New York State of mind: Lessons from ambitious targets for clean energy goals

A new McKinsey & Company report looks at the state of New York, which recently passed the Climate and Community Protection Act that details goals to increase the state’s renewable energy production to 70 per cent by 2030, and 100 per cent zero-emissions electricity by 2040.

The Act initially targets the power sector to fast-track the rate of decarbonisation – which also means the electrification of other sectors will occur on a cleaner grid.

McKinsey notes that New York State provides an important case study that could prove useful to other international markets, as more regions move away from power sectors that rely on coal. The European Union plans to achieve 100 per cent decarbonisation for the whole economy - not just the power sector - by 2050. Australia is expected to continue to increase its renewable generation and storage capacities, and has announced plans for new pumped hydro, such as Snowy 2.0 and the Battery of the Nation. While China is building more solar, nuclear and natural-gas.

McKinsey notes that while New York is not comparable to other international markets the state could still be looked at as a test case, not just in the use of policies and aggressive targets to meet clean-power generation, but at the order in which it could be rolled-out.

Last year non-hydro renewables (wind, solar, biomass) made up around 5 per cent of the state’s electricity generation. Generation was mainly sourced from fossil fuels predominately from gas and dual-fuel oil and gas (41 per cent), nuclear power (32 per cent), and hydro (21 per cent). New gas pipelines have been restricted in the state, while there are currently no plans to build new hydro-electric plants.

So what needs to happen for New York State to reach its ambitious goals?

Ambitious targets

The United States has seen a surge in states and cities announcing 100 per cent clean power targets and goals in the next 20-30 years. McKinsey notes that meeting these targets will require “extensive efforts” across different sectors, “successful bets” on technology, and policy changes that incorporate market incentives, costs, customer acceptance and interconnections with nearby regions.

New York State’s Protection Act details specific clean-energy goals, aiming for:

- 70 per cent renewable energy production by 2030 (currently 26 per cent with hydroelectric making up over 80 per cent);

- 100 per cent zero-emissions electricity (including hydropower and nuclear) by 2040; and,

- a reduction in greenhouse-gas (GHG) emissions of 40 per cent by 2030 and 85 per cent by 2050 (compared to 1990 levels).

To achieve this, the Act focusses on the rapid deployment of specific technologies, including:

- 9GW of offshore wind by 2035 (compared to none now);

- 6GW of distributed solar generation by 2025 (compared to 1.6 GW as of 2018);

- 3GW of energy storage by 2030 (compared to very little now); and,

- a 60 per cent increase in energy efficiency by 2030.

Aspiration implications

McKinsey’s report models the Act’s decarbonisation goals to identify the potential implications on the state’s infrastructure. It considers all types of generation, the retirement of generation assets, weather and demand, and the subsequent effects of the electrification of heating and transport. And while it measures costs, it does not model the customer end-costs. McKinsey’s modelling found:

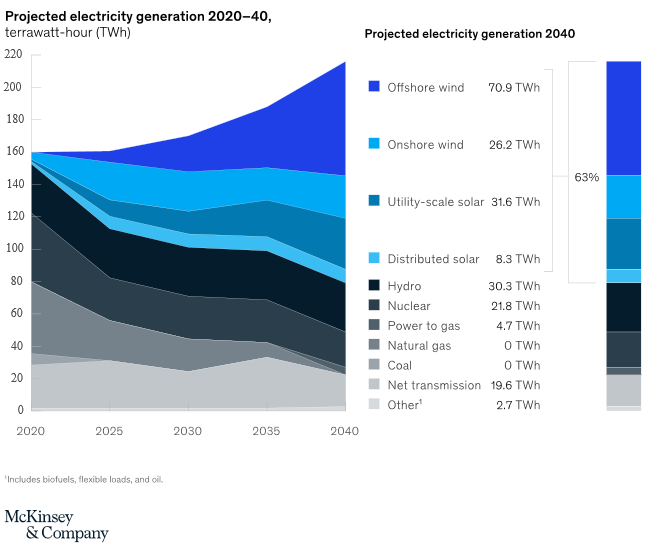

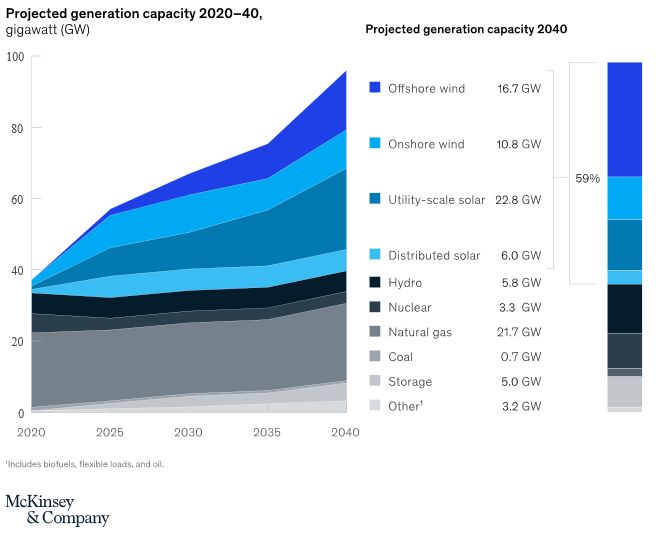

- Around 60 per cent of the state’s electricity will come from wind and solar by 2040 (figure 1), while offshore wind, onshore wind, and solar will mainly replace conventional fuels and provide more than 60 per cent of New York State’s electricity by 2040 (figure 2) - therefore, improving grid flexibility will require using a wide range of options.

