A solar challenge: Managing rooftop systems

The need to better manage the amount of solar PV generation produced on Australian rooftops was one focus of the Renewable Integration Study: Stage 1 report released last week. While outlining the potential for renewable generation in the grid, the study released by Australian Energy Market Operator (AEMO) also illustrates the hurdles that need to be met.

The report flags the mounting challenge that comes from the current invisibility of behind-the-meter solar to the market operator, along with its inability to control the output of an electricity source that exceeds the output of the largest individual generator.

Australia’s rooftop solar capacity is world leading and a significant source of electricity. The National Electricity Market (NEM) has peak demand of around 34GW with generating capacity of 48GW[i] . There is estimated to be 9GW[ii] of rooftop solar in the NEM today and 10.7GW across Australia, which is produced by more than 2.3 million solar installations[iii]. The NEM’s rooftop PV capacity is forecast to increase to 14GW or more in the next 10 years.

So how best to manage this growing capacity?

Load volatility

AEMO devoted an appendix to the issue and has outlined a range of proposals to address the overall system operational risks (shown in table 2). A paramount challenge is that during daytime and particularly on mild, sunny days, significant output from rooftop panels can impact grid loads. Solar PV output can also rapidly and dramatically reduce output or stop producing because of changing weather conditions, while solar inverters can be tripped by voltage fluctuations.

Apart from creating increasingly volatile spot prices[iv] which we have looked at previously (see Record negative prices set) extreme net load volatility risks excessive voltage swings, “overloading of components, protection operation issues or loss of supply if not appropriately managed”.

Energy networks are the first to be impacted as local areas see more solar systems installed, but as solar PV becomes significant at an overall system level the inability of the operator to see and actively manage the solar panels can impact “almost all core duties of the system operator in some way – including system balancing, power system stability, and recovery and restoration following major system events”.

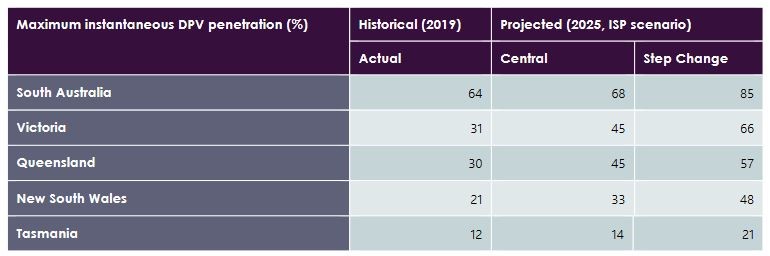

The challenge varies by region. In terms of percentage of dwellings with solar, Queensland has 35.7 per cent and South Australia has 35 per cent[v]. And when assessing how much demand is met by rooftop PV, last year SA reached 64 per cent. It is already the state’s biggest generator with about 1300MW of capacity[vi], and AEMO projects that this could be 84 per cent by 2025. Queensland by comparison met 30 per cent of its demand last year. But Queensland and other mainland NEM regions could be regularly operating at around or over 50 per cent instantaneous penetration by 2025 (see table 1).

Table 1: Historical and Projected Maximum Instantaneous Penetration of Solar PV

Note: Projections based on AEMO’s Integrated System Plan scenarios / Source: Renewable Integration Study

The challenge of managing solar PV was also identified as an issue for Western Australia’s South West Interconnected System (SWIS) with the State Government recently releasing a Distributed Energy Resources Roadmap (see DER: Does WA’s roadmap set the right direction?).

Almost a third of all WA homes have solar panels installed and around 2000 are adding a system each month. This has made solar PV (at 1100MW) the largest single source of generation in the SWIS. It means daytime demand falls and becomes more pronounced during mild, sunny days as PV picks up during the middle of the day before falling away late in the afternoon when demand picks up.

What to do?

Increasing levels of passive rooftop solar generation has started to impact AEMO’s ability to securely operate the SA power system today, and are beginning to impact operation in other NEM regions.

To tackle it, AEMO is recommending that over the next year the sector needs to develop minimum technical standards and device level requirements for rooftop solar to cover power system security, along with cyber security needs, communication and interoperability.

AEMO intends to mandate minimum device requirements for new installations in SA and other NEM regions (while WA will be encouraged to follow suite) so they can be remotely disconnected. It will also investigate whether existing solar PV needs to comply with these regional generation shedding requirements.

The market operator’s assessments to date have found that generation shedding capability as a back-stop measure is “essential”. In the short term, its study found, secure integration of rooftop solar generation into the grid urgently needs a level of generation shedding capability over enough rooftop panels during extreme system conditions.

