A peek at community attitudes and awareness towards the energy transition

Almost half a century ago US President Jimmy Carter popularised the term ‘energy transition’[i] , and since then, the level of attention in Australia given to our current move to a lower emissions grid has continued to grow. This week the Federal Government announced a range of budget measures to help accelerate and support the energy transition. Given this, it is somewhat surprising that a new survey of attitudes and understanding around the transition in Australia shows only one in four Australians say they have heard of the term (28 per cent), with only 23 per cent of those aged 35 and under being aware of the concept of the energy transition. While awareness of the phrase increased five per cent since the previous year, it suggests there is scope and a need for government, regulatory bodies and energy participants to continue to work to increase awareness of what the transition involves and the implications of the shift.

Recent surveys from KPMG, SEC Newgate and the CSIRO also indicate cost-of-living pressures are having some impact on the appetite for the energy transition, which can only make the challenge of bringing the community along with the changes even more pressing. We take a look in more detail at the surveys’ findings below.

Awareness of Key Concepts

While awareness in the term ‘energy transition’ is low, Australians are aware of other key concepts such as ‘renewable energy’ (77 per cent) or ‘clean energy’ (68 per cent). Encouragingly, KPMG’s The Human Side of the Energy Transition found the public’s understanding of key energy sector terms has increased year on year, with the term ‘net zero’ seeing the largest increase (52 per cent to 59 per cent).[ii]

Figure 1: Understanding of energy sector terms

Source: KPMG: The Human Side of the Transition

Yet the level of knowledge about specific energy technologies remains low.

The CSIRO undertook research on attitudes in what it described as the “most comprehensive survey of Australians’ attitudes toward the renewable energy transition”[iii]. The survey found the highest level of knowledge of energy technology was for rooftop solar (2.9 on a scale of 1 – 5 with 5 being the highest knowledge). There was limited knowledge on other forms of technology (see figure).

Figure 2: Knowledge about energy technology

Source: CSIRO: Energy Transition Survey

The data from the CSIRO and KPMG suggest there is an opportunity to shift the conversation around the energy transition to not just the types of renewable generation, but to the opportunities, changes and impact this will have on communities and the greater economy.

Young people lead the charge

Despite having a relative lack of awareness and greater diffusion of responsibility, those aged under 35 show a willingness to accepting a lower standard of living, are more willing to pay more in taxes, invest in renewable technology, upgrade their homes and are open to changing their financial commitments to help encourage the transition to renewable energy. On top of this, they have expressed enthusiasm for the emerging jobs and opportunities the transition will bring.[iv]

Younger Australians are also embracing sustainable practices, with 69 per cent using public transport instead of driving and 63 per cent actively encouraging others to adopt eco-friendly behaviours. Those aged under 35 were almost two times more likely to purchase environmentally friendly products (59 per cent) compared with those aged over 55 (32 per cent).

In contrast those aged over 55 show a lack of interest in making active changes to support the transition, when compared with those aged under 35. Again, those aged over 55 are unwilling to change their personal financial investments to more ethical and sustainability related investment options (13 per cent compared to 48 per cent) and are unwilling to shift to a ‘green’ energy retailer (28 per cent compared to 48 per cent).

Figure 3: Active changes made to help with the transition

Source: KPMG: The Human Side of Energy Transition

This data was backed up with SEC Newgate’s Mood of the Nation April 2024 report[v]. Less than 50 per cent of respondents aged over 55 had positive attitudes towards the shift towards renewables (47 per cent) compared to two thirds of those aged below 35 (66 per cent), and those aged 55 and above were twice as likely to believe the energy transition was happening too quickly when compared to those aged under 35 (26 per cent compared to 13)[vi].

Surprisingly, almost half of those aged 35 and under believe tackling climate change is the responsibility of large emitters of pollution only, compared to those aged 35 to 54 (29 per cent) and those aged 55 and over (22 per cent).

Hitting the hip pocket nerve

One of the key findings across the CSIRO survey, the KPMG report and SEC Newgate’s Mood of the Nation report is that Australians are supportive of change towards an increasingly renewables grid, but with cost-of-living pressures and energy affordability remaining a high priority, this support has been decreasing.

The three reports found most people don’t want to pay more or risk blackouts for a faster transition. A majority surveyed by the CSIRO strongly disagreed or disagreed with paying more for electricity (64 per cent), gas (62 per cent) or risking more blackouts (58 per cent) but were a bit more receptive to the idea of shifting their household electricity use to non-peak times[vii]. KPMG found consumer willingness to pay higher taxes to support the transition had dipped eight per cent year-on-year to 28 per cent, along with overall support for the transition which dropped four per cent (63 per cent). Adding to this, SEC Newgate saw a drop of seven per cent in those who rated climate change action as extremely important since February 2024 (34 per cent). This figure has dropped 14 per cent since March 2022.

Given the challenges we have seen to gain a social licence for new energy infrastructure in part of the country, the survey’s highlight mixed views depending on location.

Based on a hypothetical situation of living within 10 kilometres of renewable infrastructure, 80 per cent of people would tolerate it. According to the CSIRO, at this stage many Australians have moderate views about living near renewable energy infrastructure, which “suggests a broad willingness to support, or at least tolerate, the development of solar farms, onshore and offshore windfarms, and transmission infrastructure”.

The overall attitude and feelings towards living near renewable infrastructure can be seen in the two figures below. Solar farms had the highest level of acceptance, although attitudes to solar farms were less favourable in 2023 (88 per cent would at least tolerate living near a solar farm) compared with an earlier survey conducted in 2020 (95 per cent).

