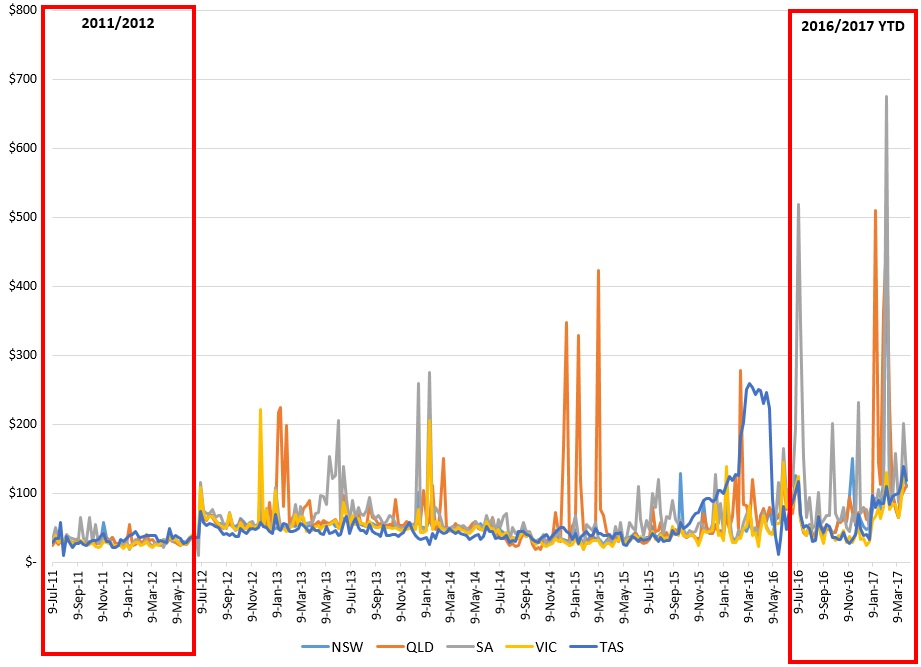

Higher average spot prices across the NEM have occurred because of lower firm supply as a result of plant outages and closures, as well as a lack of wind availability and interconnector issues also limiting supply at times. Additionally, an extended period of very high temperatures in the most recent summer led to higher demand for electricity in both NSW (which reached near record levels) and Queensland (which set a new peak demand record) while the availability of supplies from other states was limited. A closer look at high weekly volume weighted prices (VWA) across the NEM illustrates the impact all these factors have had on the VWP.

Figure 1: weekly volume weighted prices (VWP) across the NEM – 2011 to 2017

Source: NEM Review, AEC Analysis, 2017

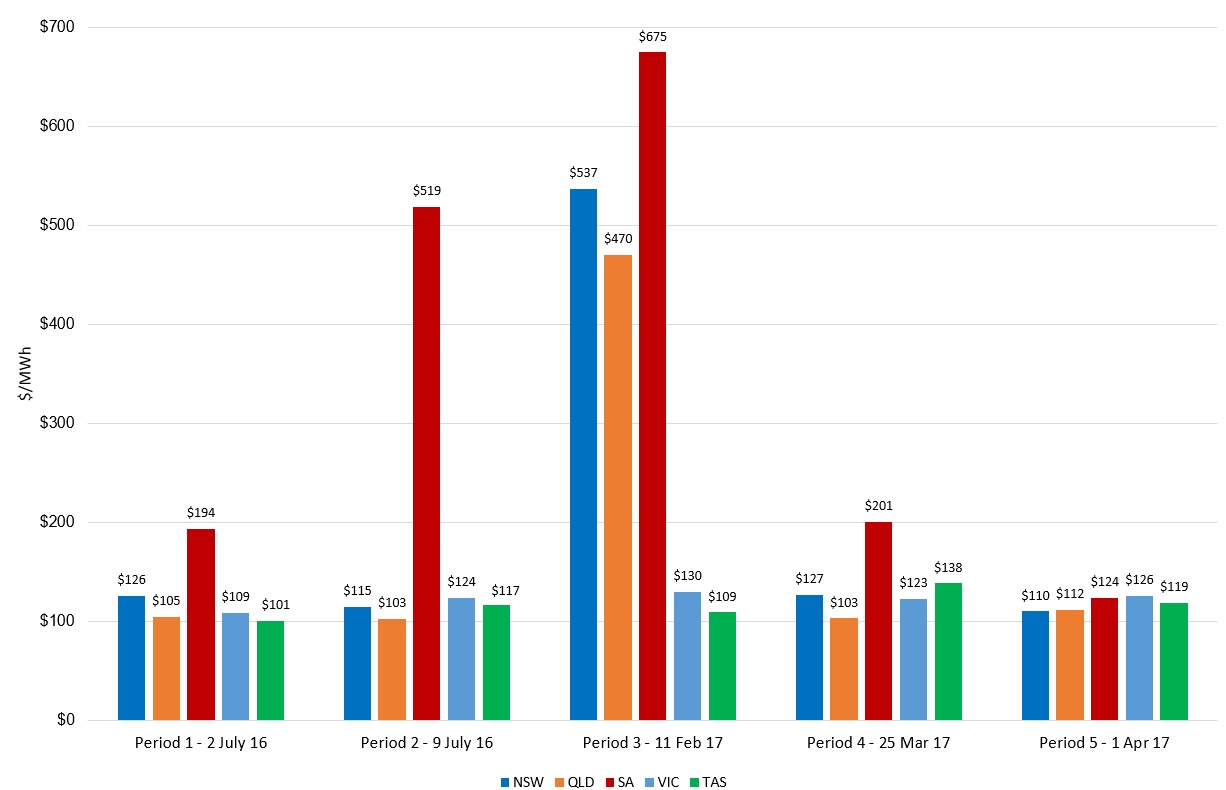

Figure 2 shows that there have been five occasions across the NEM in 2016-17 where the spot price spiked over $100/MWh - something that had not occurred prior to calendar year 2016. Over the five periods there were numerous reasons for the high weekly VWP across the NEM. These included:

