A Battery for SA: Durable or barely energised?

Last week the South Australian Government announced that Tesla Inc. had won the tender to build utility-scale battery storage in time for the coming summer. We take a look at how valuable this will be for South Australia.

The Big Picture

South Australia sources around 52 per cent of its local generation from intermittent sources, mainly wind (42.7 per cent) and solar (9 per cent). Given interconnectors supply only around 25 per cent of peak demand, the SA electricity grid is dependent on the highest level of intermittent generation in the world.

South Australia’s peak five-minute demand over the past five years was 3,259MW[i], and its annual consumption is about 12,000GWh[ii]. It has about 4,700MW of generation within the state[iii] (of which 2,900MW is scheduled), and can source 870MW of generation via interconnections with Victoria.

It’s therefore useful to accelerate the deployment of storage technologies, to see how these work in real time at a commercial level, to increase both system security and reliability and to assess their potential impact on wholesale prices.

Tesla’s proposed battery will be paired with Neoen’s Hornsdale Wind Farm, a 315MW project with 99 wind turbines located about 200km north of Adelaide. It will be able to supply 100MW instantaneously (about 3 per cent of SA’s demand) and 129MWh, or about an hour and a quarter at its full discharge rate. There have been reports that the battery will be configured to provide 70MW of Frequency Control Ancillary Services (FCAS) for 10 minutes and 30MW of energy for three hours[iv].

Tesla’s battery may be the largest battery in the world, but it is still relatively small part of a relatively small market like South Australia. 100MW can perform a useful role to manage system security under some specific conditions (should they arise and the battery be charged), but this first foray into large scale storage is particularly valuable for what we learn from it. Specifically, how does the battery operate in real time to maximise its revenues that will come from both providing ancillary services and higher wholesale prices? A successful commercial trial may incentivise other storage technologies to enter the market sooner.

In this regard it may have been preferable for the South Australian Government to spread the trial across three or four different smaller storage projects. This would have allowed the market to compare different technologies and how they operate. If the Tesla battery is located behind the connection point at the wind farm its operation may not be visible to other market participants. There is also a risk its commercial performance will not be visible and most of the important learning will be done by Tesla, not the market.

There are also potentially valuable lessons about how different applications of energy storage work. Would the battery be more useful if it were located closer to the regional reference node? How does a storage device attached to a wind farm operate differently to a solar linked battery, or a stand-alone battery? How do longer discharge technologies like pumped storage compare to chemical batteries? What is the optimal capacity and discharge duration? Is an hour enough? These are valuable comparative questions that we will not find many answers to with a single 100MW Tesla battery located at the Hornsdale wind farm. We assume this location was chosen primarily to expedite grid connection than for any other strategic reason.

Modelling the Battery’s Contribution

So how would the Tesla battery operate under the most extreme conditions experienced in South Australia? How much could it help manage the severe demand peaks of an extended heatwave?

It is assumed that the wind farm will keep the Tesla battery “topped up” when pool prices are low, and it will discharge when power prices are sufficiently high, but such operational decisions will need to be made by considering expected market prices.

For each five minute dispatch interval, the available generation and demand can be determined from AEMO’s data. While supply in SA comes from both local generation and the interconnectors, a simple means of assessing the proposed battery is to consider the battery’s output when available generation falls below zero, i.e. the state is dependent upon imports to maintain security.

Ostensibly the 70MW FCAS support component is sized to allow fast-start generation to synchronise to the network, and this assumes that plant (and its requisite fuel) is available when required.