More than 80 per cent of people surveyed would at least tolerate or be okay with living near a windfarm. However, those in proposed offshore windfarm regions were more likely to reject living near them.

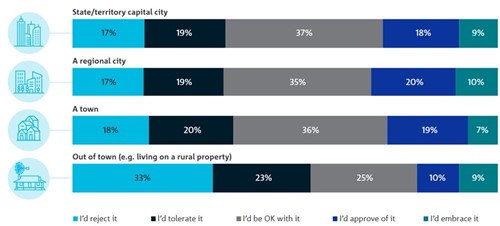

Views were fairly consistent between those living in capital cities, regional cities and towns, but more negative views emerge with those living out-of-town. More people were opposed to living near transmission lines and this again was most noticeable for those living out-of-town (see figures below), according to the CSIRO assessment. This clearly highlights the hurdles being faced for planned new transmission lines in regional areas, as we have already seen via public campaigns.

Source: CSIRO

Source: CSIRO

Similarly, support for new renewable generation has dropped, according to SEC Newgate’s findings. Solar farms, hydro-electric power and waste-to-energy projects, which all see the highest amount of support, have experienced a decrease since February’s report. Support for solar dropped four per cent (75 per cent), hydro-electric power dropped five per cent (73 per cent) and waste to energy dipped two per cent (75 per cent). Support for onshore wind dropped five per cent (63 per cent) and offshore dropped two percent (62 per cent).

Over the past 12 months, the debate around the role nuclear energy could play in Australia’s transition has intensified, with the Liberal Party publicly supporting nuclear plants. Support for nuclear however, has not increased substantially since October 2023, with SEC Newgate only seeing a two per cent increase in support (40 per cent) in the past seven months.

While support for new renewable generation has dropped, support for new coal-fired plants and gas-fired plants has increased, albeit off a low base. Gas-fired generation increased to 36 per cent support, an increase of six per cent, while coal-fired generation increased five per cent to 33 per cent. This increase in support for fossil fuel generation is consistent with KPMG’s findings and likely reflects the increased public debate about reliability of the energy system. There was also a decline of five per cent in support for phasing out all fossil fuel generation completely as soon as possible and relying completely on renewable generation (20 per cent) while there was an increase in support for investing and prioritising renewable generation while also keeping coal and gas in the system.

Figure 4: Support for new electricity generation projects

Source: SEC Newgate: Mood of the Nation, April 2024.

Conclusion

Whilst there has been work undertaken by governments, market bodies and energy market participants on educating the public on the energy transition, this latest research from the CSIRO, KPMG and SEC Newgate suggests more work is needed particularly as the transition will need to accelerate and with it, the need to maintain a social licence for change will mount. The challenge of continuing to bring the community along with what is a once-in-a-century transition is currently being made all the more challenging by the cost-of-living pressures and higher energy bills that households and businesses have faced. It all adds up to the need for a lot more work to be done.

[i] https://manhattan.institute/article/x-raying-the-reality-and-origin-of-a-hollow-phrase-energy-transition

[ii] KPMG surveyed around 1000 Australians in November 2023, with the demographic of those canvassed being inline with proportions that represent that Australian population according to the Australian Bureau of Statistics.

[iii] The CSIRO survey canvassed more than 6,700 people in all states and territories, capital cities and regional areas, between August and September 2023.

[iv] https://assets.kpmg.com/content/dam/kpmg/au/pdf/2024/human-side-of-energy-transition.pdf

[v] SEC Newgate’s Mood of the Nation, April 2024 canvassed 1,208 Australians aged 18+ in late April 2024, with quotas being set on gender, age and location.

[vi] https://www.secnewgate.com.au/mood-of-the-nation-april-2024-summary/

[vii] https://publications.csiro.au/publications/publication/PIcsiro:EP2024-1146

Related Analysis

Getting it right: How to make the “Solar Sharer” work for everyone

On paper, the government’s proposed "Solar Sharer Offer" (SSO) sounds like the kind of policy win that everyone should cheer for. The pitch is delightful: Australia has too much solar power in the middle of the day; the grid is literally overflowing with sunshine: let’s give households free energy during 11am and 2pm. But as the economist Milton Friedman famously warned, "There is no such thing as a free lunch." Here is a no-nonsense guide to making the SSO work.

Nuclear Fusion Deals – Based on reality or a dream?

Last week, Italian energy company ENI announced a $1 billion (USD) purchase of electricity from U.S.-based Commonwealth Fusion Systems (CFS), described as the world’s leading commercial fusion energy company and backed by Bill Gates’ Breakthrough Energy Ventures. CFS plans to start building its Arc facility in 2027–28, targeting electricity supply to the grid in the early 2030s. Earlier this year, Google also signed a commercial agreement with CFS. These are considered the world’s first commercial fusion-power deals. While they offer optimism for fusion as a clean, abundant energy source, they also recall decades of “breakthrough” announcements that have yet to deliver practical, grid-ready power. The key question remains: how close is fusion to being not only proven, but scalable and commercially viable, and which projects worldwide are shaping its future?

Community Power Network Trial: Potential risks and market impact

Australia leads the world in rooftop solar, yet renters, apartment dwellers and low-income households remain excluded from many of the benefits. Ausgrid’s proposed Community Power Network trial seeks to address this gap by installing and operating shared solar and batteries, with returns redistributed to local customers. While the model could broaden access, it also challenges the long-standing separation between monopoly networks and contestable markets, raising questions about precedent, competitive neutrality, cross-subsidies, and the potential for market distortion. We take a look at the trial’s design, its domestic and international precedents, associated risks and considerations, and the broader implications for the energy market.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.