- In July 2016 a planned outage restricted imports across the Heywood interconnector into South Australia and a period of low or no wind exacerbated supply conditions in South Australia.

- In February 2017 high temperatures led to high demand for electricity in both NSW and Queensland, with the higher power consumption reducing export availability to other states[i]. Prices also reflected South Australia’s blackout on 8 February which affected 90,000 households.

- In March 2017 the capacity of the Heywood and Basslink interconnectors were reduced[ii].

Impacts in one or two states can impact the whole NEM grid through a reduction in overall supply and limited ability to export across the interconnectors to balance supply and demand.

Figure 2: Five occasions where prices were over $100/MWh across the NEM

Source: NEM Review, AEC Analysis, 2017

Since the closure of South Australia’s Northern Power Station in April last year, the state is now sourcing almost half its electricity from intermittent generation. While other regions may have high renewable penetration, none are as singularly reliant on intermittent renewables as South Australia. As we have observed over the past year, managing a high intermittent generation electricity grid is materially different to the conventional baseload model of the 20th century.

Firm generation is increasingly required to operate as a counterweight to the growth of intermittent renewable supply, often at very short notice and for short durations, yet the increase in renewable generation can marginalise the business case for firm generation, and help accelerate the retirement of firm capacity. This reduction in supply and increased supply volatility in turn is increasing forward contract prices.

What are the implications for the future?

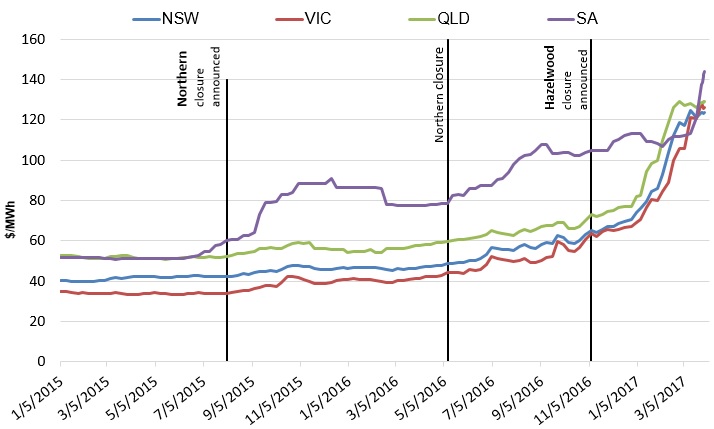

Increased volatility and the exit of baseload generation from the market is being reflected in increased future contract prices. Figure 3 shows future contract prices across NSW, SA, QLD and VIC.

Figure 3: Future contract prices for NSW, VIC, QLD and SA

Source: AEC Analysis, 2017

Figure 3 highlights the impacts that the closures of Northern and Hazelwood power stations have had on future wholesale prices. Without a stable national policy, and with ageing power stations closing and no signals for how they should be replaced about how they will be replaced, there is likely to be continued volatility in wholesale prices. The recent future contract price rises are the result of sustained policy changes at state and national level and, as a result, ongoing uncertainty. This is the inheritance of a lack of consistent, bipartisan energy policy across the NEM.

[i] AER Electricity market reports, << https://www.aer.gov.au/wholesale-markets/market-performance?f[0]=field_accc_aer_report_type%3A324 >>

[ii] NEM Review program

Related Analysis

Is increased volatility the new norm?

This year has showcased an increased level of volatility in the National Electricity Market (NEM). To date we have seen significant fluctuations in spot prices with prices hitting both maximum price caps on several occasions and ongoing growth in periods of negative prices with generation being curtailed at times. We took a closer look at why this is happening and the impact this could have on the grid in the future.

Is there a better way to manage AEMO’s costs?

The market operator performs a vital role in managing the electricity and gas systems and markets across Australia. In WA, AEMO recovers the costs of performing its functions via fees paid by market participants, based on expenditure approved by the State’s Economic Regulation Authority. In the last few years, AEMO’s costs have sky-rocketed in WA driven in part by the amount of market reform and the challenges of budgeting projects that are not adequately defined. Here we take a look at how AEMO’s costs have escalated, proposed changes to the allowable revenue framework, and what can be done to keep a lid on costs.

Retail protection reviews – A view from the frontline

The Australian Energy Regulator (AER) and the Essential Services Commission (ESC) have released separate papers to review and consult on changes to their respective regulation around payment difficulty. Many elements of the proposed changes focus on the interactions between an energy retailer’s call-centre and their hardship customers, we visited one of these call centres to understand how these frameworks are implemented in practice. Drawing on this experience, we take a look at the reviews that are underway.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.