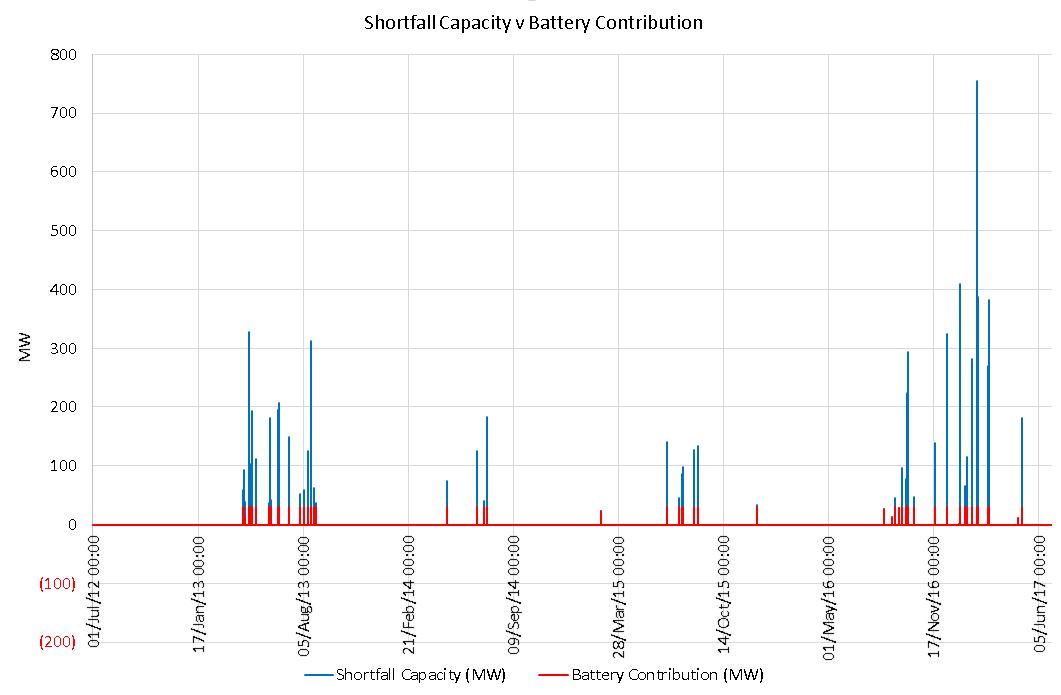

If the remaining component of the battery (30MW and 90MWh) is modelled using market data at five minute resolution from the past five financial years[v], we can see that there are a number of shortfalls which can’t be addressed by the battery, either because its size is too small, or its capacity is too limited.

Figure 1: Shortfall Capacity v Battery Contribution for the past five financial years