Figure 1: Projected electricity generation

Figure 2: Projected generation capacity

- Decarbonising power generation will not be enough: The state’s power sector accounts for 17 per cent of its GHG emissions. But McKinsey believes that heating electrification is going to be more challenging, given the economics of electric heat pumps and the difficulty of retrofitting existing buildings.

- Demand for power will increase: While demand has been flat or falling, it will rise if cars and buildings go electric. McKinsey project the state’s electric load will grow by one third (51tWh) by 2040.

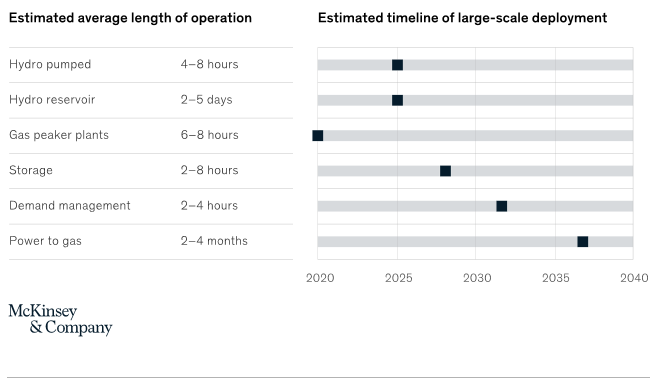

- Market structures need to change: New York State has a variable climate, and while battery storage could help, there could be times where conventional power-generation assets, such as combined-cycle natural-gas plants, will need to fill the gaps.

- The role of natural gas: McKinsey suggest that natural-gas plants will be an essential source of grid flexibility and stability, but investing to keep them operational could be "controversial" because of their GHG emissions. While a few power-to-gas plants exist, costs will need to drop if it is to be deployed on a large scale. For buildings, converting from natural gas to electric heat pumps is costly with difficult logistics.

Figure 3: Estimated operation and deployment

- Hydropower use increases: McKinsey’s modelling shows that like Australia it is targeting pumped hydro to help with the heavy lifting. Pumped hydro is expected to move from five to ten days of “substantial usage” a year to more than 250 days. It notes that the way in which these assets are operated will need to change accordingly, allowing for faster ramp-up times.

- Flows will reverse: Currently there is a transmission flow south of about 5 GW from hydro and four nuclear plants that are upstate. In the future, downstate will likely account for relatively more offshore-wind and distributed-solar generation. By 2030, north-to-south flows could sometimes be closer to zero, and eventually, the flow could reverse, if that happens grid upgrades and changes to how the network is operated will be required.

- Transmission and distribution networks will need to adapt: McKinsey suggest that 17 GW of offshore-wind assets, 11 GW of onshore-wind assets, and 23 GW of utility-scale-solar assets will need to be connected to the grid, to meet the state’s 2040 goals. This will require major investments and improvements in transmission grids. Distribution grids will also need to be extended and modernised due to the increased demand from EVs and building heat, and will require new ways of managing that demand.

- Managing demand will likely become more important. With an expected future increase in the intermittency of the state’s power supply, demand response and load-shifting programs will be needed to incentivise consumers to reduce their power use when needed to balance the grid. With more EVs, vehicle-to-grid approaches could play an increasingly important role to manage demand (although, it is possible to sell excess energy stored in EV batteries back to the grid). However the report notes that there are a few vehicle-to-grid projects, and identifying the most effective market will be difficult.

- Transition investment. While the costs of wind and solar have dropped over the past decade, there will be a need for capacity to backup their intermittency, the build-out of grids, the replacement of existing conventional infrastructure, and the electrification of heat and transport. McKinsey estimate that new generation and storage—and associated transmission interconnects— could cost an additional $30 billion through to 2040.

Not easy, but not impossible

McKinsey notes that while this transition to essentially non-hydro renewables will not be easy, it points to the United Kingdom where 8GW of offshore wind has been installed over the past decade. It also notes that Texas has 22.5GW of onshore wind, compared to 11GW that New York State would need to add by 2030. New York also shows promising possibilities with installed solar capacity rising more than tenfold across the state since 2012.

While its transition to clean energy has just started, New York State is still ahead of many other US regions. And no doubt, there will be many international observers looking to learn from their journey.

Related Analysis

The ‘f’ word that’s critical to ensuring a successful global energy transition

You might not be aware but there’s a new ‘f’ word being floated in the energy industry. Ok, maybe it’s not that new, but it is becoming increasingly important as the world transitions to a low emissions energy system. That word is flexibility. The concept of flexibility came up time and time again at the recent International Electricity Summit held in in Sendai, Japan, which considered how the energy transition is being navigated globally. Read more

International Energy Summit: The State of the Global Energy Transition

Australian Energy Council CEO Louisa Kinnear and the Energy Networks Australia CEO and Chair, Dom van den Berg and John Cleland recently attended the International Electricity Summit. Held every 18 months, the Summit brings together leaders from across the globe to share updates on energy markets around the world and the opportunities and challenges being faced as the world collectively transitions to net zero. We take a look at what was discussed.

Great British Energy – The UK’s new state-owned energy company

Last week’s UK election saw the Labour Party return to government after 14 years in opposition. Their emphatic win – the largest majority in a quarter of a century - delivered a mandate to implement their party manifesto, including a promise to set up Great British Energy (GB Energy), a publicly-owned and independently-run energy company which aims to deliver cheaper energy bills and cleaner power. So what is GB Energy and how will it work? We take a closer look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.