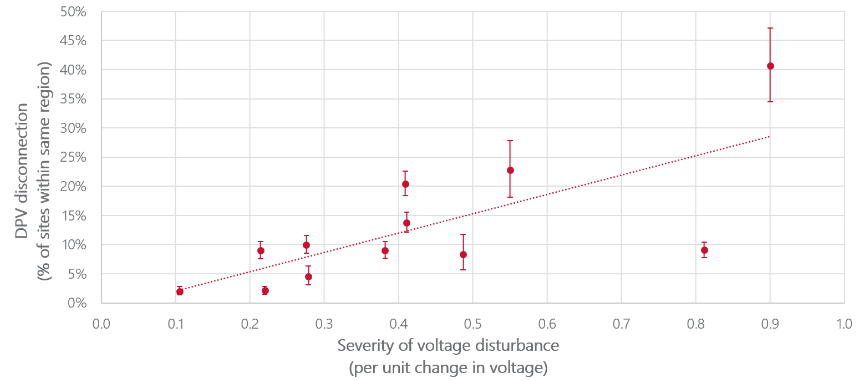

AEMO also wants new inverters for rooftop solar systems to be able to ride through voltage disturbances. The impact of voltage disturbances on residential PV systems can be seen in Figure 1.

Figure 1: Solar PV disconnection behaviour following historical voltage disturbances

Note: DPV = Distributed Solar PV /

Note: DPV = Distributed Solar PV /

Source: Renewable Integration Study Stage 1 Appendix A

On the last point, there is already work underway to fast track the need for all new solar PV inverters in SA and WA (with other NEM regions encouraged) to be able to ride-through voltage disturbances to avoid trips. There is also a review to assess the need to update existing systems to comply with this requirement, which could involve retrofitting.

It will look to update the national standard for inverters to incorporate “bulk system disturbance withstand and autonomous grid support capability”. Other measures recommended by AEMO are shown in the following table.

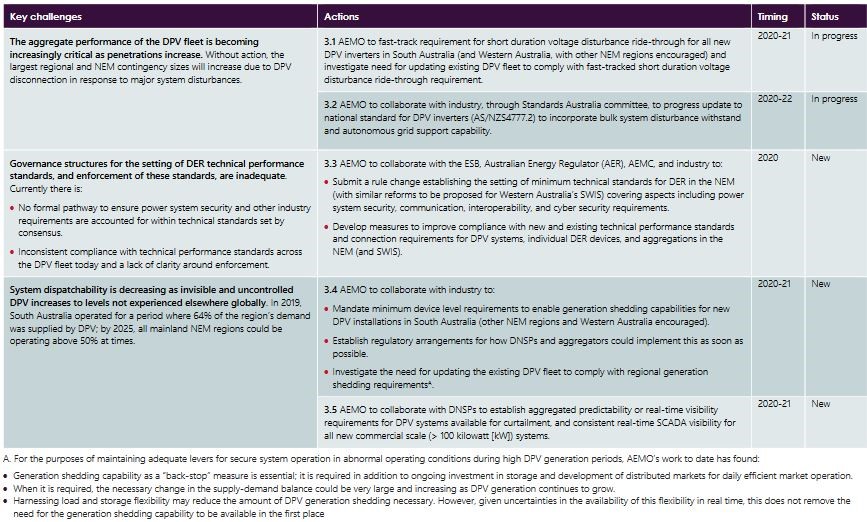

Table 2: Key Actions *view larger image here

AEMO flags that in the absence of these reforms, it will need to put “hard” limits on passive rooftop solar, which could lead to moratoriums on new installations or costly retrofits of existing systems.

One key action is to establish real-time visibility or better predictability of how much power rooftop solar is providing.

The assessment is that in the longer term, integration of solar PV generation will require active daily management with other distributed energy resources to be able to align load and behind-the-meter generation with overall power system needs.

AEMO notes: “DPV [distributed solar PV] generation shedding capability will require a level of visibility or predictability over the generation available for shedding at any given time in order to quantify the secure technical operating envelope of the power system.”

[i] Annual generation capacity and peak demand – NEM, Australian Energy Regulator

[ii] Renewable Integration Study, Stage 1 Report, Australian Energy Market Operator

[iii] Solar Report Q1, 2020, Australian Energy Council

[iv] AEMC Economic Insights

[v] Australian PV Institute

[vi] “Solar rooftops put the heat on the energy grid”, Australian Financial Review, 7 May 2020

Related Analysis

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Community Power Network Trial: Potential risks and market impact

Australia leads the world in rooftop solar, yet renters, apartment dwellers and low-income households remain excluded from many of the benefits. Ausgrid’s proposed Community Power Network trial seeks to address this gap by installing and operating shared solar and batteries, with returns redistributed to local customers. While the model could broaden access, it also challenges the long-standing separation between monopoly networks and contestable markets, raising questions about precedent, competitive neutrality, cross-subsidies, and the potential for market distortion. We take a look at the trial’s design, its domestic and international precedents, associated risks and considerations, and the broader implications for the energy market.

Judicial review in environmental law – in the public interest or a public nuisance?

As the Federal Government pursues its productivity agenda, environmental approval processes are under scrutiny. While faster approvals could help, they will remain subject to judicial review. Traditionally, judicial review battles focused on fossil fuel projects, but in recent years it has been used to challenge and delay clean energy developments. This plot twist is complicating efforts to meet 2030 emissions targets and does not look like going away any time soon. Here, we examine the politics of judicial review, its impact on the energy transition, and options for reform.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.