Source: AEC analysis based on NEM-Review data

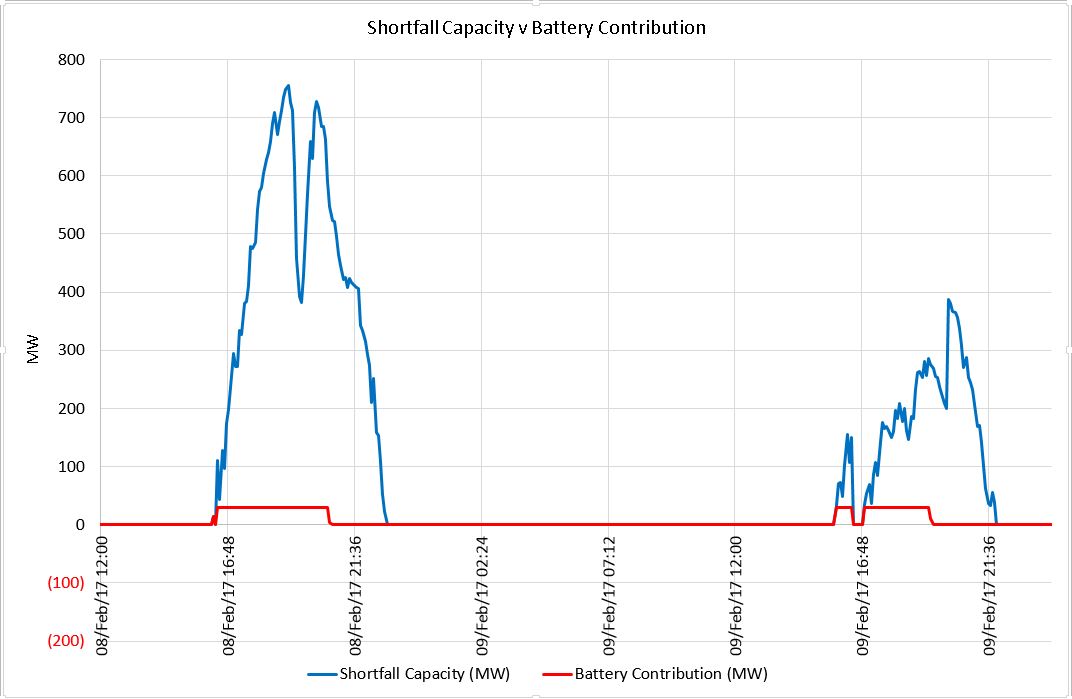

To provide more understanding on how the battery would be working, we can drill down to 8 and 9 February 2017 when there was high demand in South Australia due to extreme heat. This caused AEMO to shed load (on the 8th) and direct plant to run (on the 9th) due to concern that local generation capacity and interconnector capacity was insufficient.

In this case, the battery might have run as follows:

Figure 2: Shortfall Capacity v Battery Contribution on 8-9 February 2017

Source: AEC analysis based on NEM-Review data

On each of the days, this shows the battery discharging to meet the shortfall in capacity until it is exhausted, in three hours. The AEMO anticipated shortfall is present throughout and continues once the battery is depleted. At that time the battery is no further use until the system has sufficient surplus to recharge the battery.

Prices overnight between 8 and 9 February remained high due to the extended heat, and the volume-weighted cost of replenishing the battery would have been $146/MWh – but the recharging would have been handsomely rewarded since the volume-weighted average price for the 9th February’s discharge would have been over $1,500/MWh.

Of course if batteries such as this were used to cover shortfalls such as the 8-9 February period, many more of them would be needed. The peak shortfall on 8 February was around 750MW, meaning 25 battery installations configured like the Tesla/Neoen project would be required to meet it. Moreover the shortfalls lasted longer than the three hours any one of these would have lasted, although given the peak shortfalls were only for a short period some of the batteries could have been run below maximum in order to last longer. Of course, more batteries would likely mean both lower prices at the point of discharge and higher prices for the interim periods when batteries were recharging, so the financial returns of each project would be affected. Already Zen Energy has indicated they may rethink their own SA battery project[vi].

Conclusion

Although the analysis has been necessarily brief, it indicates that the proposed battery for South Australia has limitations in both its output and its capacity. It will be interesting to see if the installation provides the increased system security needed over the coming summer – and whether lessons learned from the trial will be made publicly available.

[i] 16th January 2014

[ii] Australian Energy Council (2016), Electricity Gas Australia

[iii] http://www.aemo.com.au/Electricity/National-Electricity-Market-NEM/Participant-information/Current-participants/Current-registration-and-exemption-lists

[iv] http://reneweconomy.com.au/explainer-what-the-tesla-big-battery-can-and-cannot-do-42387/

[v] Thanks to a beta version of Global-Roam’s NEM-Review v7 data analysis tools.

[vi] The Australian, 11th July 2017

Related Analysis

Certificate schemes – good for governments, but what about customers?

Retailer certificate schemes have been growing in popularity in recent years as a policy mechanism to help deliver the energy transition. The report puts forward some recommendations on how to improve the efficiency of these schemes. It also includes a deeper dive into the Victorian Energy Upgrades program and South Australian Retailer Energy Productivity Scheme.

Beyond the Rebate: Battery Policy, VPPs, and Household Returns

A re-elected Labor Government’s promise to cut home battery costs by 30 per cent through the Small-scale Renewable Energy Scheme (SRES) has sparked interest—and raised questions. While the move may accelerate battery uptake among solar households, critics warn it could deepen inequities by leaving renters and vulnerable customers behind. More importantly greater value will be realised if the storage capacity is also coordinated through mechanisms like Virtual Power Plants (VPPs). We take a look at the benefits of VPPs.

The return of Trump: What does it mean for Australia’s 2035 target?

Donald Trump’s decisive election win has given him a mandate to enact sweeping policy changes, including in the energy sector, potentially altering the US’s energy landscape. His proposals, which include halting offshore wind projects, withdrawing the US from the Paris Climate Agreement and dismantling the Inflation Reduction Act (IRA), could have a knock-on effect across the globe, as countries try to navigate a path towards net zero. So, what are his policies, and what do they mean for Australia’s own emission reduction targets? We take a look.

Send an email with your question or comment, and include your name and a short message and we'll get back to you shortly.